Dutch Equities Fall As US Trade War Intensifies

Table of Contents

Impact of US Tariffs on Dutch Exports

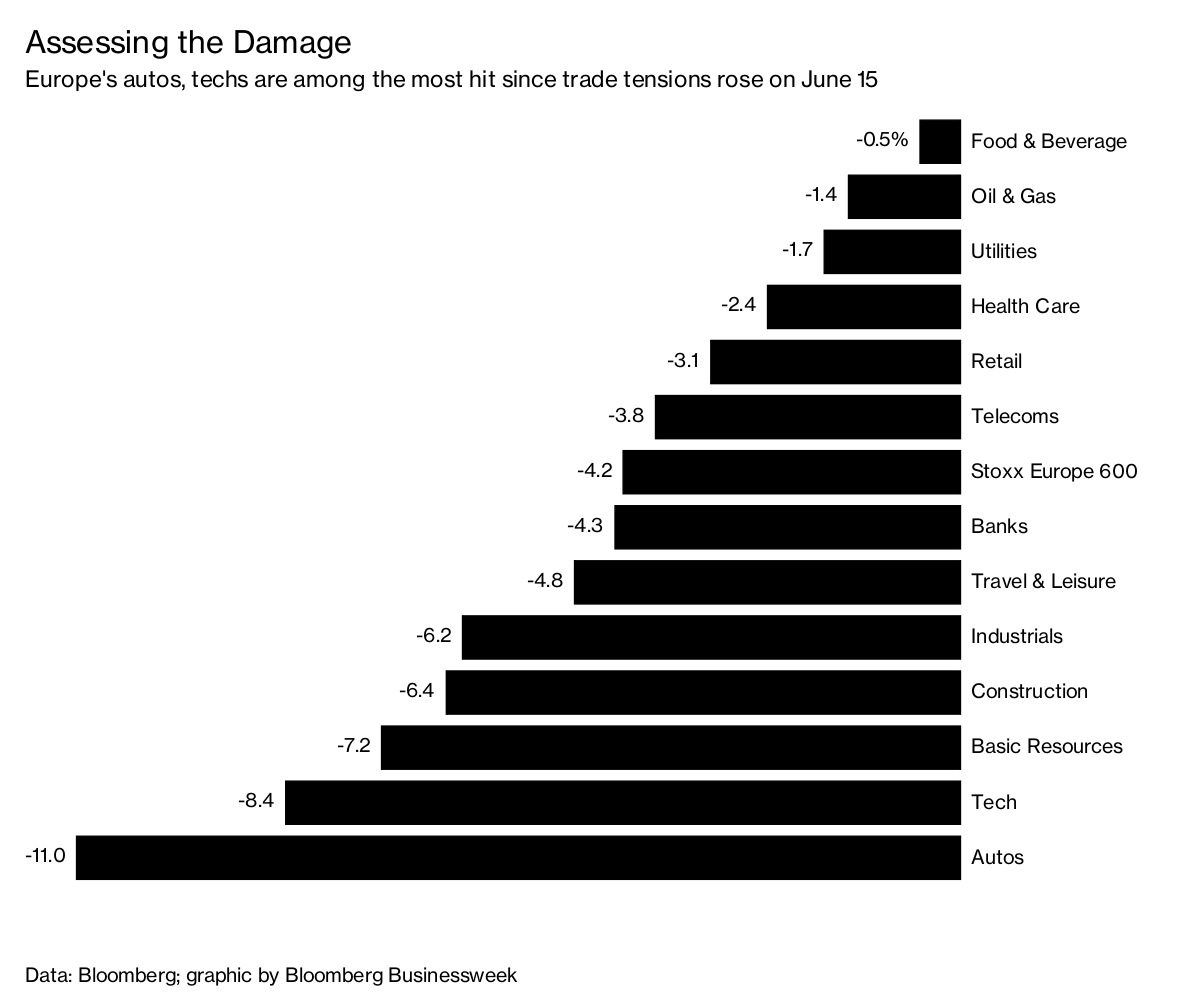

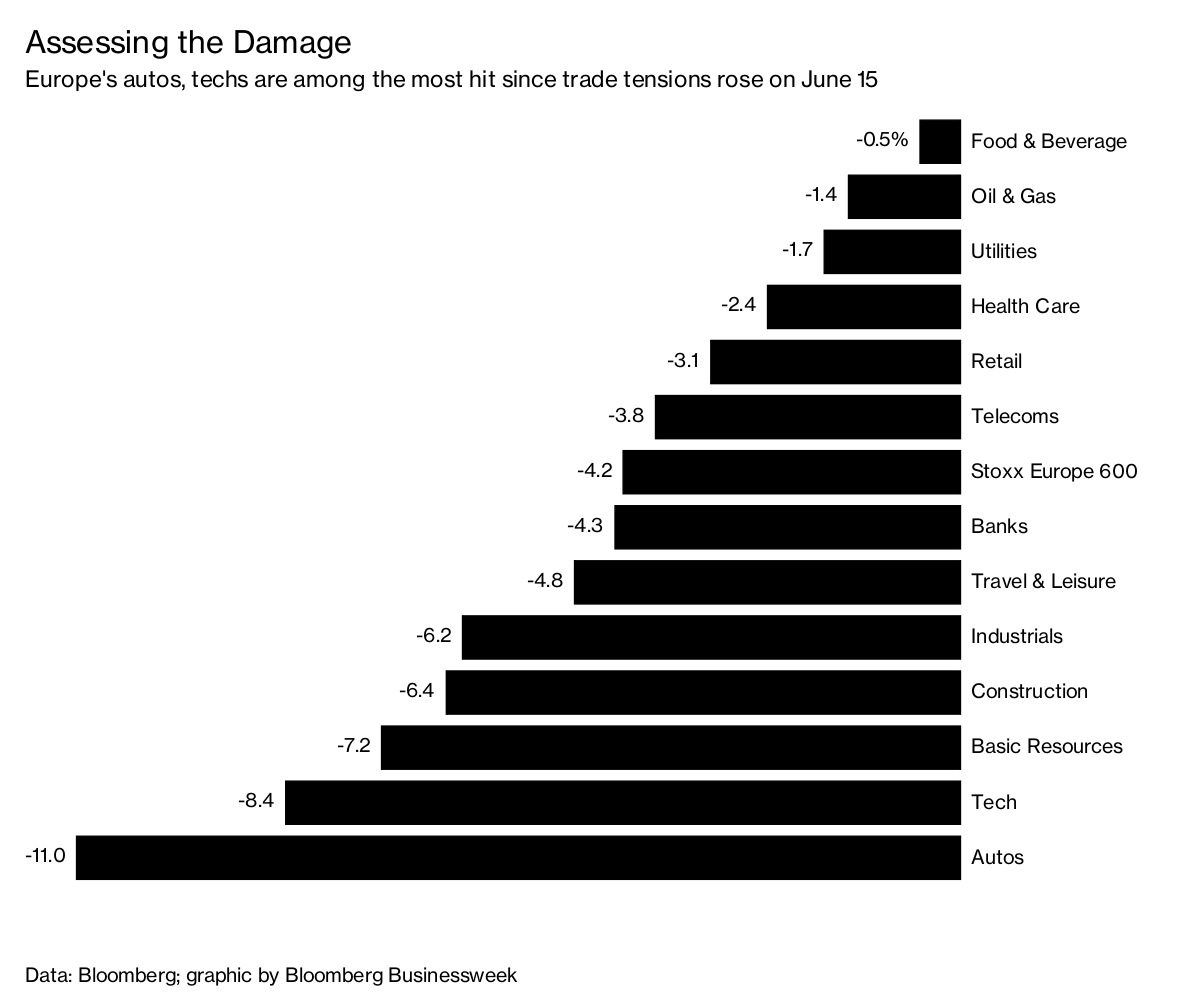

The imposition of US tariffs has directly impacted several key Dutch export sectors, leading to a decline in Dutch equities.

Decline in Key Export Sectors

The agricultural sector, a significant contributor to the Dutch economy, has been particularly hard hit. Dutch farmers, known for their high-quality produce, face increased tariffs on their exports to the US, reducing their competitiveness and profitability.

- Quantify the drop in exports to the US (if data available): While precise figures require detailed analysis, reports suggest a double-digit percentage decrease in agricultural exports to the US since the trade war intensified. (Note: Replace this with actual data if available from reputable sources like the CBS (Centraal Bureau voor de Statistiek) or other relevant economic institutions).

- Mention specific examples of companies affected and the magnitude of their losses: For example, [Insert name of a Dutch agricultural company if available] reported a [percentage]% decrease in US sales, impacting their overall profitability. Similar challenges are affecting technology and manufacturing sectors, albeit to varying degrees.

- Analyze the ripple effect on related industries within the Netherlands: The decline in agricultural exports has a ripple effect, impacting related industries such as food processing and logistics companies dependent on this sector. This interconnectedness makes the overall impact on Dutch equities more significant.

Weakening Euro and its effect on Dutch Equities

The weakening Euro, partly a consequence of global trade uncertainty, further exacerbates the situation for Dutch equities. Dutch companies’ earnings, primarily reported in Euros, translate to fewer US dollars when exported, impacting their bottom line.

- Discuss the correlation between the Euro's value and Dutch equity performance: A weaker Euro negatively correlates with the performance of Dutch equities, as foreign investors receive fewer Euros for their investments. This effect is amplified during times of market uncertainty.

- Mention any currency hedging strategies employed by Dutch companies: Some Dutch companies use currency hedging strategies (like forward contracts) to mitigate the risks of fluctuating exchange rates, but complete protection is rarely achievable.

Investor Sentiment and Market Volatility

The intensifying US trade war has significantly dampened investor confidence in Dutch equities, leading to increased market volatility.

Decreased Investor Confidence

Uncertainty surrounding future trade relations and the potential for further tariff escalations has led to a decline in investor confidence.

- Discuss the impact on foreign investment in Dutch companies: Foreign direct investment in the Netherlands has decreased, reflecting investors' reluctance to commit capital during times of economic uncertainty.

- Mention any significant sell-offs in the Dutch stock market: Significant sell-offs have been observed in the AEX index (Amsterdam Exchange Index), the benchmark for Dutch equities, reflecting investor anxieties. (Note: Include specific data points if available).

- Refer to relevant stock market indices (e.g., AEX index) and their performance: The AEX index performance can be directly correlated with the news cycle surrounding the US trade war, showing a clear negative relationship.

Increased Market Volatility

The daily news cycle related to the US trade war fuels volatility in the Dutch equity market, resulting in sharp fluctuations in stock prices and trading volumes.

- Describe the fluctuations in stock prices and trading volumes: Increased volatility translates to higher risk for investors, potentially impacting their investment decisions.

- Discuss the impact on long-term investment strategies: Long-term investors are re-evaluating their strategies, potentially shifting towards more conservative approaches or diversifying their portfolios to reduce risk.

Government Response and Mitigation Strategies

The Dutch government has implemented several measures to support businesses affected by the trade war and mitigate its impact on Dutch equities.

Government Initiatives to Support Businesses

The Dutch government has implemented various initiatives aimed at cushioning the blow to affected businesses.

- Discuss potential subsidies, tax breaks, or other forms of support: Specific programs and their details should be referenced here, focusing on their potential effectiveness. (Note: Include specific examples of government initiatives if available).

- Analyze the effectiveness of these measures: The effectiveness of these measures is still being evaluated; however, they are intended to lessen the negative impact on the affected industries and Dutch equities.

Long-term Economic Outlook for Dutch Equities

The long-term economic outlook for Dutch equities remains uncertain, dependent on the resolution of the US trade war and its global impact.

- Present expert opinions and economic forecasts: Include forecasts from reputable economic institutions or experts on the predicted recovery timeline for the Dutch equity market. (Note: Cite your sources here).

- Mention potential opportunities arising from the shifting global trade landscape: Despite the challenges, the shifting global trade landscape may present new opportunities for some Dutch companies, potentially leading to diversification and growth in other sectors.

Conclusion

The intensifying US trade war has demonstrably impacted Dutch equities, leading to a decline in key export sectors, decreased investor confidence, and increased market volatility. While the Dutch government has taken steps to mitigate the damage, the long-term economic outlook remains intertwined with the resolution of this global trade conflict. Understanding the interplay between the US trade war and Dutch equities is crucial for informed investment decisions. Stay informed about the evolving situation and consider diversifying your investment portfolio to mitigate risk. Regularly monitoring market trends is essential for navigating this uncertain landscape. Understanding the impact of global events on Dutch equities and related sectors is crucial for successful long-term investment strategies.

Featured Posts

-

Zheng Qinwen Upsets Sabalenka In Rome Sets Up Gauff Clash

May 25, 2025

Zheng Qinwen Upsets Sabalenka In Rome Sets Up Gauff Clash

May 25, 2025 -

Novoe Foto Naomi Kempbell V Smelykh Obrazakh Dlya Modnogo Zhurnala

May 25, 2025

Novoe Foto Naomi Kempbell V Smelykh Obrazakh Dlya Modnogo Zhurnala

May 25, 2025 -

Escape The Everyday A Charming Andalusian Farmstay

May 25, 2025

Escape The Everyday A Charming Andalusian Farmstay

May 25, 2025 -

Real Madrid E Uefa Sorusturmasi Arda Gueler Ve Takim Arkadaslari Tehlikede Mi

May 25, 2025

Real Madrid E Uefa Sorusturmasi Arda Gueler Ve Takim Arkadaslari Tehlikede Mi

May 25, 2025 -

Is Virtue Signaling Killing Architecture A Candid Conversation

May 25, 2025

Is Virtue Signaling Killing Architecture A Candid Conversation

May 25, 2025