Deloitte's Economic Forecast: Considerable Slowdown Predicted For US Growth

Table of Contents

Key Factors Contributing to the Predicted US Growth Slowdown

Deloitte's Economic Forecast points to several interconnected factors driving the anticipated US growth slowdown. Understanding these factors is crucial for navigating the coming economic challenges.

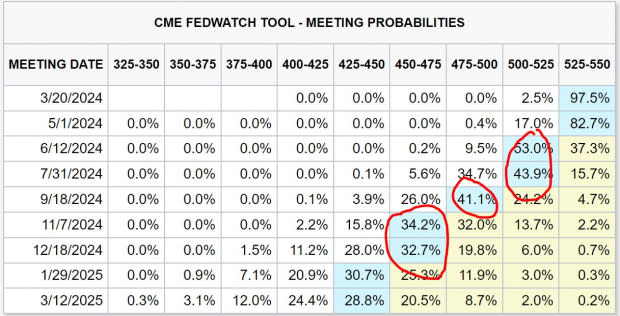

Inflationary Pressures and Interest Rate Hikes

Persistent inflation remains a major headwind. The Federal Reserve's response, through aggressive interest rate hikes, aims to curb inflation but also risks slowing economic growth. These interest rate hikes increase borrowing costs, impacting several key areas:

- Consumer Spending: Higher interest rates lead to increased borrowing costs for consumers, potentially reducing spending on durable goods and discretionary items. Deloitte's report suggests a potential decline in consumer confidence directly linked to increased interest rates.

- Business Investment: Businesses are less likely to invest in expansion or new projects when borrowing costs are high, leading to a decrease in capital expenditures. Deloitte's data shows a correlation between rising interest rates and decreased business investment in the manufacturing sector.

- Housing Market: Mortgage rates directly reflect interest rate hikes, making home purchases less affordable and potentially triggering a slowdown in the housing market. Deloitte's forecast indicates a significant cooling effect on the housing market due to increased borrowing costs.

Geopolitical Uncertainty and Supply Chain Disruptions

The war in Ukraine, along with other global conflicts and political instability, continues to create significant geopolitical uncertainty. This uncertainty further exacerbates existing supply chain disruptions, impacting the availability and cost of goods.

- Energy Prices: The conflict in Ukraine has significantly impacted global energy markets, leading to higher energy prices and increased inflation. This has a ripple effect across various sectors.

- Raw Material Shortages: Disruptions to global supply chains have led to shortages of raw materials, increasing production costs for businesses and contributing to inflationary pressures.

- Manufacturing Bottlenecks: Numerous manufacturing processes have experienced significant delays due to supply chain issues, leading to reduced output and impacting economic growth.

Labor Market Dynamics and Workforce Shortages

While the unemployment rate remains relatively low, the US labor market faces significant challenges. Workforce shortages across various sectors are impacting productivity and overall economic growth.

- Wage Growth: Competition for workers is driving up wages, adding to inflationary pressures and potentially squeezing profit margins for businesses. Deloitte's report highlights above-average wage growth in several key sectors.

- Labor Participation Rate: The labor participation rate remains below pre-pandemic levels, suggesting a persistent labor shortage. This shortage limits economic output.

- Productivity Slowdown: Workforce shortages and skills mismatches can lead to decreased productivity, negatively impacting economic output.

Deloitte's Forecast: Specific Predictions for Key Economic Indicators

Deloitte's Economic Forecast offers specific predictions for several key economic indicators, providing a more detailed picture of the anticipated slowdown.

GDP Growth Projections

Deloitte projects a significant deceleration in GDP growth for the next year, with a projected rate considerably lower than previous forecasts. Their methodology relies on a complex econometric model incorporating various factors influencing economic activity.

- Year-over-Year Growth: Deloitte's report projects a [insert projected GDP growth rate]% year-over-year growth for [insert year].

- Long-Term Outlook: The forecast also offers projections for subsequent years, highlighting a gradual recovery but a slower growth trajectory compared to previous expectations.

Unemployment Rate Predictions

Deloitte anticipates a [insert projected unemployment rate]% unemployment rate by [insert timeframe]. While this remains relatively low compared to historical averages, the forecast suggests potential implications for the job market.

- Sectoral Differences: Deloitte’s report may highlight potential variations in unemployment across different sectors, reflecting the impact of economic changes on specific industries.

- Potential for Job Losses: The report may indicate specific sectors experiencing potential job losses as a result of the economic slowdown.

Inflation Outlook

Deloitte's inflation outlook suggests a [insert projected inflation rate]% inflation rate by [insert timeframe]. The forecast explores the possibility of inflation persisting or easing, and the potential implications for monetary policy.

- Easing Inflation: Deloitte's report may indicate a gradual easing of inflation as interest rate hikes take effect and supply chain disruptions ease.

- Persisting Inflationary Pressures: Conversely, the report might highlight factors that could keep inflationary pressures elevated, such as persistent supply chain constraints or unexpected geopolitical events.

Implications for Businesses and Investors

Deloitte's Economic Forecast has significant implications for businesses and investors. Understanding the predicted slowdown is crucial for effective strategic planning.

Strategies for Navigating the Economic Slowdown

Businesses and investors need to adopt proactive strategies to navigate the anticipated slowdown. Key strategies include:

- Cost-Cutting Measures: Identify and implement cost-cutting measures to improve efficiency and profitability in a potentially slowing market.

- Diversification: Diversify product offerings or investment portfolios to mitigate risk and ensure resilience in a challenging economic environment.

- Strategic Investments: Invest strategically in areas with strong long-term growth potential, despite near-term economic headwinds.

Conclusion: Understanding Deloitte's Economic Forecast for Informed Decision-Making

Deloitte's Economic Forecast paints a clear picture: a significant slowdown in US economic growth is anticipated. This prediction is driven by a combination of inflationary pressures, geopolitical uncertainty, and labor market dynamics. Understanding these factors and Deloitte's specific predictions for key economic indicators, including GDP growth, unemployment, and inflation, is crucial for businesses, investors, and policymakers. By leveraging the insights provided in Deloitte's full report, individuals and organizations can make informed decisions and develop effective strategies to navigate this challenging economic landscape. To learn more about Deloitte's comprehensive analysis and to access the full report, [insert link to Deloitte report here]. Understanding Deloitte's Economic Forecast is key to successfully navigating the predicted US growth slowdown.

Featured Posts

-

Camille Claudel Bronze Sculpture A 3 Million Auction Result

Apr 27, 2025

Camille Claudel Bronze Sculpture A 3 Million Auction Result

Apr 27, 2025 -

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025 -

Pfc To Announce Fourth Dividend For Fy 25 On March 12 2025

Apr 27, 2025

Pfc To Announce Fourth Dividend For Fy 25 On March 12 2025

Apr 27, 2025 -

Ariana Grandes Bold Transformation A Look At The Professional Stylists

Apr 27, 2025

Ariana Grandes Bold Transformation A Look At The Professional Stylists

Apr 27, 2025 -

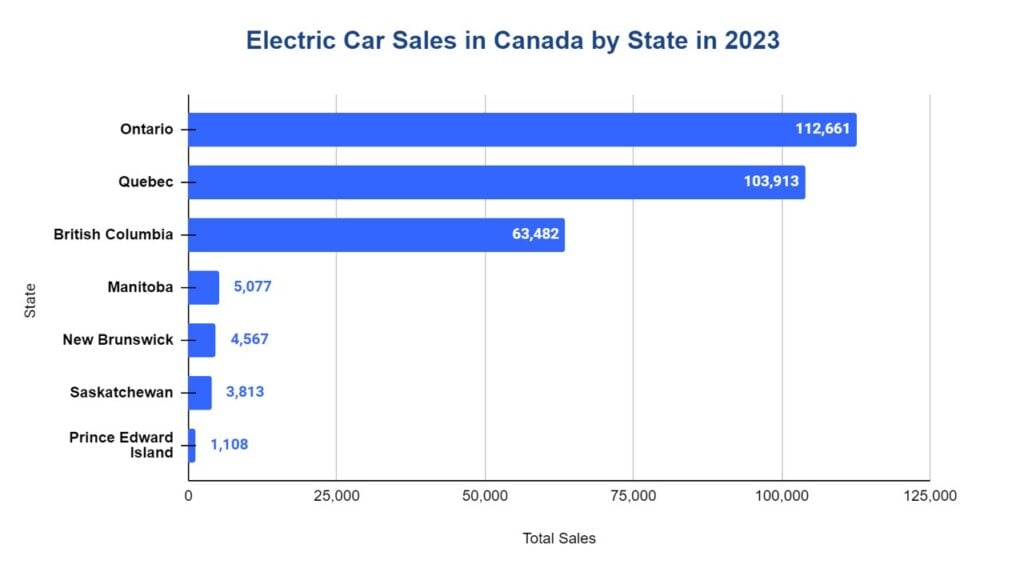

Canadians Ev Interest Dips For Third Consecutive Year

Apr 27, 2025

Canadians Ev Interest Dips For Third Consecutive Year

Apr 27, 2025

Latest Posts

-

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 28, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 28, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 28, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 28, 2025 -

16 Million Penalty T Mobiles Three Year Data Breach Settlement

Apr 28, 2025

16 Million Penalty T Mobiles Three Year Data Breach Settlement

Apr 28, 2025 -

T Mobile Data Breaches 16 Million Fine Highlights Security Gaps

Apr 28, 2025

T Mobile Data Breaches 16 Million Fine Highlights Security Gaps

Apr 28, 2025 -

From Scatological Documents To Podcast Success The Power Of Ai

Apr 28, 2025

From Scatological Documents To Podcast Success The Power Of Ai

Apr 28, 2025