D-Wave Quantum (QBTS) Stock Plunge: Understanding The Monday Market Reaction

Table of Contents

Analyzing the D-Wave Quantum (QBTS) Stock Performance

Before delving into the reasons for Monday's plunge, let's examine QBTS's recent performance. Leading up to the drop, QBTS had experienced [Describe the trend – e.g., a period of relative stability, a gradual decline, or a period of volatility].

[Insert a chart or graph visually representing QBTS stock price movement over the relevant period. Clearly label the axes and highlight the day of the significant drop.]

- October 26, 2023: QBTS closed at [Price].

- October 27, 2023: Significant negative news [Specify news, if any] impacted the stock price.

- October 30, 2023: The stock experienced a sharp decline, closing at [Price], representing a [Percentage]% drop from the previous closing price.

- Compared to the broader market, specifically the Nasdaq Composite, QBTS's performance on this day was [Compare performance - significantly worse, slightly worse, similar, etc.].

Potential Factors Contributing to the D-Wave Quantum (QBTS) Stock Plunge

Several factors could have contributed to the sharp decline in D-Wave Quantum's stock price. Let's explore some key possibilities:

Financial Performance and Earnings Reports

Recent financial reports and earnings announcements often play a crucial role in shaping investor sentiment.

- Revenue: D-Wave Quantum's recent revenue figures were [Describe revenue - e.g., lower than expected, in line with expectations, significantly lower than previous quarters].

- Losses: The company reported [Describe losses – e.g., increased losses compared to the previous quarter, unexpected losses].

- Debt: The company's debt levels [Describe debt levels - e.g., remained high, increased].

- Market Reaction: The market reacted negatively to these metrics, likely contributing to the sell-off. Investors may have been concerned about [Mention specific concerns, e.g., the company's ability to achieve profitability, its long-term financial sustainability].

Market Sentiment and Overall Investor Confidence

The broader market conditions also significantly impact individual stock performance.

- Tech Sector Downturn: A general downturn in the technology sector, particularly in the quantum computing space, might have negatively influenced investor confidence in QBTS.

- Investor Confidence: Investor confidence in the quantum computing sector as a whole may have waned due to [Mention reasons, e.g., slower-than-expected technological advancements, increased competition].

- Analyst Ratings: Any recent downgrades from financial analysts could have further exacerbated the negative sentiment surrounding QBTS.

Company-Specific News and Announcements

Any company-specific news, whether positive or negative, can influence investor decisions.

- Product Launches/Partnerships: The absence of significant new product launches or strategic partnerships could have disappointed investors.

- Delays: Any delays in project timelines or technological advancements could have negatively impacted investor expectations.

- Regulatory Issues: Potential regulatory hurdles or legal challenges facing the company could have contributed to the sell-off.

Competition in the Quantum Computing Industry

The quantum computing industry is highly competitive, with major players like IBM, Google, and IonQ vying for market share.

- Competitor Advancements: Significant advancements by competitors could have put pressure on D-Wave Quantum's market position and investor confidence.

- Market Share: Concerns about D-Wave Quantum's ability to maintain or grow its market share might have fueled the stock price decline.

- Growth Potential: Uncertainty about the overall growth potential of the quantum computing sector in the near term could also contribute to investor apprehension.

Conclusion

The D-Wave Quantum (QBTS) stock plunge on Monday was likely a result of a confluence of factors, including disappointing financial performance, negative market sentiment, and competitive pressures within the quantum computing industry. Understanding these market dynamics and conducting thorough fundamental analysis is crucial for making informed investment decisions. Before investing in D-Wave Quantum (QBTS) stock or any other quantum computing stock, it's essential to carefully consider the factors discussed in this article and conduct your own comprehensive research. Further reading on topics such as quantum computing stocks, market analysis, and risk management is strongly recommended. Remember to carefully assess the risks involved before investing in D-Wave Quantum (QBTS).

Featured Posts

-

Charles Leclercs Richard Mille Rm 72 01 Features And Specifications

May 20, 2025

Charles Leclercs Richard Mille Rm 72 01 Features And Specifications

May 20, 2025 -

March 27 2024 Nyt Mini Crossword Full Solutions

May 20, 2025

March 27 2024 Nyt Mini Crossword Full Solutions

May 20, 2025 -

No Murder In Towards Zero Episode 1 Exploring Agatha Christies Intentions

May 20, 2025

No Murder In Towards Zero Episode 1 Exploring Agatha Christies Intentions

May 20, 2025 -

Romes Glory Jasmine Paolinis Breakthrough Victory

May 20, 2025

Romes Glory Jasmine Paolinis Breakthrough Victory

May 20, 2025 -

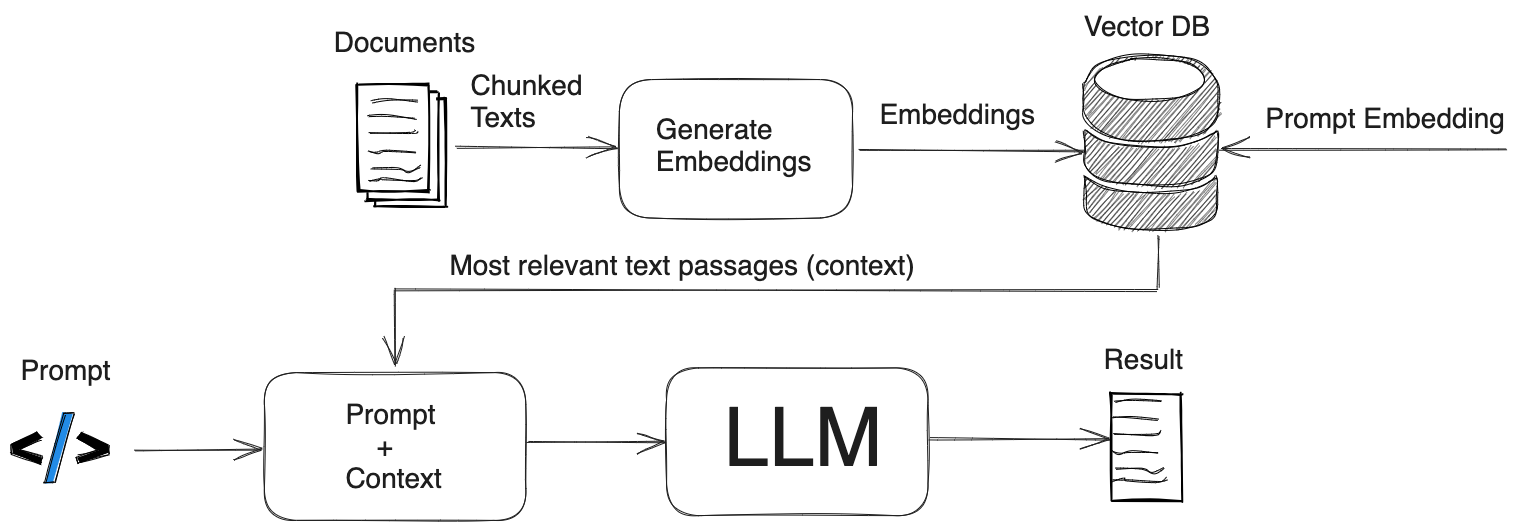

Apples Next Generation Siri Powered By Llms

May 20, 2025

Apples Next Generation Siri Powered By Llms

May 20, 2025