E2open Acquired By WiseTech Global In $2.1 Billion Debt-Funded Transaction

Table of Contents

E2open, a leading provider of cloud-based supply chain planning and execution software, boasts a robust platform serving a diverse global clientele. WiseTech Global, a dominant player in the logistics and SCM software space, is known for its comprehensive suite of solutions and global reach. This acquisition positions WiseTech Global for even greater market dominance, while promising significant changes for E2open and its users.

Deal Details and Financial Aspects of the E2open Acquisition

The acquisition of E2open by WiseTech Global is valued at $2.1 billion, primarily financed through debt. This signifies a significant investment reflecting WiseTech Global's confidence in E2open's potential and market position.

- Total deal value: $2.1 Billion USD

- Funding mechanism: Primarily debt financing

- Expected closing date: [Insert Date if available, or "Pending Regulatory Approvals"]

- Regulatory hurdles: [List anticipated or completed approvals, e.g., Antitrust approvals in key jurisdictions such as the US and EU]

The acquisition timeline involves navigating the typical regulatory approvals process, including antitrust reviews in various jurisdictions. The precise closing date remains contingent upon the successful completion of these approvals. The financial structure, relying heavily on debt, underscores WiseTech Global's aggressive strategy to consolidate its position in the SCM market.

Strategic Rationale Behind WiseTech Global's Acquisition of E2open

WiseTech Global's acquisition of E2open is driven by several key strategic objectives. The primary motivation lies in bolstering its market share and expanding its product offerings.

- Market consolidation and leadership position: This acquisition significantly increases WiseTech Global's market share, solidifying its position as a leading provider of SCM software.

- Expansion into new geographical markets: E2open's established global presence provides WiseTech Global with immediate access to new markets and customer segments.

- Enhanced product portfolio and technological capabilities: The combination of E2open's and WiseTech Global's technologies creates a more comprehensive and powerful platform for clients.

- Synergies between E2open and WiseTech Global platforms: Integrating E2open’s capabilities into WiseTech Global's existing ecosystem will lead to enhanced functionality and efficiency.

By acquiring E2open, WiseTech Global gains access to a broader range of clients, technologies, and geographic markets, strengthening its overall competitive advantage. The synergies between the two platforms are expected to drive significant revenue growth and innovation.

Impact of the E2open Acquisition on the Supply Chain Management (SCM) Software Market

The E2open acquisition by WiseTech Global has profound implications for the SCM software market.

- Increased market concentration: The merger leads to a more concentrated market, potentially impacting competition and pricing.

- Potential for pricing changes: The combined entity's market power may influence pricing strategies, affecting both existing and new clients.

- Impact on competing SCM software providers: Competitors will likely face increased pressure to innovate and improve their offerings to remain competitive.

- Innovation and technological advancements: The integration of both companies' technologies could lead to accelerated innovation and the development of more advanced SCM solutions.

The acquisition also raises questions about the future of E2open's workforce. While job security is a primary concern for employees, the integration process could also create new opportunities and career advancements within the combined entity. The impact on existing E2open clients largely depends on the successful integration of platforms and the company’s post-merger strategy.

Future Outlook and Predictions Following the E2open Acquisition by WiseTech Global

The successful integration of E2open and WiseTech Global's operations is crucial for realizing the full potential of this acquisition.

- Integration timeline and potential hurdles: Integrating diverse technologies, customer bases, and corporate cultures will require careful planning and execution.

- Projected market share gains for WiseTech Global: The acquisition is expected to significantly boost WiseTech Global's market share, solidifying its position as a market leader.

- Long-term financial outlook for the combined entity: The combined entity is expected to benefit from increased revenue, improved profitability, and enhanced market share.

- Potential for new product offerings and service enhancements: The integration of both companies' technologies is likely to result in the development of new and improved SCM solutions.

The long-term success hinges on effective integration, addressing potential cultural clashes, and maintaining a strong focus on customer satisfaction. The combined entity's ability to innovate and adapt to the evolving needs of the SCM market will be crucial for sustained growth.

Conclusion: The Significance of the E2open Acquisition and What it Means for the Future

The E2open acquisition by WiseTech Global represents a landmark event in the SCM software industry, consolidating market power and promising significant changes in the competitive landscape. The deal's financial scale, strategic rationale, and potential market impact are all substantial. The future success of this merger relies on effective integration and the ability to leverage the combined strengths of both organizations. Stay tuned for updates on the E2open acquisition and its implications for the broader SCM market. Follow us for further analysis of the WiseTech Global and E2open merger and learn more about the impact of this significant E2open acquisition on the supply chain industry.

Featured Posts

-

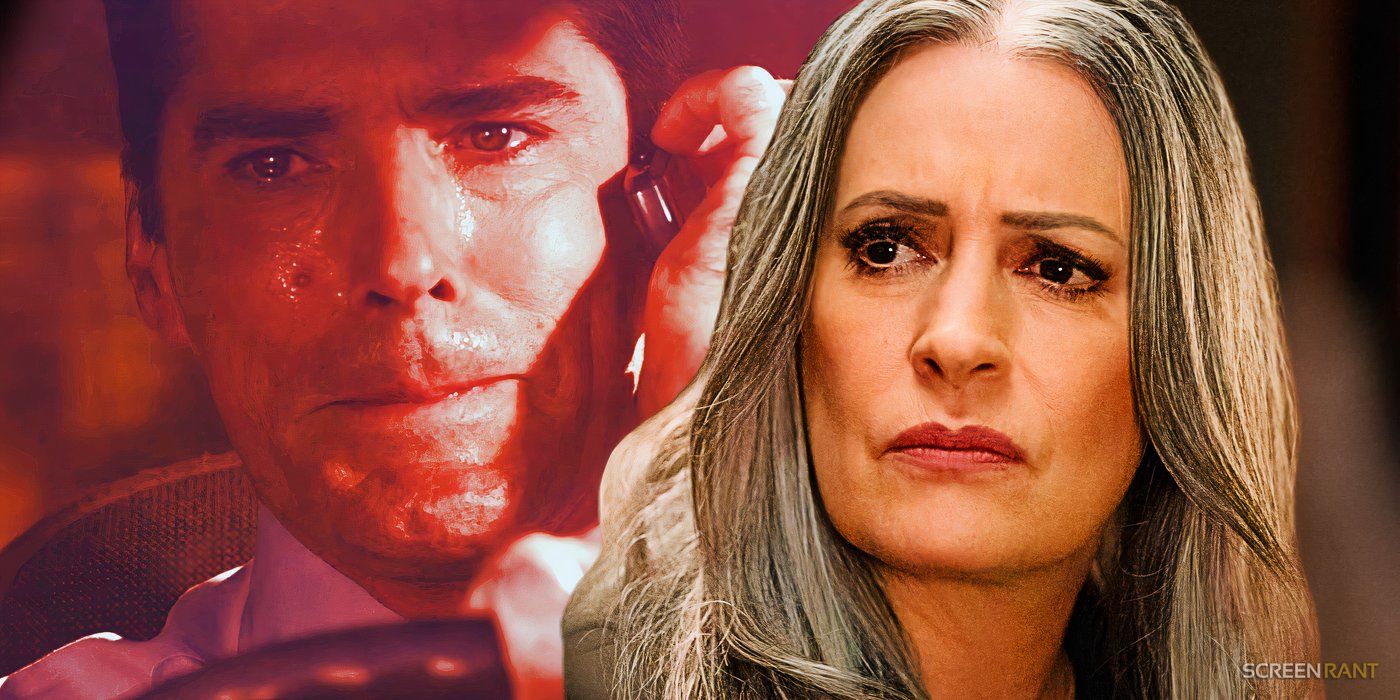

Criminal Minds Evolution S18 E02 First Look At The Zookeeper Images

May 27, 2025

Criminal Minds Evolution S18 E02 First Look At The Zookeeper Images

May 27, 2025 -

Womens Gucci Re Web Sneakers Blue Denim 838831 Faevu 4645 Available May 2025

May 27, 2025

Womens Gucci Re Web Sneakers Blue Denim 838831 Faevu 4645 Available May 2025

May 27, 2025 -

Emegha Transfer West Hams Challenge To Newcastles Pursuit

May 27, 2025

Emegha Transfer West Hams Challenge To Newcastles Pursuit

May 27, 2025 -

Porto Raftis Kai Athina Listes Eisvalloyn Se Monokatoikies Prokalontas Tromo

May 27, 2025

Porto Raftis Kai Athina Listes Eisvalloyn Se Monokatoikies Prokalontas Tromo

May 27, 2025 -

Nimetska Viyskova Dopomoga Ukrayini Povniy Perelik Nadanoyi Tekhniki Ta Ozbroyennya

May 27, 2025

Nimetska Viyskova Dopomoga Ukrayini Povniy Perelik Nadanoyi Tekhniki Ta Ozbroyennya

May 27, 2025