D-Wave Quantum Inc. (QBTS) Stock Plunge: Monday's Market Crash Explained

Table of Contents

Monday saw a significant and unsettling drop in D-Wave Quantum Inc. (QBTS) stock, leaving many investors scrambling to understand the cause of this sudden market crash. This sharp decline in the quantum computing stock raises crucial questions about the future of the company and the broader technology sector. This article delves into the factors contributing to QBTS's dramatic decline, analyzing the market conditions and potential underlying reasons for the sharp decrease in share price. We will explore the implications for investors and offer insights into navigating this volatile situation, helping you understand the QBTS stock plunge and make informed decisions.

The Extent of Monday's QBTS Stock Drop

Percentage Decline and Closing Price

Monday's trading session concluded with a devastating [Insert Exact Percentage]% drop in QBTS stock. The closing price settled at $[Insert Closing Price], a significant decrease from the previous day's closing price of $[Insert Previous Day's Closing Price]. This represents a substantial loss for investors and a considerable divergence from the overall market performance on Monday, which saw [Insert Overall Market Performance, e.g., a slight uptick or a general downturn].

Volume Traded

The trading volume for QBTS on Monday was exceptionally high, reaching [Insert Trading Volume]. This unusually high volume further underscores the magnitude of the market reaction and suggests significant investor activity, likely driven by panic selling and a flight from the quantum computing stock. This contrasts sharply with the average daily trading volume of [Insert Average Daily Trading Volume], indicating a significant market event.

- Specific numbers illustrating the magnitude of the drop: A [Insert Percentage]% decrease represents a considerable loss for investors, especially those with significant holdings in QBTS.

- Comparison to other tech stocks' performance on the same day: In contrast to QBTS's dramatic fall, other technology stocks in the same sector experienced [Insert Performance of Similar Tech Stocks, e.g., only minor fluctuations or a similar downturn]. This suggests that factors specific to D-Wave Quantum may have contributed significantly to the plunge.

- Mention of any unusual trading activity: [Insert Information on Unusual Trading Activity, e.g., Any unusual spikes or patterns in trading activity should be noted here. If no unusual activity was reported, state that.]

Potential Factors Contributing to the QBTS Stock Plunge

Overall Market Sentiment

Monday's broader market conditions contributed to a negative overall sentiment across the tech sector. [Insert information about the overall market on Monday, e.g., a general downturn in the tech sector, negative news affecting the broader market, global economic concerns]. This negative sentiment undoubtedly exacerbated the drop in QBTS stock.

Company-Specific News or Announcements

While no single catastrophic event was publicly announced by D-Wave Quantum on Monday, the absence of positive news in a volatile market could have triggered the sell-off. [Insert any company-specific news or lack thereof that could have impacted the stock. For example, a delayed product launch, a missed earnings projection, or even a lack of substantial positive announcements could have fuelled negative speculation.]

Sector-Specific Trends

The quantum computing sector is still relatively nascent, characterized by significant volatility. [Discuss recent trends within the Quantum Computing sector that might have impacted investor confidence. This could include increased competition, concerns about technological advancements, or overall uncertainty about the sector's future].

- Specific news articles or announcements that might have impacted the stock price: [Cite specific news articles or company announcements, if applicable]

- Mention of any analyst downgrades or negative reports: [Mention any recent analyst downgrades or negative reports that might have influenced investor sentiment]

- Discussion of any competitive pressures in the quantum computing industry: [Discuss any competitive pressures or emerging technologies that might have created uncertainty in the market]

Analyzing the Impact on Investors

Short-Term vs. Long-Term Implications

The short-term implications of Monday's QBTS stock plunge are clearly negative for investors who bought at higher prices. However, the long-term implications are more nuanced and depend heavily on D-Wave Quantum's future performance and the broader quantum computing market's trajectory. For long-term investors with a high-risk tolerance, this could be considered a buying opportunity, while others might choose to hold or sell, depending on their individual investment strategies.

Risk Assessment for QBTS Investment

Investing in QBTS carries significant risk. As a company operating in a relatively unproven technology sector, its stock price is highly susceptible to market fluctuations and shifts in investor sentiment. This inherent volatility requires a thorough risk assessment before investing.

- Advice for investors considering their next move: Investors should carefully consider their risk tolerance and long-term investment goals before making any decisions regarding their QBTS holdings.

- Discussion on risk tolerance and investment strategies: Diversification is crucial in mitigating risk; investors should ensure that QBTS doesn't represent a disproportionately large part of their investment portfolio.

- Mention of diversification as a risk-mitigation strategy: Diversification across various asset classes and sectors is essential for managing risk effectively.

Conclusion

Monday's significant D-Wave Quantum Inc. (QBTS) stock plunge resulted from a complex interplay of factors. The overall negative market sentiment, coupled with the inherent volatility of the quantum computing sector and potentially company-specific uncertainties, triggered a sell-off. While the short-term implications are negative for many, the long-term outlook depends on D-Wave Quantum's future performance and the development of the quantum computing industry as a whole.

Key Takeaways: The QBTS stock plunge highlights the volatility inherent in technology stocks, particularly those in nascent sectors. Informed decision-making, thorough due diligence, and a well-defined investment strategy, considering risk tolerance, are crucial for navigating such market events.

Call to Action: Monitor QBTS stock closely, stay updated on D-Wave Quantum news and developments within the quantum computing sector. Understand the risks before investing in QBTS and continue monitoring its performance to make better-informed investment decisions. Don't solely rely on short-term fluctuations when assessing your investment in QBTS or other quantum computing stocks. Conduct thorough research and consider consulting a financial advisor before making any investment decisions.

Featured Posts

-

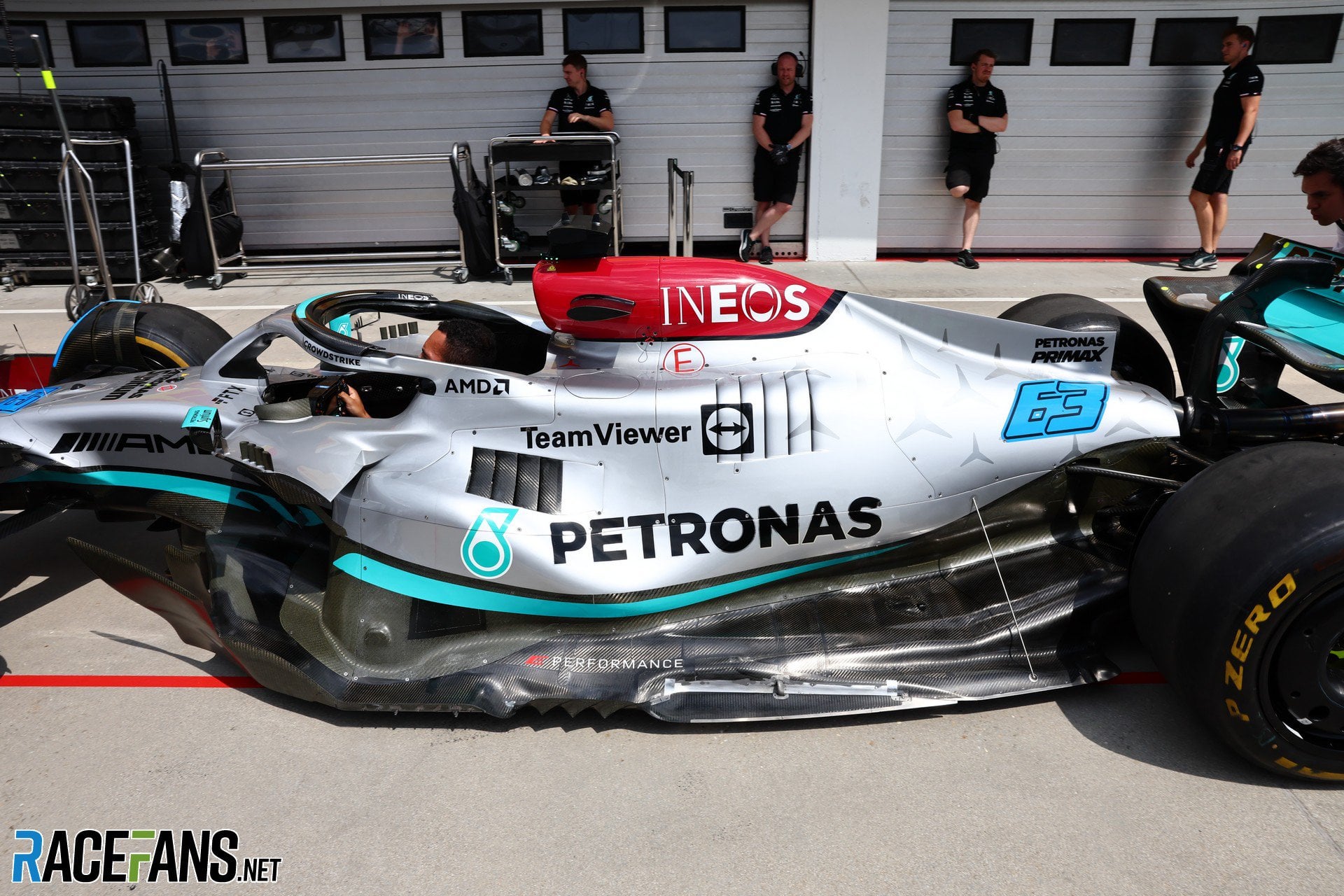

Hamiltons 2023 F1 Season Key Differences Compared To Leclercs Success

May 20, 2025

Hamiltons 2023 F1 Season Key Differences Compared To Leclercs Success

May 20, 2025 -

Aghatha Krysty Hyt Mn Jdyd Rwayat Jdydt Baldhkae Alastnaey

May 20, 2025

Aghatha Krysty Hyt Mn Jdyd Rwayat Jdydt Baldhkae Alastnaey

May 20, 2025 -

I Metagrafi Giakoymaki Stin Los Antzeles Pithanotites Kai Ekselikseis

May 20, 2025

I Metagrafi Giakoymaki Stin Los Antzeles Pithanotites Kai Ekselikseis

May 20, 2025 -

The Impact Of Michael Strahans Interview On The Television Ratings War

May 20, 2025

The Impact Of Michael Strahans Interview On The Television Ratings War

May 20, 2025 -

Casting News Mia Wasikowska For Taika Waititis Family Project

May 20, 2025

Casting News Mia Wasikowska For Taika Waititis Family Project

May 20, 2025