Decoding Musk's X Debt Sale: What The New Financials Tell Us

Table of Contents

The Mechanics of the X Debt Sale

The specifics of X's debt sale remain somewhat opaque, but reports suggest a complex mix of high-yield bonds and potentially syndicated loans. This type of financing, often favored by companies with a higher risk profile, allows X to raise significant capital quickly, albeit at a potentially higher cost.

- Total Amount of Debt Raised: While the exact figure remains unconfirmed, reports suggest billions of dollars were raised. The sheer scale of this debt financing is a key factor in assessing its impact.

- Interest Rates and Repayment Terms: High-yield bonds typically carry significantly higher interest rates than more conventional debt instruments. Repayment terms are likely structured to provide Musk some flexibility, but this will likely come at a premium. The length and structure of these repayment schedules are crucial for understanding X's long-term financial burden.

- Credit Rating Agencies' Assessment of X's Creditworthiness: Credit rating agencies, such as Moody's and S&P, will likely downgrade X's credit rating following this significant debt undertaking. This will increase the cost of future borrowing.

- Potential Impact on X's Future Borrowing Capacity: The substantial debt load could significantly limit X's ability to raise additional capital in the future. This constraint could hinder future growth initiatives and acquisitions.

The rationale behind Musk's decision to pursue such a substantial debt sale likely involves several factors: funding platform improvements (including potential investments in AI and enhanced features), potential acquisitions to expand X's capabilities, and possibly refinancing existing debt. The hefty interest payments suggest a high-stakes gamble to fuel significant growth.

Analyzing X's Financial Health Post-Debt Sale

X's financial health after this debt sale is a significant concern. The influx of cash will temporarily boost liquidity, but the increased debt burden poses considerable long-term risks.

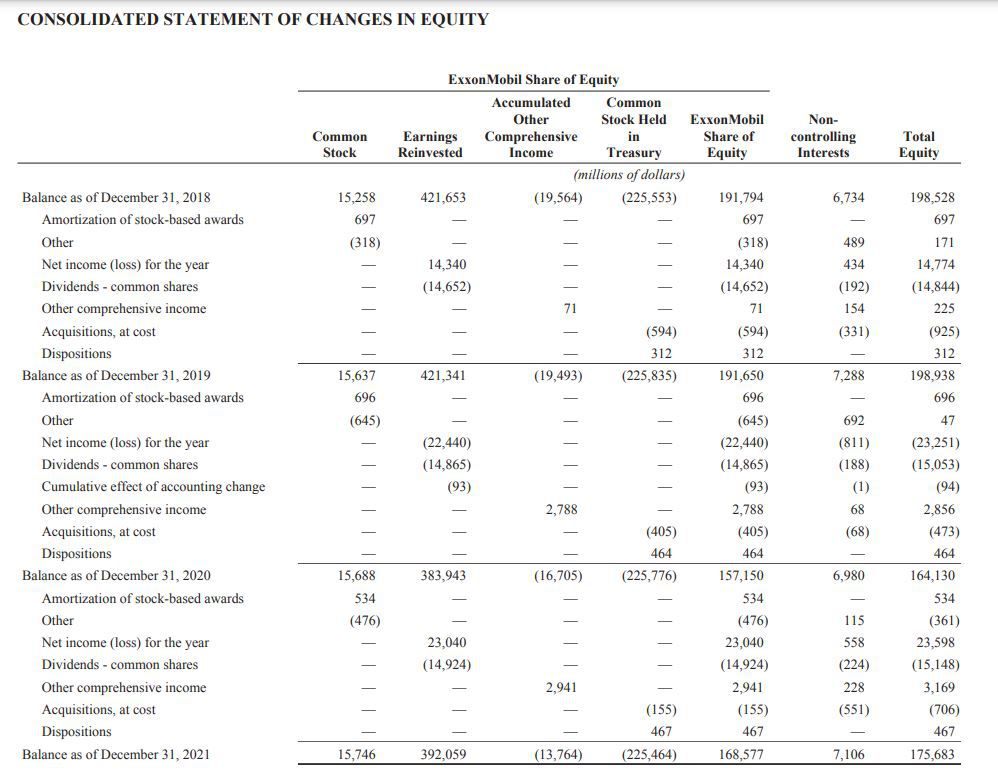

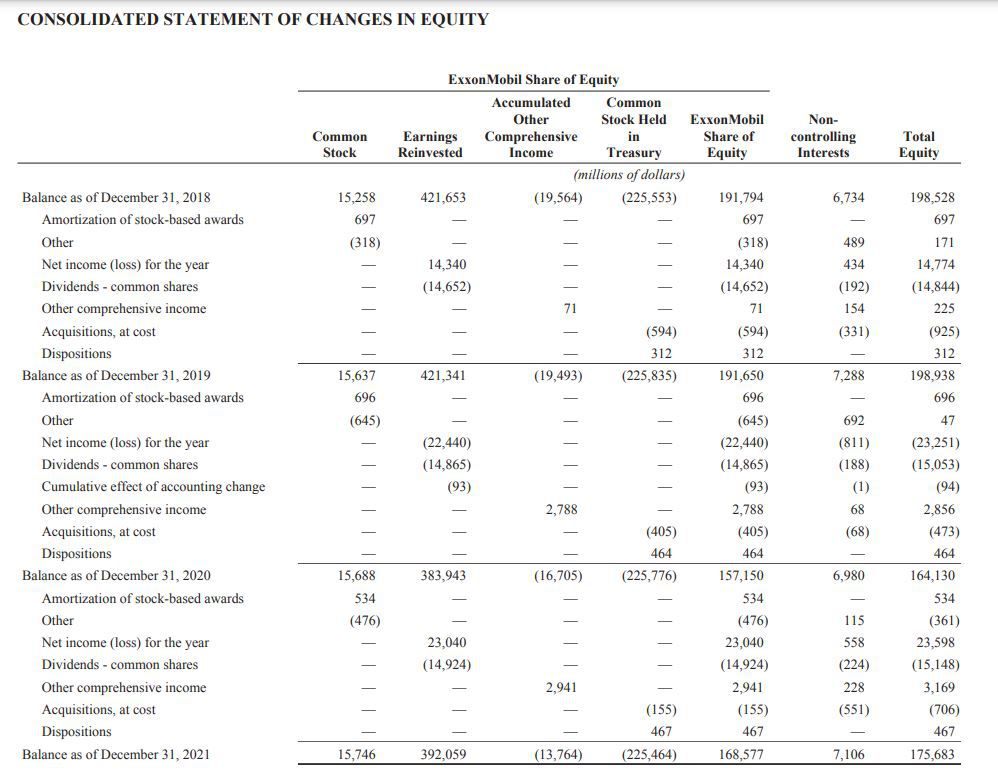

- Debt-to-Equity Ratio: This key metric will undoubtedly rise sharply. A high debt-to-equity ratio indicates increased financial leverage, meaning X is more vulnerable to economic downturns and interest rate hikes.

- Cash Flow Projections: Analyzing X's cash flow projections is crucial. Can X generate enough cash to cover its operational expenses and, crucially, the substantial interest payments on its new debt? This is a key indicator of financial stability.

- Impact on Profitability and Future Earnings: The increased interest expense will significantly impact X's profitability. Unless X can substantially increase its revenue, profitability will likely suffer. Future earnings forecasts will need to account for this increased financial burden.

- Comparison to Other Social Media Companies' Financial Health: Comparing X's post-debt sale financial health to competitors like Meta and Alphabet will provide valuable context. This comparison will illustrate X's relative financial strength and vulnerability.

The potential risks associated with such high debt levels are significant. Default on debt repayments is a real possibility if X fails to meet its revenue projections. This scenario could lead to bankruptcy or a forced sale of assets.

Strategic Implications of the X Debt Sale

The strategic implications of Musk's debt sale are multifaceted and depend largely on how effectively the capital is deployed. Musk's vision likely involves several key goals:

- Investment in New Technologies: A major portion of the raised capital could be channeled into advancements such as AI integration, improved algorithms, enhanced content moderation capabilities, and the development of new revenue streams, like payment processing features.

- Acquisitions of Smaller Companies: Musk may use the funds to acquire smaller companies that complement X's existing capabilities, expanding the platform's functionalities and market reach. This could involve companies specializing in AI, payment processing, or other relevant technologies.

- Expansion into New Markets or Revenue Streams: The debt sale might pave the way for X to expand into new geographical markets or explore alternative revenue streams beyond advertising. This expansion could improve financial stability.

- Debt Consolidation or Refinancing: Part of the raised capital might be used to refinance existing debt, potentially at more favorable terms. This would reduce the immediate financial pressure.

The debt sale's impact on X's competitive landscape is significant. This influx of capital positions X for potentially aggressive growth and expansion, increasing competition within the social media and technology sectors.

Market Reaction and Investor Sentiment

The market's response to the X debt sale has been mixed, reflecting the inherent risks and uncertainties surrounding the deal.

- Changes in X's Stock Price (if publicly traded): If X were publicly traded, the stock price would likely reflect investor sentiment. A significant drop could indicate negative investor confidence.

- Investor Confidence Levels: Investor confidence in Musk’s leadership and X's future is likely to be tested. A successful execution of Musk's strategic plans will be crucial for bolstering investor confidence.

- Credit Rating Changes: A credit rating downgrade would make it more expensive for X to borrow money in the future.

- Analyst Assessments and Predictions: Financial analysts will provide forecasts and evaluations of the deal’s impact. These will offer important insights into future expectations.

Overall, the market reaction will heavily influence investor sentiment and X's future prospects. Whether Musk's vision can be realized and whether X can weather the financial challenges ahead remain open questions.

Conclusion

This analysis of Musk's X debt sale reveals a complex financial strategy with both potential benefits and risks. The move significantly alters X's financial structure, potentially impacting its long-term growth and stability. The strategic implications are far-reaching, depending heavily on Musk's success in leveraging the capital for innovation and expansion. Understanding the financial intricacies of this sale is key to interpreting X's future trajectory.

Call to Action: Stay informed about the evolving financial landscape of X by following our ongoing coverage of Musk's decisions and their impact. Keep an eye out for future articles analyzing Musk's X financial strategies and their consequences. Continue to decode Musk's X financial moves with us.

Featured Posts

-

Bubba Wallaces Brake Failure Causes Phoenix Crash

Apr 28, 2025

Bubba Wallaces Brake Failure Causes Phoenix Crash

Apr 28, 2025 -

Martinsville Restart How Bubba Wallace Lost Second Place

Apr 28, 2025

Martinsville Restart How Bubba Wallace Lost Second Place

Apr 28, 2025 -

Mets Starters Impressive Outing Taking The Next Step

Apr 28, 2025

Mets Starters Impressive Outing Taking The Next Step

Apr 28, 2025 -

Office365 Data Breach Millions In Losses Reported Criminal Charges Filed

Apr 28, 2025

Office365 Data Breach Millions In Losses Reported Criminal Charges Filed

Apr 28, 2025 -

Abrz Mealm Fn Abwzby 2024

Apr 28, 2025

Abrz Mealm Fn Abwzby 2024

Apr 28, 2025