EBay, Vinted, Depop Sellers: What To Know About HMRC Nudge Letters

Table of Contents

What are HMRC Nudge Letters?

HMRC nudge letters are gentle reminders from Her Majesty's Revenue and Customs about potential tax liabilities. They're not typically the start of a full-blown tax investigation, but rather a prompt to ensure you're meeting your obligations. Think of them as a friendly (but firm) nudge in the right direction.

-

Examples of situations triggering a nudge letter:

- Discrepancies between your declared income on your self-assessment tax return and the transaction data HMRC receives from online marketplaces like eBay, Vinted, or Depop.

- HMRC noticing a significant increase in your online sales income without a corresponding update to your tax return.

- Failure to register for VAT when your sales exceed the threshold.

-

What information the letter typically contains:

- An estimate of the tax you may owe.

- Deadlines for responding and taking action.

- Information on how to rectify the situation.

-

The importance of responding promptly: Ignoring an HMRC nudge letter is a mistake. Responding promptly demonstrates your commitment to tax compliance and could prevent more serious consequences.

Why You Might Receive an HMRC Nudge Letter (eBay, Vinted, Depop Sellers)

Several reasons could lead to an HMRC nudge letter. The most common relate to inaccurate record-keeping and incomplete tax returns. Remember, HMRC has access to data from online marketplaces, enabling them to compare your reported income with their records.

- Inaccurate or incomplete self-assessment tax returns: Even minor errors can trigger a letter. Double-check your figures carefully.

- Failure to declare all income from online sales: This is a major cause. Every sale, regardless of how small, should be accounted for.

- Discrepancies between reported income and information shared by online marketplaces with HMRC: This highlights the importance of accurate record-keeping.

- Lack of VAT registration when required: If your online sales exceed the VAT threshold, you're legally obliged to register. Failure to do so can result in significant penalties.

Understanding Your Tax Obligations as an Online Seller

Your tax obligations depend on your income level and the nature of your online selling activities. Understanding these thresholds is vital to avoid HMRC nudge letters and potential penalties.

- Income tax thresholds and rates for online sellers: Your profit from online sales is subject to income tax. The rate depends on your total income, including any other sources of income. Use the official HMRC guidance to determine your tax bracket.

- VAT registration requirements and thresholds: If your taxable turnover exceeds the VAT threshold, you must register for VAT. This means charging VAT on your sales and paying it to HMRC. The current threshold is regularly reviewed, so stay informed.

- Record-keeping best practices (transactions, expenses): Maintaining meticulous records is crucial. Keep detailed records of every transaction, including expenses related to your online selling business. This includes postage, packaging, advertising fees, and any other relevant costs.

- Using accounting software specifically designed for online sellers: Software solutions streamline the process of tracking sales, expenses, and generating reports for your tax return. They can significantly reduce the risk of errors and make tax filing easier.

How to Respond to an HMRC Nudge Letter

Receiving an HMRC nudge letter can be daunting, but a calm and organized response is essential.

- Reviewing the letter carefully and understanding the information provided: Read the letter thoroughly to understand the specific issue HMRC has raised.

- Gathering necessary financial records: Collect all relevant documentation, including bank statements, sales records, and expense receipts.

- Contacting HMRC directly if you have any questions or need clarification: Don't hesitate to contact HMRC if something is unclear.

- Considering seeking advice from a tax advisor or accountant: For complex situations or if you're unsure how to proceed, seeking professional advice is highly recommended.

- Filing an amended self-assessment tax return if necessary: If you've made errors, correct them promptly by filing an amended return.

Conclusion

Understanding HMRC nudge letters and your tax obligations as an eBay, Vinted, or Depop seller is vital for avoiding problems. Accurate record-keeping, timely tax returns, and prompt responses to HMRC communications are key to successful online selling. Don't ignore HMRC nudge letters! Take proactive steps to ensure compliance and avoid penalties. Learn more about your tax responsibilities as an online seller, and seek professional advice if needed. Proper record-keeping is your best defense against future HMRC nudge letters.

Featured Posts

-

Public Works Ministry Awards 6 Billion In Coastal And River Defense Contracts

May 20, 2025

Public Works Ministry Awards 6 Billion In Coastal And River Defense Contracts

May 20, 2025 -

Napad Na Detsu U Bi Kh Tadi Trazhi Odgovornost Shmita

May 20, 2025

Napad Na Detsu U Bi Kh Tadi Trazhi Odgovornost Shmita

May 20, 2025 -

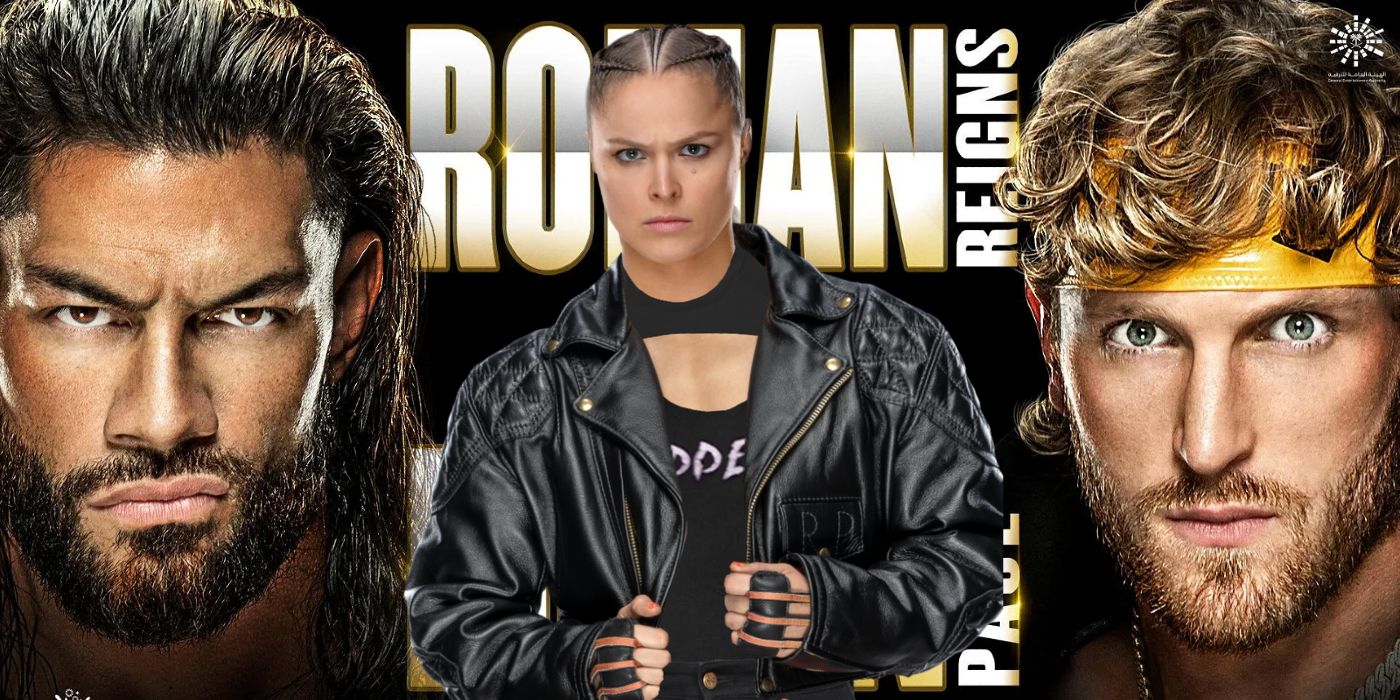

Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

May 20, 2025

Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

May 20, 2025 -

James Cronins New Coaching Role At Highfield Rugby Club

May 20, 2025

James Cronins New Coaching Role At Highfield Rugby Club

May 20, 2025 -

Aghatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Alkhlq Walabtkar

May 20, 2025

Aghatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Alkhlq Walabtkar

May 20, 2025