Dismissing Valuation Concerns: BofA's View On The Current Stock Market

Table of Contents

BofA's Rationale for Dismissing Valuation Concerns

BofA's optimistic outlook isn't simply blind faith; it's rooted in a careful analysis of several key factors influencing the current stock market valuation.

Strong Corporate Earnings & Profitability

BofA's assessment centers on the robust performance of corporate earnings and their projected future growth. They see strong profitability across various sectors, fueling their belief that current valuations are justified.

- Key Sectors Driving Profitability: BofA highlights the technology sector, particularly software and cloud computing, as a major driver of earnings growth. The healthcare and consumer staples sectors also show promising profitability.

- Data from BofA Reports: BofA projects a 15% earnings growth in the technology sector for the next fiscal year, significantly higher than the projected average for other sectors. This positive projection underpins their relatively bullish view on stock valuations.

- Potential Risks to Earnings Growth: BofA acknowledges potential risks, including supply chain disruptions and rising labor costs. However, they believe these risks are manageable and unlikely to derail the overall positive trend in corporate earnings.

Low Interest Rates & Monetary Policy

The prevailing low interest rate environment plays a crucial role in BofA's assessment of BofA stock market valuation.

- Impact of Low Interest Rates: Low interest rates reduce borrowing costs for businesses and encourage investment, stimulating economic growth and supporting higher stock prices.

- Monetary Policy's Influence: BofA's analysis considers the accommodative monetary policy adopted by central banks globally. This policy helps keep interest rates low, supporting higher valuations.

- Data Supporting BofA's View: BofA points to historical data correlating low interest rates with periods of sustained market growth, supporting their argument that current valuations are not inherently unsustainable.

- Potential Shifts in Monetary Policy: While BofA acknowledges the possibility of future interest rate hikes, they believe that any increase will likely be gradual, minimizing the negative impact on stock valuations.

Long-Term Growth Potential & Technological Innovation

BofA's long-term outlook is underpinned by a belief in sustained market expansion driven by technological innovation.

- Technological Advancements: BofA points to advancements in artificial intelligence, renewable energy, and biotechnology as key drivers of future economic growth.

- Innovative Companies Driving Growth: Companies at the forefront of these technological advancements are expected to fuel significant market expansion in the coming years.

- Challenges to Long-Term Growth: BofA acknowledges potential challenges, such as regulatory hurdles and geopolitical instability, but believes that the long-term growth potential outweighs these risks.

Counterarguments and Risks Considered by BofA

While optimistic, BofA's analysis also acknowledges potential counterarguments and risks to their assessment of BofA stock market valuation.

Potential for Inflationary Pressures

BofA acknowledges the potential for inflationary pressures to impact valuations negatively.

- Inflationary Scenarios: BofA analyzes different inflationary scenarios, ranging from mild to severe, and their potential effects on stock prices.

- Consequences of Inflation: High inflation could erode corporate profits and lead to higher interest rates, potentially dampening stock market growth.

- BofA's Assessment of Inflation Risks: BofA believes current inflationary pressures are manageable, and they anticipate a return to a more stable inflationary environment.

Geopolitical Uncertainty & Market Volatility

Geopolitical uncertainty is another factor considered by BofA.

- Key Geopolitical Factors: Trade tensions, political instability in certain regions, and potential conflicts are highlighted as potential market disruptors.

- Mitigating Geopolitical Risks: BofA emphasizes the importance of diversification and risk management strategies to mitigate these risks.

Investment Implications & BofA's Recommendations

Based on their analysis, BofA offers several recommendations for investors.

Sector-Specific Opportunities

BofA identifies several sectors poised for growth, offering specific investment opportunities for investors looking to capitalize on their positive outlook on BofA stock market valuation.

- Technology: Software, cloud computing, and cybersecurity are highlighted as particularly attractive sectors.

- Healthcare: Innovation in biotechnology and pharmaceuticals is seen as a long-term growth driver.

Portfolio Diversification Strategies

To mitigate risk, BofA recommends diverse investment strategies.

- Asset Allocation: Diversifying across different asset classes, including stocks, bonds, and real estate, is crucial.

- Geographic Diversification: Investing in companies across different regions helps mitigate geopolitical risks.

Long-Term Investment Horizon

BofA strongly advocates for a long-term investment approach.

- Long-Term Perspective: BofA believes that a long-term perspective is essential to weather short-term market volatility and reap the rewards of long-term growth.

Conclusion

Bank of America's analysis suggests that while high valuations exist, several factors, including strong corporate earnings, low interest rates, and long-term growth potential, mitigate these concerns. While risks such as inflation and geopolitical uncertainty remain, BofA's perspective offers a compelling counterpoint to overly pessimistic valuations. Understanding BofA's reasoning can aid investors in making informed decisions about their portfolios. For a more comprehensive understanding of BofA's view on the current stock market and its implications for your investment strategy, consult their latest reports and consider seeking professional financial advice regarding your specific situation and BofA stock market valuation strategies.

Featured Posts

-

Arnold Schwarzenegger Egy Apa Bueszkesege Joseph Baena

May 06, 2025

Arnold Schwarzenegger Egy Apa Bueszkesege Joseph Baena

May 06, 2025 -

Patrick Schwarzenegger On His Failed Superman Audition A Conversation With David Corenswet

May 06, 2025

Patrick Schwarzenegger On His Failed Superman Audition A Conversation With David Corenswet

May 06, 2025 -

Westpac Wbc Profit Decline Margin Pressure Impacts Earnings

May 06, 2025

Westpac Wbc Profit Decline Margin Pressure Impacts Earnings

May 06, 2025 -

High Praise For Sinner Spike Lees Endorsement

May 06, 2025

High Praise For Sinner Spike Lees Endorsement

May 06, 2025 -

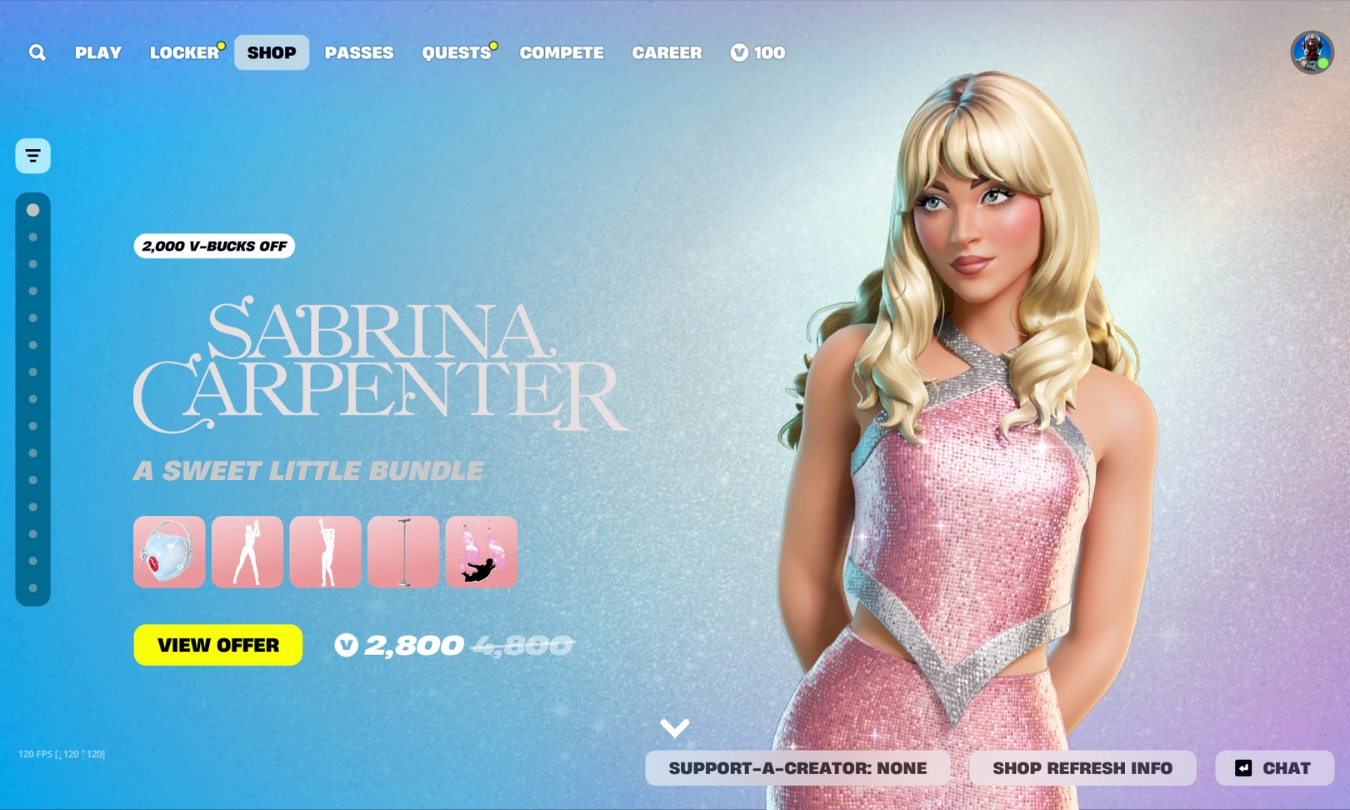

Fortnite Sabrina Carpenter Skins Where To Find Them

May 06, 2025

Fortnite Sabrina Carpenter Skins Where To Find Them

May 06, 2025