Dissecting The GOP Mega Bill: A Closer Look At Its Contents

Table of Contents

Tax Implications of the GOP Mega Bill

This section analyzes the bill's proposed changes to the tax code, exploring its potential effects on individuals, corporations, and states.

Individual Income Tax Changes

The GOP mega bill proposes several significant changes to individual income taxes. These alterations could dramatically reshape the financial landscape for millions of Americans.

- Increased Standard Deduction: The bill may increase the standard deduction, potentially benefiting lower- and middle-income taxpayers. This could simplify tax filing for many, but it might also reduce the overall tax revenue collected by the government.

- Altered Tax Brackets: Changes to tax brackets are anticipated, potentially altering the tax rates for various income levels. Higher earners might see a reduction in their tax rates, while lower earners might experience minimal changes or even small increases.

- Elimination of Specific Deductions: Certain itemized deductions, such as those for state and local taxes (SALT), might be eliminated or significantly limited, impacting taxpayers who previously benefited from them. This could lead to higher tax burdens for some individuals, particularly those in high-tax states.

The potential impact on different demographics is substantial. High-income earners could see significant tax savings, while the impact on middle- and low-income families is less clear and could vary depending on the specific changes implemented. The long-term economic consequences of these tax changes are a subject of ongoing debate, with economists offering varying predictions on their impact on economic growth and income inequality.

Corporate Tax Rate Adjustments

The bill's proposed changes to corporate tax rates are a central point of contention. Lowering the corporate tax rate, as proposed, could stimulate business investment and job creation, but it could also lead to increased corporate profits without a commensurate increase in wages or job growth.

- Proposed Corporate Tax Rate: The exact proposed rate requires further scrutiny as the bill evolves, but a lower rate than the current one is anticipated.

- Impact on Small Businesses vs. Large Corporations: The impact on small businesses versus large corporations is debated. While large corporations may benefit more directly from lower rates, small businesses could also see indirect benefits through increased economic activity.

- Increased or Decreased Corporate Profitability: The effect on corporate profitability is uncertain. While lower taxes could boost profits, increased competition and other economic factors could offset this effect. It is crucial to analyze the overall economic climate to predict the impact.

Impact on State and Local Taxes (SALT)

The GOP mega bill's potential modifications to the SALT deduction are of particular concern to taxpayers in high-tax states.

- Current SALT Deduction: Currently, taxpayers can deduct state and local taxes from their federal income tax liability, which provides significant tax relief for residents of high-tax states.

- Proposed Changes: The bill may propose limiting or eliminating this deduction, which would increase the tax burden for residents of high-tax states like California, New York, and New Jersey. This could lead to significant financial hardship for some individuals and families.

- Increased Tax Burden in High-Tax States: The elimination or limitation of the SALT deduction could lead to a significant increase in the overall tax burden for individuals in these high-tax states, potentially impacting their ability to afford essential services like housing and healthcare.

Healthcare Provisions within the GOP Mega Bill

This section focuses on the bill's proposed alterations to healthcare policies, including potential changes to the Affordable Care Act (ACA), and funding for Medicare and Medicaid.

Changes to the Affordable Care Act (ACA)

The bill may include provisions to repeal, amend, or modify the Affordable Care Act (ACA). The proposed changes could significantly alter healthcare access and affordability for many Americans.

- Changes to Pre-existing Conditions Coverage: The bill's potential impact on pre-existing conditions coverage is a major concern. Weakening protections for individuals with pre-existing conditions could lead to higher healthcare costs and reduced access to care for millions.

- Medicaid Expansion: The bill might impact Medicaid expansion, potentially reducing federal funding for states that expanded Medicaid under the ACA. This could lead to reduced healthcare coverage and access for low-income individuals and families.

- Impact on Healthcare Access and Affordability: The overall impact on healthcare access and affordability is uncertain and highly debated, with various stakeholders expressing concerns about potential negative consequences.

Medicare and Medicaid Funding

The bill may propose changes to funding levels for Medicare and Medicaid, two crucial programs providing healthcare to millions of Americans.

- Proposed Funding Changes: The specific details of proposed funding changes require careful analysis as the bill progresses. Potential cuts to these programs could lead to reduced access to care and decreased quality of services.

- Effects on Program Access and Quality of Care: Reduced funding could lead to longer wait times for care, fewer available services, and reduced quality of care for beneficiaries. This could disproportionately affect vulnerable populations who rely on these programs.

- Long-Term Sustainability: Changes to funding could also affect the long-term sustainability of these programs, raising questions about their ability to meet the healthcare needs of an aging population.

Environmental Regulations and the GOP Mega Bill

This section assesses the bill's potential impact on environmental policies and regulations.

Proposed Changes to Environmental Protection Agency (EPA) Funding and Regulations

The GOP mega bill might include provisions to cut funding for the Environmental Protection Agency (EPA) and weaken environmental regulations.

- Reduced Funding for Environmental Protection Programs: Reduced funding could hinder the EPA's ability to enforce existing regulations and implement new initiatives to protect air and water quality.

- Weakening of Emission Standards: Weakening emission standards could lead to increased air and water pollution, negatively impacting public health and the environment.

- Long-Term Environmental Consequences: The long-term environmental consequences of these changes are a significant concern, potentially leading to increased greenhouse gas emissions, accelerated climate change, and other environmental problems.

Impact on Climate Change Initiatives

The bill's potential impact on climate change initiatives is another major area of concern.

- Specific Examples of Affected Initiatives: The bill might affect initiatives related to renewable energy development, carbon emission reduction targets, and international agreements on climate change.

- Potential Impact on Greenhouse Gas Emissions: Weakening environmental regulations could lead to increased greenhouse gas emissions, exacerbating climate change and its associated consequences.

- Long-Term Implications for Climate Change Mitigation: The overall impact on climate change mitigation efforts could be significant, potentially hindering progress towards a sustainable future.

Conclusion

The GOP mega bill presents a complex tapestry of proposed changes across various sectors. This analysis has highlighted key aspects of the bill's tax implications, healthcare provisions, and environmental regulations, emphasizing the far-reaching consequences of this significant legislation. Understanding the intricacies of the GOP mega bill is paramount for informed participation in the ongoing political discourse. Further research and engagement are crucial to fully grasp the potential implications of this sweeping legislation. Continue to learn more about the intricacies of the GOP mega bill and participate in the national conversation. Stay informed and make your voice heard.

Featured Posts

-

San Diego Padres News Roster Moves Ahead Of Game

May 16, 2025

San Diego Padres News Roster Moves Ahead Of Game

May 16, 2025 -

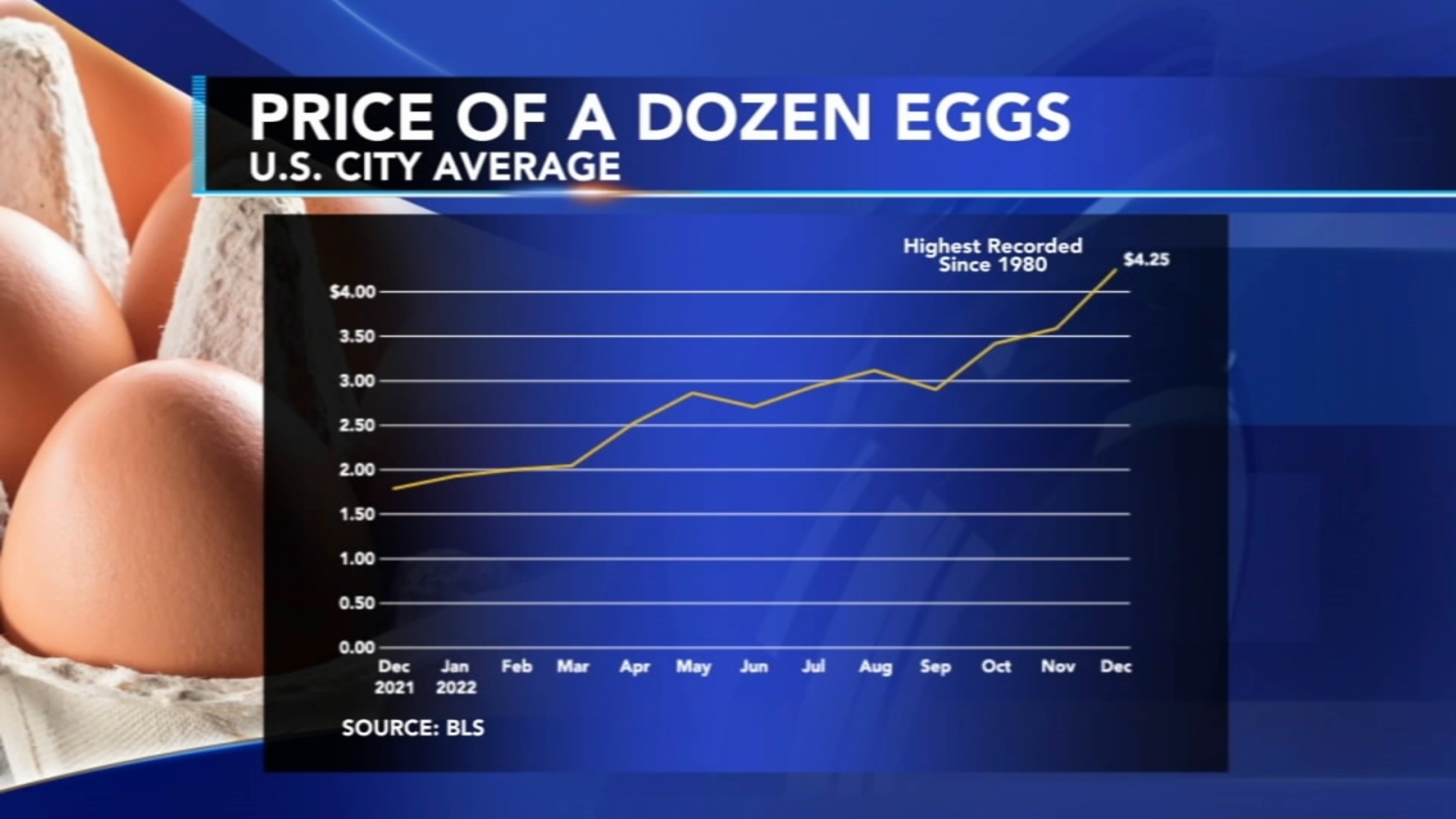

Egg Prices Plummet A Dozen Now Costs 5 In The Us

May 16, 2025

Egg Prices Plummet A Dozen Now Costs 5 In The Us

May 16, 2025 -

Tampa Bey Vyigryvaet Seriyu U Floridy Blagodarya Kucherovu

May 16, 2025

Tampa Bey Vyigryvaet Seriyu U Floridy Blagodarya Kucherovu

May 16, 2025 -

Predicting The Celtics 76ers Game Who Will Win

May 16, 2025

Predicting The Celtics 76ers Game Who Will Win

May 16, 2025 -

Cody Poteet Chicago Cubs Spring Training Abs Challenge Champion

May 16, 2025

Cody Poteet Chicago Cubs Spring Training Abs Challenge Champion

May 16, 2025