DWP Universal Credit Overpayment: Claim Your Refund

Table of Contents

Understanding Your Universal Credit Overpayment Notice

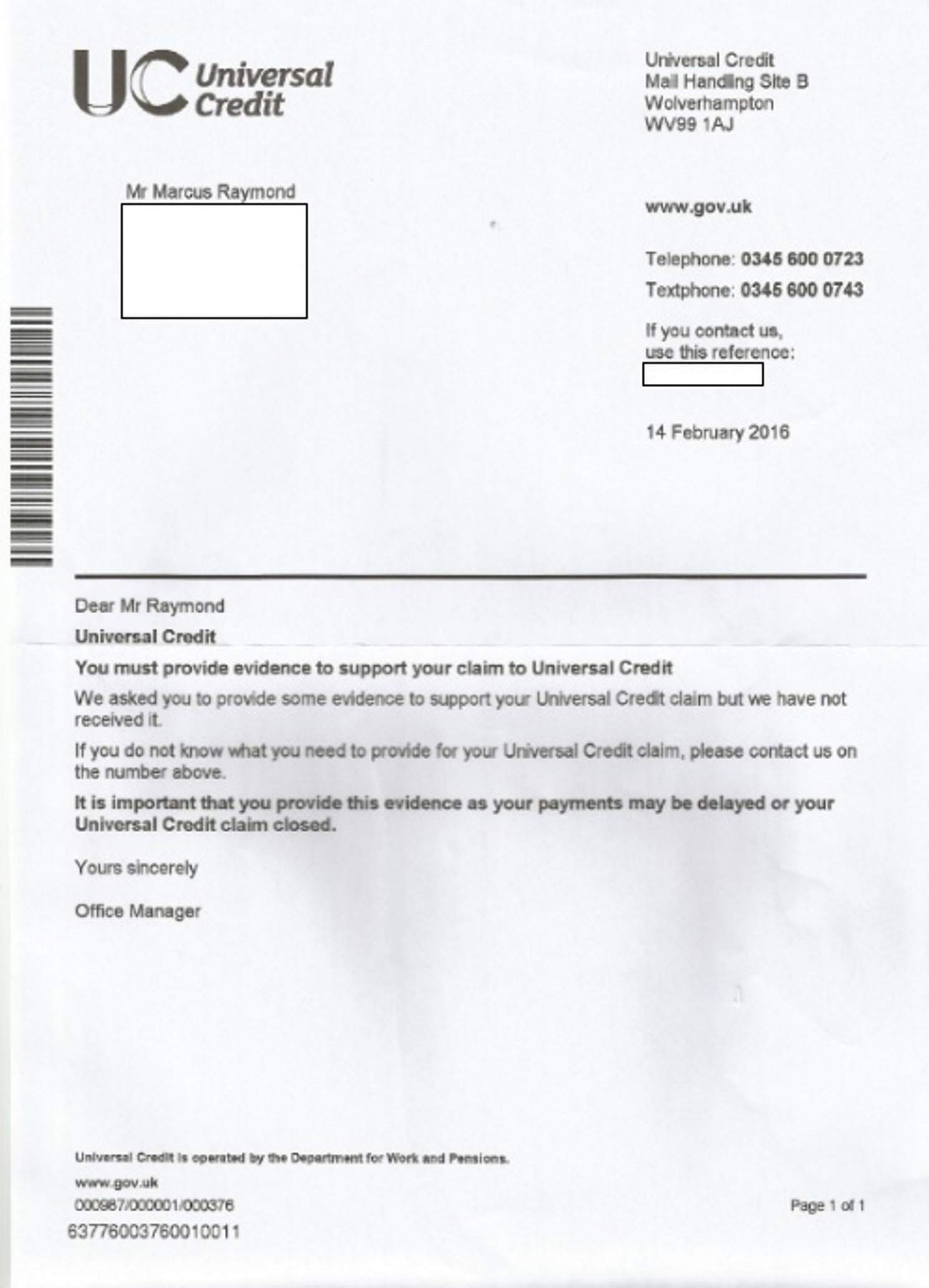

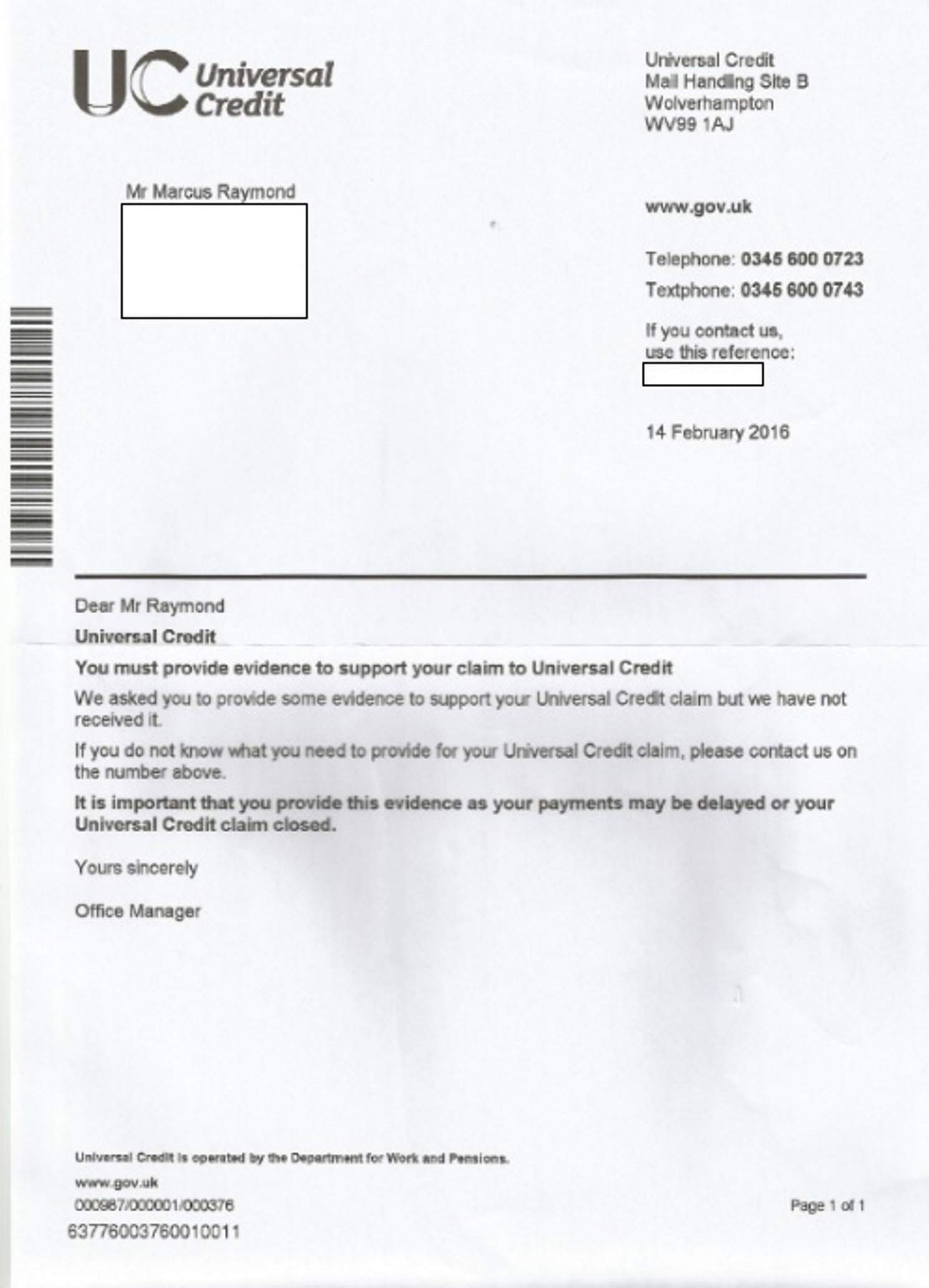

The first step in addressing a DWP Universal Credit overpayment is thoroughly understanding the notice you've received. This official communication from the Department for Work and Pensions outlines the key details of the overpayment.

Deciphering the Letter

The DWP's overpayment notice will contain crucial information:

- Identify the specific reason for the overpayment: This might be due to a change in your circumstances (e.g., a new job, change in household income) that wasn't reported, incorrect information provided during your application, or an administrative error on the DWP's part. Understanding the reason is crucial for deciding how to proceed.

- Note the total amount of the overpayment: This is the total sum the DWP believes you were overpaid. Carefully review this figure to ensure its accuracy.

- Understand the repayment plan proposed by the DWP: The notice will usually outline a proposed repayment schedule, detailing the amount and frequency of repayments.

- Check the deadline for responding to the notice: This is a crucial detail. Failing to respond within the specified timeframe could negatively impact your ability to challenge the overpayment or negotiate a suitable repayment plan.

It's vital to read the notice carefully. If any part is unclear, don't hesitate to seek independent advice from organizations like Citizens Advice or a benefits advisor. They can help you understand the implications and guide you through the next steps.

Challenging a Universal Credit Overpayment

While you're obligated to repay any legitimately overpaid Universal Credit, there are circumstances where you can challenge the decision.

Grounds for Appeal

You may be able to contest a Universal Credit overpayment if:

- The DWP made an error: This could include mistakes in calculating your entitlement, failing to consider relevant information, or misinterpreting your circumstances.

- Exceptional circumstances affected your ability to report changes: Serious illness, bereavement, or other significant events might have prevented you from promptly reporting changes in your situation.

To successfully challenge an overpayment, you need strong evidence.

- Gather evidence to support your claim: This might include payslips, bank statements, medical certificates, or any other documentation supporting your case. The more evidence you have, the stronger your appeal.

- Understand the appeals process: The DWP's website provides information on the appeals process, including deadlines and required documentation. Familiarize yourself with this process carefully.

- Consider seeking help from a benefits advisor or solicitor: If the process seems complex or you are unsure about your rights, professional assistance can prove invaluable.

Remember, challenging an overpayment requires meticulous documentation and a clear understanding of the appeals process.

Repaying Your Universal Credit Overpayment

If you agree with the overpayment amount, you'll need to arrange repayment.

Repayment Options

The DWP generally offers several repayment options for Universal Credit overpayments:

- Lump sum payment: If financially viable, you can repay the entire amount at once.

- Installments: A more manageable option, allowing you to repay the overpayment in smaller, regular amounts over a set period.

It's crucial to:

- Negotiate a manageable repayment plan with the DWP: If the proposed repayment plan causes undue financial hardship, contact the DWP to discuss alternative arrangements.

- Inquire about hardship funds: If you're facing significant financial difficulties, explore whether you're eligible for hardship funds or other support.

- Understand the implications of failing to repay the overpayment: Failure to repay can lead to further action from the DWP, including debt recovery measures.

Open communication with the DWP is key to resolving the issue effectively and avoiding further complications.

Preventing Future Universal Credit Overpayments

Proactive steps can significantly reduce the risk of future Universal Credit overpayments.

Reporting Changes Promptly

The most important preventative measure is to immediately report any changes in your circumstances.

- Report changes promptly: This includes changes in income, employment status, address, household composition, or any other relevant details.

- Keep accurate records of all income and expenses: Maintaining detailed financial records allows you to accurately report your circumstances and avoid discrepancies.

- Regularly review your Universal Credit claim online: Log in to your online account to check your details are accurate and up-to-date.

- Understand your responsibilities as a Universal Credit claimant: Familiarize yourself with your obligations, ensuring you fulfil all reporting requirements.

By taking these steps, you'll minimize the risk of future Universal Credit overpayments and maintain the accuracy of your claim.

Conclusion

Successfully navigating a DWP Universal Credit overpayment involves understanding your notice, challenging it if necessary, and arranging a manageable repayment plan. Remember to gather evidence, understand the appeals process, and communicate openly with the DWP. Proactive reporting of changes in circumstances is key to preventing future issues. Don't let a DWP Universal Credit overpayment affect your finances. Review your notice today and take the necessary steps to claim your refund! For further assistance, visit the official DWP website and Citizens Advice for valuable resources.

Featured Posts

-

Ripple Xrp Price Surge Will It Reach 3 40

May 08, 2025

Ripple Xrp Price Surge Will It Reach 3 40

May 08, 2025 -

Champions League Semi Final Barcelona And Inter Milan Battle To Six Goals

May 08, 2025

Champions League Semi Final Barcelona And Inter Milan Battle To Six Goals

May 08, 2025 -

Xrp To 5 In 2025 Analyzing The Possibilities

May 08, 2025

Xrp To 5 In 2025 Analyzing The Possibilities

May 08, 2025 -

Paramount S 7 Best Kept Streaming Secrets Movies

May 08, 2025

Paramount S 7 Best Kept Streaming Secrets Movies

May 08, 2025 -

Bitcoin In Buguenkue Durumu Deger Hareketler Ve Gelecek Tahminleri

May 08, 2025

Bitcoin In Buguenkue Durumu Deger Hareketler Ve Gelecek Tahminleri

May 08, 2025