Easing College Costs: A Survey Of Parental Concerns And Student Loan Usage

Table of Contents

Parental Concerns Regarding College Affordability

The Financial Strain of College Tuition

The rising cost of college tuition presents a significant financial strain on parents. Inflation, coupled with decreased financial aid in some areas, has dramatically increased the burden of funding a child's education. This affordability crisis affects families across all income brackets.

- Tuition increases: Tuition, fees, room and board costs have seen significant annual increases far exceeding the rate of inflation in many institutions.

- Emotional toll: The financial pressure associated with college expenses can cause significant stress and anxiety for parents, impacting their overall well-being.

- Impact on family savings: Many families find their savings depleted or severely impacted by the high cost of college, affecting long-term financial planning.

Navigating Financial Aid and Scholarships

Securing financial aid and scholarships is crucial for easing college costs, but the process can be complex and daunting. Understanding eligibility requirements and navigating the application process requires time, effort, and careful attention to detail.

- Types of Financial Aid: Financial aid encompasses grants (free money), loans (money that must be repaid), and scholarships (merit-based awards).

- FAFSA (Free Application for Federal Student Aid): Completing the FAFSA is the first step for accessing federal student aid, determining eligibility for grants and loans.

- Maximizing Financial Aid: Explore all available options, including state-specific grants, institutional scholarships, and need-based aid. Seek advice from college financial aid offices.

- Common Misconceptions: Be aware of common myths surrounding financial aid and scholarships to avoid missing out on potential funding.

The Long-Term Impact of Student Debt on Families

The implications of student loan debt extend beyond the student borrower. Parents who co-sign loans or contribute significantly to their children’s education face considerable financial risks.

- Risks of Co-signing Loans: Co-signing a student loan means you are legally responsible for the debt if the student fails to repay. This can severely impact your credit score and financial stability.

- Impact on Credit Scores: Defaulting on student loans (for both students and co-signers) can lead to damaged credit scores, making it difficult to obtain loans, mortgages, or other financial products in the future.

- Potential for Family Financial Hardship: The weight of significant student loan debt can place undue financial strain on the entire family, impacting retirement savings and other long-term financial goals.

- Strategies for Managing Co-signed Loans: Regularly monitor loan payments, explore loan refinancing options, and understand your rights and responsibilities as a co-signer.

Student Loan Usage and Repayment Strategies

Understanding Different Types of Student Loans

Understanding the differences between federal and private student loans is essential for responsible borrowing.

- Federal Student Loans: Offered by the government, these loans typically have lower interest rates and more flexible repayment options than private loans.

- Private Student Loans: Offered by banks and credit unions, these loans often come with higher interest rates and less favorable terms. They are generally only considered after federal aid has been exhausted.

- Interest Rates and Repayment Terms: Carefully compare interest rates, repayment periods, and fees when choosing between loan types.

- Loan Consolidation: Combining multiple student loans into a single loan can simplify repayment, potentially lowering your monthly payment.

Developing a Responsible Student Loan Repayment Plan

Creating a realistic budget and exploring various repayment options is critical for avoiding loan default.

- Budgeting Tips: Track your income and expenses, prioritize loan payments, and identify areas where you can reduce spending.

- Income-Driven Repayment (IDR) Plans: These plans adjust your monthly payments based on your income and family size.

- Loan Deferment and Forbearance: These options temporarily postpone or reduce your loan payments, but interest may still accrue.

- Understanding the Consequences of Default: Defaulting on student loans has severe consequences, including damaged credit scores, wage garnishment, and legal action.

Strategies for Minimizing Student Loan Debt

Proactive measures can significantly reduce the amount of student loan debt you accumulate.

- Scholarship Search Strategies: Dedicate time to researching and applying for scholarships based on merit, demographics, and specific fields of study.

- Maximizing Financial Aid: Complete the FAFSA promptly and accurately, explore all available grants and aid programs, and appeal any initial financial aid decisions you feel are unfair.

- Finding Part-Time Work: Part-time jobs during the academic year or full-time employment during the summer can supplement financial aid and reduce the need for loans.

- Saving Money During College: Develop responsible budgeting habits to reduce unnecessary expenses and save money wherever possible.

Conclusion: Finding Solutions for Easing College Costs

This article highlighted the significant financial burdens associated with college education for both parents and students. Understanding the complexities of financial aid, managing student loan debt, and employing proactive cost-saving strategies are essential for easing college costs. Proactive planning, responsible borrowing, and exploring all available financial aid options are key takeaways. Start easing your college costs today! Explore resources like the Federal Student Aid website ([link to FAFSA website]) and scholarship search engines ([link to scholarship search engine]) to find solutions for affordable college education. Learn more about strategies for easing college costs and securing a brighter financial future.

Featured Posts

-

The Moment Trump Was Humbled Lawrence O Donnells Show Reveals All

May 17, 2025

The Moment Trump Was Humbled Lawrence O Donnells Show Reveals All

May 17, 2025 -

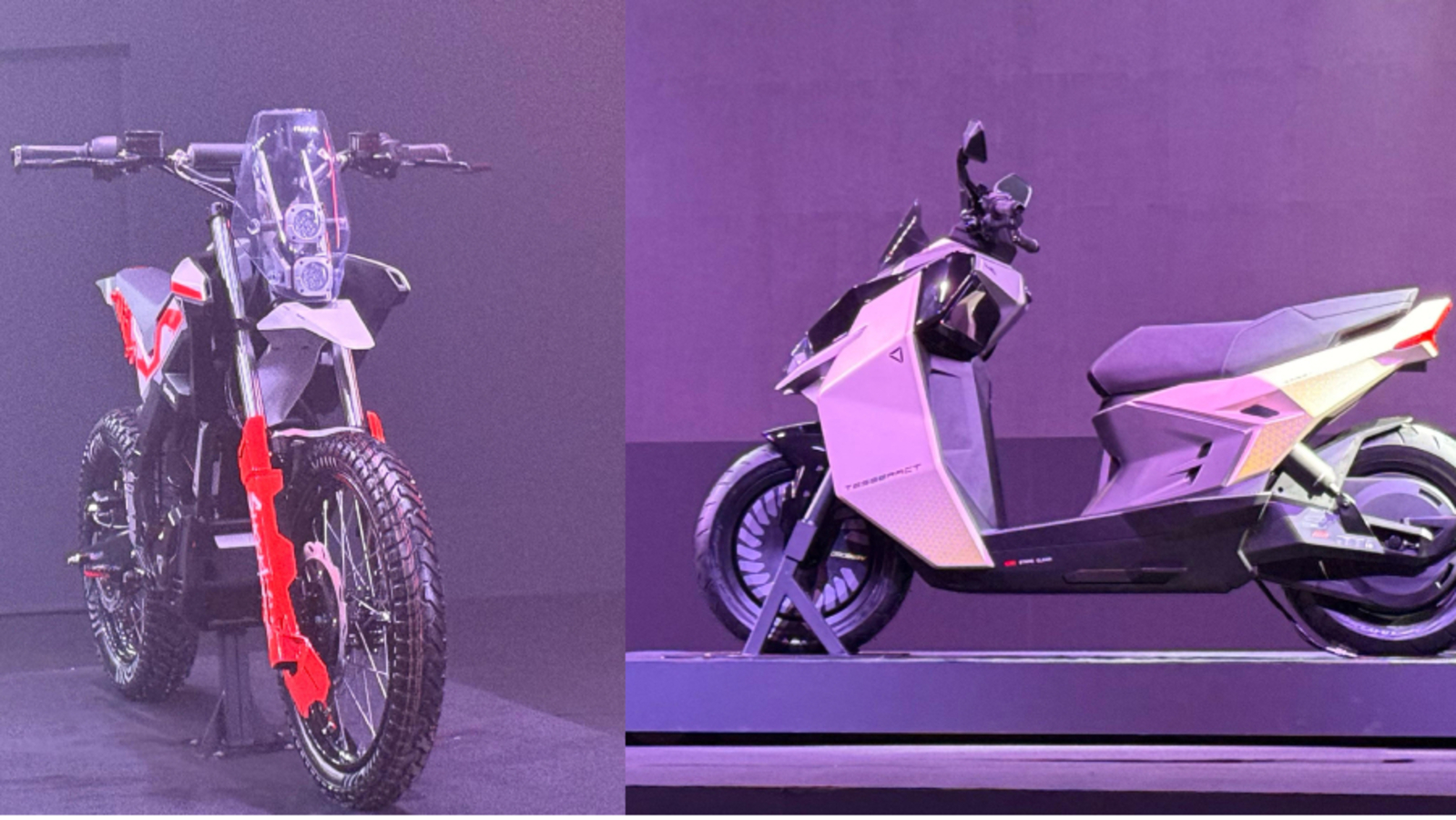

Ultraviolette Tesseract New Ev Launch At R1 45 Lakh Range Specs And Features

May 17, 2025

Ultraviolette Tesseract New Ev Launch At R1 45 Lakh Range Specs And Features

May 17, 2025 -

Wnba Cba Negotiations Reese And Carrington Warn Of Potential Player Strike

May 17, 2025

Wnba Cba Negotiations Reese And Carrington Warn Of Potential Player Strike

May 17, 2025 -

Pistons Vs Knicks Key Factors Determining Their Respective Seasons

May 17, 2025

Pistons Vs Knicks Key Factors Determining Their Respective Seasons

May 17, 2025 -

Knicks Coach Thibodeau Highlights St Johns Success A Positive Assessment

May 17, 2025

Knicks Coach Thibodeau Highlights St Johns Success A Positive Assessment

May 17, 2025