D-Wave Quantum (QBTS): Analyzing The Significant Stock Decline In 2025

Table of Contents

Macroeconomic Factors Impacting QBTS Performance in 2025

The significant drop in QBTS stock price in 2025 wasn't solely attributable to D-Wave Quantum's internal issues. The broader macroeconomic landscape played a substantial role. 2025 presented a challenging economic climate, marked by several factors that negatively impacted growth stocks, particularly in the technology sector.

-

Impact of rising interest rates on tech stocks: The Federal Reserve's aggressive interest rate hikes throughout 2024 and into 2025 aimed to curb inflation. These hikes increased borrowing costs, making it more expensive for companies like D-Wave Quantum to invest in research and development, impacting future growth projections. This generally led to a decrease in valuations for growth-oriented technology stocks like QBTS.

-

Correlation between general market downturn and QBTS performance: The overall market downturn experienced in 2025, fueled by recessionary fears and high inflation, dragged down even fundamentally sound companies. QBTS, being a relatively young and still-developing company in the quantum computing space, was particularly vulnerable to this general market volatility.

-

Investor sentiment shift towards less risky assets: As uncertainty loomed large, investors shifted their focus from riskier investments like technology stocks to safer havens such as government bonds. This flight to safety further exacerbated the decline in QBTS stock. Keywords: macroeconomic factors, interest rates, inflation, recession, market volatility, investor sentiment.

Company-Specific Challenges Faced by D-Wave Quantum in 2025

While macroeconomic headwinds contributed significantly to the QBTS stock decline, internal challenges faced by D-Wave Quantum also played a crucial role.

-

Competition from other quantum computing companies: The quantum computing industry is rapidly evolving, with several emerging players competing for market share. Increased competition intensified the pressure on D-Wave Quantum to demonstrate its technological superiority and market leadership, potentially affecting investor confidence.

-

Challenges in scaling up quantum computer production: Manufacturing and scaling up the production of quantum computers presents enormous technical hurdles. Delays or difficulties in scaling operations could have negatively impacted D-Wave Quantum's financial performance and investor expectations.

-

Slower-than-expected adoption of quantum computing technology: The widespread adoption of quantum computing technology is still some years away. Slower-than-anticipated market adoption likely impacted D-Wave Quantum’s revenue projections and investor sentiment.

-

Financial performance and revenue shortfalls: Any reported financial shortfalls or missed revenue targets during 2025 would have significantly impacted investor confidence and contributed to the stock price decline.

-

Negative news or announcements: Any negative press, announcements of delays, or setbacks in research and development could have further fueled the downward trend in the QBTS stock price. Keywords: D-Wave Quantum challenges, competition, quantum computing market, scaling challenges, revenue, financial performance, technology adoption.

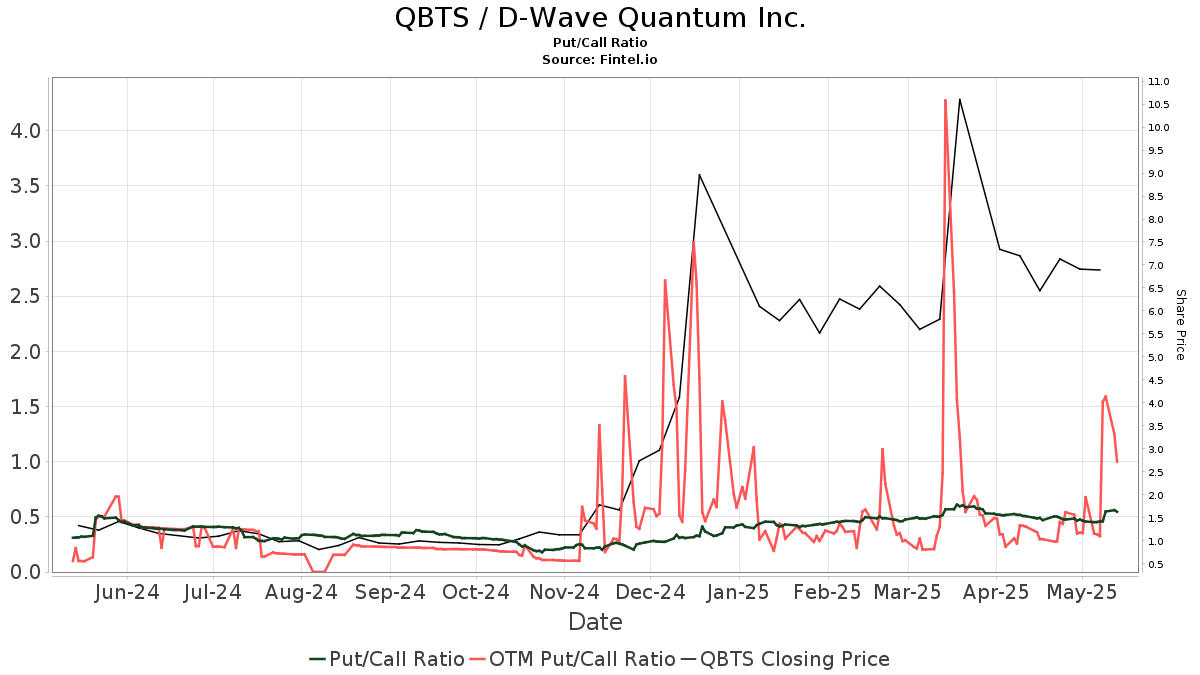

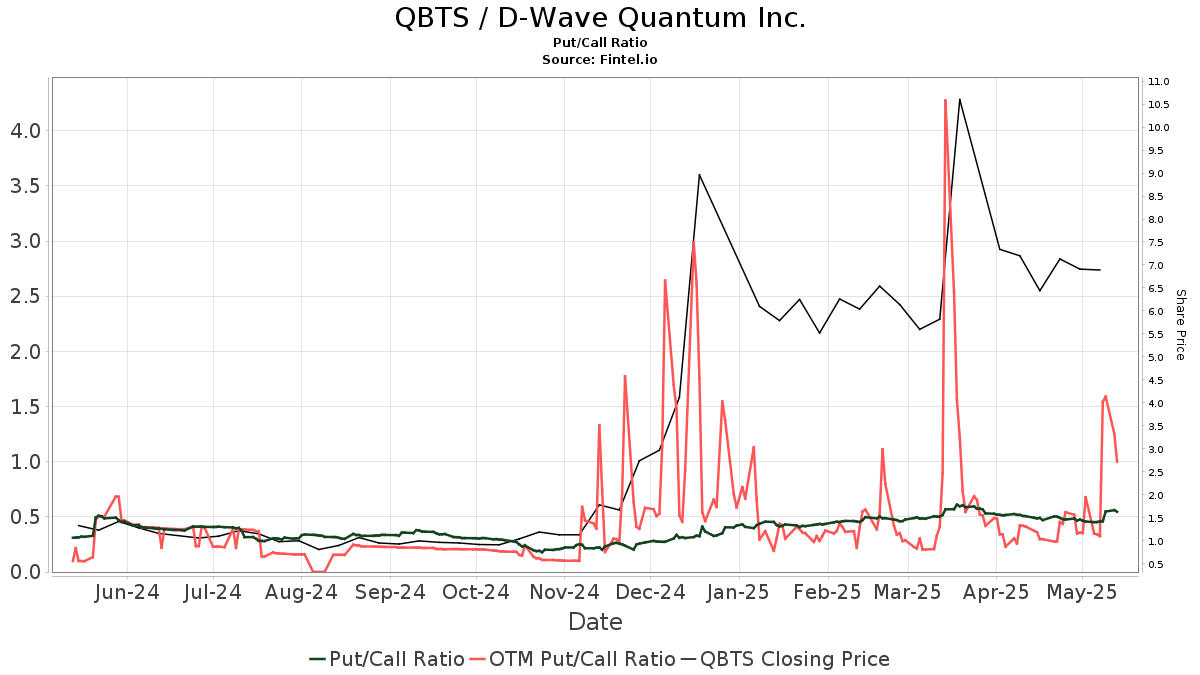

Analyzing Investor Sentiment and Market Reactions to D-Wave Quantum News in 2025

Investor reactions to news and announcements throughout 2025 significantly shaped the QBTS stock price trajectory.

-

Impact of positive and negative press releases on QBTS stock: Positive press releases announcing technological breakthroughs or partnerships generally resulted in temporary stock price increases. Conversely, negative news or delays had an immediate and often severe impact on the stock price.

-

Analyst ratings and their influence on investor confidence: Analyst ratings and recommendations significantly influenced investor sentiment and trading decisions. Downgrades from prominent analysts likely contributed to the sell-off.

-

Social media sentiment analysis regarding D-Wave Quantum: Social media sentiment, reflecting the overall public perception of D-Wave Quantum, played a role in shaping investor attitudes and trading patterns. Negative social media sentiment could have exacerbated the stock price decline.

-

Impact of significant partnerships or collaborations (positive or negative): The announcement of new partnerships or collaborations, whether positive or negative, had a direct impact on investor perception and the QBTS stock price. Keywords: investor sentiment, market reaction, stock price volatility, news impact, analyst ratings, social media sentiment, partnerships.

Future Outlook and Potential for D-Wave Quantum (QBTS) Recovery

While 2025 presented significant challenges, the long-term prospects for D-Wave Quantum and the quantum computing industry remain promising.

-

Long-term prospects of the quantum computing industry: The potential applications of quantum computing are vast and transformative. The long-term outlook for the industry remains positive, suggesting potential for future QBTS recovery.

-

D-Wave Quantum’s strategic initiatives for growth: D-Wave Quantum's strategic initiatives to enhance its technology, expand its partnerships, and penetrate new markets will play a crucial role in its future success and stock price recovery.

-

Potential catalysts for a stock price rebound: Several factors could trigger a QBTS stock price rebound, including significant technological advancements, successful product launches, strategic partnerships, and improving macroeconomic conditions.

-

Risks and uncertainties that could hinder recovery: However, several risks and uncertainties remain, including intensifying competition, technological challenges, and potential macroeconomic instability. These factors need careful consideration. Keywords: future outlook, stock recovery, quantum computing future, growth potential, risk assessment, investment opportunities.

Conclusion: Investing in D-Wave Quantum (QBTS) – A Look Ahead

The significant decline in D-Wave Quantum (QBTS) stock price in 2025 was a result of a confluence of factors: challenging macroeconomic conditions, internal company challenges, and fluctuating investor sentiment. Understanding the interplay of these factors is crucial for assessing the risks and opportunities associated with investing in QBTS. While the future outlook for D-Wave Quantum and the broader quantum computing sector remains promising, thorough due diligence is paramount before making any investment decisions. Consider the long-term potential of quantum computing alongside the company-specific risks before investing in D-Wave Quantum (QBTS) or any other quantum computing stocks. Keywords: D-Wave Quantum investment, QBTS stock analysis, quantum computing investment, due diligence, informed investment.

Featured Posts

-

Viaje En Helicoptero Michael Schumacher De Mallorca A Suiza Para Reunion Familiar

May 20, 2025

Viaje En Helicoptero Michael Schumacher De Mallorca A Suiza Para Reunion Familiar

May 20, 2025 -

Manaus Festival Da Cunha Com Maiara E Maraisa Confirmado Por Isabelle Nogueira

May 20, 2025

Manaus Festival Da Cunha Com Maiara E Maraisa Confirmado Por Isabelle Nogueira

May 20, 2025 -

Mirra Andreeva Biografiya Pobedy I Luchshie Matchi Voskhodyaschey Zvezdy Tennisa

May 20, 2025

Mirra Andreeva Biografiya Pobedy I Luchshie Matchi Voskhodyaschey Zvezdy Tennisa

May 20, 2025 -

Sidirodromiko Diktyo Elladas Prokliseis Kai Eykairies

May 20, 2025

Sidirodromiko Diktyo Elladas Prokliseis Kai Eykairies

May 20, 2025 -

Agatha Christies Poirot A Study Of Character And Crime Solving Techniques

May 20, 2025

Agatha Christies Poirot A Study Of Character And Crime Solving Techniques

May 20, 2025