Deutsche Bank's Digital Journey: The Role Of IBM's Software Portfolio

Table of Contents

Enhancing Core Banking Systems with IBM Software

Deutsche Bank's core banking systems, like many legacy systems in the financial sector, needed modernization to meet the demands of a rapidly evolving digital landscape. IBM software provides the tools and solutions to achieve this crucial upgrade, boosting efficiency and scalability while ensuring seamless operations.

Modernizing Legacy Systems

Outdated systems often struggle with performance and integration. Deutsche Bank utilizes IBM's advanced modernization tools to address these challenges. This initiative involves:

- IBM Db2: This robust database management system improves data management, providing enhanced performance and reliability for critical banking operations. The scalability of Db2 is vital for handling Deutsche Bank's massive data volume.

- IBM Cloud Pak for Applications: This platform allows Deutsche Bank to containerize and deploy applications more efficiently, accelerating the modernization process and enabling faster innovation cycles. This containerization strategy increases agility and reduces deployment time.

- IBM Z and LinuxONE: These mainframe modernization solutions allow Deutsche Bank to leverage the power of existing mainframe infrastructure while integrating modern technologies, ensuring a smooth transition and minimizing disruption. This hybrid approach optimizes cost efficiency while enhancing functionality.

Improving Transaction Processing

The high-volume nature of Deutsche Bank's transactions demands high-performance computing solutions. IBM software plays a critical role in ensuring the smooth and efficient processing of these transactions. Key elements include:

- IBM WebSphere: This application server infrastructure provides a robust and scalable platform for running mission-critical banking applications, ensuring high availability and minimizing downtime.

- IBM MQ: A reliable messaging system, IBM MQ ensures secure and efficient communication between different applications and systems within Deutsche Bank's infrastructure, crucial for real-time transaction processing.

- Enhanced Real-time Transaction Processing Capabilities: The combination of IBM software solutions leads to improved real-time transaction processing, directly enhancing customer experience and operational efficiency. Faster processing times lead to improved customer satisfaction.

Strengthening Cybersecurity with IBM Security Solutions

In the financial industry, robust cybersecurity is paramount. Deutsche Bank relies on IBM's comprehensive security portfolio to safeguard its sensitive data and protect against emerging cyber threats.

Data Protection and Threat Detection

Protecting sensitive customer and financial data is a top priority. IBM's security solutions provide a multi-layered defense strategy:

- IBM QRadar: This Security Information and Event Management (SIEM) platform provides real-time threat detection and analysis, enabling proactive responses to security incidents.

- IBM Guardium: This data loss prevention (DLP) solution protects sensitive data both in transit and at rest, ensuring regulatory compliance and minimizing the risk of data breaches.

- IBM MaaS360: This endpoint security solution protects Deutsche Bank's devices from malware and other threats, ensuring comprehensive security across the entire infrastructure.

Compliance and Regulatory Adherence

Meeting stringent regulatory requirements is crucial for financial institutions. IBM helps Deutsche Bank achieve and maintain compliance:

- IBM Cloud Security Services: These services help Deutsche Bank meet various compliance certifications, streamlining the audit process and reducing compliance-related risks.

- Integration with Regulatory Reporting Frameworks: IBM's solutions integrate with existing regulatory reporting frameworks, simplifying compliance reporting and minimizing manual effort.

- Improved Audit Capabilities: Improved audit trails and reporting capabilities provide greater transparency and accountability, simplifying audits and reducing potential risks.

Cloud Adoption and Hybrid Cloud Strategies with IBM Cloud

Deutsche Bank is leveraging the power of cloud computing to accelerate innovation and improve efficiency. IBM Cloud provides the platform for this transformation.

Accelerating Innovation through Cloud Migration

The adoption of cloud technologies allows Deutsche Bank to deploy new applications quickly and efficiently:

- IBM Cloud Private: This on-premises cloud solution offers the benefits of cloud computing while maintaining control over data and infrastructure.

- IBM Cloud Public: This scalable and flexible public cloud platform allows Deutsche Bank to adapt to changing demands and rapidly deploy new applications.

- Hybrid Cloud Approach: The hybrid approach combines the benefits of both public and private clouds, optimizing resource utilization and balancing cost-effectiveness with security and control.

Cost Optimization and Resource Management

Cloud adoption also leads to significant cost savings and improved resource management:

- Optimized Resource Allocation: IBM Cloud allows for more efficient resource allocation, minimizing waste and optimizing performance.

- Pay-as-you-go Models: Flexible pay-as-you-go models allow Deutsche Bank to only pay for the resources it uses, optimizing cost and preventing overspending.

- Reduced Operational Costs: Automation and streamlined processes reduce operational costs associated with managing on-premises infrastructure.

Conclusion

Deutsche Bank's digital transformation is a complex but crucial undertaking, and IBM's software portfolio is a key driver of its success. From modernizing core banking systems and bolstering cybersecurity to enabling seamless cloud adoption, IBM's solutions are enabling Deutsche Bank to operate more efficiently, strengthen its security posture, and ultimately provide a superior customer experience. By leveraging the power of Deutsche Bank IBM software solutions, Deutsche Bank is setting the stage for future innovation and continued growth in the dynamic financial world. Learn more about how Deutsche Bank and IBM are collaborating to transform the financial industry by exploring IBM's website and case studies.

Featured Posts

-

Air Jordan Launches May 2025 Preview And Release Dates

May 30, 2025

Air Jordan Launches May 2025 Preview And Release Dates

May 30, 2025 -

Evan Longoria Retires Rays Legend Announces End Of Career

May 30, 2025

Evan Longoria Retires Rays Legend Announces End Of Career

May 30, 2025 -

Understanding The Popularity Of Jacob Alons Fairy In A Bottle

May 30, 2025

Understanding The Popularity Of Jacob Alons Fairy In A Bottle

May 30, 2025 -

Tileoptikes Metadoseis Savvatoy 10 Maioy

May 30, 2025

Tileoptikes Metadoseis Savvatoy 10 Maioy

May 30, 2025 -

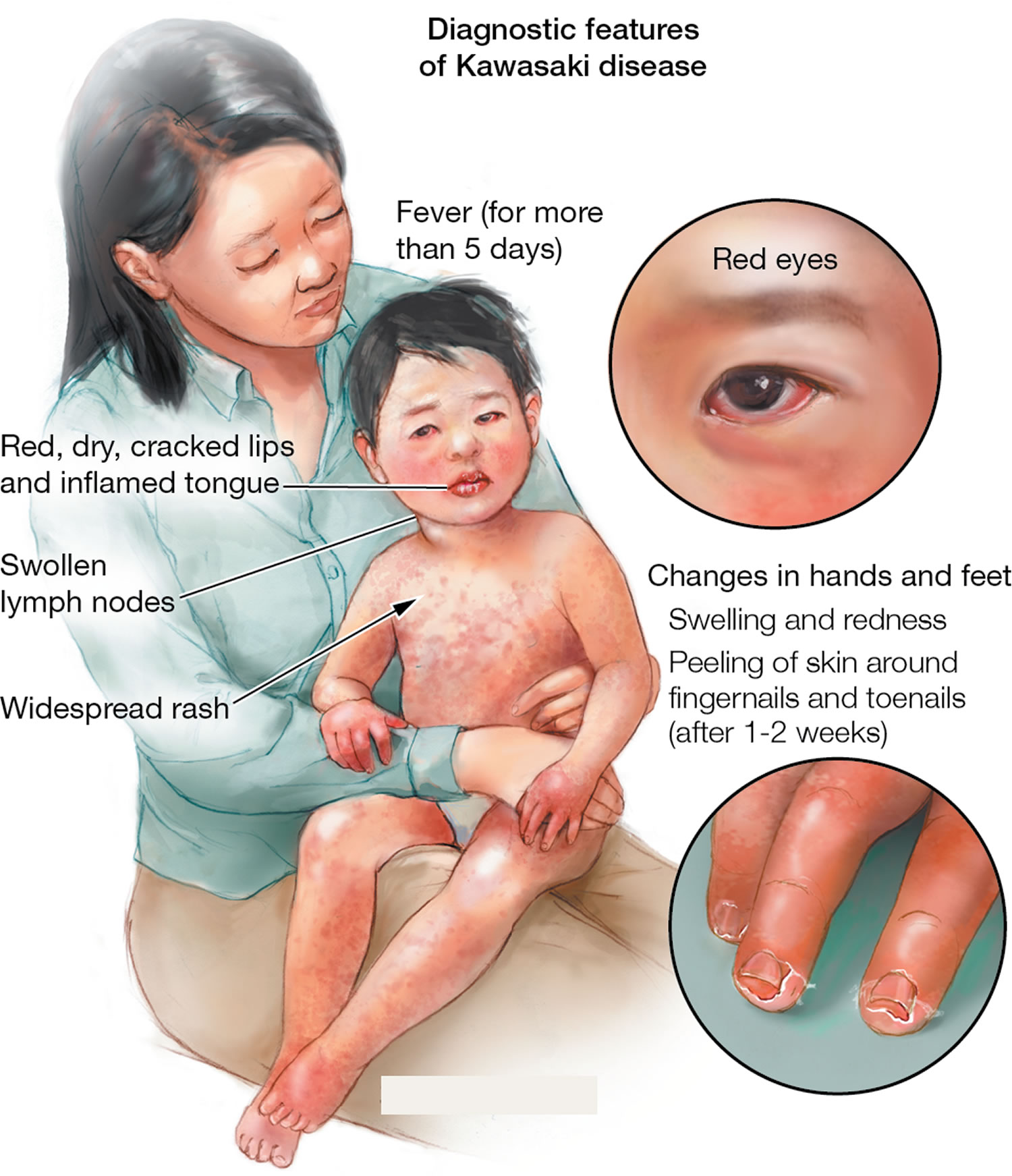

Is A Single Unknown Respiratory Virus The Cause Of Kawasaki Disease New Data Suggests So

May 30, 2025

Is A Single Unknown Respiratory Virus The Cause Of Kawasaki Disease New Data Suggests So

May 30, 2025