Decoding Warren Buffett's Apple Stock Sale: What's Next For The Oracle?

Table of Contents

Analyzing Berkshire Hathaway's Apple Stock Reduction: The Numbers and the Timing

The Scale of the Sale:

Berkshire Hathaway's reduction in its Apple holdings was substantial. Over several quarters, they significantly decreased their stake, impacting both their portfolio and market sentiment.

- Dates: The sales occurred across multiple quarters, starting in [Insert specific quarter and year] and continuing through [Insert most recent quarter and year].

- Figures: Berkshire Hathaway sold approximately [Insert Number] shares of Apple stock, representing a [Insert Percentage]% reduction in their overall holdings. This translated to a financial impact of approximately [Insert Dollar Amount] based on the average selling price.

- Comparison: This sale represents a significant shift from Berkshire Hathaway's previous position as one of Apple's largest shareholders. [Mention previous percentage holding for comparison].

- Market Conditions: The sales took place during a period of [Describe market conditions - e.g., rising interest rates, increased market volatility, inflation concerns]. This context is crucial in understanding the potential motivations behind the decision.

The Strategic Implications:

Several strategic reasons might underlie Berkshire Hathaway's decision to reduce its Apple holdings.

- Portfolio Diversification: Buffett has always emphasized the importance of diversification. Reducing Apple's concentration might be a strategic move to balance risk across various sectors.

- Cash Needs for Other Investments: Berkshire Hathaway is always on the lookout for attractive investment opportunities. The sale of Apple stock could free up capital for acquisitions or other investments deemed more promising.

- Shifting Market Outlook: Changes in the economic landscape, industry trends, or Apple's own performance could have influenced Buffett's assessment of the stock's long-term potential. The sale could reflect a change in his outlook on Apple's future prospects.

- Expert Opinions: [Insert quotes from financial analysts or experts discussing the strategic rationale behind the sale, citing their sources].

Warren Buffett's Investment Philosophy and its Relation to the Apple Sale

Buffett's Value Investing Approach:

Warren Buffett is renowned for his value investing approach, focusing on companies with strong fundamentals and long-term growth potential.

- Long-Term Growth: Value investing emphasizes buying undervalued assets and holding them for the long term, allowing for substantial appreciation in value.

- Company Fundamentals: Buffett meticulously analyzes a company's financial health, management team, and competitive advantage before making an investment.

- Intrinsic Value: He seeks to purchase companies below their intrinsic value, creating a margin of safety against potential losses.

Apple's Fundamentals and Shifting Market Dynamics:

Analyzing Apple's current financial standing is crucial to understanding Buffett's decision.

- Market Competition: Increased competition in the smartphone and technology sector might have impacted Buffett's assessment of Apple's long-term dominance.

- Product Innovation: The pace of innovation in the tech industry is rapid. If Buffett perceived a slowdown in Apple's innovative capacity, it could have influenced his decision.

- Economic Conditions: Inflation, interest rate hikes, and global economic uncertainties can impact consumer spending and, consequently, Apple's performance.

- Long-Term vs. Short-Term Strategies: The sale could signal a potential shift from a predominantly long-term, buy-and-hold strategy to a more dynamic approach in response to the changing market landscape.

Future Outlook: What's Next for Apple and Berkshire Hathaway?

Apple's Stock Performance Post-Sale:

The market's reaction to Berkshire Hathaway's Apple stock sale provides valuable insights into investor sentiment.

- Immediate Price Changes: The immediate impact on Apple's stock price was [Describe the price movement - e.g., a slight dip, no significant change].

- Investor Sentiment: The sale likely influenced investor sentiment, potentially impacting future price fluctuations. [Mention any changes in analyst ratings or investor confidence].

- Long-Term Projections: Financial analysts' long-term projections for Apple's stock price will be influenced by this significant development.

Berkshire Hathaway's Next Moves:

Following the Apple stock reduction, speculation abounds about Berkshire Hathaway's future investment strategies.

- Potential Investment Sectors: Berkshire Hathaway might shift its focus towards other promising sectors such as [mention possible sectors - e.g., energy, healthcare, infrastructure].

- Acquisition Targets: The freed-up capital could be used for acquisitions of companies aligned with Berkshire Hathaway's long-term investment goals.

- Diversification Strategy: This sale highlights the ongoing importance of diversification within Berkshire Hathaway's portfolio to mitigate risk and ensure long-term growth.

Conclusion: Decoding the Oracle's Move – What Does it Mean for the Future?

Warren Buffett's decision to reduce Berkshire Hathaway's Apple stock holdings is a complex event with several contributing factors. The sale reflects a strategic decision potentially influenced by a combination of portfolio diversification needs, the availability of more promising investment opportunities, and a reassessment of Apple's long-term prospects within a shifting economic landscape. The implications are far-reaching, impacting both Apple's stock performance and potentially reshaping Berkshire Hathaway's future investment strategy. The Oracle's move underscores the dynamic nature of even the most established investment strategies.

Stay tuned for further analysis on Warren Buffett's investment strategies and the ever-evolving world of stock market investing. Subscribe to our newsletter to stay informed on future developments regarding Warren Buffett's Apple stock and other key market trends.

Featured Posts

-

Canadas Poilievre A 20 Point Lead Lost What Went Wrong

Apr 23, 2025

Canadas Poilievre A 20 Point Lead Lost What Went Wrong

Apr 23, 2025 -

State Treasurers Confront Tesla Board Regarding Elon Musks Leadership

Apr 23, 2025

State Treasurers Confront Tesla Board Regarding Elon Musks Leadership

Apr 23, 2025 -

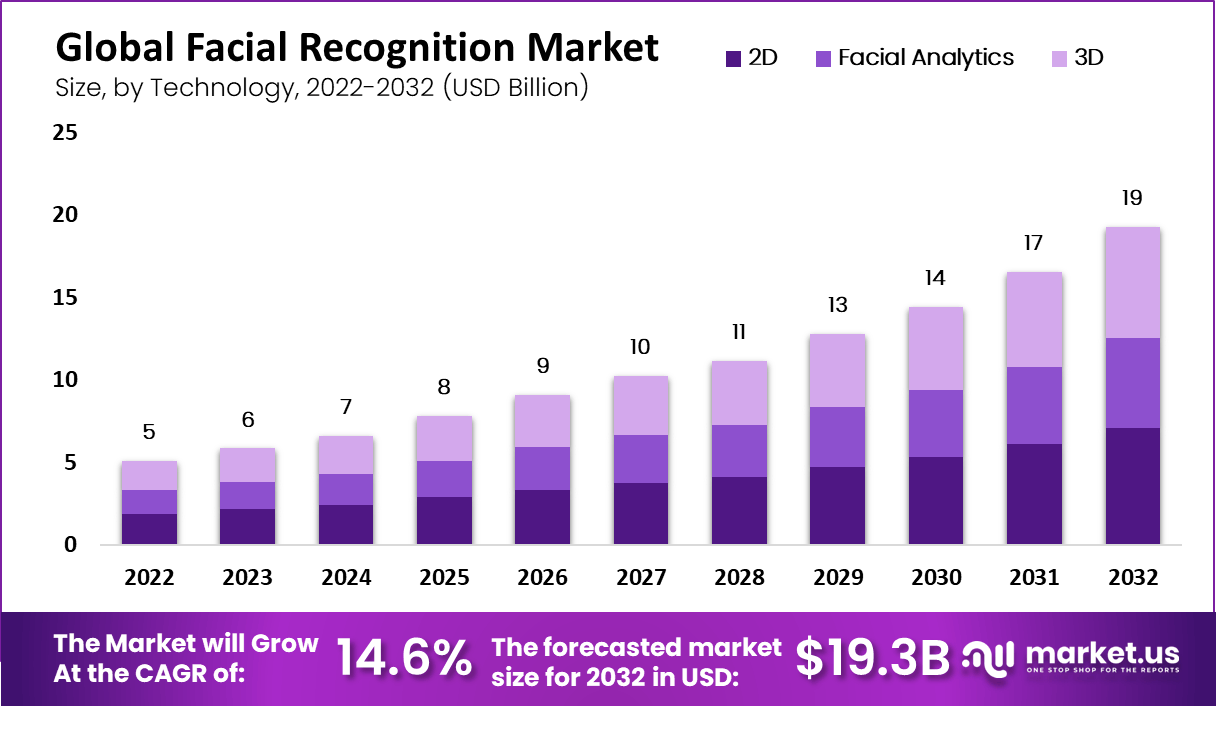

Target Fields Go Ahead Entry Facial Recognition Speeds Up Lines

Apr 23, 2025

Target Fields Go Ahead Entry Facial Recognition Speeds Up Lines

Apr 23, 2025 -

Sf Giants Win Flores And Lee Lead The Charge Against Brewers

Apr 23, 2025

Sf Giants Win Flores And Lee Lead The Charge Against Brewers

Apr 23, 2025 -

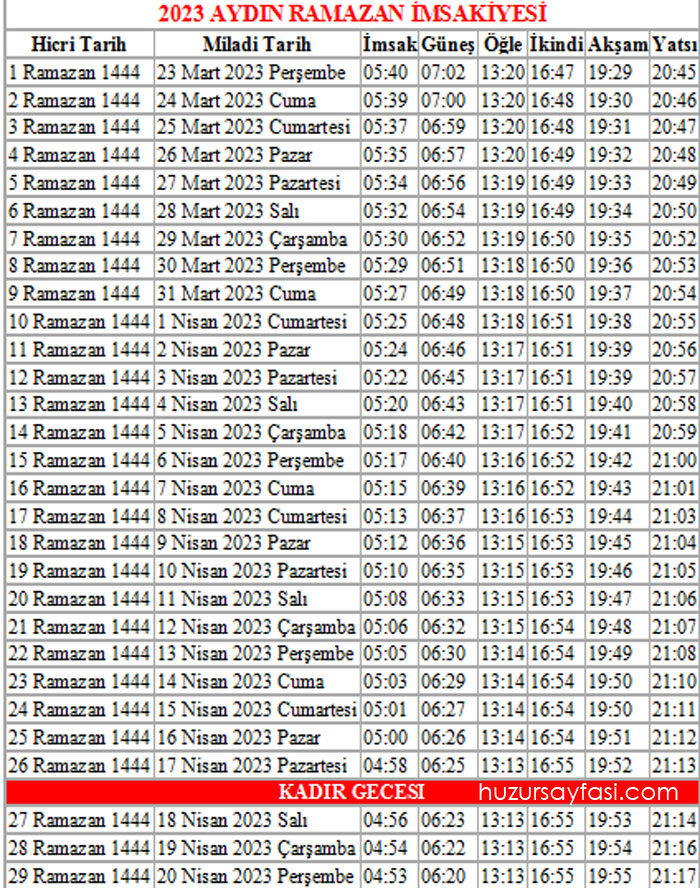

2025 Ankara Ramazan Iftar Sahur Saatleri 10 Mart Pazartesi

Apr 23, 2025

2025 Ankara Ramazan Iftar Sahur Saatleri 10 Mart Pazartesi

Apr 23, 2025