Daily Oil Market Report: April 23rd Price And News Summary

Table of Contents

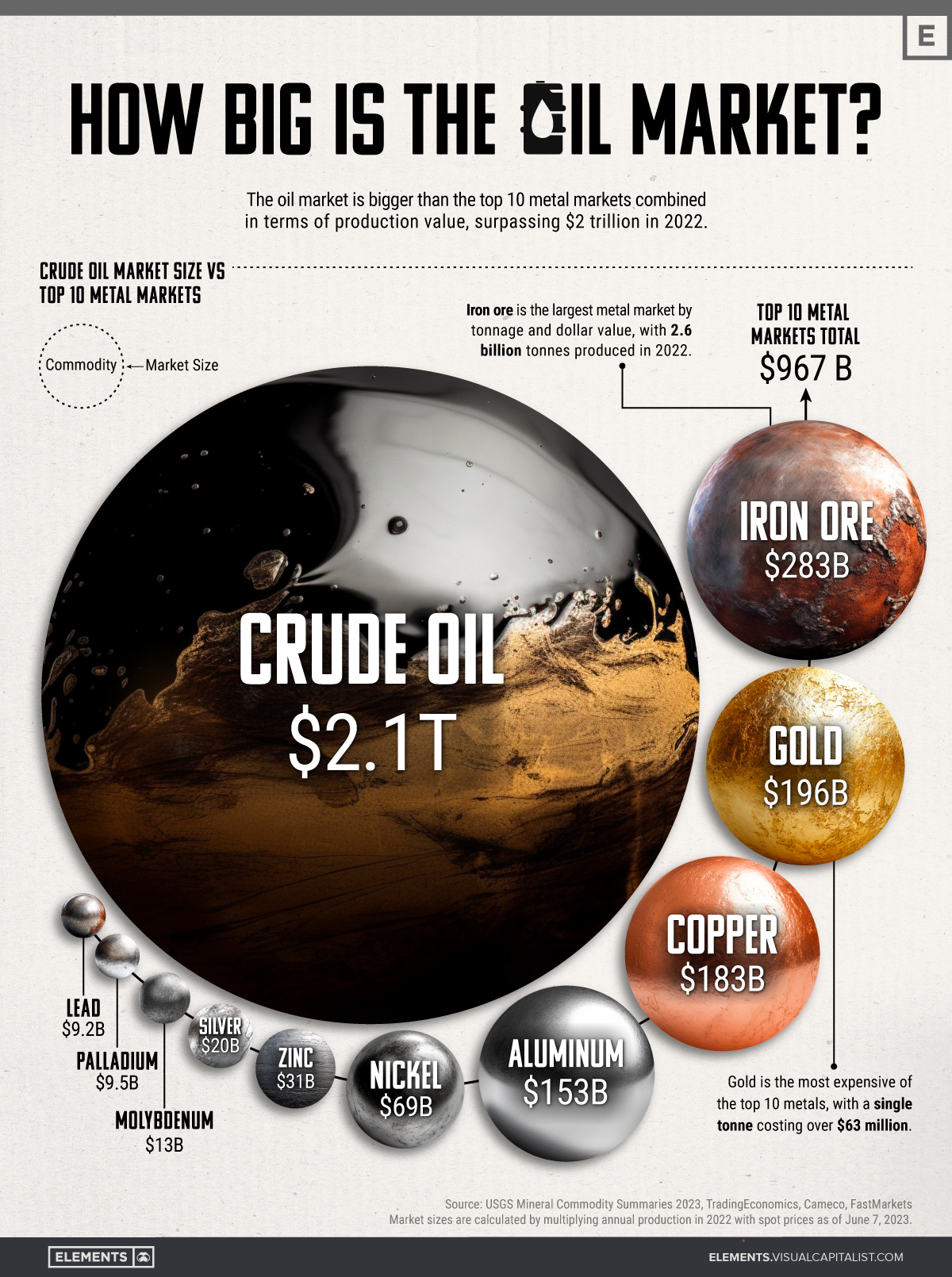

The daily oil market report provides crucial insights into the dynamic world of energy trading. This report summarizes the key price movements, news events, and market sentiment for April 23rd, offering a comprehensive overview of the day's activity in the oil market. Understanding these daily fluctuations is critical for investors, traders, and anyone impacted by crude oil price and petroleum product changes.

Crude Oil Price Movements on April 23rd

WTI Crude Oil Price

West Texas Intermediate (WTI) crude oil experienced a relatively stable day on April 23rd.

- Opening Price: $78.50 per barrel

- High: $79.20 per barrel

- Low: $77.80 per barrel

- Closing Price: $78.90 per barrel

- Percentage Change: +0.51% compared to the previous day's closing price.

The overall trend for WTI was a slight upward movement, influenced primarily by positive sentiment surrounding renewed hopes for a global economic recovery and ongoing discussions regarding OPEC+ production levels. Concerns remain, however, about potential future interest rate hikes by the Federal Reserve.

Brent Crude Oil Price

Brent crude oil, the global benchmark, followed a similar pattern to WTI on April 23rd.

- Opening Price: $82.00 per barrel

- High: $82.70 per barrel

- Low: $81.30 per barrel

- Closing Price: $82.40 per barrel

- Percentage Change: +0.49% compared to the previous day's closing price.

The price movement for Brent largely mirrored that of WTI, suggesting a general positive sentiment across the global oil market. The slight difference in percentage change reflects the varying degrees of sensitivity to global economic factors between the two benchmarks.

Price Volatility and Trading Volume

April 23rd witnessed relatively low volatility in both WTI and Brent crude oil markets.

- Volatility Index (VIX): The oil volatility index remained below average, suggesting a degree of market confidence. (Specific data would be included here if available).

- Trading Volume: Trading volume was slightly below average, possibly indicating some market hesitancy despite the positive price movement. (Specific trading volume figures would be added here)

The low volatility and moderate trading volume suggest a period of consolidation in the market following recent price fluctuations.

Key News and Events Impacting Oil Prices on April 23rd

Geopolitical Developments

Geopolitical stability on April 23rd generally supported positive oil price movements. However, ongoing tensions in Eastern Europe remained a background factor influencing market sentiment. Any significant escalation or de-escalation would have had a considerable impact on oil prices.

- Impact on Supply: Potential disruptions to oil supply from this region continue to act as a price floor.

OPEC+ Decisions

No major announcements or production adjustments were made by OPEC+ on April 23rd. The continued adherence to the existing production targets contributed to a stable market environment.

- Impact on Prices: The maintenance of current production levels helped to prevent any significant price swings.

Inventory Reports

The American Petroleum Institute (API) released its weekly inventory report on April 22nd, showing a slight decrease in crude oil inventories. This data supported the positive market sentiment.

- Crude Oil Inventories: A drawdown in crude oil inventories is generally bullish for prices, suggesting a tightening of the supply-demand balance. (Specific API data would be included here)

Economic Indicators

Positive economic data released from major economies around the world contributed to higher oil demand expectations and thus supported prices.

- GDP Growth: Positive GDP growth projections indicate stronger future demand for oil. (Specific data would be included here).

Market Sentiment and Analyst Forecasts

Market Sentiment Analysis

The overall market sentiment on April 23rd leaned slightly bullish. The moderate price increase, coupled with relatively low volatility and positive economic data, created a sense of cautious optimism among traders. This sentiment was reflected in trader positioning and various media reports.

- Evidence: Increased long positions in oil futures contracts supported the prevailing bullish sentiment.

Analyst Predictions

Leading energy analysts maintained a generally positive outlook for the short to medium term, with price forecasts ranging from $80 to $85 per barrel for both WTI and Brent crude oil.

- Predictions: Several analysts cited improving global demand and ongoing geopolitical uncertainty as key factors supporting their projections.

Conclusion

The daily oil market report for April 23rd reflects a period of relative stability and cautious optimism. While slight price increases were observed for both WTI and Brent crude oil, low volatility and moderate trading volume indicated a period of consolidation rather than strong directional momentum. Positive economic data, coupled with ongoing geopolitical concerns and stable OPEC+ production levels, were the main drivers influencing oil prices throughout the day.

Stay updated on daily oil market movements. Check back tomorrow for the latest Daily Oil Market Report and insightful oil price analysis. Follow us on [Social Media Links] for real-time updates and market insights.

Featured Posts

-

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025 -

Zaboravljeni Projekt Tarantino I Travolta Razlozi Za Izbjegavanje Jednog Filma

Apr 24, 2025

Zaboravljeni Projekt Tarantino I Travolta Razlozi Za Izbjegavanje Jednog Filma

Apr 24, 2025 -

Execs Targeted Millions Stolen Via Office 365 Breaches Feds Say

Apr 24, 2025

Execs Targeted Millions Stolen Via Office 365 Breaches Feds Say

Apr 24, 2025 -

V Mware Costs To Soar 1050 At And T Details Broadcoms Extreme Price Increase

Apr 24, 2025

V Mware Costs To Soar 1050 At And T Details Broadcoms Extreme Price Increase

Apr 24, 2025 -

Analysis Of Oil Prices And Market Trends April 23rd

Apr 24, 2025

Analysis Of Oil Prices And Market Trends April 23rd

Apr 24, 2025