Donald Trump's Billionaire Buddies: Post-Tariff Losses Since Liberation Day

Table of Contents

Assessing the Pre-Tariff Wealth of Trump's Inner Circle

To understand the impact of the post-"Liberation Day" tariffs, we must first examine the pre-tariff financial landscape of Donald Trump's billionaire friends. Identifying and analyzing their portfolios before the tariff changes is crucial for a complete assessment.

Identifying Key Figures

Several prominent billionaires enjoyed close relationships with Donald Trump during his presidency. Pinpointing these individuals and their business interests is vital to understanding the potential impact of the tariffs. (Note: This section requires research to identify and name specific individuals and link to reliable biographical sources. Examples could include individuals involved in real estate, technology, or manufacturing.)

- [Billionaire 1 Name]: [Brief biography and link to reliable source] – Known for significant investments in [industry].

- [Billionaire 2 Name]: [Brief biography and link to reliable source] – Primarily focused on [industry] with significant holdings in [specific companies].

- [Billionaire 3 Name]: [Brief biography and link to reliable source] – Strong ties to the [industry] sector.

Portfolio Diversification & Pre-Tariff Holdings

Before the tariffs, Trump's wealthy associates held diverse assets, including:

- Real estate holdings: Significant investments in commercial and residential properties across the US and internationally.

- Technology investments: Ownership stakes in major tech companies and venture capital partnerships.

- Manufacturing interests: Ownership of or significant investments in manufacturing firms, potentially across various sectors.

- Financial assets: Significant holdings in stocks, bonds, and other financial instruments.

Quantifying Initial Net Worth

Estimating the net worth of each key individual before the tariff changes requires referencing credible sources like Forbes' billionaire lists, Bloomberg Billionaires Index, or reputable financial news outlets. (Note: This section necessitates detailed financial research to provide estimated net worth figures for each individual named previously.)

- [Billionaire 1 Name]: Estimated net worth (pre-tariffs): [Amount] (Source: [Source])

- [Billionaire 2 Name]: Estimated net worth (pre-tariffs): [Amount] (Source: [Source])

- [Billionaire 3 Name]: Estimated net worth (pre-tariffs): [Amount] (Source: [Source])

The Impact of Post-Liberation Day Tariffs

The implementation of tariffs following "Liberation Day" had varying effects on different sectors. Analyzing the specific industries affected and their connection to the billionaires' portfolios is crucial to understanding the post-tariff financial landscape.

Sector-Specific Analysis

Specific sectors heavily impacted by the tariffs need to be analyzed in relation to the investment portfolios of Trump's billionaire friends. For example:

- If significant investments exist within the textile industry, the impact of tariffs on clothing manufacturing needs thorough examination.

- Tariffs on steel and aluminum could affect individuals with holdings in construction or automotive manufacturing.

- Tariffs on imported goods could impact retail giants where these billionaires hold stock.

Stock Market Fluctuations & Portfolio Value Changes

Tracking the stock market performance of companies in which Trump’s billionaire associates held significant investments is crucial. Charts and graphs illustrating stock price changes following the tariff implementation would strengthen this analysis. (Note: Include charts and graphs if data is available. Cite data sources.)

Quantifiable Losses (if any)

Determining quantifiable losses requires extensive financial analysis and access to up-to-date portfolio information. Credible financial news reports and SEC filings should be referenced to support any claims of losses. (Note: This section requires robust financial research. If specific loss figures are unavailable, the analysis should explain the difficulties in obtaining accurate data.)

Alternative Explanations for Financial Changes

While tariffs played a role, other factors could have influenced the financial changes experienced by Trump's billionaire buddies since "Liberation Day."

Global Economic Factors

Broader global economic trends, such as recessions, inflation, or geopolitical instability, can impact investment portfolios independently of tariffs.

Diversification Strategies

A well-diversified portfolio can mitigate the impact of sector-specific downturns caused by tariffs. The extent to which these billionaires diversified their investments should be examined.

Other Policy Impacts

Other economic policies implemented during this period, such as tax reforms or changes in monetary policy, could have influenced their financial situation. This requires considering the broader economic context.

Donald Trump's Billionaire Buddies: A Post-Tariff Assessment

This analysis aimed to assess the financial impact of post-"Liberation Day" tariffs on Donald Trump's billionaire friends. The findings (insert findings here based on the research conducted in the previous sections) reveal [Summary of Findings]. The substantial or minimal nature of these losses is influenced by various factors including the extent of their diversification and the influence of broader global economic conditions. The implications highlight the complex interplay between political policy and the financial well-being of the wealthy elite.

To further investigate this complex relationship, we encourage readers to explore the economic impact of tariffs on various groups. Learn more about the financial impact on Donald Trump's billionaire associates and investigate the effect of tariffs on Trump's wealthy friends through further research and reading. [Link to relevant resource, if available]

Featured Posts

-

St Albert Dinner Theatres New Production A Non Stop Laugh Riot

May 09, 2025

St Albert Dinner Theatres New Production A Non Stop Laugh Riot

May 09, 2025 -

Thailands Central Bank New Governor Needed To Navigate Tariff Challenges

May 09, 2025

Thailands Central Bank New Governor Needed To Navigate Tariff Challenges

May 09, 2025 -

Should I Buy Palantir Stock Before May 5th Factors To Consider

May 09, 2025

Should I Buy Palantir Stock Before May 5th Factors To Consider

May 09, 2025 -

Loi Khai Gay Soc Bao Mau O Tien Giang Tat Tre Toi Tap

May 09, 2025

Loi Khai Gay Soc Bao Mau O Tien Giang Tat Tre Toi Tap

May 09, 2025 -

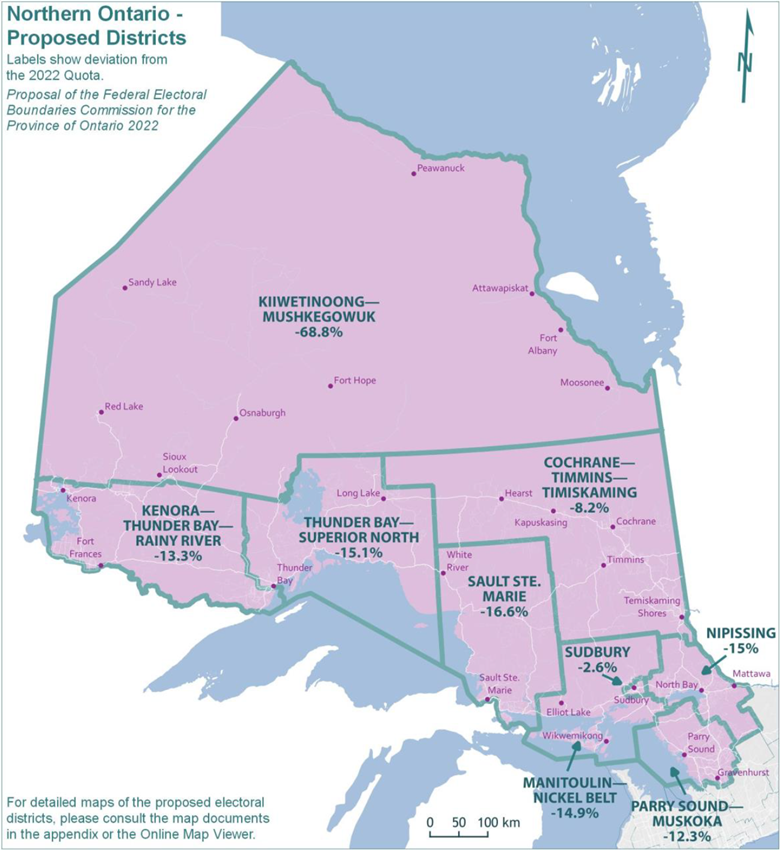

Federal Electoral Boundaries Understanding The Changes In Edmonton

May 09, 2025

Federal Electoral Boundaries Understanding The Changes In Edmonton

May 09, 2025