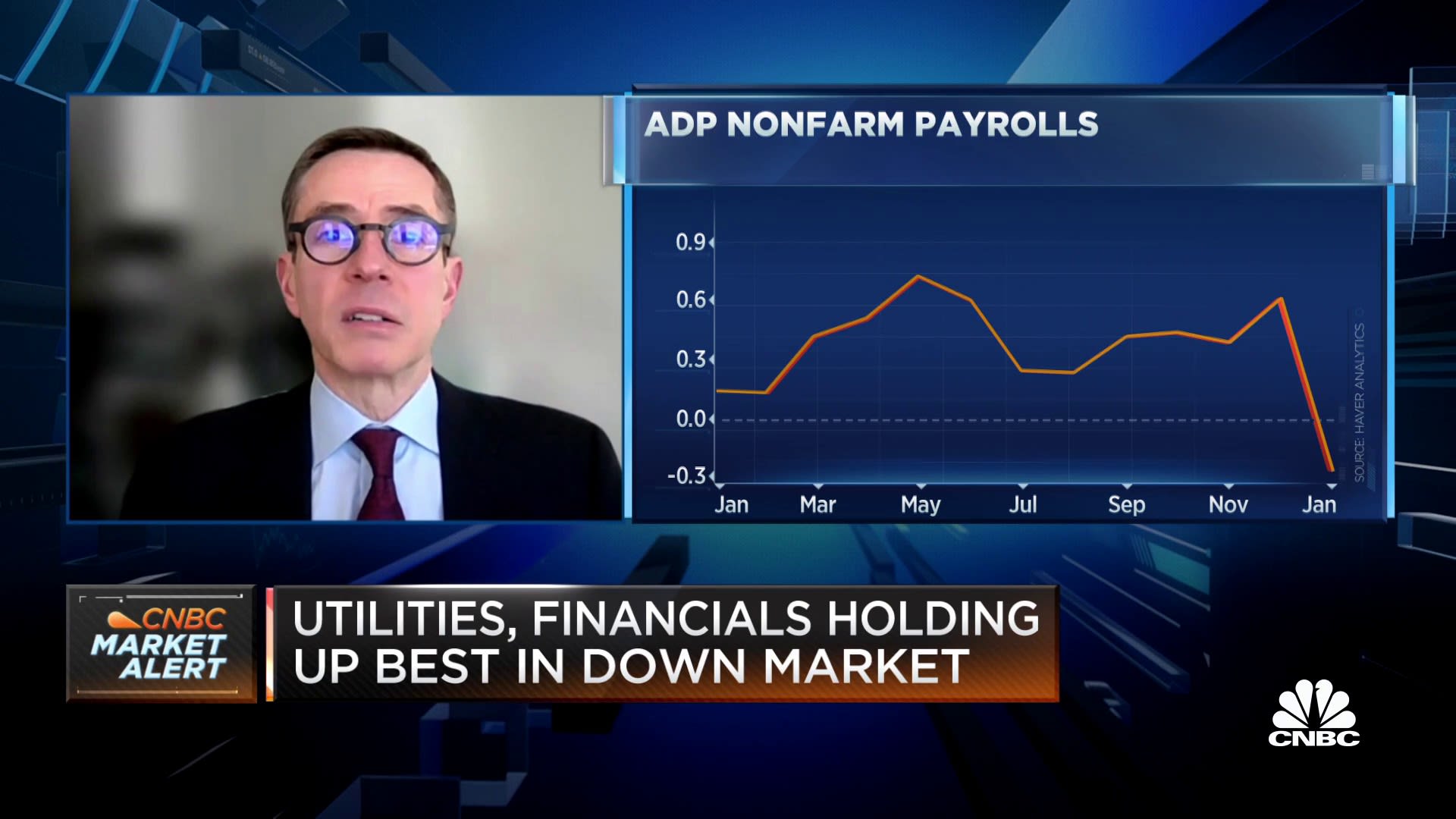

ECB Official Holzmann On The Disinflationary Implications Of Trump's Tariffs

Table of Contents

Holzmann's Stance on Tariffs and Inflation

ECB Official Holzmann, in various statements and reports (specific references would need to be inserted here based on available public information), articulated a clear position on the disinflationary effects of Trump's tariffs. He argued that while initially, some prices might increase due to tariffs, the overall impact on inflation would be deflationary. This nuanced perspective contrasts with simple analyses that focus solely on the direct impact of increased import prices.

- Impact on Supply Chains: Holzmann likely highlighted how tariffs disrupt established global supply chains. This disruption leads to higher costs for businesses, impacting their ability to pass on price increases to consumers.

- Impact on Eurozone Consumer Prices: His analysis probably emphasized that while some imported goods would see price increases, this effect would be counterbalanced by reduced consumer spending and a dampening effect on overall economic growth. The net result, according to his perspective, would likely be disinflationary pressure within the Eurozone.

- Dampening Economic Growth: Holzmann's view likely included an assessment of how tariffs, by hindering trade and investment, could lead to slower economic growth. Reduced economic activity translates into lower demand, thus weakening inflationary pressures.

Mechanisms of Disinflationary Pressure from Tariffs

Several mechanisms explain how Trump's tariffs exerted disinflationary pressure, aligning with Holzmann's perspective.

Reduced Consumer Spending

Higher prices stemming from tariffs directly impact consumer purchasing power.

- Impact on Disposable Income: Increased prices for imported goods reduce disposable income, forcing consumers to cut back on spending.

- Substitution Effect: Consumers are likely to substitute more expensive tariff-affected goods with cheaper alternatives, further reducing demand for the targeted products.

- Reduced Economic Activity: This decreased consumer spending ripples throughout the economy, reducing overall economic activity and dampening demand-pull inflation.

Supply Chain Disruptions

Tariffs disrupt the smooth flow of goods and materials across borders, leading to increased production costs.

- Increased Costs of Imported Inputs: Businesses face higher costs for imported raw materials and intermediate goods, impacting their production costs.

- Impact on Business Investment: Uncertainty and higher costs caused by tariffs discourage business investment and expansion, hindering capacity utilization and further impacting prices.

- Absorption of Cost Increases: Businesses might absorb some cost increases rather than fully passing them on to consumers, especially in competitive markets, to maintain market share. This results in lower inflation than a straightforward pass-through of tariff costs.

Weakening Global Demand

Trump's tariffs contributed to a broader trade war, weakening global demand and economic growth.

- Impact of Trade Wars on Global Economy: The tit-for-tat nature of trade wars reduces overall global trade and economic activity.

- Effect on Eurozone Exports: Export-oriented industries within the Eurozone were directly affected by reduced global demand, limiting their ability to raise prices.

- Deflationary Pressures in a Weakened Economy: A weakened global economy is more susceptible to deflationary pressures, as reduced demand puts downward pressure on prices across various sectors.

Counterarguments and Alternative Perspectives

While Holzmann's analysis provides a valuable perspective, alternative viewpoints exist on the inflationary or deflationary impact of Trump's tariffs.

- Opposing Views: Some economists might argue that the initial impact of tariffs was inflationary, pointing to short-term price spikes in specific sectors. They might also emphasize the role of other economic factors in obscuring the pure impact of tariffs.

- Short-Term Inflationary Spikes: While acknowledging the long-term disinflationary effects, it's crucial to acknowledge the possibility of short-term inflationary spikes before the overall disinflationary effects become dominant.

- Complexity of Economic Factors: Disentangling the impact of tariffs from other concurrent economic factors—such as changes in oil prices or monetary policy—is extremely complex, making it difficult to isolate the pure effect of tariffs on inflation.

Conclusion

ECB Official Holzmann's perspective on the disinflationary implications of Trump's tariffs highlights the importance of considering the complex interplay between trade policy and price stability. The mechanisms – supply chain disruptions, reduced consumer spending, and weakened global demand – all contribute to the overall disinflationary pressure. However, it is crucial to acknowledge counterarguments and the inherent difficulty in isolating the effects of tariffs from other economic influences. To gain a deeper understanding of the intricate relationship between trade policy and inflation, further research into the economic impacts of Trump's tariffs is crucial. Continue exploring the multifaceted effects of Trump's Tariffs Disinflationary Impact on the global economy and the Eurozone specifically.

Featured Posts

-

Chelsea Handler Netflix Special Trailer And Release Date Announced

Apr 26, 2025

Chelsea Handler Netflix Special Trailer And Release Date Announced

Apr 26, 2025 -

Mv Callaway Parker Successful Delivery By Verret To Ptc

Apr 26, 2025

Mv Callaway Parker Successful Delivery By Verret To Ptc

Apr 26, 2025 -

Nintendos Action Leads To Ryujinx Emulator Development Cease

Apr 26, 2025

Nintendos Action Leads To Ryujinx Emulator Development Cease

Apr 26, 2025 -

Mission Impossible Dead Reckoning Teaser Ethan Hunts Thrilling Return

Apr 26, 2025

Mission Impossible Dead Reckoning Teaser Ethan Hunts Thrilling Return

Apr 26, 2025 -

20 140 2025 3 17

Apr 26, 2025

20 140 2025 3 17

Apr 26, 2025