D-Wave Quantum (QBTS) Stock Performance: Analyzing Monday's Decrease

Table of Contents

Market-Wide Factors Influencing QBTS Stock Performance

The decline in D-Wave Quantum (QBTS) stock wasn't occurring in a vacuum. Several broader market trends likely played a significant role in Monday's dip. The quantum computing sector, while promising, is still considered an emerging technology, making it susceptible to shifts in overall investor sentiment.

- General market correction affecting growth stocks: Growth stocks, especially those in speculative sectors like quantum computing, often experience heightened volatility during market corrections. Monday's dip could be attributed to a broader sell-off impacting high-growth, high-risk investments.

- Investor risk aversion impacting speculative investments: Periods of economic uncertainty or rising interest rates often lead to increased risk aversion among investors. This can result in a flight to safety, causing investors to divest from riskier assets like QBTS stock.

- Influence of macroeconomic factors like inflation or interest rates: Macroeconomic factors such as inflation and interest rate hikes can significantly influence investor behavior. Rising interest rates, for example, can make alternative investments more attractive, potentially leading to a decrease in demand for growth stocks like QBTS.

- Comparison to other quantum computing stocks’ performance: Analyzing the performance of other publicly traded quantum computing companies can provide context. Did similar declines occur across the sector, suggesting a broader industry trend, or was the QBTS drop more company-specific?

Specific News or Events Affecting D-Wave Quantum (QBTS)

Beyond market-wide factors, company-specific news or events could have triggered the QBTS stock price decrease. It's crucial to examine any recent announcements or developments.

- Analysis of recent press releases and announcements: A thorough review of D-Wave's recent press releases and announcements is necessary to identify any potential negative news that might have impacted investor confidence. This could include delays in product development, missed earnings targets, or changes in management.

- Impact of any new product launches or partnerships: While new product launches or partnerships can be positive catalysts, a poorly received product launch or a terminated partnership could negatively affect stock price. Analyzing the reception of any recent announcements is crucial.

- Discussion of any regulatory changes affecting the company: Regulatory changes specific to the quantum computing industry or affecting D-Wave directly could also have influenced investor sentiment. Any new regulations or investigations could impact stock price.

- Mention of any analyst ratings or reports released around Monday's drop: Any new analyst reports or ratings downgrades released around the time of the stock drop should be carefully considered, as these can significantly influence market perception.

Technical Analysis of QBTS Stock Chart

A technical analysis of the QBTS stock chart can offer further insights into Monday's price movement. While detailed technical analysis requires expertise, a few key indicators can provide valuable context. (Insert relevant chart of QBTS stock price from Monday here)

- Analysis of trading volume on Monday: High trading volume on Monday, coupled with the price drop, could suggest a significant number of investors selling their shares, further exacerbating the decline.

- Examination of key support and resistance levels: Identifying whether the price drop broke through any significant support levels can indicate the strength of the selling pressure. Resistance levels can help determine potential price ceilings.

- Interpretation of relevant technical indicators (e.g., moving averages, RSI): Technical indicators like moving averages and the Relative Strength Index (RSI) can help assess the momentum and potential overbought or oversold conditions of the stock.

- Visual aid: Including a chart clearly illustrating the price movement on Monday provides valuable visual context and strengthens the analysis.

Long-Term Outlook for D-Wave Quantum (QBTS) Stock

While Monday's decline is concerning, it's crucial to maintain a balanced perspective on the long-term prospects of D-Wave Quantum and the quantum computing sector as a whole.

- Assessment of D-Wave's competitive landscape: Analyzing D-Wave's position relative to its competitors is vital. Identifying its strengths and weaknesses in the market will help determine its potential for future growth.

- Evaluation of the company's technological advancements: The ongoing development and improvement of D-Wave's quantum computing technology are crucial factors in determining its long-term potential. Significant technological breakthroughs could drive future stock price appreciation.

- Discussion of the overall growth potential of the quantum computing market: The quantum computing market is expected to experience significant growth in the coming years. D-Wave's potential to benefit from this growth should be considered.

- Identification of potential catalysts for future stock price appreciation: Identifying potential catalysts like successful product launches, strategic partnerships, or positive regulatory developments can help investors gauge the potential for future stock price increases.

Conclusion

Monday's decrease in D-Wave Quantum (QBTS) stock price resulted from a combination of market-wide factors, such as a general correction in growth stocks and increased investor risk aversion, and potentially company-specific events. A thorough analysis of recent news, technical indicators, and the broader quantum computing landscape is needed for informed decision-making. While Monday’s QBTS stock decline presents a challenge, understanding the underlying factors is crucial for informed investment decisions. Continue monitoring D-Wave Quantum (QBTS) stock performance and stay updated on news and analysis to make well-informed choices regarding your investment in this exciting and volatile sector of the quantum computing market. Further research into QBTS and the broader quantum computing landscape is recommended before making any investment decisions.

Featured Posts

-

The Amazing World Of Gumball Returns To Hulu Watch The New Teaser Trailer

May 21, 2025

The Amazing World Of Gumball Returns To Hulu Watch The New Teaser Trailer

May 21, 2025 -

Femicide Understanding The Rise In Cases And Its Underlying Causes

May 21, 2025

Femicide Understanding The Rise In Cases And Its Underlying Causes

May 21, 2025 -

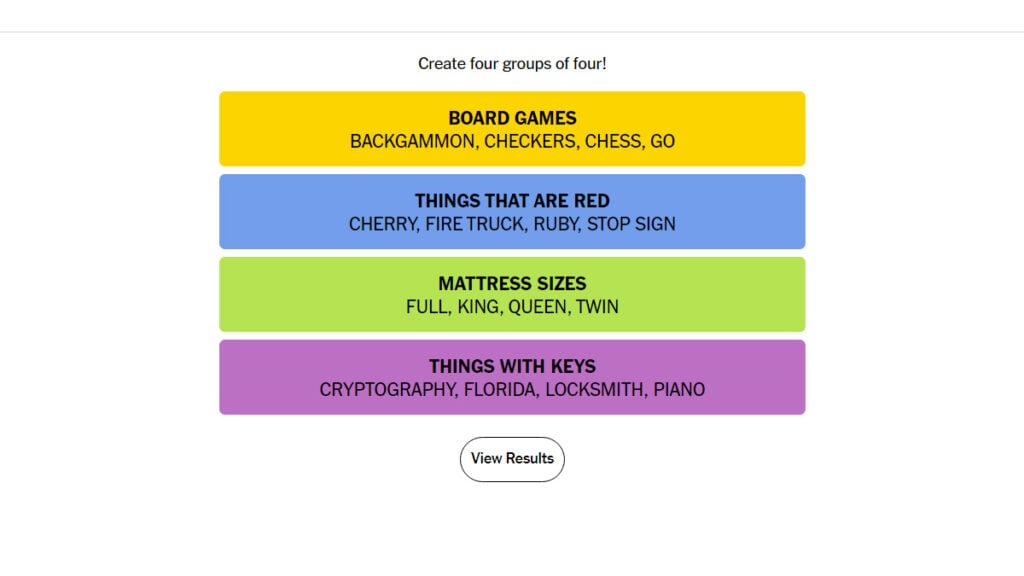

Solve The Nyt Mini Crossword Hints For April 26 2025

May 21, 2025

Solve The Nyt Mini Crossword Hints For April 26 2025

May 21, 2025 -

Cobollis First Atp Title Bucharest Open Victory

May 21, 2025

Cobollis First Atp Title Bucharest Open Victory

May 21, 2025 -

The Underrated Western Neo Noir Starring Dennis Quaid Meg Ryan And James Caan

May 21, 2025

The Underrated Western Neo Noir Starring Dennis Quaid Meg Ryan And James Caan

May 21, 2025