De Minimis Tariffs On Chinese Goods: Key G-7 Discussions

Table of Contents

Understanding De Minimis Tariffs and their Impact on Chinese Imports

Defining "De Minimis":

De minimis tariffs refer to a threshold value for imported goods. Below this value, import duties or tariffs are not applied. This is a significant factor in international trade, as it impacts the cost of importing smaller quantities of goods. For example, a de minimis threshold of $800 means that shipments valued at $800 or less would be exempt from tariffs. This threshold varies across countries and is often a source of contention in international trade negotiations.

Current De Minimis Levels in G7 Nations:

The de minimis thresholds for imported goods differ considerably among G7 nations. This disparity creates an uneven playing field for businesses and consumers.

| G7 Nation | De Minimis Threshold (USD, Example) |

|---|---|

| United States | $800 |

| Canada | $40 |

| Japan | $200 |

| Germany | $22 |

| United Kingdom | $135 |

| France | $22 |

| Italy | $22 |

(Note: These are example values and may not reflect the most current regulations. Always consult official government sources for the most up-to-date information.)

Impact on Consumers and Businesses:

Varying de minimis levels have significant impacts:

- Increased Prices: Higher thresholds can lead to increased prices for consumers, as importers may pass on tariff costs.

- Reduced Consumer Choice: High tariffs can limit the availability of certain goods, reducing consumer choice.

- Impact on Small Businesses: Small businesses relying on imports of smaller quantities of goods are disproportionately affected by higher thresholds.

- Potential for Unfair Competition: Differing de minimis levels can create an uneven playing field, leading to unfair competition between businesses in different countries.

Key G7 Discussions on De Minimis Tariffs Concerning Chinese Goods

Harmonization Efforts:

The G7 is actively discussing harmonizing de minimis thresholds for Chinese goods. This aims to create a more level playing field and reduce trade disputes. Proposals include setting a common threshold across all G7 nations, aiming for a balance between facilitating cross-border e-commerce and preventing the circumvention of tariffs.

Concerns Regarding Fair Trade and Competition:

G7 nations have expressed concerns about China's trade practices, particularly regarding the potential for low de minimis thresholds to be exploited to circumvent tariffs. "We need to ensure a fair and balanced system," stated [Insert quote from a relevant G7 official, if available]. This highlights the tension between promoting efficient cross-border trade and safeguarding against unfair competitive practices.

National Security Implications:

The discussion also involves national security. Certain goods imported from China might pose national security risks if their import is not properly controlled. Low de minimis thresholds for such goods could exacerbate those risks.

- Examples of goods impacting national security: Certain technologies, critical infrastructure components.

- Potential risks associated with low thresholds: Increased vulnerability to supply chain disruptions, potential for technological espionage.

- Countermeasures discussed: Strengthening regulatory frameworks, enhancing screening processes for imports.

Potential Outcomes and Future Implications of G7 Decisions

Scenarios for De Minimis Threshold Adjustments:

Several scenarios might emerge from the G7 discussions:

- Minimal Change: Existing de minimis levels remain largely unchanged.

- Moderate Harmonization: G7 nations agree on a slightly higher, but still varied, threshold.

- Significant Harmonization: A common, significantly higher threshold is adopted across all G7 nations.

Impact on Global Trade Relations:

The G7's decision will significantly influence global trade relations. Harmonization could foster greater trust and collaboration, while a failure to reach an agreement could escalate trade tensions.

Role of WTO Regulations:

WTO regulations play a critical role. Any significant changes to de minimis tariffs must comply with WTO rules. Failure to do so could lead to trade disputes and retaliatory measures from affected countries.

- Potential trade disputes: WTO challenges from countries affected by the G7's decision.

- Implications for multilateral trade agreements: The G7's decision could set a precedent for future negotiations.

- Possible retaliatory measures: Countries may impose retaliatory tariffs or other trade restrictions in response to perceived unfair practices.

Conclusion: The Future of De Minimis Tariffs on Chinese Goods

The G7 discussions on de minimis tariffs on Chinese goods are crucial for shaping future global trade relations. Harmonization efforts are vital for creating a fairer and more predictable trading environment. The outcomes of these discussions will have a significant impact on businesses, consumers, and global economic stability. Stay updated on de minimis tariff policies and learn more about the impacts of de minimis tariffs on Chinese goods by following the G7's decisions on de minimis tariffs and subscribing to updates from relevant international trade organizations.

Featured Posts

-

Eldorado The Bbc Soap Opera That Failed Before It Began

May 25, 2025

Eldorado The Bbc Soap Opera That Failed Before It Began

May 25, 2025 -

Alternative Delivery Services Capitalize On Canada Posts Weaknesses

May 25, 2025

Alternative Delivery Services Capitalize On Canada Posts Weaknesses

May 25, 2025 -

Rassel Prinyos Mercedes 300 Y Podium Dostizheniya Khemiltona

May 25, 2025

Rassel Prinyos Mercedes 300 Y Podium Dostizheniya Khemiltona

May 25, 2025 -

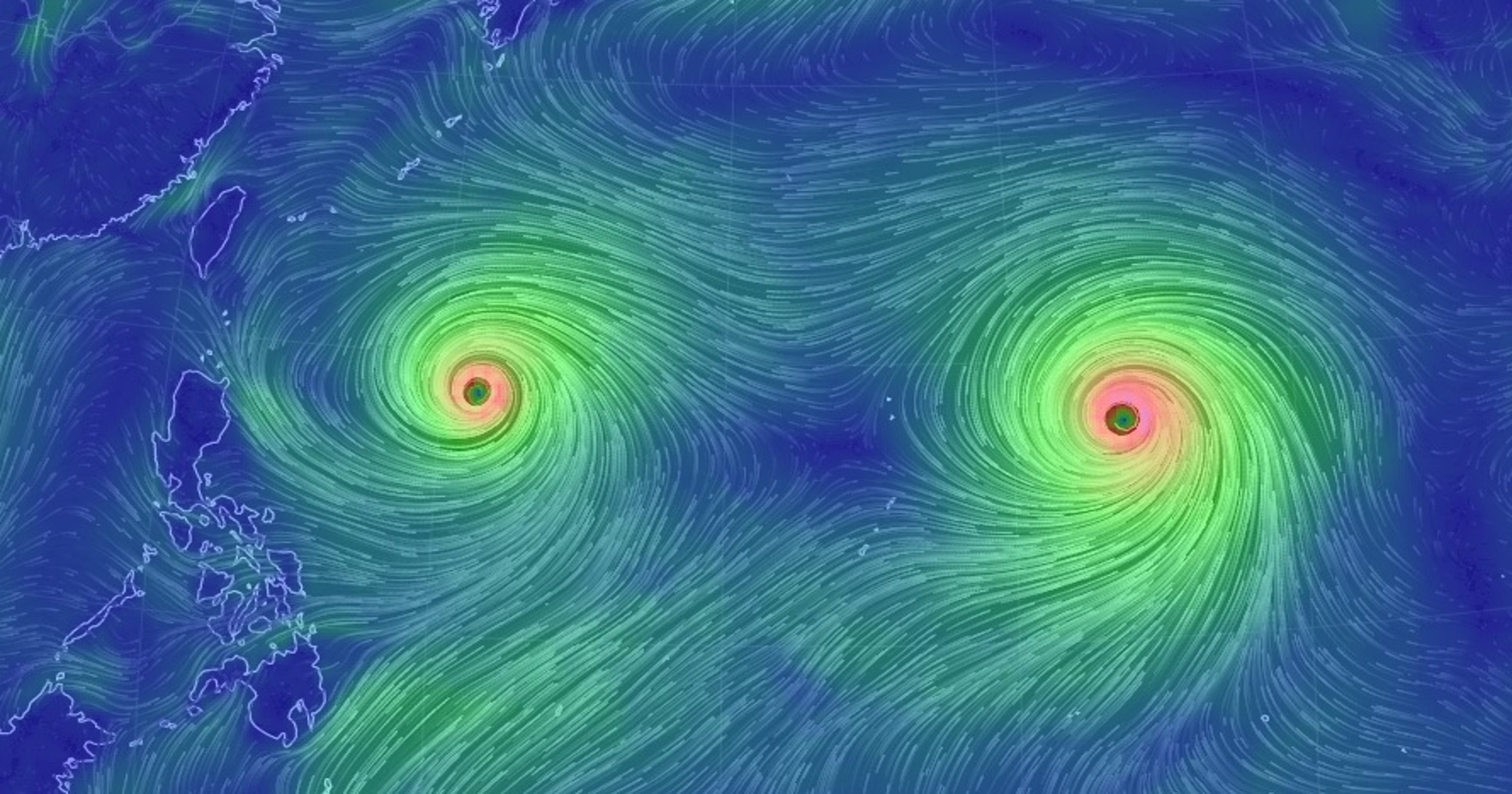

The Rise And Fall Or Continued Success Of Russell And The Typhoons

May 25, 2025

The Rise And Fall Or Continued Success Of Russell And The Typhoons

May 25, 2025 -

Safety Concerns At Southern Vacation Spot Addressed After Shooting Incident

May 25, 2025

Safety Concerns At Southern Vacation Spot Addressed After Shooting Incident

May 25, 2025