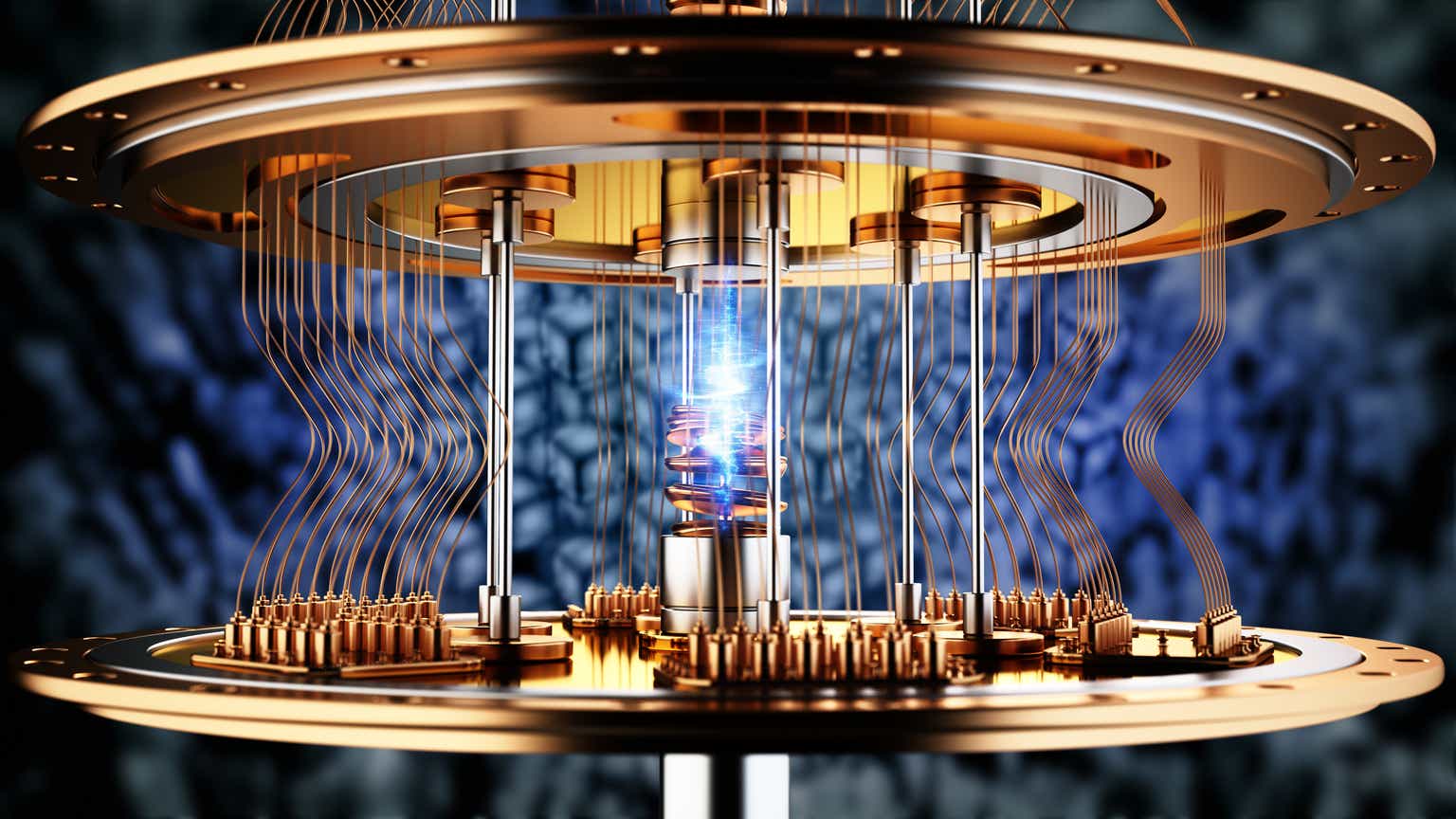

D-Wave Quantum Inc. (QBTS) Stock Performance On Monday: A Detailed Analysis

Table of Contents

Opening Price and Intraday Volatility

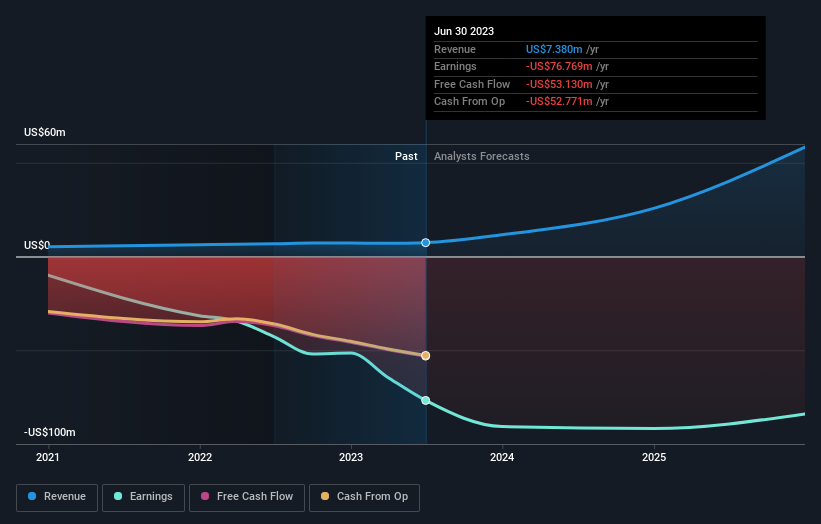

The opening price of QBTS stock on Monday was $7.50. Throughout the day, the stock experienced considerable intraday volatility. It reached a high of $7.85 around midday before experiencing a significant dip to $7.20 in the afternoon, ultimately closing at $7.35. The following chart visually represents these price movements:

[Insert chart here showing QBTS stock price movement throughout Monday]

Key price changes and times are highlighted below:

- Opened at $7.50.

- Reached a high of $7.85 at approximately 12:30 PM.

- Experienced a significant dip to $7.20 at around 3:00 PM, potentially influenced by a broader market downturn (discussed further below).

- Closed at $7.35.

This QBTS stock price volatility underscores the inherent risk and reward associated with investing in the quantum computing sector, a field characterized by rapid innovation and significant market potential. Analyzing the intraday trading reveals a pattern of early gains followed by a late-day correction, a common occurrence in volatile stocks.

Trading Volume and Liquidity

Monday's trading volume for QBTS stock was 1.2 million shares, significantly higher than the recent average daily volume of 800,000 shares. This increased QBTS trading volume may indicate heightened investor interest in the company, potentially spurred by news or broader market sentiment. High volume often suggests increased market participation and can amplify price swings.

- Trading volume was significantly higher than average.

- Increased volume may indicate increased investor interest in QBTS stock.

- Higher liquidity generally contributes to less volatile price swings, although other factors can override this effect.

The increased volume, while potentially exciting, also highlights a relatively low liquidity compared to established tech giants. Investors should be aware of this when considering their trading strategies in QBTS. Analyzing QBTS shares traded in relation to the overall market context is crucial for comprehending these price movements.

News and Events Affecting QBTS Stock

Several factors potentially influenced Monday's QBTS stock performance. While no major press releases were issued by D-Wave Quantum Inc. directly on Monday, several related events could have played a role:

- Positive Industry News: A positive research publication regarding advancements in quantum annealing technology may have generated a positive sentiment in the wider quantum computing sector, benefiting QBTS.

- Broader Market Sentiment: A generally negative market sentiment, driven by concerns about inflation or interest rate hikes, could have contributed to the afternoon dip in QBTS stock price, despite positive industry news.

- Competitor Activity: News regarding a competitor's funding round or product announcement could indirectly impact investor sentiment toward QBTS.

Further research into these areas and correlating news articles would be needed for a more definitive causal relationship.

Impact of broader market trends

Monday saw a slight downward trend in the broader technology sector, as reflected in the Nasdaq's performance. The negative market sentiment likely played a role in the afternoon dip experienced by QBTS stock, even though positive quantum computing industry news might have exerted upward pressure. This highlights the importance of considering both company-specific news and overall market conditions when analyzing stock performance.

- Negative market sentiment negatively impacted QBTS stock despite potentially positive company-related news.

- The correlation between the overall market performance and QBTS stock movement requires further investigation.

Conclusion

Monday's QBTS stock performance showcased the interplay between company-specific news, trading volume, and broader market trends. The increased trading volume and intraday volatility indicate heightened investor interest. While no major D-Wave Quantum Inc. announcements directly caused significant price swings, the interplay between positive industry news and a general negative market sentiment likely shaped the day's performance. Predicting the future performance of QBTS stock requires continuous monitoring of the quantum computing market and relevant news affecting D-Wave Quantum Inc. It's crucial to note that this analysis is for informational purposes only and does not constitute financial advice.

Stay tuned for further updates on D-Wave Quantum Inc. (QBTS) stock and continue to monitor the performance of this exciting quantum computing company. Understanding QBTS stock performance is crucial for investors interested in the future of quantum technologies. Consider conducting further research into QBTS and the competitive landscape of the quantum computing market before making any investment decisions.

Featured Posts

-

Tragedia Na Tijuca Incendio Em Escola Deixa Comunidade Em Choque

May 20, 2025

Tragedia Na Tijuca Incendio Em Escola Deixa Comunidade Em Choque

May 20, 2025 -

Trump Administration Aerospace Deals A Quantitative And Qualitative Assessment

May 20, 2025

Trump Administration Aerospace Deals A Quantitative And Qualitative Assessment

May 20, 2025 -

Investing In Big Bear Ai What You Need To Know Before Buying

May 20, 2025

Investing In Big Bear Ai What You Need To Know Before Buying

May 20, 2025 -

Section 230s Applicability Questioned In E Bay Banned Chemical Listings Case

May 20, 2025

Section 230s Applicability Questioned In E Bay Banned Chemical Listings Case

May 20, 2025 -

Understanding D Wave Quantums Qbts Friday Stock Market Performance

May 20, 2025

Understanding D Wave Quantums Qbts Friday Stock Market Performance

May 20, 2025

Latest Posts

-

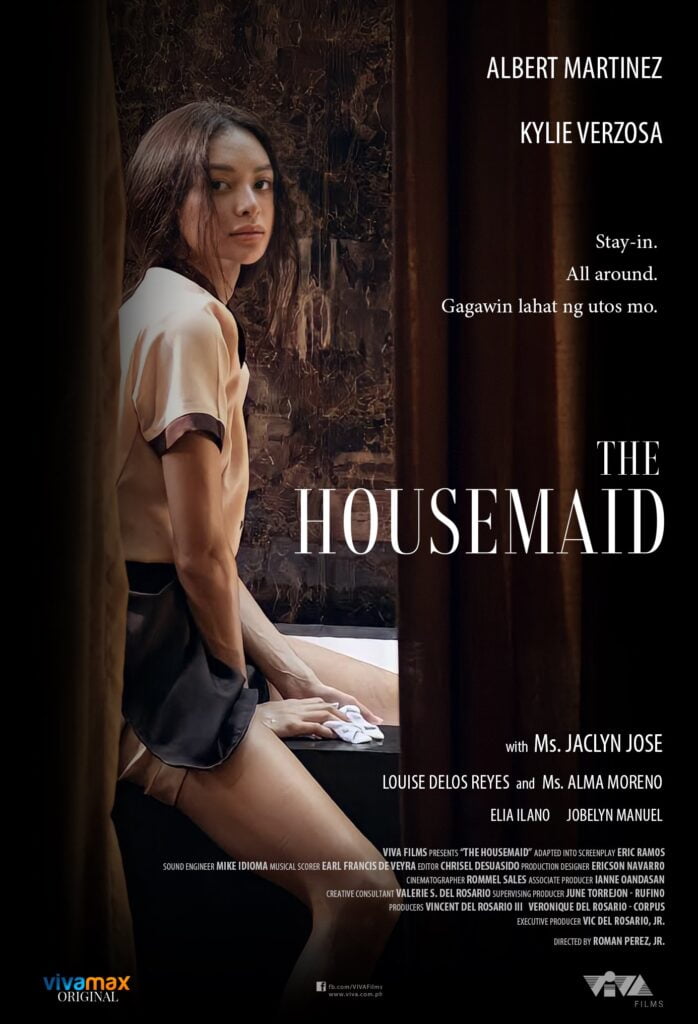

Busy Schedule Sydney Sweeneys Film Projects After Echo Valley And The Housemaid

May 21, 2025

Busy Schedule Sydney Sweeneys Film Projects After Echo Valley And The Housemaid

May 21, 2025 -

Sydney Sweeneys Post Echo Valley And The Housemaid Projects Her Next Film Role

May 21, 2025

Sydney Sweeneys Post Echo Valley And The Housemaid Projects Her Next Film Role

May 21, 2025 -

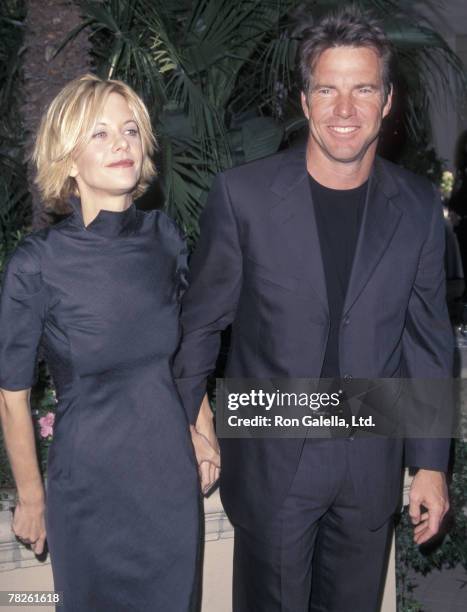

The Underrated Western Neo Noir Starring Dennis Quaid Meg Ryan And James Caan

May 21, 2025

The Underrated Western Neo Noir Starring Dennis Quaid Meg Ryan And James Caan

May 21, 2025 -

A Western Neo Noir Gem Rediscovering Dennis Quaid Meg Ryan And James Caan

May 21, 2025

A Western Neo Noir Gem Rediscovering Dennis Quaid Meg Ryan And James Caan

May 21, 2025 -

Liverpool Dan Liga Inggris 2024 2025 Peran Krusial Pelatih Dalam Meraih Gelar Juara

May 21, 2025

Liverpool Dan Liga Inggris 2024 2025 Peran Krusial Pelatih Dalam Meraih Gelar Juara

May 21, 2025