D-Wave Quantum (QBTS) Stock: Factors Contributing To Monday's Fall

Table of Contents

Market Sentiment and Sector-Wide Trends

The overall sentiment in the technology sector on Monday was somewhat negative, impacting the quantum computing market and QBTS. Several factors contributed to this bearish mood.

-

Broader Market Concerns: Negative news affecting the broader tech market played a role. Rising interest rates, persistent inflation concerns, and a general sense of economic uncertainty all contributed to a risk-off sentiment among investors. Major market indices showed a decline, reflecting this overall pessimism.

-

Competitor Activity: While no major announcements from direct competitors specifically targeted D-Wave, positive news regarding other players in the quantum computing space might have shifted investor attention and capital elsewhere. The competitive landscape in the burgeoning quantum computing field is dynamic, and relative progress by competitors can influence investor confidence. Analyzing the performance of publicly traded competitors in the sector provides valuable context.

-

Investor Risk Appetite: A decrease in overall investor risk appetite often leads to selling pressure on growth stocks, particularly those in less established sectors like quantum computing. QBTS, as a relatively new publicly traded company, is susceptible to shifts in investor risk tolerance. This heightened sensitivity to market fluctuations necessitates careful consideration of the overall market environment when assessing QBTS performance.

Company-Specific News and Developments

While no significant negative company-specific news directly caused Monday's decline, the absence of positive catalysts might have contributed to the sell-off. It's crucial to examine D-Wave Quantum's recent activities.

-

Recent Announcements: A review of D-Wave's recent press releases, earnings reports, and regulatory filings is vital. The absence of significant positive announcements around product launches, partnerships, or funding could have contributed to the lack of investor enthusiasm.

-

Potential Delays: Any hints of delays in project timelines or challenges in technological development, even if subtly communicated, can negatively impact investor confidence. Transparency about potential hurdles is critical for maintaining trust.

-

Management and Strategic Shifts: Although no major management changes were reported, any shifts in strategic direction, even minor ones, can influence investor perception and lead to uncertainty, potentially triggering selling pressure.

Impact of Analyst Ratings and Reports

Analyst ratings and research reports significantly influence investor decisions regarding QBTS. Any downgrades or negative revisions can accelerate selling pressure.

-

Analyst Rating Changes: A review of any recent downgrades by prominent financial analysts is essential. These downgrades often reflect a reassessment of the company's prospects and can trigger substantial sell-offs.

-

Research Report Summaries: Key findings from recent reports on D-Wave's financial performance, technological advancements, and market positioning should be carefully examined. These reports offer valuable insights into the overall market perception of QBTS.

-

Market Perception: The cumulative impact of analyst reports and ratings shapes the overall market perception of QBTS, influencing investment decisions and potentially contributing to price volatility.

Macroeconomic Factors and Their Influence

Broader economic conditions significantly impact investor behavior in the technology sector, including the quantum computing market.

-

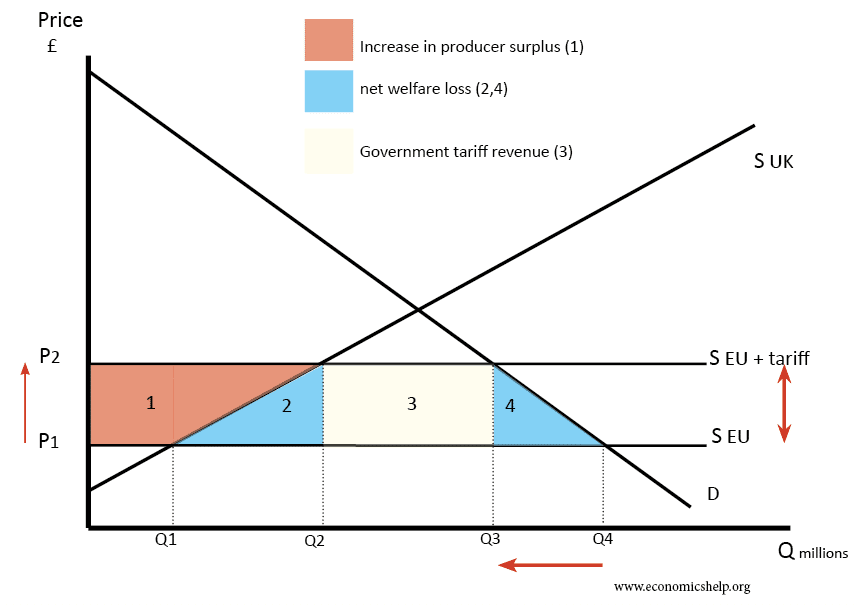

Interest Rate Hikes and Growth Stocks: Rising interest rates typically negatively affect growth stocks like QBTS because higher rates increase borrowing costs and reduce the attractiveness of future earnings.

-

Inflation and Economic Uncertainty: High inflation and general economic uncertainty often lead to investors shifting towards more defensive investments, reducing capital allocation to riskier assets like those in the burgeoning quantum computing industry.

-

Geopolitical Events: Geopolitical instability and uncertainty can also influence investor sentiment, leading to increased risk aversion and selling pressure on growth stocks.

Conclusion

This analysis of D-Wave Quantum (QBTS) stock's Monday decline highlights the interplay of various factors, including broader market trends, company-specific news, and macroeconomic influences. Understanding these interconnected elements is vital for navigating the volatility in the quantum computing market. While the reasons behind Monday's drop are multifaceted, continued monitoring of market sentiment, D-Wave Quantum's performance, and macroeconomic factors is crucial for informed investment decisions. Stay informed on future developments and continue to research D-Wave Quantum (QBTS) stock to make the best investment choices for your portfolio.

Featured Posts

-

British Ultrarunner Challenges Australian Crossing Record

May 21, 2025

British Ultrarunner Challenges Australian Crossing Record

May 21, 2025 -

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 21, 2025

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 21, 2025 -

Unpacking The Details A Closer Look At Trumps Aerospace Projects

May 21, 2025

Unpacking The Details A Closer Look At Trumps Aerospace Projects

May 21, 2025 -

Ottawa Rejects Oxford Report Claims On Us Canada Tariffs

May 21, 2025

Ottawa Rejects Oxford Report Claims On Us Canada Tariffs

May 21, 2025 -

The Buy Canadian Movement How Tariffs Affect The Local Beauty Industry

May 21, 2025

The Buy Canadian Movement How Tariffs Affect The Local Beauty Industry

May 21, 2025