Economists Predict Bank Of Canada Rate Cuts Following Grim Retail Sales Report

Table of Contents

The Grim Retail Sales Report: A Deeper Dive

The recently released retail sales figures paint a bleak picture for the Canadian economy. The significant decline has fueled speculation about the need for immediate intervention from the Bank of Canada, potentially through interest rate cuts.

Key Figures and Trends

The retail sales report revealed a dramatic year-over-year decrease of X% (replace X with actual percentage from a real report), marking the sharpest drop in [Number] years. This decline wasn't evenly distributed across sectors.

- Automotive sales: Experienced a particularly steep fall of Y% (replace Y with actual percentage), reflecting weakening consumer confidence and potential supply chain constraints.

- Furniture and home furnishings: Suffered a Z% (replace Z with actual percentage) decrease, indicating a slowdown in the housing market.

- Regional variations: While nationwide the decline was significant, certain provinces like [Province] experienced even steeper drops, suggesting regional economic disparities.

Several factors contributed to this downturn. These include:

- High inflation: Eroding consumer purchasing power and limiting discretionary spending.

- Rising interest rates: Increasing borrowing costs, making large purchases less accessible.

- Global economic uncertainty: Affecting consumer confidence and investment.

Analyst Reactions and Interpretations

Economic analysts across the board have expressed serious concerns about the implications of this retail sales report. Many believe it underscores a weakening Canadian economy and necessitates a more accommodative monetary policy.

- [Analyst Name] from [Institution] stated, "[Quote expressing concern and potential for rate cuts]."

- [Analyst Name] from [Institution] highlighted the impact on consumer confidence, saying, "[Quote about consumer confidence and spending]."

- [Analyst Name] from [Institution] pointed to the interconnectedness of various sectors, suggesting the decline in retail sales could indicate broader economic weakness.

The consensus appears to be that the retail sales figures significantly weaken the case for further interest rate hikes.

Predicting the Bank of Canada's Response: Rate Cut Imminent?

Given the severity of the retail sales report, many believe a Bank of Canada rate cut is imminent. The central bank's mandate is to maintain price stability and full employment. The current situation challenges both aspects.

The Bank of Canada's Mandate

The Bank of Canada's primary objective is to control inflation while promoting sustainable economic growth and full employment. High interest rates are generally used to combat inflation, but in the face of a potential recession, the Bank may need to prioritize economic growth.

- Lowering interest rates can stimulate economic activity by making borrowing cheaper, thereby encouraging investment and consumer spending.

- However, reducing rates too aggressively could reignite inflationary pressures. This presents a difficult balancing act for the Bank of Canada.

- The Bank's past responses to economic downturns have included rate cuts, but the timing and magnitude have varied depending on the specific circumstances.

Economists' Forecasts and Arguments

Economists are largely in agreement that a rate cut is likely, although the timing and magnitude remain subjects of debate.

- [Economist Name] predicts a [Number]% rate cut by [Month]. Their reasoning centers on the need to prevent a recession and stimulate demand.

- [Economist Name] suggests a more cautious approach, advocating for a smaller [Number]% cut, citing concerns about potential inflationary consequences.

- Others believe the Bank may wait for further data before making a decision.

The uncertainty underscores the complexity of the situation and the difficult choices facing the Bank of Canada.

Potential Impacts of Bank of Canada Rate Cuts

A Bank of Canada rate cut would have far-reaching consequences for the Canadian economy.

Impact on Borrowing Costs

Lower interest rates will translate into lower borrowing costs across the board.

- Mortgage rates will likely fall, making homeownership more affordable and potentially stimulating the housing market.

- Businesses will benefit from reduced borrowing costs, encouraging investment and expansion.

- Consumers will find it cheaper to borrow money for various purposes, potentially boosting consumer spending.

However, there are potential risks. Lower rates can sometimes fuel excessive borrowing and unsustainable levels of debt.

Impact on the Canadian Dollar and the Stock Market

Rate cuts often weaken a country's currency. A weaker Canadian dollar could boost exports but also make imports more expensive. The impact on the stock market is typically positive in the short term, as lower rates generally improve corporate earnings prospects.

- Lower interest rates can attract foreign investment, increasing the demand for the Canadian dollar.

- However, the short-term impact could be volatile, depending on market sentiment and global economic conditions.

Conclusion

The significant drop in Canadian retail sales has raised serious concerns about the health of the Canadian economy. Economists widely predict that the Bank of Canada will respond with interest rate cuts to stimulate economic activity and counter the risk of a recession. These cuts will likely impact borrowing costs, the Canadian dollar, and the stock market. The exact timing and magnitude of these cuts remain uncertain, but the situation highlights the need for careful consideration by the Bank of Canada in navigating this delicate economic balance. Stay tuned for updates on the Bank of Canada's next policy announcement and how potential Bank of Canada rate cuts will affect your financial planning. Continue to monitor the situation and learn more about the implications of the Bank of Canada rate cuts for you.

Featured Posts

-

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025 -

Key Points From Trumps Time Interview Canada Annexation Claims Xi Calls And Third Term Discussion

Apr 28, 2025

Key Points From Trumps Time Interview Canada Annexation Claims Xi Calls And Third Term Discussion

Apr 28, 2025 -

Abu Dhabis 2024 Success Key Projects Real Estate Growth And Ai Initiatives

Apr 28, 2025

Abu Dhabis 2024 Success Key Projects Real Estate Growth And Ai Initiatives

Apr 28, 2025 -

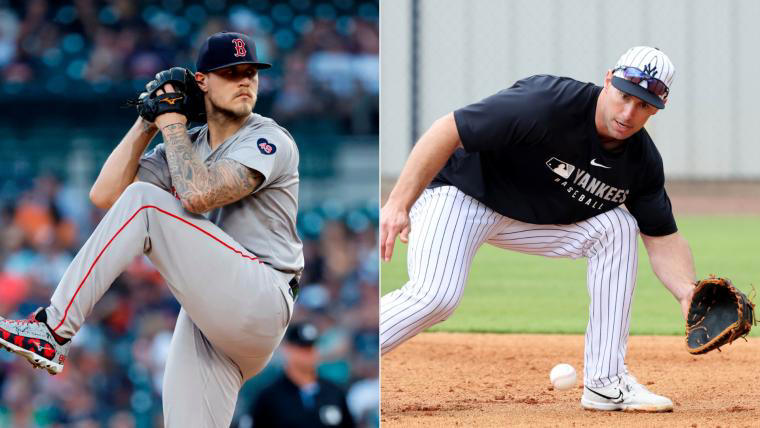

Coras Subtle Lineup Shift Impacts Red Sox Doubleheader

Apr 28, 2025

Coras Subtle Lineup Shift Impacts Red Sox Doubleheader

Apr 28, 2025 -

Pirates Defeat Yankees In Walk Off Thriller After Extra Innings

Apr 28, 2025

Pirates Defeat Yankees In Walk Off Thriller After Extra Innings

Apr 28, 2025