DBS Bank Singapore: Polluters Need Time For Green Transition

Table of Contents

The Challenges of Immediate Green Transition for Polluting Industries

A swift transition to a green economy presents significant hurdles for industries heavily reliant on fossil fuels or polluting processes. Demanding immediate decarbonization overlooks the inherent complexities involved. The transition requires a multi-faceted approach that considers the following:

-

High capital expenditure required for green technology adoption: Upgrading infrastructure and adopting new technologies, such as renewable energy sources or carbon capture systems, requires substantial investments that many companies may struggle to afford upfront. This is particularly true for smaller businesses lacking access to sustainable finance options.

-

Potential job losses and economic disruption during the transition: Shifting away from traditional, polluting industries can lead to job losses and economic instability in the short term. This necessitates careful planning and the implementation of reskilling and upskilling programs to support workers affected by the transition. Investing in sustainable development must be accompanied by strategies that mitigate potential negative economic impacts.

-

Technological limitations in certain sectors for immediate decarbonization: Some industries lack readily available and cost-effective green alternatives. For example, decarbonizing certain manufacturing processes or long-haul shipping requires significant technological breakthroughs that are still under development. Sustainable development needs to be guided by realistic assessments of technological capabilities.

-

The need for robust regulatory frameworks and incentives to support the shift: Clear and consistent policies, along with government incentives like tax breaks or subsidies for green technologies, are vital to encourage and accelerate the transition. A supportive regulatory framework is paramount for fostering sustainable development and attracting investments in green initiatives.

DBS Bank Singapore's Role in Facilitating a Gradual Green Transition

DBS Bank Singapore, as a leading financial institution, plays a pivotal role in supporting companies through this complex green transition. Its commitment to sustainable finance is critical. The bank can facilitate a gradual shift through several key actions:

-

Offering tailored financing solutions for green investments: Providing access to green loans, bonds, and other financial instruments specifically designed to support investments in renewable energy, energy efficiency, and other sustainable projects is key. This encourages businesses to invest in sustainable practices while ensuring financial viability.

-

Providing technical expertise and guidance on sustainable practices: DBS Bank Singapore can offer consulting services and training to businesses to help them understand and implement sustainable practices effectively, guiding them towards ESG (environmental, social, and governance) compliance.

-

Supporting research and development in green technologies: Investing in research and development for innovative green technologies can help accelerate the pace of the transition and create new opportunities for businesses.

-

Investing in renewable energy projects: Direct investments in renewable energy projects not only reduce carbon emissions but also demonstrate the bank's commitment to sustainable finance and create a tangible impact.

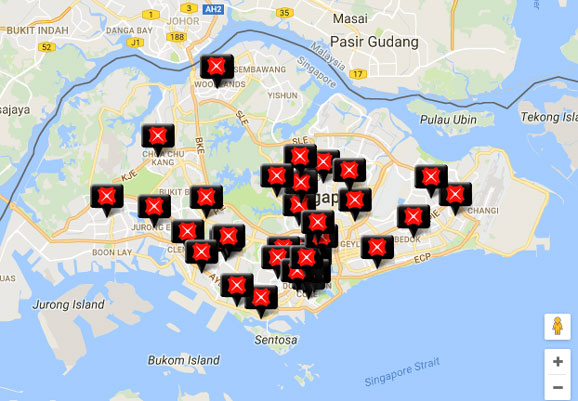

Balancing Environmental Concerns with Economic Realities in Singapore

Singapore's success hinges on balancing its ambitious environmental goals with the need to maintain economic stability. A phased approach to the green transition is crucial to navigate this delicate balance:

-

The importance of a phased approach to avoid severe economic repercussions: A sudden shift could trigger significant economic turmoil, potentially impacting employment and growth. A gradual transition allows for smoother adaptation and minimizes disruptions. Sustainable development requires long-term vision and realistic strategies that incorporate economic realities.

-

The need for government support and collaboration with businesses: Successful green transitions require a strong partnership between the government, businesses, and financial institutions. Combined efforts are critical for the implementation of policies and the provision of incentives for sustainable practices.

-

Exploring innovative solutions that combine economic growth and environmental sustainability: Investing in circular economy models, promoting sustainable tourism, and leveraging technology for greener solutions are examples of innovative approaches that can reconcile economic growth with environmental sustainability.

-

Highlighting successful examples of gradual green transitions in other countries or sectors: Learning from the experiences of other nations and industries can provide valuable insights and guidance for Singapore's own transition.

The Importance of Transparency and Accountability in the Transition

Transparency and accountability are paramount. DBS Bank Singapore must demonstrate its commitment to responsible financing by:

-

Regular reporting on ESG performance: Publicly disclosing its ESG performance metrics allows for monitoring progress and holding the bank accountable for its sustainability goals.

-

Clear criteria for selecting projects to finance: Establishing clear and transparent criteria for evaluating project proposals ensures that investments are aligned with the bank’s sustainability objectives.

-

Public engagement and stakeholder consultation: Engaging with stakeholders and actively soliciting feedback enables DBS Bank Singapore to incorporate diverse perspectives and build trust in its sustainability initiatives.

Conclusion: A Phased Approach to a Greener Future with DBS Bank Singapore

A rapid green transition is essential to combat climate change, but a phased approach is crucial to accommodate the economic realities faced by polluting industries. DBS Bank Singapore has a vital role in supporting this transition through responsible financing, innovative solutions, and a commitment to sustainable banking. By embracing a balanced strategy, the bank can contribute significantly to a greener future for Singapore. We encourage readers to learn more about DBS Bank Singapore's sustainability initiatives and engage in further discussions on achieving a sustainable future in Singapore through responsible, phased green transitions. Explore DBS Bank Singapore's commitment to green transition in Singapore and be part of the conversation on sustainable banking practices.

Featured Posts

-

Us Antisemitism Probe Boeing Seattle Campus Investigated

May 08, 2025

Us Antisemitism Probe Boeing Seattle Campus Investigated

May 08, 2025 -

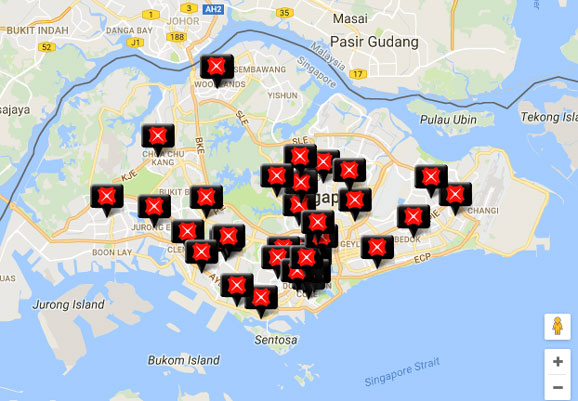

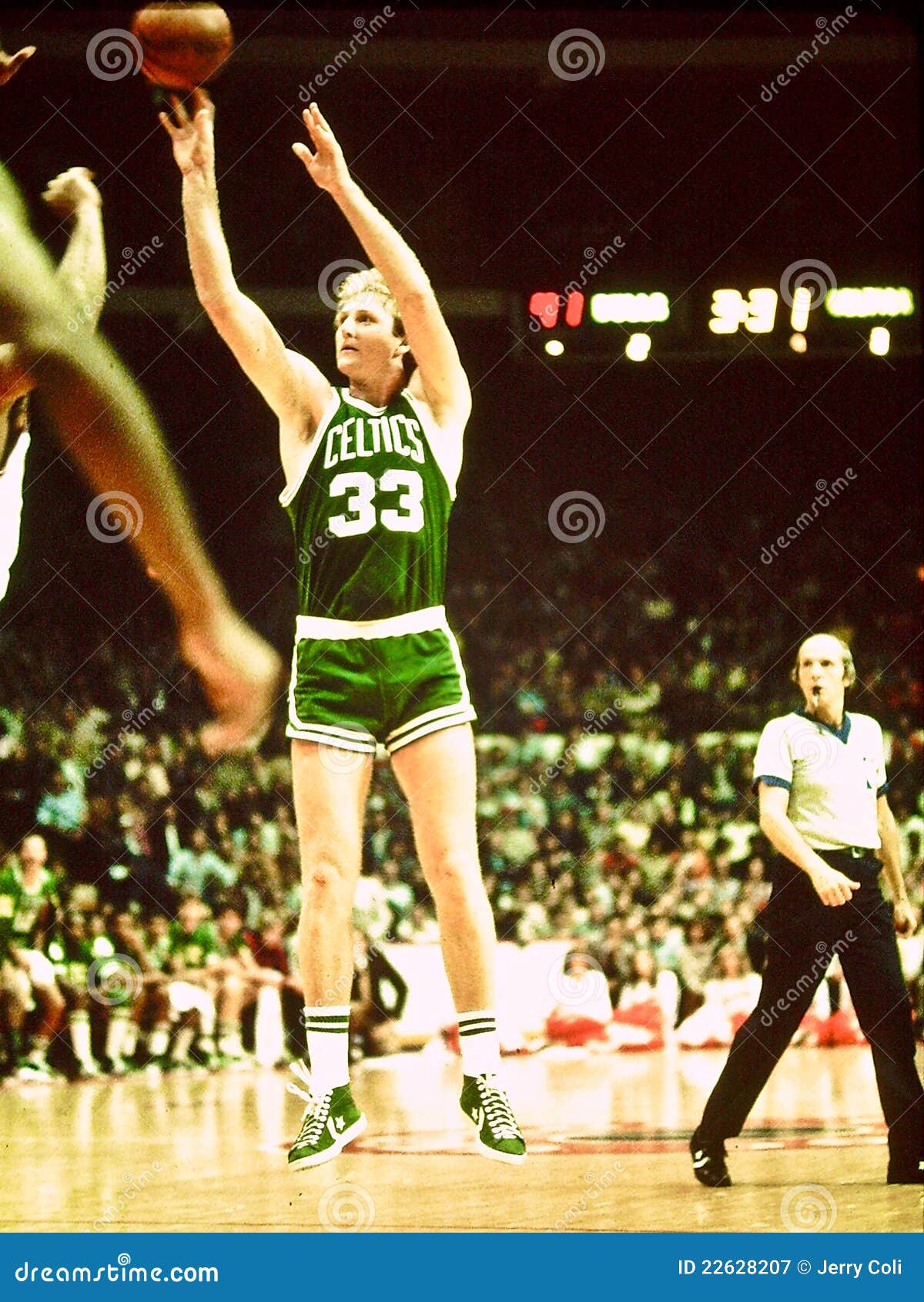

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 08, 2025 -

Wednesday Lotto Draw Results April 9th Check Your Ticket

May 08, 2025

Wednesday Lotto Draw Results April 9th Check Your Ticket

May 08, 2025 -

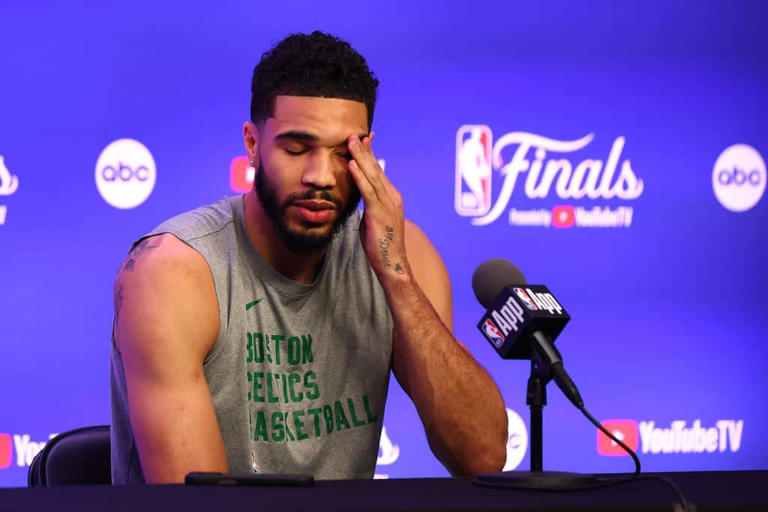

Post Game 1 Analysis Cowherds Criticism Of Jayson Tatum

May 08, 2025

Post Game 1 Analysis Cowherds Criticism Of Jayson Tatum

May 08, 2025 -

The Weirdest Superman Easter Egg Yet James Gunns Jimmy Olsen Tribute Photo

May 08, 2025

The Weirdest Superman Easter Egg Yet James Gunns Jimmy Olsen Tribute Photo

May 08, 2025