David Dodge On Canada's Economic Outlook: Ultra-Low Growth Forecast For Next Year

Table of Contents

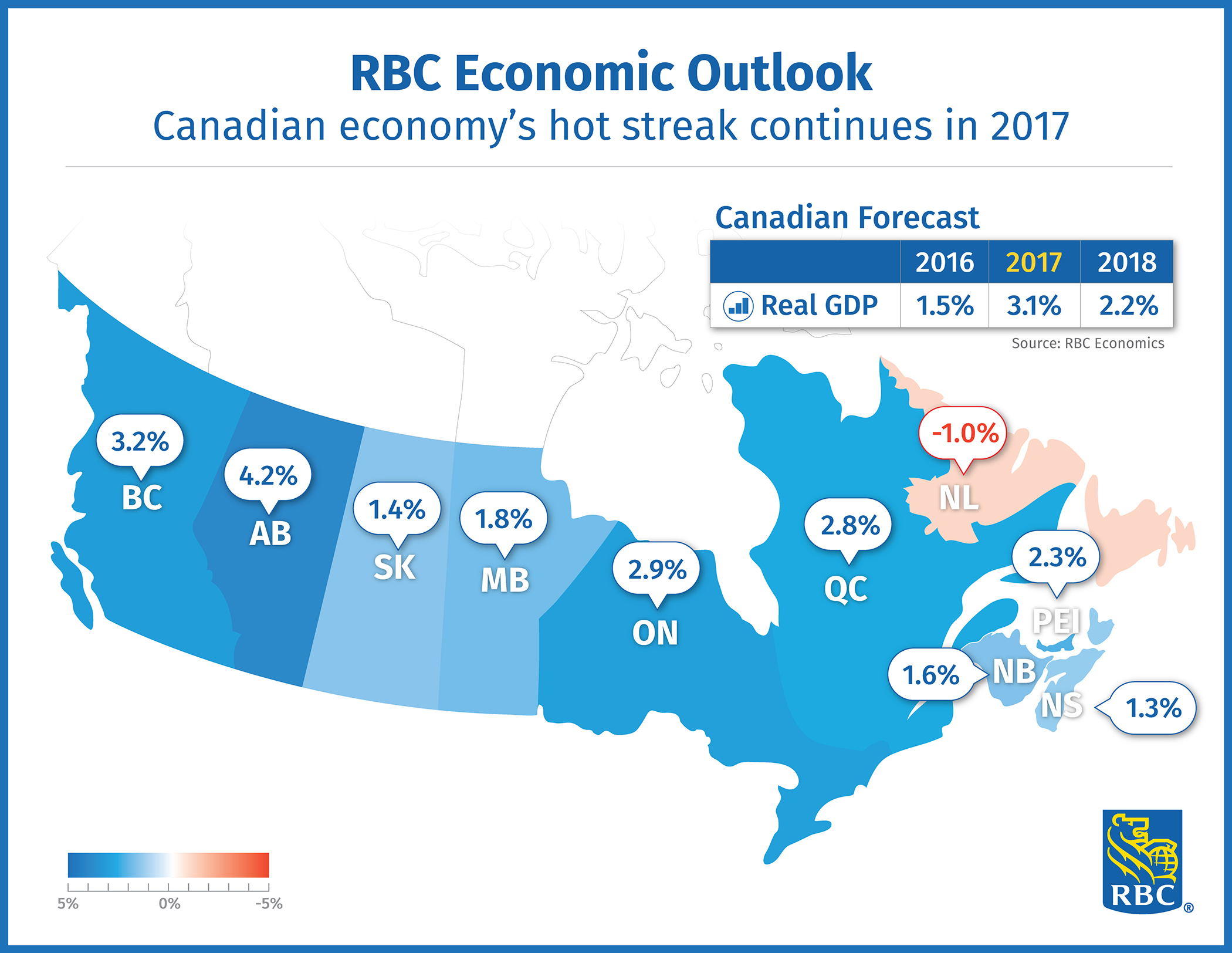

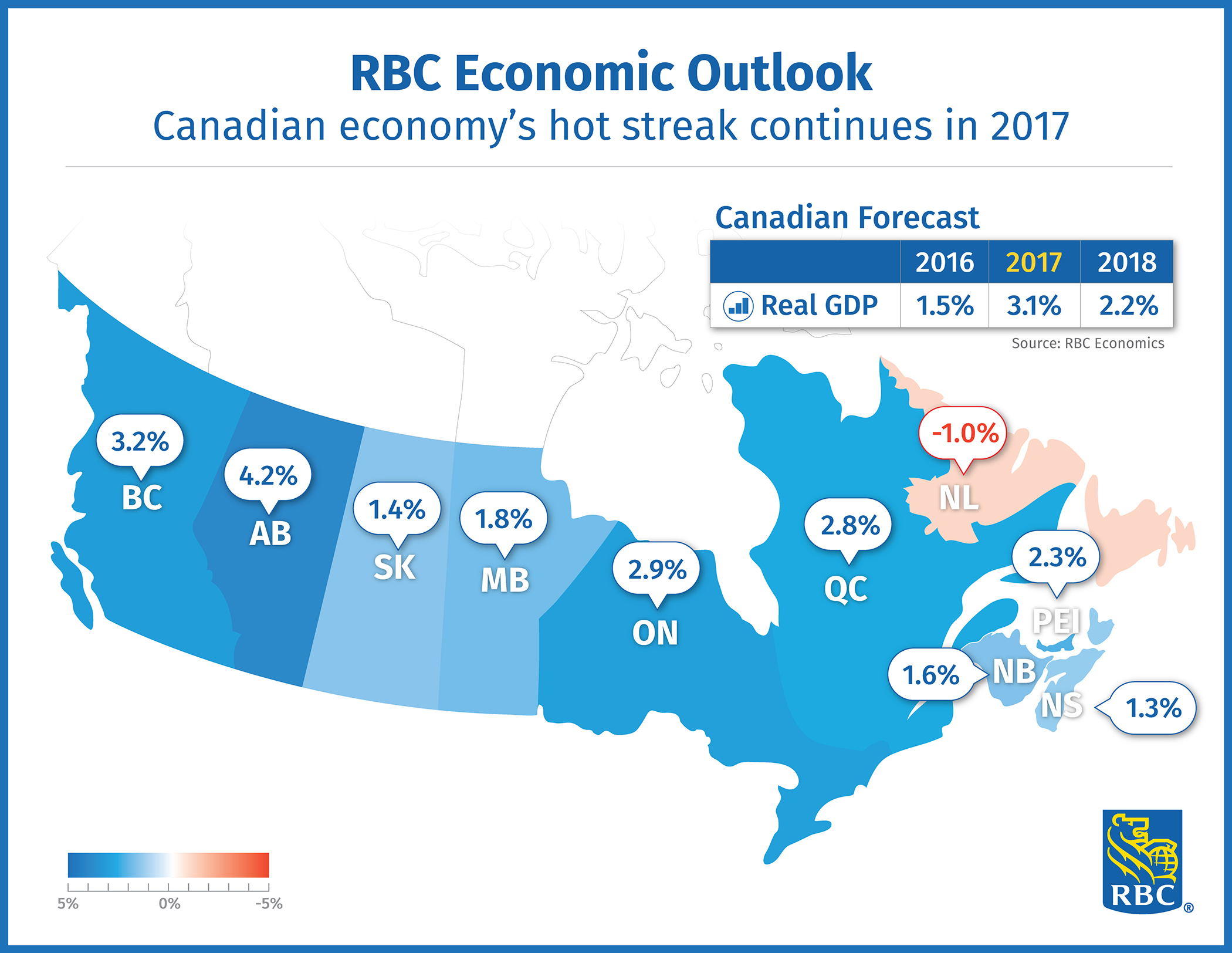

Acclaimed economist David Dodge has issued a stark warning about Canada's economic future, forecasting ultra-low growth for the next year. This prediction, carrying significant implications for Canadian businesses, consumers, and the government, demands careful consideration. This article delves into Dodge's analysis, exploring the factors contributing to this pessimistic outlook and its potential consequences for the Canadian economic forecast. Understanding the nuances of Canada's economic outlook is crucial for navigating the challenges ahead.

Key Factors Contributing to Ultra-Low Growth Forecast

Several interconnected factors contribute to David Dodge's prediction of ultra-low growth for Canada's economy in the coming year. These factors paint a complex picture of economic headwinds impacting the Canadian GDP growth.

Global Economic Slowdown

The global economy is facing significant headwinds, significantly impacting Canada's export-oriented economy. Global inflation remains stubbornly high in many major economies, fueling recessionary fears in the US and Europe. Supply chain disruptions, while easing somewhat, continue to create uncertainty and constrain growth. This translates into decreased demand for Canadian goods, weakening global trade, and a negative impact on commodity prices, all key components of Canada's economic health.

- Decreased demand for Canadian goods: Reduced global spending directly impacts exports, a crucial element of Canada's GDP growth.

- Weakening global trade: Protectionist tendencies and geopolitical instability hinder the free flow of goods and services, impacting Canadian businesses reliant on international trade.

- Impact on commodity prices: Fluctuations in global commodity prices, particularly energy and resources, directly affect Canadian export earnings and economic stability.

High Interest Rates and Inflation

The Bank of Canada's aggressive interest rate hikes, aimed at combating persistent inflation, are having a significant dampening effect on the Canadian economy. Increased borrowing costs are impacting consumer spending, business investment, and the housing market. This combination creates a feedback loop that slows down overall economic activity.

- Increased borrowing costs: Higher interest rates make borrowing more expensive for consumers and businesses, leading to reduced spending and investment.

- Decreased consumer confidence: Uncertainty surrounding inflation and interest rates erodes consumer confidence, leading to reduced spending and a decline in retail sales.

- Cooling housing market: Higher mortgage rates are significantly impacting the once-booming housing market, leading to price corrections and reduced construction activity.

- Impact on business investment: Businesses are hesitant to invest in expansion or new projects when borrowing costs are high and economic uncertainty prevails.

Geopolitical Uncertainty

Geopolitical uncertainty, largely driven by the war in Ukraine and rising global tensions, adds another layer of complexity to Canada's economic outlook. The war has created significant volatility in energy markets, impacting prices and supply chains. This uncertainty also undermines investor confidence and discourages investment in Canada.

- Increased energy prices: The war in Ukraine has exacerbated global energy price volatility, impacting inflation and consumer spending.

- Supply chain disruptions: Geopolitical instability continues to create disruptions in global supply chains, impacting businesses' ability to source materials and deliver goods.

- Uncertainty in global markets: The overall geopolitical climate creates uncertainty, making it difficult for businesses to plan for the future and impacting investor confidence.

- Impact on investor confidence: Global uncertainty makes Canada a less attractive investment destination, potentially impacting job creation and economic growth.

Implications of Ultra-Low Growth for Canada

David Dodge's ultra-low growth forecast for the Canadian economy carries significant implications across various sectors.

Impact on Employment

Reduced economic activity resulting from ultra-low growth is likely to impact employment in Canada. While not necessarily leading to widespread job losses, it could result in slower job growth, especially in sectors sensitive to economic downturns.

- Sectors most affected: Sectors like construction, retail, and hospitality are likely to be most affected by a slowdown in economic activity.

- Potential increase in unemployment: Slower job growth could lead to a slight increase in the unemployment rate, though the extent depends on the severity and duration of the economic slowdown.

- Impact on wage growth: Slower economic growth could put downward pressure on wage growth, as employers may be less inclined to offer significant salary increases.

Government Finances

Ultra-low growth will put pressure on government finances. Lower economic activity will lead to reduced tax revenues, while increased demand for social programs during times of economic hardship will likely increase government spending.

- Reduced tax revenues: Slower economic growth translates to lower tax revenues for all levels of government.

- Increased social program spending: Increased unemployment and economic hardship could lead to greater demand for social support programs.

- Potential for increased government debt: The combination of reduced revenues and increased spending could lead to an increase in government debt.

Consumer Spending and Confidence

Ultra-low growth will likely negatively impact consumer spending and confidence. Consumers facing higher interest rates, inflation, and economic uncertainty will be more cautious with their spending.

- Decreased consumer confidence: Negative economic news and uncertainty contribute to lower consumer confidence, leading to reduced spending.

- Reduced retail sales: Lower consumer spending translates into reduced retail sales, impacting businesses in the retail sector.

- Impact on household savings: Consumers may increase their savings as a precautionary measure against economic uncertainty.

Conclusion

David Dodge's ultra-low growth forecast for the Canadian economy presents a challenging outlook for the coming year. The confluence of global economic headwinds, high interest rates, and geopolitical uncertainty creates a formidable set of obstacles. Understanding these factors is crucial for businesses and individuals to adapt and navigate this potentially difficult economic period. Staying informed about Canada's economic outlook, by following expert analysis like David Dodge's, is key to making informed financial decisions and preparing for the challenges ahead. Learn more about the implications of ultra-low growth for your personal finances and business strategies. Understanding Canada's economic forecast is critical for successful navigation of the coming year.

Featured Posts

-

When Will Trust Care Health Offer Mental Health Treatment A Comprehensive Overview

May 02, 2025

When Will Trust Care Health Offer Mental Health Treatment A Comprehensive Overview

May 02, 2025 -

Return On Investment Why Early Childhood Mental Health Support Is Essential

May 02, 2025

Return On Investment Why Early Childhood Mental Health Support Is Essential

May 02, 2025 -

Brtanwy Arkan Parlymnt Ka Kshmyr Ke Msyle Pr Wadh Mwqf

May 02, 2025

Brtanwy Arkan Parlymnt Ka Kshmyr Ke Msyle Pr Wadh Mwqf

May 02, 2025 -

The Latest Fortnite Icon Skin A Comprehensive Guide

May 02, 2025

The Latest Fortnite Icon Skin A Comprehensive Guide

May 02, 2025 -

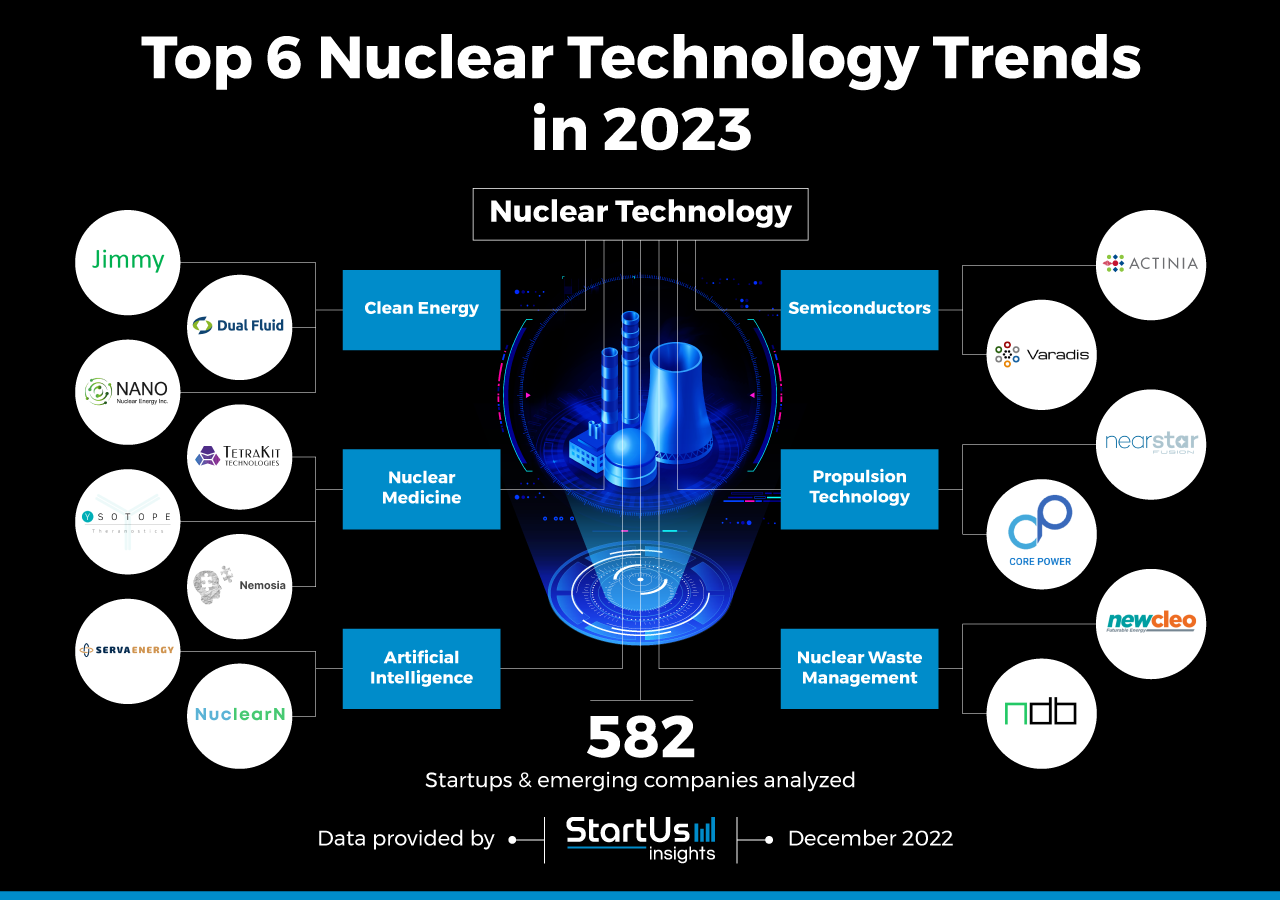

A Look At Ongoing Nuclear Litigation Current Cases And Trends

May 02, 2025

A Look At Ongoing Nuclear Litigation Current Cases And Trends

May 02, 2025