Current Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Valuation Metrics and Their Significance

BofA's assessment of current stock market valuations relies on a multifaceted approach, incorporating several key financial metrics. Understanding these metrics and their interpretation is crucial for grasping BofA's overall assessment.

Analyzing Price-to-Earnings Ratios (P/E):

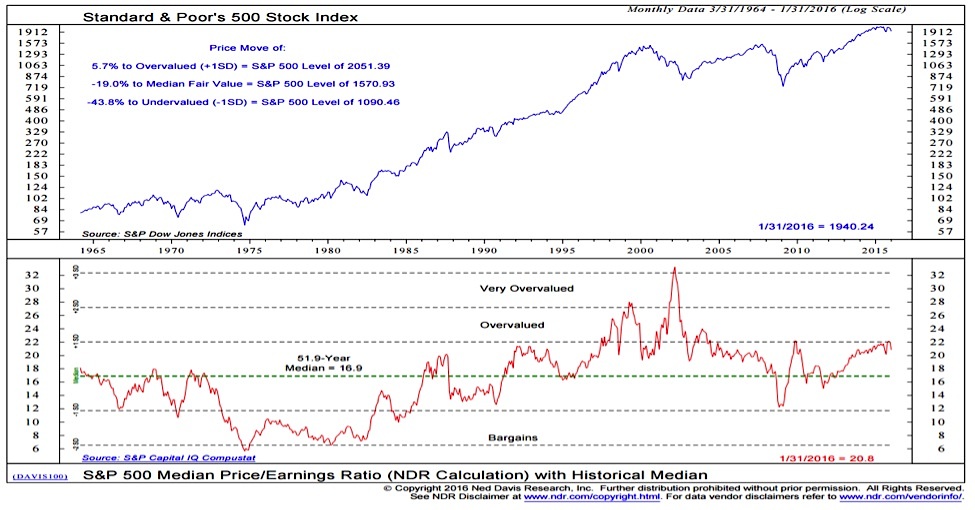

The Price-to-Earnings ratio (P/E) is a fundamental valuation metric that compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating overvaluation. Conversely, a low P/E ratio might signal undervaluation. However, it's crucial to remember that P/E ratios should be interpreted within their context, considering factors like industry norms and growth prospects.

-

Explanation of P/E ratio and its limitations: The P/E ratio is calculated by dividing the market price per share by the earnings per share. Limitations include its sensitivity to accounting practices and its inability to capture future growth potential accurately.

-

BofA's specific findings on P/E ratios for key sectors (e.g., technology, financials): While specific numbers are subject to change and require reference to BofA's latest reports, their analysis typically involves comparing current P/E ratios across various sectors to their historical averages. For instance, BofA might find that the technology sector's P/E ratio is higher than its historical average, but still within a reasonable range given expected future growth. Conversely, the financial sector might show a lower P/E ratio, potentially indicating undervaluation relative to historical norms.

-

Comparison to historical P/E ratios and implications: BofA's analysis often involves comparing current P/E ratios to long-term averages. This historical context helps determine whether current valuations are significantly deviating from established norms, providing insights into potential overvaluation or undervaluation.

Considering Other Key Valuation Metrics:

BofA's comprehensive valuation analysis goes beyond simply looking at P/E ratios. They incorporate additional metrics to provide a more holistic view.

-

Definition and significance of each metric: Price-to-Sales (P/S) ratio compares a company's market capitalization to its revenue, offering insights even for companies with negative earnings. Price-to-Book (P/B) ratio compares market capitalization to the company's net asset value, useful for valuing asset-heavy businesses. Dividend yield reflects the annual dividend payment relative to the stock price, attractive to income-oriented investors.

-

BofA's findings on these metrics and their interpretations: BofA likely uses these metrics to cross-validate their P/E ratio analysis. For instance, a high P/E ratio might be justified by a high P/S ratio if the company is experiencing strong revenue growth. Conversely, a low P/B ratio could suggest undervaluation.

-

How these metrics complement the P/E ratio analysis: By considering multiple valuation metrics, BofA develops a more robust and nuanced understanding of the market's overall valuation, mitigating the limitations of any single metric.

Macroeconomic Factors Supporting BofA's View

BofA's relatively optimistic outlook isn't solely based on valuation metrics. They also incorporate macroeconomic factors into their analysis.

Interest Rate Expectations and Their Impact:

Interest rates significantly influence stock valuations. Higher interest rates can reduce company profits and make bonds more attractive investments, potentially leading to lower stock prices.

-

BofA's predictions for future interest rates: BofA's economists provide forecasts for future interest rate movements based on their analysis of various economic indicators.

-

The relationship between interest rates and stock valuations: Generally, higher interest rates are negatively correlated with stock valuations, although the magnitude of this effect can vary depending on various factors.

-

How BofA factors interest rate expectations into their valuation models: BofA incorporates interest rate forecasts into their discounted cash flow models and other valuation techniques to account for the impact of interest rates on future company earnings and cash flows.

Inflationary Pressures and Corporate Earnings:

Inflation significantly impacts corporate earnings and stock valuations. High inflation can erode profit margins and reduce consumer spending, impacting corporate profitability.

-

BofA's inflation forecasts: BofA's economists regularly publish inflation forecasts based on their analysis of various economic data.

-

The impact of inflation on corporate profitability: High inflation can increase production costs, potentially squeezing profit margins. It can also lead to reduced consumer demand as purchasing power diminishes.

-

How BofA adjusts its valuation models to account for inflation: BofA adjusts its valuation models by incorporating inflation forecasts and their anticipated impact on future corporate earnings and cash flows.

BofA's Predictions and Investment Strategies

Based on their analysis of valuation metrics and macroeconomic factors, BofA offers insights into future market performance and investment strategies.

BofA's Outlook on Future Market Performance:

BofA's outlook typically incorporates both short-term and long-term predictions.

-

BofA's projected market returns: These projections are regularly updated and consider factors such as valuation levels, interest rate expectations, and economic growth forecasts.

-

Their recommended asset allocation strategies: BofA might suggest adjusting asset allocation based on their market outlook, recommending increased exposure to specific asset classes under certain conditions.

-

Specific sectors or investment opportunities highlighted by BofA: Based on their research, BofA might highlight specific sectors or investment opportunities that they believe are particularly well-positioned for growth in the current environment.

Managing Risk in the Current Market Environment:

BofA emphasizes the importance of risk management in navigating market volatility.

-

Risk management strategies recommended by BofA: This might include diversification, hedging, and setting stop-loss orders to limit potential losses.

-

Importance of diversification: Spreading investments across different asset classes and sectors is crucial to mitigating risk.

-

Guidance on adjusting investment portfolios based on BofA's analysis: BofA might provide recommendations on adjusting portfolio allocations to reflect their view on the market's current valuation and future trajectory.

Conclusion

BofA's analysis of current stock market valuations provides investors with a reasoned perspective amidst market fluctuations. By considering multiple valuation metrics, macroeconomic factors, and potential risks, BofA offers a framework for informed decision-making. While acknowledging market volatility, their relatively optimistic outlook emphasizes the importance of maintaining a long-term investment strategy. Understanding BofA's rationale on current stock market valuations is crucial for navigating the current market climate. Continue to monitor key economic indicators and seek professional financial advice to best manage your investments based on your personal risk tolerance and financial goals. Learn more about analyzing current stock market valuations and how to create a robust investment strategy.

Featured Posts

-

New Totalitarian Threat Taiwan Vp Lais Ve Day Address

May 09, 2025

New Totalitarian Threat Taiwan Vp Lais Ve Day Address

May 09, 2025 -

Young Thugs Back Outside Album Release Date Speculation And Hype

May 09, 2025

Young Thugs Back Outside Album Release Date Speculation And Hype

May 09, 2025 -

Nyt Strands Game 377 Hints And Solutions For March 15

May 09, 2025

Nyt Strands Game 377 Hints And Solutions For March 15

May 09, 2025 -

Significant Funding For Community Colleges To Fight Nursing Staff Deficiencies 56 Million Awarded

May 09, 2025

Significant Funding For Community Colleges To Fight Nursing Staff Deficiencies 56 Million Awarded

May 09, 2025 -

Oilers Vs Kings Game 1 Nhl Playoffs Predictions And Betting Picks

May 09, 2025

Oilers Vs Kings Game 1 Nhl Playoffs Predictions And Betting Picks

May 09, 2025