Deutsche Bank's Head Of Distressed Sales Departs For Morgan Stanley

Table of Contents

The Departure's Significance for Deutsche Bank

The departure of Deutsche Bank's Head of Distressed Sales represents a considerable blow to the institution. The loss of such a senior and experienced figure has far-reaching consequences.

Impact on Distressed Debt Trading

This departure will undoubtedly impact Deutsche Bank's distressed debt trading capabilities. The loss of this individual's expertise could lead to several negative consequences:

- Loss of expertise: Years of accumulated knowledge and market insights are lost, impacting deal structuring, risk assessment, and client relationships.

- Potential decline in market share: Reduced expertise could hinder Deutsche Bank's ability to compete effectively, potentially leading to a loss of market share in the distressed debt sector.

- Challenges in attracting new talent: The departure might create uncertainty, making it harder to attract and retain top talent in the competitive distressed sales arena.

- Impact on client relationships: Key client relationships built and nurtured by the departing executive may be jeopardized, leading to potential defections to competitors.

The individual's specific contributions, particularly in navigating complex transactions and securing lucrative deals, will be difficult to replace immediately. This could result in short-term losses and longer-term challenges in rebuilding the team's capabilities in Deutsche Bank's distressed debt division.

Repercussions for Deutsche Bank's Restructuring Efforts

This departure also casts a shadow on Deutsche Bank's broader restructuring efforts. Experienced leadership is crucial during such periods of transformation.

- Setback to ongoing restructuring: The departure could be interpreted as a setback, potentially slowing down restructuring efforts and raising concerns about the bank's overall stability.

- Potential loss of institutional knowledge: The departing executive likely possessed invaluable knowledge about the bank's internal processes and strategic direction.

- Impact on investor confidence: News of this departure might negatively impact investor confidence, especially given Deutsche Bank's ongoing efforts to improve its financial performance and market standing.

The loss of this key leader during a critical period of restructuring could significantly hinder Deutsche Bank's progress and potentially damage its reputation among investors and stakeholders.

Morgan Stanley's Strategic Gain

Morgan Stanley, on the other hand, stands to gain significantly from this high-profile acquisition.

Strengthening Morgan Stanley's Distressed Assets Team

This hire significantly strengthens Morgan Stanley's distressed assets division. The benefits are multifold:

- Enhanced expertise: The addition of this experienced professional brings immediate expertise in distressed debt trading, risk management, and client acquisition.

- Potential increase in market share: Morgan Stanley is poised to leverage this addition to capture a greater share of the distressed assets market.

- Attracting high-profile clients: The reputation of the new hire could attract high-profile clients seeking expertise in distressed debt transactions.

- Competitive advantage: This strategic move provides Morgan Stanley with a substantial competitive advantage over other investment banks operating in this specialized sector.

By securing this key figure, Morgan Stanley demonstrates its commitment to building a leading distressed assets team and solidifying its position within the market.

Implications for Morgan Stanley's Market Position

This move has substantial implications for Morgan Stanley's overall market standing:

- Improved reputation: The acquisition enhances Morgan Stanley's reputation as a leader in distressed asset trading, attracting top talent and clients.

- Increased market share: This hire has the potential to increase Morgan Stanley's market share by securing new deals and clients.

- Strengthened client relationships: The individual's existing network and relationships could significantly benefit Morgan Stanley's client base.

- Potential for higher profits: Improved market share and increased deal flow could translate to higher profits for Morgan Stanley's distressed assets division.

This hire could have a cascading effect, attracting other high-performing professionals to join Morgan Stanley, further strengthening its competitive position.

The Broader Market Context

Understanding the broader market context is crucial to fully appreciate the significance of this move.

Trends in the Distressed Debt Market

The distressed debt market is dynamic and influenced by several macroeconomic factors:

- Market volatility: Increased market volatility creates more opportunities for distressed asset trading, driving competition.

- Economic uncertainty: Economic uncertainty often leads to an increase in distressed assets, presenting both risks and rewards for investors.

- Interest rate hikes: Rising interest rates can increase the number of distressed companies and opportunities for distressed debt investors.

- Increased opportunities in distressed assets: Current market conditions are creating an increased number of opportunities in the distressed assets market.

The current environment provides a rich context for understanding the strategic implications of this personnel shift.

Competition Among Investment Banks

The distressed assets space is highly competitive:

- Increased competition: Investment banks constantly compete for talent and market share in distressed debt trading.

- Talent acquisition wars: The competition for top talent is fierce, as experienced professionals are highly sought after.

- Strategic positioning: Banks are constantly seeking strategic advantages to improve their position in this competitive market.

- Market share battles: Investment banks actively compete for market share through acquisitions, talent recruitment, and strategic partnerships.

This move reflects the intense competition for talent and market share among major investment banks in the distressed assets sector.

Conclusion

The departure of Deutsche Bank's Head of Distressed Sales to Morgan Stanley signifies a significant shift in the landscape of Deutsche Bank Distressed Sales and the wider distressed asset trading market. This move has profound implications for both banks, impacting their capabilities, strategic goals, and market positions. Deutsche Bank faces the challenge of rebuilding its expertise and maintaining its competitiveness, while Morgan Stanley gains a considerable advantage. Understanding the dynamics of this transition is crucial for investors and market analysts. Stay informed about further developments in the Deutsche Bank Distressed Sales sector and the evolving strategies of major investment banks. Keep an eye on the evolving landscape of distressed debt trading to understand future shifts and opportunities.

Featured Posts

-

Virginia Health Officials Address Second Measles Case Of 2025

May 30, 2025

Virginia Health Officials Address Second Measles Case Of 2025

May 30, 2025 -

Droits De Douane Votre Manuel De Reference Complet

May 30, 2025

Droits De Douane Votre Manuel De Reference Complet

May 30, 2025 -

Miami Open Musetti Triumphs Over Auger Aliassime In Three Sets

May 30, 2025

Miami Open Musetti Triumphs Over Auger Aliassime In Three Sets

May 30, 2025 -

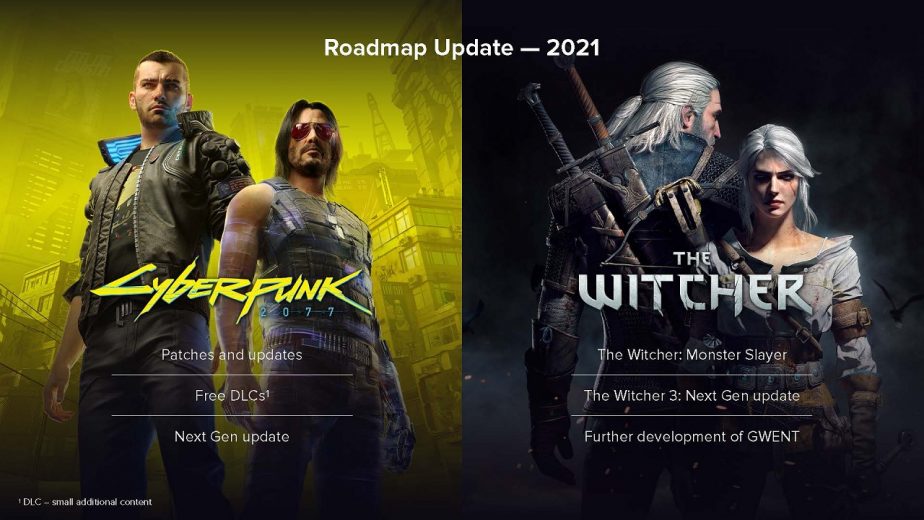

The Road Ahead For Cyberpunk Cd Projekt Reds Plans Unveiled

May 30, 2025

The Road Ahead For Cyberpunk Cd Projekt Reds Plans Unveiled

May 30, 2025 -

Caida Ticketmaster Hoy 8 De Abril Ultimas Noticias Y Actualizaciones Grupo Milenio

May 30, 2025

Caida Ticketmaster Hoy 8 De Abril Ultimas Noticias Y Actualizaciones Grupo Milenio

May 30, 2025