D-Wave Quantum Inc. (QBTS) Stock: Investment Potential And Risks

Table of Contents

Understanding D-Wave's Quantum Computing Technology and Market Position

D-Wave's Quantum Annealing Approach

D-Wave Systems employs a unique approach to quantum computing: quantum annealing. Unlike gate-based quantum computing, which uses qubits to perform universal quantum computations, quantum annealing focuses on solving specific optimization problems. It leverages the principles of adiabatic quantum computation, exploiting the natural tendency of quantum systems to find the lowest energy state.

- Advantages: Quantum annealing excels at solving complex optimization problems found in various fields, including logistics, materials science, and financial modeling. Its specialized hardware allows for tackling larger problem sizes compared to some early-stage gate-based systems.

- Limitations: Quantum annealing is not a universal quantum computer; it's not suitable for all computational tasks. Gate-based quantum computers, while still in their early stages of development, aim for broader applicability. The specific advantages of quantum annealing over classical computation in practical applications are still under active research and development. Furthermore, the claim that D-Wave's processors are truly "quantum" and offer a speedup over classical algorithms has also been subject to ongoing debate within the scientific community.

- Keywords: quantum annealing, gate-based quantum computing, adiabatic quantum computation, optimization problems, quantum supremacy.

Competitive Landscape and Market Share

D-Wave faces stiff competition in the rapidly evolving quantum computing market. Key players include industry giants like IBM, Google, and Rigetti Computing, each pursuing different quantum computing approaches. While D-Wave was a first mover in delivering commercially available quantum computers, its market share is a subject of ongoing debate, as the market is still nascent and definitions of "market share" are not standardized.

- Competitors: IBM's focus on gate-based systems, Google's advancements in superconducting qubits, and Rigetti's hybrid quantum-classical approach present significant competitive challenges. The field also sees considerable investment in other companies and academic initiatives pursuing various quantum computing approaches.

- Market Share: Accurately quantifying D-Wave's market share is difficult due to the early stage of the quantum computing industry and the diverse approaches being pursued. More established metrics will likely emerge as the market matures.

- Keywords: quantum computing market, market share, competitors, IBM, Google, Rigetti, superconducting qubits, quantum supremacy.

D-Wave's Business Model and Revenue Streams

D-Wave's revenue model is primarily based on selling its quantum annealing computers and providing cloud access to these systems through its Leap quantum cloud service. This allows researchers and businesses to explore the potential of quantum annealing without the high upfront cost of purchasing hardware. Additionally, D-Wave offers consulting and support services to help clients integrate quantum computing solutions into their workflows.

- Revenue Streams: Hardware sales, cloud access fees (Leap), and professional services constitute D-Wave's key revenue streams.

- Scalability and Sustainability: The long-term scalability and sustainability of D-Wave's business model depend heavily on the continued growth and adoption of quantum annealing technology and the development of compelling use cases for its capabilities. The company's success hinges on attracting both paying customers and attracting top scientific talent to its ongoing research.

- Keywords: revenue model, business strategy, cloud access, Leap quantum cloud service, quantum computing applications.

Financial Performance and Investment Risks of QBTS Stock

Analyzing QBTS Stock Performance

Analyzing QBTS stock requires careful consideration of its historical performance, including price trends, volatility, and key financial indicators. While past performance is not indicative of future results, it provides valuable context for understanding the investment risks involved.

- Stock Price Volatility: QBTS stock, like many other technology stocks, is likely to experience significant price volatility. This is a key risk factor to consider.

- Financial Indicators: Investors should scrutinize D-Wave's revenue growth, profitability (or lack thereof), debt levels, and cash flow to assess its financial health and sustainability.

- Valuation Metrics: Assessing the valuation of QBTS through metrics like the Price-to-Earnings (P/E) ratio (if applicable), market capitalization, and other relevant metrics helps determine if the stock is fairly valued.

- Keywords: stock price, volatility, revenue growth, profitability, debt, market capitalization, P/E ratio.

Assessing the Investment Risks

Investing in QBTS carries significant risk. The quantum computing industry is still in its early stages, and the technology faces considerable uncertainty.

- Technological Risk: Unforeseen technological challenges could hinder D-Wave's progress and impact the value of its technology.

- Market Risk: Competition is intense, and the overall market for quantum computing is still developing. Demand may not materialize as rapidly as projected.

- Financial Risk: D-Wave's financial performance might not meet investor expectations, leading to potential stock price declines.

- Keywords: investment risk, technological risk, market risk, financial risk, high-risk investment.

Factors Influencing QBTS Stock Price

Several factors can significantly influence the price of QBTS stock.

- Positive Factors: Technological breakthroughs, strategic partnerships with major corporations, regulatory changes favorable to quantum computing, and positive market sentiment can drive the stock price up.

- Negative Factors: Lack of significant technological advancements, increased competition, regulatory hurdles, negative market sentiment, and disappointing financial results can lead to stock price declines.

- Keywords: stock price drivers, market sentiment, partnerships, regulatory changes, technological advancements.

Conclusion: Should You Invest in D-Wave Quantum Inc. (QBTS) Stock?

Investing in D-Wave Quantum Inc. (QBTS) stock presents both exciting opportunities and substantial risks. While D-Wave holds a pioneering position in quantum annealing, the overall quantum computing market is highly competitive and remains relatively unproven. The company's financial performance and the successful adoption of its technology will be crucial determinants of future stock price. Before investing in QBTS, carefully weigh the potential rewards against the inherent risks. Conduct thorough due diligence, understand the company's business model, competitive landscape, and financial health, and consult with a qualified financial advisor before making any investment decisions regarding D-Wave Quantum Inc. (QBTS) stock. Remember that D-Wave Quantum Inc. (QBTS) stock is a high-risk investment.

Featured Posts

-

Video Cum Au Fost Intampinati Fratii Tate La Bucuresti Dupa Eliberare

May 21, 2025

Video Cum Au Fost Intampinati Fratii Tate La Bucuresti Dupa Eliberare

May 21, 2025 -

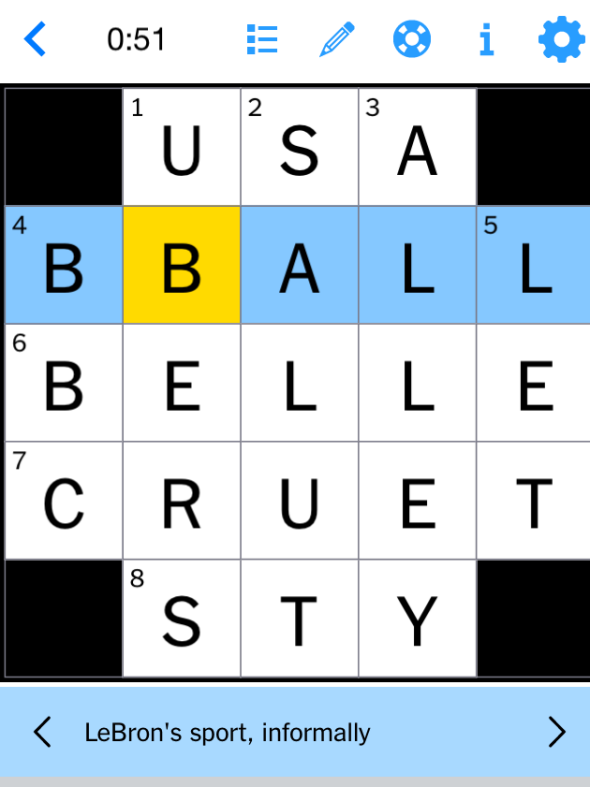

Solve The Nyt Mini Crossword March 13 Answers Hints And Strategies

May 21, 2025

Solve The Nyt Mini Crossword March 13 Answers Hints And Strategies

May 21, 2025 -

Fratii Tate Intampinati De O Multime Entuziasta In Bucuresti

May 21, 2025

Fratii Tate Intampinati De O Multime Entuziasta In Bucuresti

May 21, 2025 -

March 18 2025 Nyt Mini Crossword Complete Answers And Clues

May 21, 2025

March 18 2025 Nyt Mini Crossword Complete Answers And Clues

May 21, 2025 -

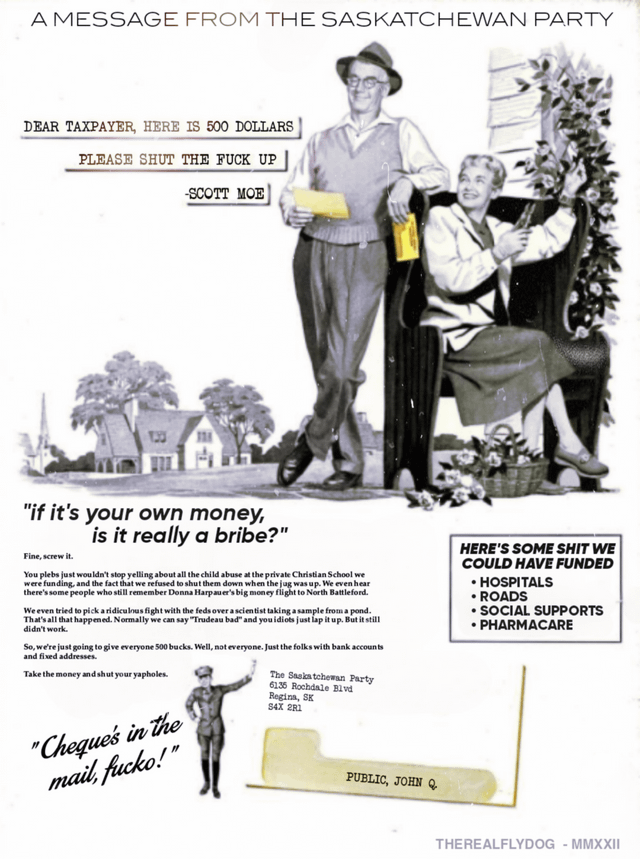

Saskatchewan Political Panel Reacts To Federal Leaders Redneck Comments

May 21, 2025

Saskatchewan Political Panel Reacts To Federal Leaders Redneck Comments

May 21, 2025