Due Diligence And Financial Modeling For A 270MWh BESS Project In Belgium

Table of Contents

- Due Diligence for a 270MWh BESS Project in Belgium

- Regulatory and Permitting Landscape

- Technical Due Diligence

- Market Analysis and Revenue Streams

- Financial Modeling for a 270MWh BESS Project in Belgium

- Capital Expenditure (CAPEX) and Operational Expenditure (OPEX)

- Revenue Projections and Cash Flow Analysis

- Risk Assessment and Mitigation

- Conclusion

Due Diligence for a 270MWh BESS Project in Belgium

Before committing significant capital to a 270MWh BESS project, comprehensive due diligence is paramount. This process involves a thorough investigation across several critical areas:

Regulatory and Permitting Landscape

Navigating the Belgian regulatory framework for energy storage projects is a complex but essential first step. This includes understanding and complying with various regulations impacting your BESS project in Belgium:

- Grid connection requirements and procedures: Liaising with Elia, the Belgian transmission system operator, is crucial to secure grid connection approval. This involves detailed technical specifications and adherence to their interconnection procedures.

- Obtaining necessary permits and licenses: This includes environmental permits, building permits, and any other licenses required at the regional and local levels. Understanding the timelines for each permit is critical for project scheduling.

- Compliance with environmental regulations: Meeting stringent environmental standards, including noise pollution and potential impact assessments, is essential. Consultations with environmental agencies are necessary to ensure full compliance.

- Specific Belgian Regulations: Key regulations include, but are not limited to, those related to renewable energy integration, grid stability, and environmental protection. Detailed legal counsel specializing in Belgian energy law is recommended.

Relevant Authorities: Elia (transmission system operator), CREG (Commission de Régulation de l'Électricité et du Gaz), and local authorities responsible for building permits and environmental approvals.

Technical Due Diligence

Technical due diligence focuses on the viability and performance of the proposed BESS system. This encompasses:

- BESS Technology Suitability: Evaluating the suitability of the chosen battery technology (e.g., lithium-ion) for the Belgian climate, considering factors like temperature fluctuations and potential degradation.

- Site Selection and Feasibility Studies: Careful site selection is critical, considering proximity to the grid, land availability, geological factors (soil stability, groundwater levels), and accessibility for construction and maintenance. Thorough feasibility studies are crucial to identify and mitigate potential technical challenges.

- Battery Lifespan and Degradation: Understanding the expected lifespan of the battery system and its degradation rate is crucial for accurate financial modeling and long-term planning. Realistic degradation rates must be incorporated into projections.

- Technical Risk Analysis: Identifying potential technical risks (e.g., equipment failure, fire hazards, cybersecurity threats) and developing mitigation strategies is essential to minimize operational disruptions and financial losses.

Key Technical Parameters: Battery capacity (MWh), power rating (MW), round-trip efficiency, cycle life, safety features, and thermal management systems.

Market Analysis and Revenue Streams

A comprehensive market analysis is vital to identify potential revenue streams for your BESS project in Belgium. This involves:

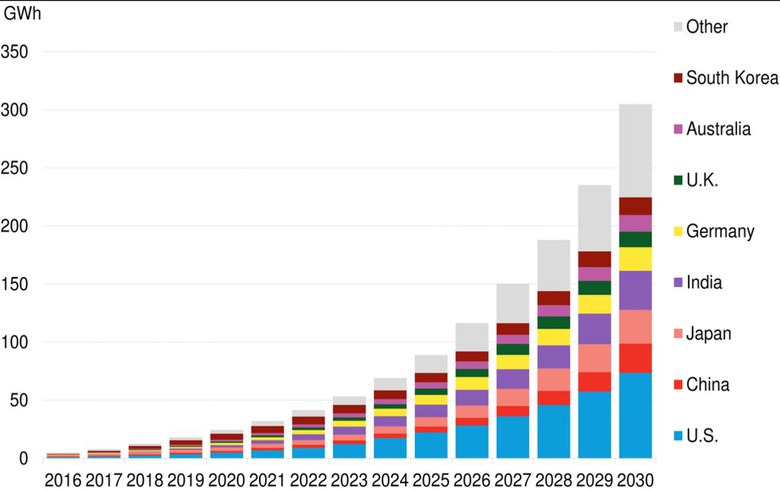

- Belgian Energy Market Assessment: Analyzing the current and projected demand for energy storage services in the Belgian energy market, considering factors like renewable energy penetration and grid stability requirements.

- Revenue Stream Identification: Exploring various revenue opportunities, such as frequency regulation, peak shaving, arbitrage, and ancillary services provided to the grid.

- Electricity Price Forecasting: Developing accurate electricity price forecasts is crucial for predicting profitability. This should consider seasonal variations and potential market volatility.

- Power Purchase Agreements (PPAs): Securing PPAs with off-takers is essential to guarantee revenue streams. Negotiating favorable PPA terms is critical to project profitability.

- Competitive Landscape Analysis: Analyzing the competitive landscape of existing and planned energy storage projects in Belgium is crucial to understand market dynamics and potential competition.

Key Market Drivers: Growth of renewable energy sources, increasing electricity demand, grid modernization initiatives, and government policies supporting energy storage.

Financial Modeling for a 270MWh BESS Project in Belgium

Robust financial modeling is crucial for assessing the financial viability of your 270MWh BESS project in Belgium. This involves:

Capital Expenditure (CAPEX) and Operational Expenditure (OPEX)

A detailed breakdown of project costs is essential:

- Cost Breakdown: This includes equipment costs (batteries, inverters, transformers, etc.), installation costs, permitting fees, land acquisition costs, and ongoing maintenance expenses.

- Sensitivity Analysis: Performing sensitivity analysis on cost estimates helps understand the impact of variations in cost assumptions on project profitability.

- Financing Options: Exploring various financing options (e.g., bank loans, project finance, equity investment) and their associated costs and terms.

Key Cost Drivers: Battery costs, installation complexity, site preparation requirements, and permitting fees.

Revenue Projections and Cash Flow Analysis

Accurate revenue projections are critical for assessing project profitability:

- Revenue Projection Development: Based on the market analysis and anticipated energy prices, detailed revenue projections should be developed.

- Discounted Cash Flow (DCF) Model: A comprehensive DCF model should be constructed to determine the net present value (NPV) and internal rate of return (IRR) of the project.

- Sensitivity Analysis: Performing sensitivity analysis on key assumptions (e.g., electricity prices, operating costs, degradation rates) is crucial to understand potential risks and uncertainties.

Key Financial Metrics: NPV, IRR, payback period, and levelized cost of storage (LCOS).

Risk Assessment and Mitigation

Identifying and mitigating potential risks is crucial for project success:

- Risk Identification: Identifying potential financial risks (e.g., regulatory changes, market volatility, technology failure, and force majeure events).

- Risk Mitigation Strategies: Developing strategies to mitigate identified risks, such as insurance policies, hedging strategies, and contingency plans.

Key Risk Factors: Regulatory uncertainty, electricity price volatility, battery degradation, and operational disruptions.

Conclusion

Successful implementation of a 270MWh BESS project in Belgium hinges on comprehensive due diligence and robust financial modeling. Thorough investigation of the regulatory environment, technical feasibility, and market dynamics is crucial for your BESS project in Belgium. Equally important is the creation of a detailed financial model that accurately reflects the project's potential profitability and incorporates a comprehensive risk assessment. By diligently addressing these aspects, investors can significantly increase the likelihood of a successful and profitable BESS project in the Belgian energy market. Contact us today to learn more about our expertise in due diligence and financial modeling for BESS projects in Belgium, and let us help you navigate the complexities of this exciting sector. We can assist you with all aspects of your BESS project in Belgium, from initial due diligence to securing financing and managing the construction process.

Lion Storages 1 4 G Wh Battery Energy Storage System In Netherlands Financial Close Achieved

Lion Storages 1 4 G Wh Battery Energy Storage System In Netherlands Financial Close Achieved

Bradley Coopers New Relationship Impact On His Friendship With Leonardo Di Caprio

Bradley Coopers New Relationship Impact On His Friendship With Leonardo Di Caprio

Ufc 314 Winner Paddy Pimblett Hosts Lavish Yacht Party

Ufc 314 Winner Paddy Pimblett Hosts Lavish Yacht Party

Ryan Garcia And Teofimo Lopez Back To Their Fathers After Reynoso Split

Ryan Garcia And Teofimo Lopez Back To Their Fathers After Reynoso Split

La Prevencion De La Imprudencia Metodos Efectivos

La Prevencion De La Imprudencia Metodos Efectivos