ECB's Holzmann: Trump Tariffs And The Disinflationary Impact

Table of Contents

Holzmann's Stance on Trump Tariffs and Inflation

Robert Holzmann, a prominent figure within the ECB, has publicly commented on the economic consequences of the Trump administration's protectionist trade policies. His analysis consistently highlights a link between the tariffs and disinflationary pressures in the Eurozone.

- Specific Statements: Holzmann's views are often expressed in speeches at ECB conferences and interviews with financial news outlets. Searching for transcripts of these appearances using keywords like "Holzmann Trump tariffs" will reveal his detailed arguments.

- Key Arguments: A core tenet of Holzmann's perspective is that the increased uncertainty and higher prices on imported goods resulting from the tariffs dampened consumer spending and overall economic activity, contributing to lower inflation. He argued that this disinflationary effect wasn't simply a short-term blip, but a significant consequence of disrupted global trade.

- Long-Term vs. Short-Term Impact: Holzmann's analysis suggests that while the immediate impact might be visible in reduced price increases, the long-term implications of such trade wars on global supply chains and investment could potentially affect future inflation dynamics. He emphasizes the need for a cautious approach, given the complexity of global economic interactions.

Mechanisms Through Which Tariffs Can Cause Disinflation

The disinflationary effect of tariffs isn't a direct or simple outcome. Several economic mechanisms are at play:

- Reduced Consumer Purchasing Power: Tariffs directly increase the prices of imported goods, making them less affordable for consumers. This leads to a reduction in real disposable income and potentially lower overall consumer spending.

- Suppressed Aggregate Demand: The uncertainty created by trade wars and tariffs discourages businesses from investing and expanding. This reduced aggregate demand (total demand for goods and services in an economy) can further dampen inflationary pressures.

- Supply Chain Disruptions: Tariffs and trade disputes often lead to disruptions in global supply chains. Increased delays and uncertainty in sourcing materials can lead to higher production costs, impacting final prices, sometimes resulting in lower price increases, or even price decreases due to lower demand.

- Reduced Import Competition (Counterintuitive Effect): While not always the case, in some sectors, tariffs can reduce competition from cheaper imports. This can, paradoxically, lead to higher domestic prices, though this effect is often counterbalanced by the overall disinflationary pressures described above.

The ECB's Response to Disinflationary Pressures

The ECB faced the challenge of responding to disinflationary pressures potentially worsened by Trump's tariffs while maintaining a stable and sustainable economic growth trajectory.

- Monetary Policy Adjustments: The ECB's response involved carefully considering the balance between stimulating economic activity and managing inflation expectations. This could have included adjustments to interest rates or quantitative easing programs, aiming to counter the disinflationary impact of tariffs and other macroeconomic factors. Analyzing ECB meeting minutes and policy statements from the period offers insights into these decisions.

- Balancing Growth and Price Stability: The ECB's mandate requires balancing economic growth and price stability. The challenge lay in determining the appropriate policy response without overstimulating the economy and risking asset bubbles, even in the face of disinflationary risks potentially linked to trade disputes.

- ECB Acknowledgment of Trade Disputes: Statements and publications from the ECB during this period likely acknowledged the impact of global trade disputes, including those stemming from the Trump tariffs, on the overall inflation outlook for the Eurozone.

Alternative Perspectives and Criticisms

While Holzmann's perspective is insightful, it's crucial to acknowledge alternative viewpoints and criticisms:

- Differing Economic Opinions: Not all economists agreed on the magnitude or even the direction of the inflationary impact of Trump's tariffs. Some argued that the effects were limited or that other factors were more significant drivers of inflation during that time.

- Limitations of Holzmann's Analysis: It's vital to assess any limitations or potential biases in Holzmann's analysis. This includes examining the data used, the methodology employed, and whether alternative data sources or interpretations might yield different conclusions.

- Other Influencing Factors: Inflation is a complex phenomenon influenced by multiple factors. It's essential to consider other potential drivers of inflation or disinflation during the period in question, such as oil prices, global demand, and technological advancements, to gain a complete picture.

Conclusion

Robert Holzmann's analysis suggests a link between the Trump tariffs and disinflationary pressures in the Eurozone. He emphasized several mechanisms through which these tariffs could reduce inflation, including diminished consumer purchasing power, suppressed aggregate demand, and supply chain disruptions. The ECB responded with monetary policy adjustments, carefully balancing economic growth with price stability objectives. While valuable, Holzmann's perspective isn't without alternative viewpoints and criticisms, highlighting the complexities of assessing the impact of protectionist trade policies on inflation. Understanding the complex relationship between trade policy and inflation is crucial. To stay informed on the latest analyses of the ECB's response to global economic challenges, including future assessments of the legacy of Trump's tariffs and similar trade disputes, continue to explore our resources on ECB Holzmann Trump Tariffs Disinflation and related topics. Further research into the long-term implications of protectionist trade policies is vital.

Featured Posts

-

George Santos Prison Fears And Outburst Against Prosecutors Before Sentencing

Apr 26, 2025

George Santos Prison Fears And Outburst Against Prosecutors Before Sentencing

Apr 26, 2025 -

Deion Sanders Predicts Shedeur Sanders As Top 3 Nfl Draft Pick Amidst Giants Interest

Apr 26, 2025

Deion Sanders Predicts Shedeur Sanders As Top 3 Nfl Draft Pick Amidst Giants Interest

Apr 26, 2025 -

12 Guests We D Love To See On A New York Knicks Roommates Show

Apr 26, 2025

12 Guests We D Love To See On A New York Knicks Roommates Show

Apr 26, 2025 -

Dr Sanjay Gupta On The Potential Ban Of Food Dyes

Apr 26, 2025

Dr Sanjay Gupta On The Potential Ban Of Food Dyes

Apr 26, 2025 -

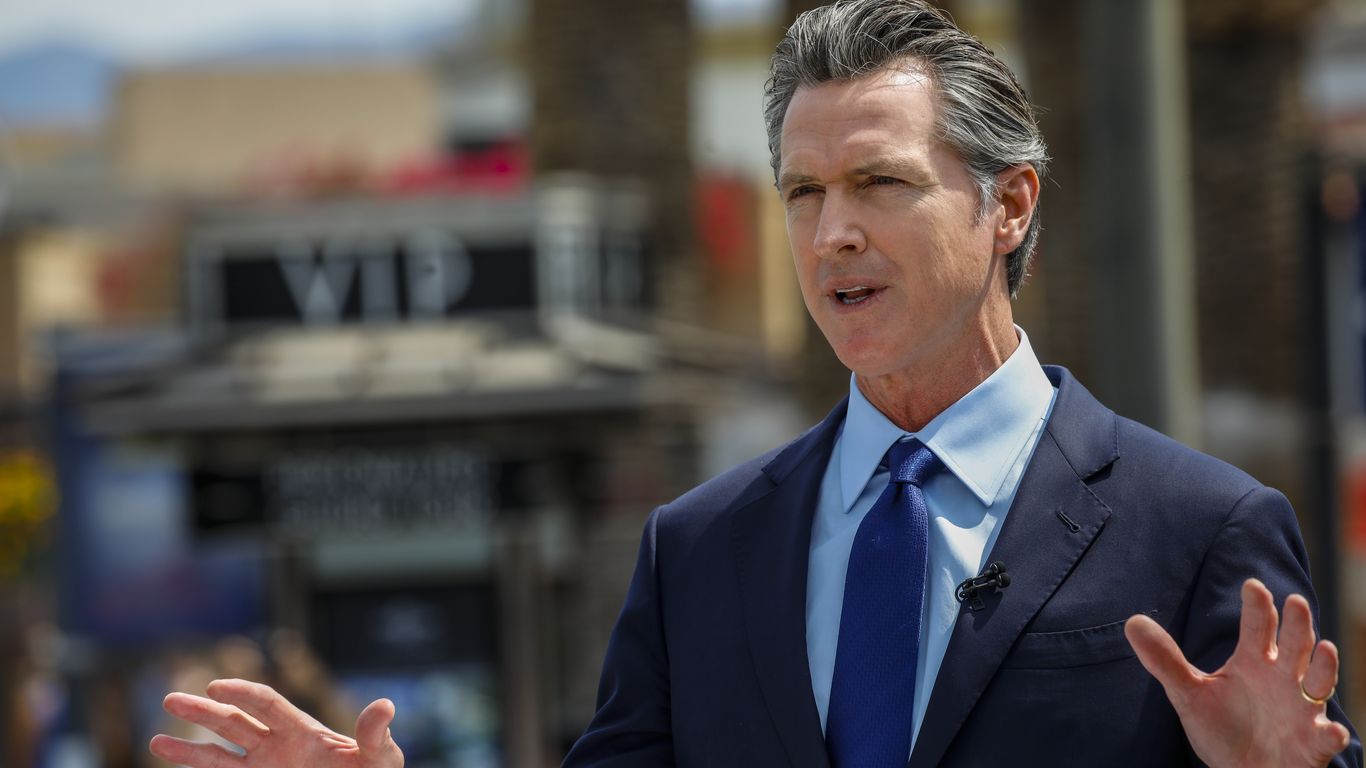

Assessing The Validity Of Criticisms Against Gavin Newsom

Apr 26, 2025

Assessing The Validity Of Criticisms Against Gavin Newsom

Apr 26, 2025