DAX Falls Below 24,000: Frankfurt Stock Market Closing Losses

Table of Contents

Factors Contributing to the DAX Decline

Several interconnected factors contributed to the DAX's dramatic fall below 24,000. These factors encompass global economic headwinds, Eurozone-specific challenges, and company-specific news.

Global Economic Uncertainty

The global economic landscape currently presents a complex and challenging environment for investors. Several key factors are impacting investor sentiment and driving market volatility:

- Inflation and Rising Interest Rates: Persistent high inflation in many countries has forced central banks, including the European Central Bank (ECB), to aggressively raise interest rates. This increases borrowing costs for businesses, dampening investment and economic growth.

- Geopolitical Tensions: The ongoing war in Ukraine continues to disrupt global supply chains, fuel energy price volatility, and create widespread economic uncertainty. This uncertainty significantly impacts investor confidence.

- Energy Crisis: The European energy crisis, exacerbated by the war in Ukraine, poses a significant threat to German industry, impacting production costs and profitability. This crisis is a major contributor to the current economic slowdown.

These global factors significantly influence investor sentiment, leading to risk aversion and capital flight from riskier assets, including stocks listed on the DAX. The correlation between these global economic indicators and DAX performance is undeniable.

Eurozone Economic Slowdown

The Eurozone faces the increasing risk of a recession or a significant economic slowdown. This poses a direct threat to German businesses, many of which are heavily integrated into the European economy.

- Weakening Eurozone Economic Indicators: Data on key Eurozone economic indicators, such as GDP growth, industrial production, and consumer confidence, point towards a weakening economy. These indicators directly impact investor confidence in the DAX.

- Vulnerable Sectors: Sectors like automobiles and chemicals, crucial components of the German economy, are particularly vulnerable to a Eurozone slowdown due to their reliance on exports and global supply chains.

A weakening Eurozone economy directly translates into reduced demand for German goods and services, impacting corporate profits and leading to a decline in stock prices.

Company-Specific News and Earnings Reports

Negative news and disappointing earnings reports from several major DAX-listed companies contributed to the market's downward pressure.

- Examples of Negative News: [Insert examples of specific companies and the nature of the negative news impacting their stock prices. E.g., "Company X announced lower-than-expected quarterly earnings due to supply chain disruptions," or "Company Y is facing investigations related to [specific issue]."]

- Ripple Effect: Negative news from prominent companies often creates a ripple effect, impacting investor sentiment towards the entire market and contributing to a general sell-off.

These company-specific events, combined with the broader macroeconomic factors, create a perfect storm leading to the significant DAX decline.

Impact of the DAX Fall on the German Economy

The DAX fall below 24,000 has significant implications for the German economy and investor confidence.

Investor Sentiment and Confidence

The decline in the DAX has negatively impacted investor sentiment and confidence.

- Stock Market Performance and Confidence: Stock market performance is a key indicator of economic health and directly affects consumer and business confidence. A falling DAX can lead to reduced consumer spending and business investment.

- Consequences of Reduced Confidence: Reduced investor confidence can hinder investment, leading to slower economic growth and potentially even a recession.

The negative sentiment surrounding the DAX decline can create a self-fulfilling prophecy, with further sell-offs driven by fear and uncertainty.

Potential for Further Market Volatility

The possibility of further DAX declines cannot be ruled out.

- Technical Analysis: Technical analysis indicators may suggest further downward pressure on the DAX. [Insert example of relevant technical indicators, e.g., "The breaking of key support levels suggests further potential downside."]

- Potential Support Levels and Triggers for a Rebound: Identifying potential support levels and triggers for a rebound is crucial for investors and market analysts. [Mention potential support levels and events that might trigger a market reversal.]

Government Response and Policy Implications

The German government may implement policy measures to mitigate the impact of the DAX fall.

- Economic Stimulus Packages: The government might introduce economic stimulus packages to boost economic activity and investor confidence.

- Policy Changes: Policy changes aimed at supporting specific sectors or easing the energy crisis could also be implemented.

The effectiveness of these government actions will be crucial in determining the future trajectory of the DAX and the German economy.

Conclusion: Navigating the DAX's Fall Below 24,000 – What's Next for Frankfurt's Stock Market?

The DAX's fall below 24,000 is a result of a confluence of factors: global economic uncertainty, a potential Eurozone slowdown, and company-specific news. This decline has significantly impacted investor sentiment and raises concerns about the German economy's outlook. The potential for further market volatility remains, and careful monitoring of economic indicators and government policy responses is crucial. To navigate this challenging market environment, staying informed about DAX developments and market trends is vital. Consider seeking professional financial advice tailored to your specific investment goals and risk tolerance for informed decision-making in this volatile market. For continuous DAX analysis, regular Frankfurt Stock Market updates, and in-depth insights into the German Stock Market outlook, stay tuned for further updates.

Featured Posts

-

Improving Drug Efficacy Through Orbital Crystal Research

May 24, 2025

Improving Drug Efficacy Through Orbital Crystal Research

May 24, 2025 -

Get A First Look Tulsa King Season 2 Blu Ray With Sylvester Stallone

May 24, 2025

Get A First Look Tulsa King Season 2 Blu Ray With Sylvester Stallone

May 24, 2025 -

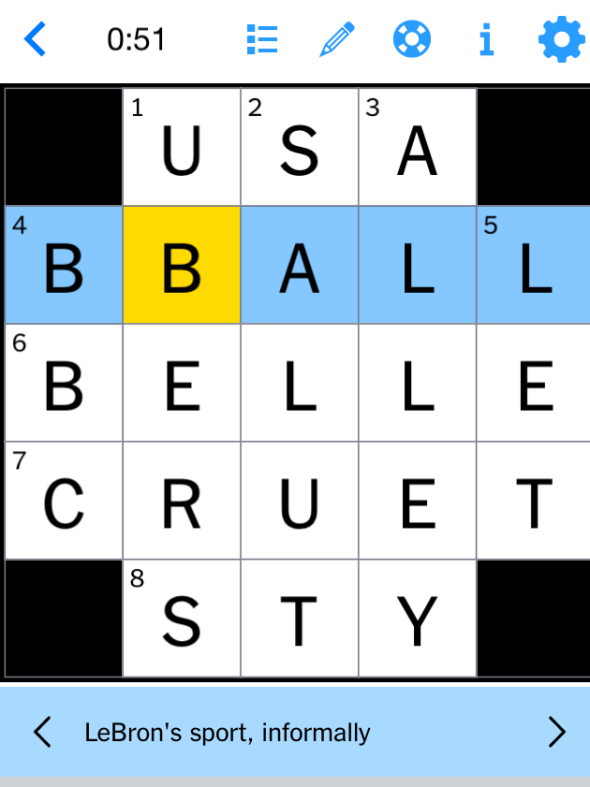

Nyt Mini Crossword March 24 2025 Hints And Solutions

May 24, 2025

Nyt Mini Crossword March 24 2025 Hints And Solutions

May 24, 2025 -

Dax Soars Frankfurt Equities Open Higher Record High Nears

May 24, 2025

Dax Soars Frankfurt Equities Open Higher Record High Nears

May 24, 2025 -

Rybakina Igraet Za 4 Milliarda Smotret Onlayn

May 24, 2025

Rybakina Igraet Za 4 Milliarda Smotret Onlayn

May 24, 2025