Dasani's UK Absence: Distribution And Availability Explained

Table of Contents

The History of Dasani in the UK

Dasani's history in the UK is, to put it mildly, brief and somewhat underwhelming. Unlike its success in other global markets, the brand has never truly established a significant presence on British shelves. While there's no publicly available information on a large-scale launch attempt, any initial foray into the UK market appears to have been short-lived and ultimately unsuccessful. The reasons for this lack of sustained presence remain a subject of speculation, but several factors likely contributed to its failure to gain traction.

- Key Dates and Events (Speculative, due to lack of public information):

- Early 2000s (estimated): Potential initial test launch with limited distribution.

- Mid-2000s (estimated): Withdrawal from the UK market due to unspecified reasons.

- Present: No significant attempts to relaunch the brand in the UK.

Keywords: Dasani UK launch, Dasani UK history, bottled water UK market.

Distribution Challenges and Logistics

Importing and distributing bottled water to the UK presents significant logistical hurdles. The UK's island geography means reliance on sea freight and potentially higher transportation costs compared to landlocked countries. Furthermore, warehousing and efficient supply chain management are critical for a product with a relatively short shelf life. Brexit added another layer of complexity, with potential increases in customs duties and delays impacting the viability of importing large quantities of bottled water.

- Logistical Hurdles:

- High transportation costs from manufacturing locations.

- Significant warehousing requirements to manage inventory effectively.

- Increased complexity and costs associated with navigating post-Brexit regulations.

- Maintaining a consistent and reliable supply chain to meet demand.

Keywords: Dasani UK distribution, water import UK, supply chain bottled water, UK logistics.

Competitive Landscape and Market Saturation

The UK bottled water market is fiercely competitive, dominated by established brands with extensive distribution networks. Brands like Highland Spring, Buxton, and Volvic hold significant market share, leaving little room for newcomers to easily penetrate the market. Dasani's brand positioning, often perceived as a more mainstream and less premium option compared to many established UK brands, may further hinder its potential success.

- Major Competitors and Market Share (Illustrative):

- Highland Spring: Holds a substantial market share, benefiting from strong regional branding.

- Buxton: Appeals to consumers seeking a natural, mineral-rich water.

- Volvic: A well-known international brand with a solid UK presence.

- Other brands (e.g., Tesco, own-brand waters): These offer a significant and price-competitive challenge.

Keywords: UK bottled water market, bottled water competitors UK, Dasani market share UK.

Coca-Cola's Brand Strategy and Prioritization

Coca-Cola, Dasani's parent company, has a vast portfolio of beverages in the UK, including established and highly profitable brands like Coca-Cola, Fanta, and Sprite. It's plausible that Coca-Cola's strategic focus lies on maximizing the return on investment from its existing, successful brands in the UK market. Investing resources in launching and promoting Dasani might be considered less of a priority given the challenges and saturation already present.

- Coca-Cola's UK Strategy (Inferred):

- Prioritizing established brands with a proven track record in the UK.

- Focusing resources on marketing and distribution for its most profitable products.

- Limited appetite for investment in a new product launch facing significant market challenges.

Keywords: Coca-Cola UK strategy, beverage market UK, brand portfolio Coca-Cola.

Consumer Demand and Perception

While there's no definitive data on specific UK consumer demand for Dasani, anecdotal evidence suggests it isn't a widely sought-after brand. The lack of brand awareness compared to established competitors could be a significant factor contributing to its absence. Moreover, UK consumers often display strong loyalty to local or well-known brands, making it difficult for a new bottled water brand to establish a foothold.

- Consumer Habits and Opinions (Inferred):

- Preference for established and locally sourced bottled water brands.

- Limited awareness of the Dasani brand amongst UK consumers.

- Potential perception of Dasani as a less premium or desirable option compared to existing brands.

Keywords: consumer preference bottled water UK, Dasani brand awareness UK, UK water consumption.

Conclusion

Dasani's absence from the UK market is a complex issue stemming from a combination of logistical challenges, intense competition, and Coca-Cola's strategic brand prioritization. While consumer demand remains an open question, the high cost of importing and distributing bottled water, coupled with the saturated UK market, likely contributes significantly to Dasani's unavailability. The lack of a clear historical attempt at establishing a significant UK presence further supports this conclusion.

Call to Action: If you're interested in learning more about the intricacies of the UK beverage market or the challenges faced by international brands entering the UK, stay tuned for future articles exploring similar topics. Understanding the factors influencing Dasani's UK distribution helps us understand the complexities of the bottled water market.

Featured Posts

-

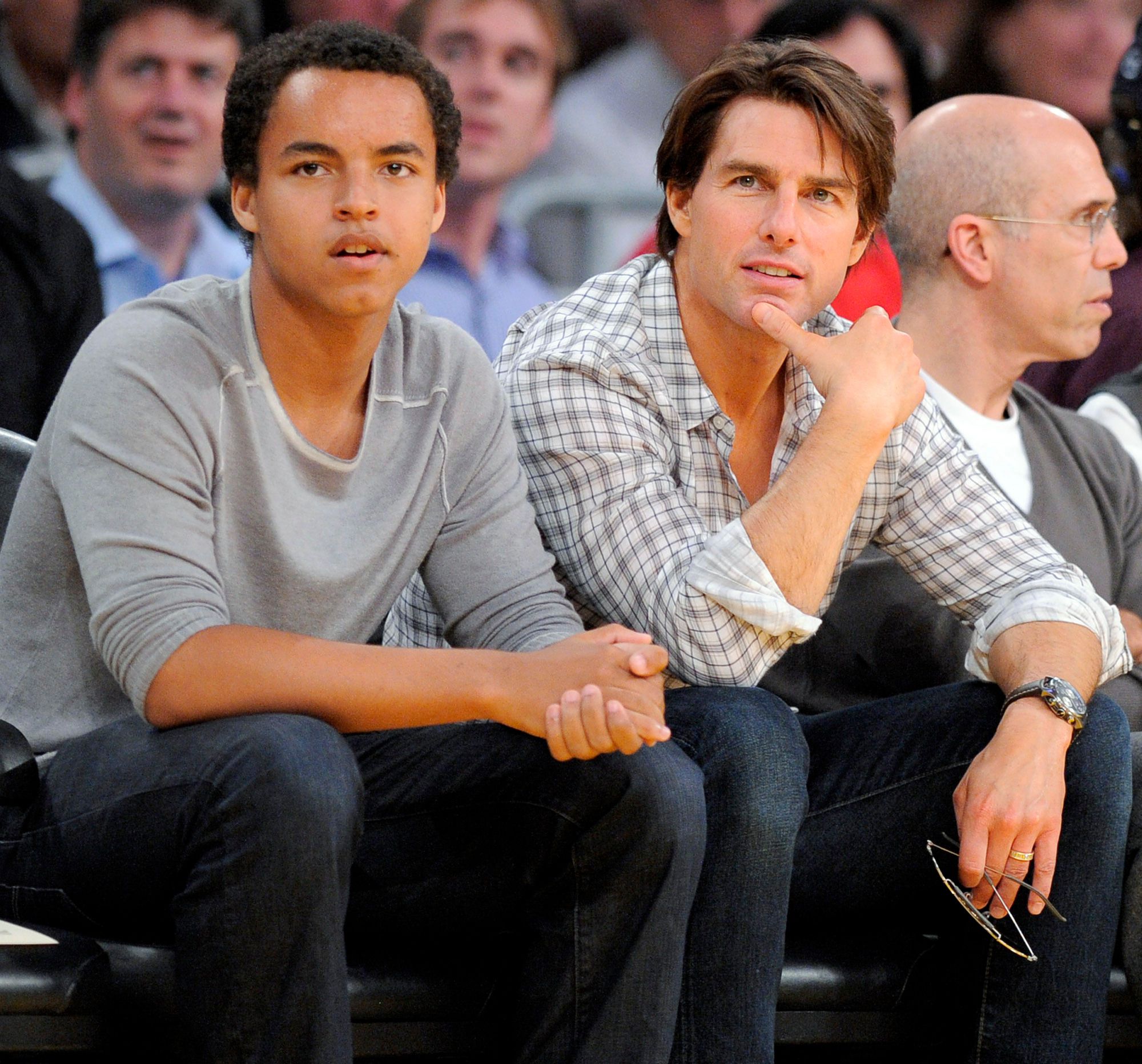

Tom Cruise And His Significant Others A Comprehensive Overview

May 16, 2025

Tom Cruise And His Significant Others A Comprehensive Overview

May 16, 2025 -

Leafs Vs Panthers Playoff Implications On The Line

May 16, 2025

Leafs Vs Panthers Playoff Implications On The Line

May 16, 2025 -

Microsoft Announces 6 000 Job Cuts What It Means For The Tech Industry

May 16, 2025

Microsoft Announces 6 000 Job Cuts What It Means For The Tech Industry

May 16, 2025 -

Partido Roma Monza Minuto A Minuto

May 16, 2025

Partido Roma Monza Minuto A Minuto

May 16, 2025 -

New Twins Spark Renewed Debate Over Elon Musk And Amber Heards Relationship

May 16, 2025

New Twins Spark Renewed Debate Over Elon Musk And Amber Heards Relationship

May 16, 2025