Dow Futures And China Economy: A Stock Market Update

Table of Contents

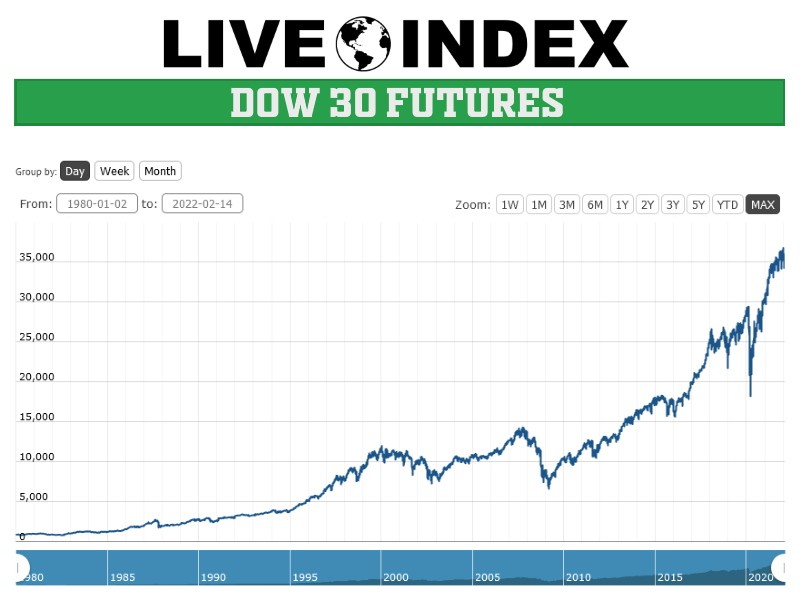

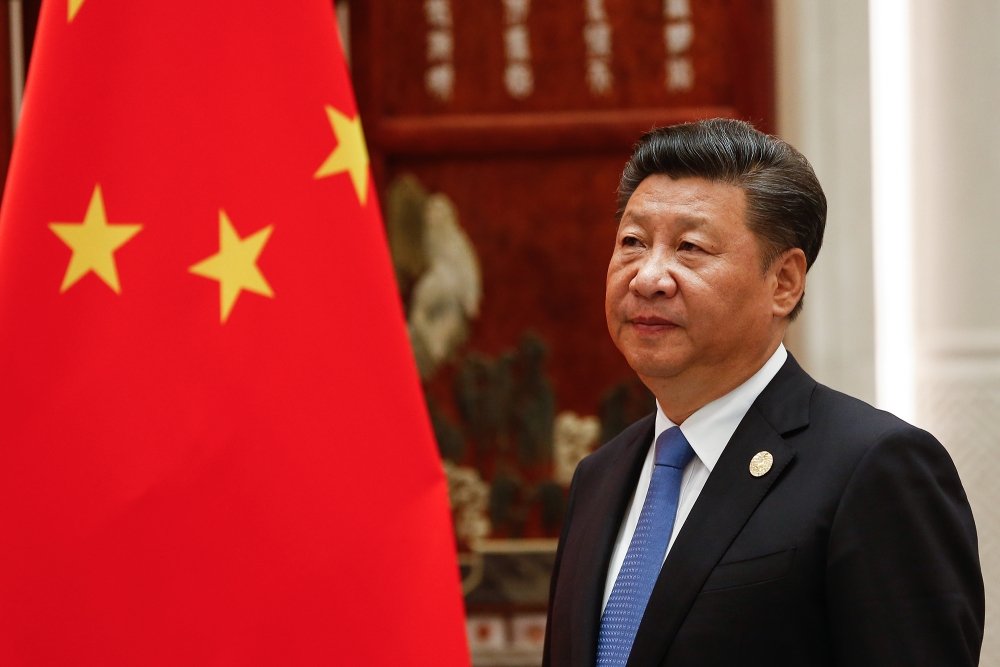

The Impact of China's Economic Growth on Dow Futures

The historical correlation between Chinese economic performance and Dow Futures is undeniable. China's emergence as a global economic powerhouse has profoundly influenced global markets, and the Dow is no exception. Key economic indicators emanating from China – GDP growth, the Manufacturing Purchasing Managers' Index (PMI), and consumer spending – serve as vital barometers for predicting future Dow Futures movements.

- Slowdown in Chinese Growth: A slowdown in China's growth directly affects global supply chains. Many US companies rely on Chinese manufacturing, and disruptions there lead to production delays, increased costs, and reduced profits, negatively impacting Dow Futures.

- Chinese Demand and Commodity Prices: China's immense consumer base significantly influences global commodity prices. Stronger Chinese demand drives up prices for materials like oil and metals, benefiting companies within the Dow with exposure to these commodities. Conversely, weak demand leads to price drops.

- Chinese Investment in US Markets: Chinese investment plays a significant role in the US stock market. Changes in Chinese investment strategies can create substantial shifts in stock prices, including those within the Dow Futures.

Analyzing Recent Dow Futures Movements in Light of China's Economic Data

Recent Dow Futures movements reflect the ongoing interplay between the US and Chinese economies. For instance, (insert specific recent example, e.g., a slowdown in Chinese manufacturing PMI coupled with a drop in Dow Futures). Analyzing the divergence between expected and actual Chinese economic data is crucial. When China's economic performance surpasses expectations, it often boosts investor confidence, leading to gains in Dow Futures. Conversely, underperformance frequently results in market corrections.

- Specific Examples: (Provide 2-3 concrete examples of recent news impacting both markets, linking specific Chinese economic data releases to subsequent Dow Futures movements. Include links to reputable news sources.)

- Investor Sentiment: (Discuss how shifts in investor sentiment related to China's economic outlook have influenced Dow Futures. For example, a surge in pessimism about China's property market might trigger sell-offs in the Dow.)

- Price Fluctuations: (Analyze the magnitude of price fluctuations in Dow Futures in response to specific Chinese economic events, highlighting the sensitivity of the market to these developments.)

Key Sectors Most Affected by the China-Dow Connection

Several sectors within the Dow are particularly susceptible to fluctuations in the Chinese economy. Understanding these sensitivities is crucial for effective portfolio management.

- Technology Sector: The technology sector heavily relies on Chinese components and markets. Any disruption in the Chinese tech industry directly impacts US tech giants, impacting their stock prices and influencing Dow Futures.

- Consumer Goods: The performance of consumer goods companies is strongly linked to Chinese consumer spending. Strong consumer spending boosts sales, while a downturn leads to reduced demand and impacts company profits.

- Industrial Companies: Many industrial companies depend on Chinese manufacturing for their supply chains. Disruptions in these supply chains due to economic slowdowns or geopolitical tensions in China can significantly impact their stock prices and, by extension, Dow Futures.

Strategies for Investors Navigating this Interplay

The interconnectedness of Dow Futures and the Chinese economy demands a proactive approach to investment management. Effective strategies incorporate risk mitigation and diversification.

- Stay Informed: Staying informed about Chinese economic news is paramount. Follow reputable financial news sources for up-to-date information on key economic indicators.

- Diversification: Diversification is key to mitigating risks associated with the China-Dow relationship. Spread your investments across different sectors and asset classes to reduce exposure to any single market.

- Identify Opportunities: Periods of volatility due to China-related events can present unique investment opportunities. Careful analysis can uncover undervalued stocks in sectors less directly impacted by the fluctuations.

Conclusion: Staying Informed on Dow Futures and China's Economic Impact

The relationship between Dow Futures and the Chinese economy is complex but undeniably crucial for investors. Monitoring key economic indicators from China, understanding their impact on various sectors, and employing robust risk management strategies are essential for making informed investment decisions. Stay updated on Dow Futures and China Economy news through reliable financial resources like (suggest a reputable financial news source or newsletter) to navigate this dynamic market effectively and protect your portfolio. Understanding this intricate interplay between Dow Futures and the Chinese economy is your key to successful stock market navigation.

Featured Posts

-

Todays Nyt Spelling Bee Solutions And Support March 25 387

Apr 26, 2025

Todays Nyt Spelling Bee Solutions And Support March 25 387

Apr 26, 2025 -

Santierul Naval Mangalia Conflictul Si Interventia Solicitata Ambasadei Olandei De Catre Navalistul

Apr 26, 2025

Santierul Naval Mangalia Conflictul Si Interventia Solicitata Ambasadei Olandei De Catre Navalistul

Apr 26, 2025 -

Jorgensons Repeat Win American Cyclist Conquers Paris Nice Again

Apr 26, 2025

Jorgensons Repeat Win American Cyclist Conquers Paris Nice Again

Apr 26, 2025 -

A Us Military Base Ground Zero In The Us China Power Struggle

Apr 26, 2025

A Us Military Base Ground Zero In The Us China Power Struggle

Apr 26, 2025 -

California Now Worlds Fourth Largest Economy An Economic Analysis

Apr 26, 2025

California Now Worlds Fourth Largest Economy An Economic Analysis

Apr 26, 2025