Easy Dividend Investing: A Straightforward Path To Profit

Table of Contents

Dividend investing is the practice of owning shares in companies that regularly distribute a portion of their profits to shareholders. This offers the dual benefit of generating passive income – those regular dividend payments – and potentially benefiting from long-term growth in the value of your shares. This article will provide a straightforward guide to easy dividend investing, outlining key strategies and considerations for beginners.

Understanding Dividend Investing Basics

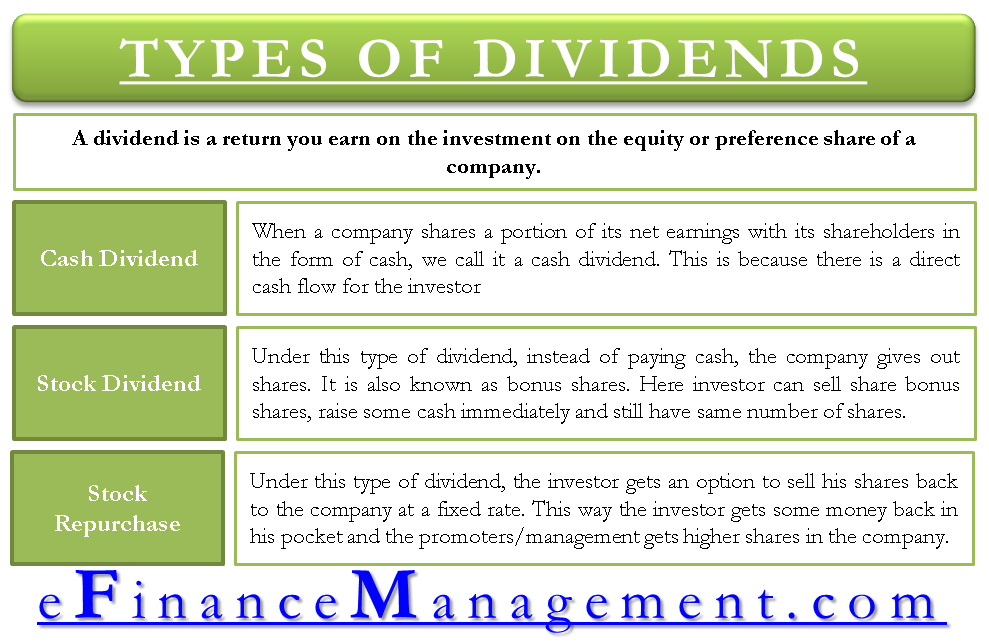

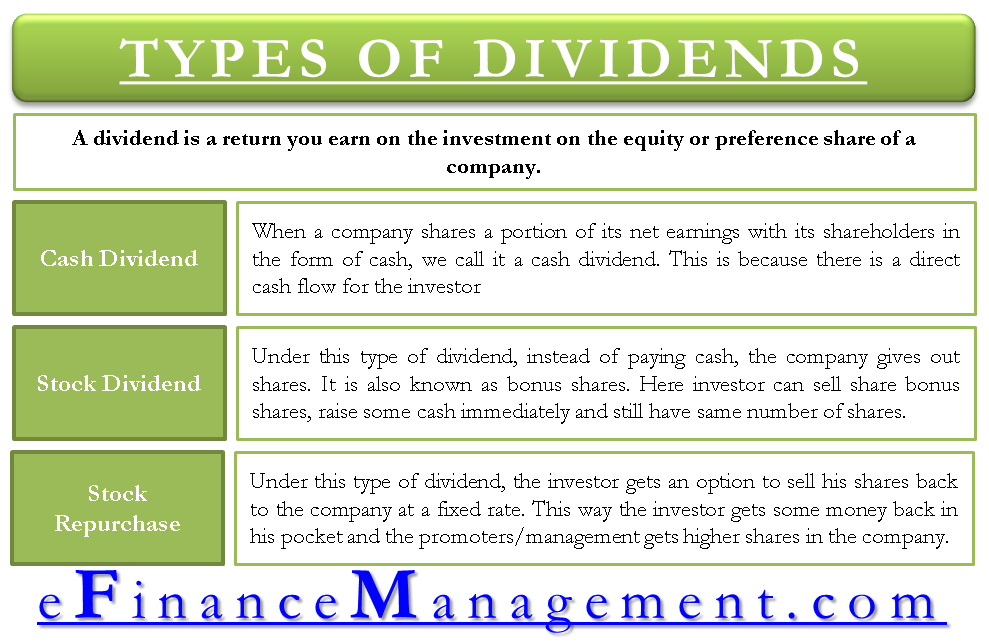

Before diving into specific stocks, it's crucial to grasp the fundamentals. Dividends are payments made by a company to its shareholders, typically from its profits. There are different types of dividends:

- Regular Dividends: These are the most common, paid out at fixed intervals (quarterly, semi-annually, or annually).

- Special Dividends: These are one-time payments, often made when a company has excess cash flow.

- Stock Dividends: Instead of cash, the company issues additional shares of stock.

Two key metrics help evaluate the attractiveness of a dividend-paying stock:

- Dividend Yield: This represents the annual dividend payment relative to the stock's price. It's calculated as (Annual Dividend per Share / Stock Price) x 100%. A higher yield generally indicates a higher return on your investment, but it's crucial to consider other factors.

- Payout Ratio: This shows the percentage of a company's earnings paid out as dividends. A sustainable payout ratio is generally below 70%, indicating the company retains enough earnings for reinvestment and future growth. A high payout ratio could signal potential dividend cuts.

Choosing between a dividend growth strategy (focusing on companies with a history of increasing dividends) and a high-yield strategy (prioritizing companies with high dividend yields) depends on your investment goals and risk tolerance.

Identifying Strong Dividend-Paying Stocks

Successful easy dividend investing requires careful stock selection. Fundamental analysis is key:

- Key Financial Ratios: Examine metrics like the Price-to-Earnings (P/E) ratio (a measure of valuation), Return on Equity (ROE) (indicating profitability), and debt-to-equity ratio (assessing financial leverage).

- Company Financial Health: Look for companies with a strong balance sheet, consistent profitability, and a long history of dividend payments.

Utilizing screening tools can significantly streamline this process:

- Reputable Resources: Many brokerage platforms (like Fidelity, Schwab, TD Ameritrade) and financial websites (like Yahoo Finance, Google Finance) offer powerful stock screeners.

- Screening Criteria: You can filter stocks based on minimum dividend yield (e.g., 3%), consistent dividend history (e.g., 5+ years of consecutive payouts), strong financial performance (e.g., high ROE), and specific industry sectors.

Remember, diversification is crucial for mitigating risk. Spread your investments across different sectors, company sizes (market capitalization), and geographies. This helps reduce the impact of any single company's underperformance.

Building Your Dividend Investing Portfolio

Once you've identified promising dividend stocks, it's time to build your portfolio. Consider these approaches:

- Buy-and-Hold: This involves purchasing shares and holding them long-term, reinvesting dividends to compound your returns. This strategy benefits from long-term growth and dividend increases.

- Dollar-Cost Averaging (DCA): This involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of investing a lump sum at a market peak.

Set realistic investment goals and a suitable time horizon. Regularly review and adjust your portfolio based on market conditions and your financial goals. Many brokerage accounts offer Dividend Reinvestment Plans (DRIPs), automatically reinvesting dividends to purchase additional shares.

However, be aware of potential risks:

- Dividend Cuts/Suspensions: Companies may reduce or eliminate dividends due to financial difficulties.

- Market Volatility: Even with dividend income, your overall portfolio value can fluctuate with market changes.

Tax Implications of Dividend Income

Dividend income is typically taxed as ordinary income, but the specific tax rate depends on your income bracket and the type of account. Tax-advantaged accounts like 401(k)s and IRAs can offer significant tax benefits for long-term dividend investing. Consult a financial advisor for personalized tax planning.

Unlocking the Power of Easy Dividend Investing

Building a successful dividend investing portfolio involves understanding the basics, identifying strong dividend-paying stocks, building and maintaining a diversified portfolio, and considering the tax implications. Easy dividend investing offers the potential for passive income, long-term wealth creation, and relative stability compared to other investment strategies. Begin your easy dividend investing strategy today by researching and choosing dividend-paying stocks that align with your financial goals and risk tolerance. Start your easy dividend investing journey and embrace easy dividend investing for a brighter financial future!

Featured Posts

-

Bayern Munichs Future Without Mueller Fan Reactions And Expert Opinions

May 11, 2025

Bayern Munichs Future Without Mueller Fan Reactions And Expert Opinions

May 11, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Reports A 1050 Increase

May 11, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1050 Increase

May 11, 2025 -

Bulls Fall Short Again As Knicks Secure Second Straight Overtime Win

May 11, 2025

Bulls Fall Short Again As Knicks Secure Second Straight Overtime Win

May 11, 2025 -

Bayern Munichs Final Home Game Muellers Farewell And Championship Celebration

May 11, 2025

Bayern Munichs Final Home Game Muellers Farewell And Championship Celebration

May 11, 2025 -

Transferrykten Thomas Mueller Pa Vaeg Bort Fran Bayern

May 11, 2025

Transferrykten Thomas Mueller Pa Vaeg Bort Fran Bayern

May 11, 2025