D-Wave Quantum Inc. (QBTS) Stock Drop On Monday: Reasons And Analysis

Table of Contents

Market Sentiment and Overall Tech Sector Downturn

The decline in QBTS stock on Monday wasn't an isolated event; it reflects a broader trend impacting the technology sector.

Broader Market Influences

- Major market indices like the Nasdaq experienced downward pressure on Monday, indicating a general negative sentiment among investors. This overall market weakness likely contributed to the QBTS stock drop.

- Growing concerns about inflation and potential interest rate hikes also played a role, increasing risk aversion among investors and leading to a sell-off in many growth stocks, including QBTS.

- Geopolitical instability and uncertainties in the global economy further fueled the negative market sentiment, making investors more cautious about their investments. The correlation between the overall market performance and QBTS's performance is undeniable. Data showing the correlation between Nasdaq and QBTS movements on Monday would strengthen this argument.

Investor Confidence and Risk Appetite

Investor confidence in emerging technologies, particularly quantum computing, can be volatile.

- Recent news about advancements by competitors in the quantum computing space might have impacted investor perception of D-Wave's competitive position, potentially leading to some profit-taking.

- A general increase in risk aversion, coupled with QBTS being a relatively high-risk, high-growth stock, likely contributed to investors shifting their portfolios towards less volatile investments. The perceived risk associated with quantum computing investments increased, leading to a sell-off.

Company-Specific News and Developments (if any)

While no major company-specific announcements directly preceded the QBTS stock drop on Monday, a thorough analysis of recent developments is necessary.

Financial Performance and Earnings Reports

- (Insert any relevant details regarding recent financial reports, including revenue figures, earnings, and guidance. If no negative news is available, state that clearly. For example: "While D-Wave's most recent earnings report did not reveal any significant negative surprises, the overall market downturn likely overshadowed any positive aspects.")

- Analyze the market reaction to these numbers. Were they perceived as falling short of expectations, or did the overall market sentiment simply overwhelm any positive news?

Product Development and Competition

- (Insert any details regarding recent product development announcements from D-Wave or its competitors. For example: "While D-Wave has not announced any major setbacks in its product roadmap recently, significant advancements by competitors could have influenced investor sentiment.")

- The competitive landscape in quantum computing is rapidly evolving. Any news regarding competitor breakthroughs could pressure QBTS stock.

Technical Analysis of the QBTS Stock Chart

Analyzing the QBTS stock chart provides further insight into Monday's drop.

Chart Patterns and Indicators

- (Insert relevant details about technical indicators such as moving averages, RSI, and MACD. For example: "Observing the QBTS stock chart reveals a potential break of key support levels on Monday, suggesting a weakening trend. The Relative Strength Index (RSI) also indicated oversold conditions, though this doesn't necessarily predict a reversal.")

- Include images of relevant chart patterns (e.g., a bearish engulfing candle) and explain their significance.

Trading Volume and Volatility

- (Insert details about trading volume on Monday. For example: "A significant spike in trading volume accompanied Monday's price drop, suggesting a large number of investors were actively selling QBTS shares.")

- High trading volume coupled with the already negative market sentiment exacerbated the price decline, making the drop more pronounced.

Conclusion: Navigating the D-Wave Quantum Inc. (QBTS) Stock Drop and Future Outlook

The QBTS stock drop on Monday appears to be a confluence of factors, including a broader tech sector downturn, general market uncertainty, and potentially some investor concerns regarding the competitive landscape within the quantum computing industry. While no specific company-related news directly triggered the plunge, the overall negative market sentiment likely amplified the impact. The future outlook for QBTS stock remains somewhat uncertain, heavily dependent on both overall market conditions and D-Wave's progress in product development and market adoption.

Understanding the factors contributing to the recent D-Wave Quantum Inc. (QBTS) stock drop is crucial for informed investment decisions. Conduct thorough due diligence before investing in QBTS or any other quantum computing stock. Further research into quantum computing technology, market analysis of QBTS stock performance, and a robust investment strategy are essential for navigating the volatility of this emerging sector. Careful analysis of D-Wave stock analysis is crucial for making informed decisions about your portfolio.

Featured Posts

-

Huuhkajien Valmennus Uudistukset Ja Tulevaisuuden Suunnitelmat

May 20, 2025

Huuhkajien Valmennus Uudistukset Ja Tulevaisuuden Suunnitelmat

May 20, 2025 -

Jennifer Lawrence Aparicao Magra Apos Rumores De Segundo Filho

May 20, 2025

Jennifer Lawrence Aparicao Magra Apos Rumores De Segundo Filho

May 20, 2025 -

At And T Reports Extreme Price Increase Following Broadcoms V Mware Bid

May 20, 2025

At And T Reports Extreme Price Increase Following Broadcoms V Mware Bid

May 20, 2025 -

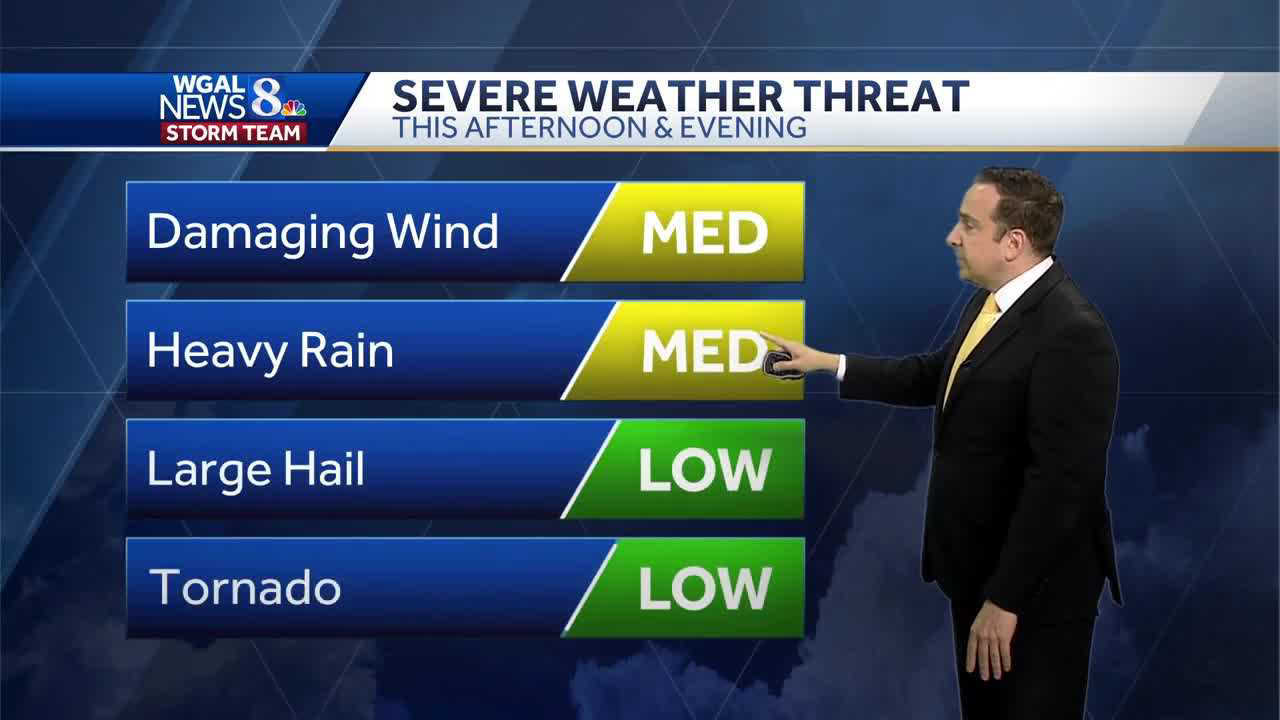

Understanding Damaging Winds Associated With Fast Moving Storms

May 20, 2025

Understanding Damaging Winds Associated With Fast Moving Storms

May 20, 2025 -

Find Sandylands U On Tv Schedule And Where To Watch

May 20, 2025

Find Sandylands U On Tv Schedule And Where To Watch

May 20, 2025