Dax Volatility: Understanding The Effects Of Elections And Economic Releases

Table of Contents

The Impact of Elections on Dax Volatility

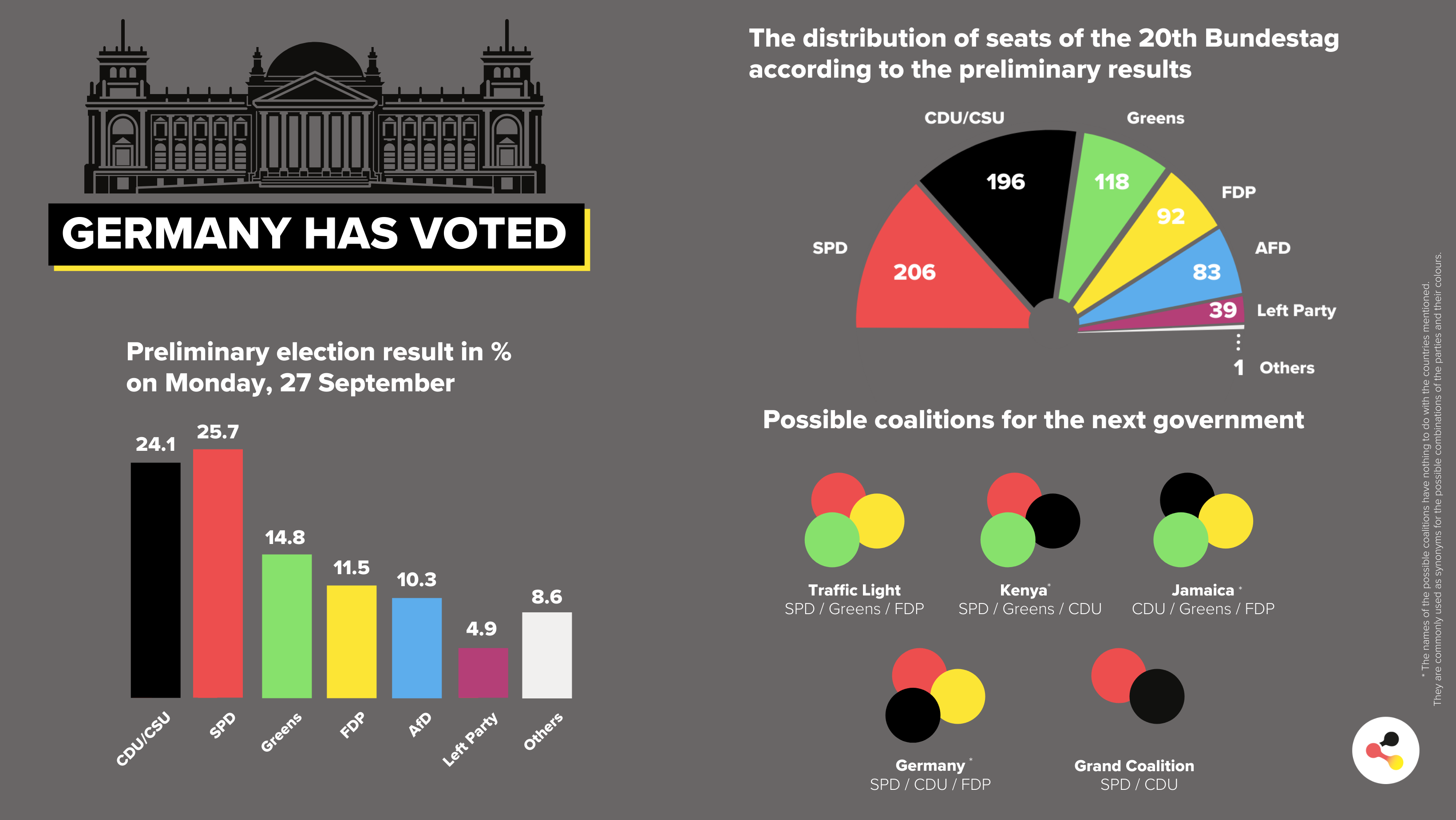

H3: Political Uncertainty and Market Sentiment: Elections inject uncertainty into the market, directly impacting investor confidence. A change in government can lead to significant policy shifts affecting businesses and the overall German economy. This uncertainty often translates into increased market volatility.

- Increased uncertainty often leads to increased volatility. Investors become hesitant to make large commitments until the political landscape becomes clearer.

- Investors may adopt a "wait-and-see" approach, leading to price fluctuations. This cautious approach can amplify price swings as trading volume decreases and individual actions create larger price impacts.

- Specific policy proposals (e.g., tax changes, regulatory reforms) during election campaigns can significantly influence market sentiment. Announcements regarding potential changes to corporate tax rates, environmental regulations, or social welfare programs can trigger immediate reactions in the market. Understanding the potential impact of these proposals is key to anticipating volatility.

H3: Analyzing Past Election Cycles: Examining historical DAX performance around past German federal elections provides valuable insights into typical volatility patterns. Analyzing the period before, during, and after the election reveals predictable trends.

- Identify trends in volatility levels during different phases of the election cycle. Volatility often increases in the lead-up to an election and can remain elevated during coalition negotiations post-election.

- Compare volatility to other market indices to establish relative impact. Comparing DAX volatility to other major European indices during election periods can help determine whether the impact is specific to Germany or a broader European phenomenon.

- Consider the impact of coalition negotiations on post-election volatility. The formation of a stable government can lead to decreased volatility, while protracted negotiations might extend the period of uncertainty.

Economic Releases and Their Effect on Dax Volatility

H3: Key Economic Indicators and Their Influence: Specific economic data releases significantly impact the DAX. Key indicators like GDP growth, inflation rates, unemployment figures, and Purchasing Managers' Indices (PMI) directly influence investor sentiment and market behavior.

- Positive surprises (better-than-expected data) generally lead to increased DAX values and potentially reduced short-term volatility. Positive economic news boosts investor confidence and can lead to a rally.

- Negative surprises (worse-than-expected data) can trigger sell-offs and increased volatility. Disappointing economic news often prompts investors to sell off their holdings, leading to a decline in the DAX and increased market volatility.

- Understanding the weight and relevance of each indicator for the German economy is crucial. Different indicators carry varying degrees of importance for the DAX. Investors need to be aware of which indicators hold the greatest influence on market sentiment.

H3: Reaction Time and Market Behavior: The immediate reaction to economic data releases can be dramatic, creating short-term Dax volatility. However, the market often adjusts and stabilizes relatively quickly.

- Analyze the speed and magnitude of DAX price movements following key releases. Understanding the typical market reaction time helps in predicting the potential impact of future releases.

- Study how different investor types (e.g., short-term traders vs. long-term investors) react to economic news. Short-term traders tend to react more dramatically to news than long-term investors.

- Examine the correlation between specific indicators and DAX volatility. Identifying strong correlations helps in predicting future volatility based on the release of specific economic indicators.

Strategies for Managing Dax Volatility

H3: Diversification and Risk Management: A diversified investment portfolio is crucial to mitigate the effects of Dax volatility. Employing various risk management tools is equally important.

- Consider hedging strategies to protect against potential losses. Hedging involves using financial instruments to offset potential losses.

- Implement stop-loss orders to limit downside risk. Stop-loss orders automatically sell your assets when they reach a specific price, limiting potential losses.

- Use options and futures contracts to manage exposure. Options and futures contracts offer tools to manage risk and potentially profit from Dax volatility.

H3: Fundamental vs. Technical Analysis: Employing both fundamental analysis (evaluating company performance and economic factors) and technical analysis (chart patterns and trading indicators) can significantly improve your understanding of Dax movements and volatility.

- Utilize technical indicators (e.g., moving averages, Bollinger Bands) to identify potential turning points. Technical indicators can provide signals of potential price reversals.

- Combine technical indicators with fundamental analysis to improve prediction accuracy. Combining both approaches enhances the accuracy of your market predictions.

- Consider sentiment analysis of news and social media to gauge market mood. Understanding overall market sentiment can provide valuable insights into potential price movements.

Conclusion

Understanding Dax volatility, particularly the influence of elections and economic releases, is paramount for successful investing. By analyzing historical data, understanding key economic indicators, and implementing effective risk management strategies, investors can better navigate the complexities of this dynamic market. Consistent monitoring of news and economic releases, coupled with robust investment strategies, are crucial for managing Dax volatility effectively. Stay informed and continue learning about Dax volatility to make more informed investment decisions. Mastering Dax volatility is key to long-term investment success.

Featured Posts

-

El Sistema Alberto Ardila Olivares Tu Garantia De Logro

Apr 27, 2025

El Sistema Alberto Ardila Olivares Tu Garantia De Logro

Apr 27, 2025 -

Mc Cook Jeweler Supports Nfl Players Second Chances 3 28 25

Apr 27, 2025

Mc Cook Jeweler Supports Nfl Players Second Chances 3 28 25

Apr 27, 2025 -

Canadas Rising Tourism Outpacing The Us

Apr 27, 2025

Canadas Rising Tourism Outpacing The Us

Apr 27, 2025 -

Werner Herzogs Bucking Fastard Real Life Sisters To Star

Apr 27, 2025

Werner Herzogs Bucking Fastard Real Life Sisters To Star

Apr 27, 2025 -

German Politics Crumbach Resignation And Its Implications For The Bsw Spd Coalition

Apr 27, 2025

German Politics Crumbach Resignation And Its Implications For The Bsw Spd Coalition

Apr 27, 2025

Latest Posts

-

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Center Of The Case

Apr 28, 2025

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Center Of The Case

Apr 28, 2025 -

Open Ai Facing Ftc Probe Concerns Regarding Chat Gpts Data Practices

Apr 28, 2025

Open Ai Facing Ftc Probe Concerns Regarding Chat Gpts Data Practices

Apr 28, 2025 -

Cassidy Hutchinsons Upcoming Memoir Details January 6th Testimony

Apr 28, 2025

Cassidy Hutchinsons Upcoming Memoir Details January 6th Testimony

Apr 28, 2025 -

Cassidy Hutchinson Key Witness To Publish Memoir On January 6th Hearings

Apr 28, 2025

Cassidy Hutchinson Key Witness To Publish Memoir On January 6th Hearings

Apr 28, 2025 -

Hollywood Production Halted Writers And Actors Strikes Combine

Apr 28, 2025

Hollywood Production Halted Writers And Actors Strikes Combine

Apr 28, 2025