Economic Uncertainty Intensifies: Inflationary Pressures And Job Market Weakness

Table of Contents

Soaring Inflation: Eroding Purchasing Power and Consumer Confidence

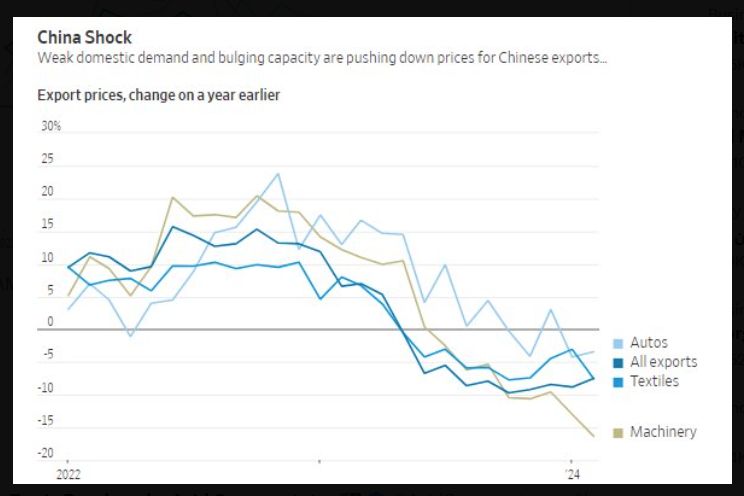

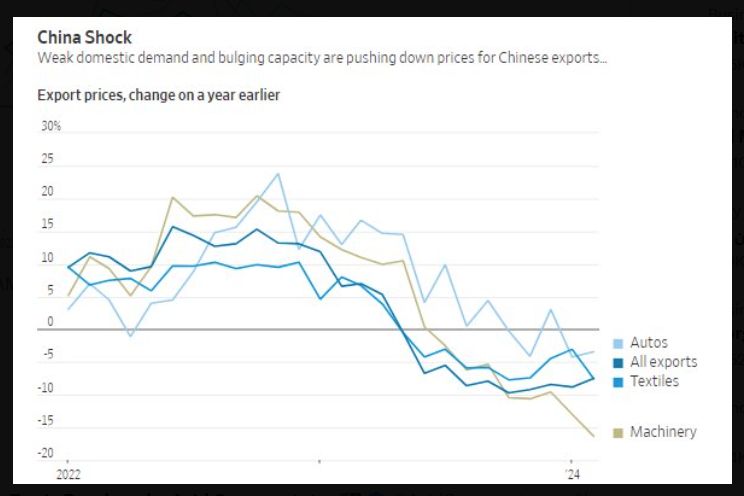

High inflation is a significant contributor to current economic uncertainty. It erodes purchasing power, dampens consumer confidence, and creates a challenging environment for businesses.

Understanding the Inflationary Spiral

Inflation, a general increase in the price level of goods and services, is fueled by several factors currently at play. These include:

- Supply chain disruptions: The lingering effects of the pandemic and geopolitical instability have created bottlenecks, limiting the availability of goods and driving up prices.

- Rising energy costs: The volatility in global energy markets, particularly with respect to oil and natural gas, significantly impacts transportation, manufacturing, and household expenses.

- Increased demand: While demand has cooled in some sectors, it remains robust in others, contributing to upward pressure on prices.

For example, food prices have increased significantly, with the cost of staples like bread and milk rising considerably. Energy costs, encompassing gasoline and electricity, have also surged, impacting household budgets. The housing market, while showing signs of cooling, still reflects elevated prices in many regions. The Bureau of Labor Statistics (BLS) reported a [insert current inflation rate]% increase in the Consumer Price Index (CPI) in [insert month, year], highlighting the persistent inflationary pressures. Different types of inflation, such as demand-pull (driven by excess demand) and cost-push (driven by increased production costs), are contributing to this complex picture.

The Impact on Consumer Spending

Soaring inflation directly impacts consumer behavior. Reduced purchasing power leads to decreased consumer spending, particularly on discretionary items. This can be seen in:

- Reduced discretionary spending: Consumers are cutting back on non-essential purchases, impacting retail sales and business revenues.

- Decreased consumer confidence: Surveys reveal a decline in consumer confidence as people worry about rising prices and their future financial security.

- Increased debt levels: Some consumers are resorting to debt to maintain their living standards, potentially exacerbating future economic difficulties.

- Lower savings rates: With prices rising faster than wages, many find it harder to save, further hindering future economic stability.

This reduced consumer demand raises significant concerns about the potential for a recession driven by decreased aggregate demand. Monitoring economic indicators like the CPI and the consumer sentiment index provides crucial insights into the evolving situation.

Job Market Weakness: Rising Unemployment and Underemployment

Another key element of the current economic uncertainty is the weakening job market. While unemployment remains relatively low in some sectors, there are clear indicators of a slowdown.

Signs of a Cooling Labor Market

Several factors point towards a cooling labor market:

- Slowing job growth: The pace of job creation has noticeably slowed in recent months compared to previous years.

- Rising unemployment claims: The number of individuals filing for unemployment benefits is increasing, suggesting a rise in job losses.

- Decreased hiring activity: Businesses are becoming more cautious about hiring, reflecting uncertainty about the economic outlook.

- Increased layoffs: Some sectors are experiencing significant layoffs as businesses cut costs to weather the economic storm.

The Bureau of Labor Statistics (BLS) reports a [insert current unemployment rate]% unemployment rate, with [insert sector] experiencing [insert percentage]% job losses. The impact of automation and technological advancements is also contributing to shifts in the job market, leading to job displacement in certain sectors.

The Impact on Wages and Income Inequality

A weakening job market negatively impacts wages and exacerbates income inequality:

- Wage stagnation: Wage growth is failing to keep pace with inflation, resulting in a decline in real wages for many workers.

- Impact on low-income households: Low-income households are disproportionately affected by inflation and job losses, leading to increased financial hardship.

- Potential social consequences: Rising income inequality can lead to social unrest and instability.

The combination of inflation eroding real wages and a slower job market creates a precarious situation for many, especially those already struggling financially. Data from sources like the BLS and the OECD provide a comprehensive picture of these trends.

Interconnected Challenges: The Feedback Loop Between Inflation and Unemployment

The relationship between inflation and unemployment is complex and crucial to understanding the current economic uncertainty. The two factors are intertwined, creating a potentially damaging feedback loop.

The Stagflationary Threat

The potential for a stagflationary scenario—a period of slow economic growth accompanied by high inflation and unemployment—is a major concern.

- The Phillips Curve: The traditional Phillips Curve suggests an inverse relationship between inflation and unemployment. However, this relationship may be less reliable in the current economic environment.

- Inflation leading to unemployment: High inflation can reduce consumer spending, leading to businesses cutting jobs to reduce costs.

- Unemployment leading to inflation: High unemployment can lead to wage stagnation, but simultaneously, supply chain issues and other factors can independently drive up inflation.

Government policies play a crucial role in addressing this interconnected challenge.

Potential Policy Responses

Policymakers face difficult choices in addressing the interconnected challenges of inflation and unemployment. Options include:

- Monetary policy adjustments: Central banks can raise interest rates to curb inflation but risk slowing economic growth and increasing unemployment.

- Fiscal stimulus measures: Government spending can boost economic activity but may exacerbate inflationary pressures.

Each policy option has pros and cons, and the optimal approach depends on a nuanced understanding of the economic situation and its potential evolution. The complexities and trade-offs involved in policy decision-making are substantial.

Conclusion

The current period of heightened economic uncertainty, characterized by both inflationary pressures and job market weakness, presents significant challenges for businesses, consumers, and policymakers alike. Understanding the intricate relationship between these two forces is crucial for navigating this turbulent economic landscape. Staying informed about the latest economic data and policy developments related to economic uncertainty, including variations like economic instability and economic volatility, is essential. We encourage you to continue monitoring the evolving situation and seeking advice from financial professionals to mitigate the risks associated with this period of economic uncertainty.

Featured Posts

-

House Of Kong Immersive Gorillaz Exhibition Lands In London This Summer

May 30, 2025

House Of Kong Immersive Gorillaz Exhibition Lands In London This Summer

May 30, 2025 -

Manitoba Cfs Intervention Rates A 20 Year Study Of First Nations Families 1998 2019

May 30, 2025

Manitoba Cfs Intervention Rates A 20 Year Study Of First Nations Families 1998 2019

May 30, 2025 -

Sunnova Energy Denied 3 Billion Loan Under Trump Administration

May 30, 2025

Sunnova Energy Denied 3 Billion Loan Under Trump Administration

May 30, 2025 -

Is Jungkook Leaving Bts Top 10 Fan Questions And Speculations

May 30, 2025

Is Jungkook Leaving Bts Top 10 Fan Questions And Speculations

May 30, 2025 -

Alcarazs Comeback Winning The Monaco Championship

May 30, 2025

Alcarazs Comeback Winning The Monaco Championship

May 30, 2025