Elon Musk's Influence On Dogecoin: A Shifting Landscape

Table of Contents

Musk's Tweets and Dogecoin's Price Volatility

The correlation between Elon Musk's tweets and Dogecoin's price is undeniable. His pronouncements, often cryptic or humorous, have repeatedly triggered significant price swings, showcasing the potent influence of social media on cryptocurrency markets. This volatility creates both opportunities and risks for investors.

-

Examples of tweets that dramatically impacted Dogecoin's price: Numerous instances exist where a single tweet from Musk mentioning "Doge," "Dogecoin," or related concepts caused immediate and substantial price increases (or decreases). One notable example was a tweet in 2021 where Musk simply stated "Doge," causing a rapid price surge. Conversely, negative comments or even the absence of mentions have led to significant price drops.

-

Analysis of the resulting price surges and crashes: These price fluctuations are often dramatic, characterized by rapid pumps and dumps. This extreme volatility makes Dogecoin a highly risky investment, as gains can evaporate quickly, leaving investors with substantial losses.

-

Discussion of the potential for market manipulation through social media influence: Musk's actions raise concerns about potential market manipulation. His immense social media following allows him to significantly influence market sentiment, potentially creating artificial price bubbles and harming unsuspecting investors.

-

Examination of regulatory concerns surrounding Musk's actions: Regulatory bodies are increasingly scrutinizing the impact of social media influencers on cryptocurrency markets. Musk's actions highlight the need for clearer guidelines and regulations to protect investors from manipulation and ensure fair market practices. The SEC (Securities and Exchange Commission) has already investigated Musk's past tweets and their impact on various stock prices, underscoring the gravity of this issue.

The Meme Coin Phenomenon and its Impact

Dogecoin's success is closely tied to the broader phenomenon of meme coins – cryptocurrencies born from internet memes and often lacking the fundamental technological innovation of other cryptocurrencies like Bitcoin or Ethereum. Dogecoin, however, occupies a unique position within this space, owing largely to Musk's influence.

-

Explanation of what constitutes a "meme coin": Meme coins typically lack a strong underlying technology or use case beyond their internet meme origins. Their value is often driven by hype, community sentiment, and social media trends.

-

Dogecoin's community and its role in price fluctuations: Dogecoin benefits from a large and active online community that actively promotes the coin and responds enthusiastically to Musk's pronouncements. This community plays a significant role in amplifying price movements.

-

Comparison of Dogecoin to other meme coins: While Dogecoin is the most prominent meme coin, others exist, though none have achieved the same level of market capitalization or recognition. Dogecoin's association with Musk sets it apart.

-

Discussion of the risks and rewards associated with investing in meme coins: Investing in meme coins is inherently speculative and high-risk. While potential gains can be substantial, the volatility and lack of intrinsic value make them unsuitable for risk-averse investors.

Elon Musk's Business Interests and Dogecoin

The connection between Musk's business interests and his apparent enthusiasm for Dogecoin remains a subject of speculation. While no direct, formal connection has been established, the possibility of strategic integration raises intriguing questions.

-

Speculation on Tesla accepting Dogecoin as payment: Tesla briefly accepted Dogecoin for some merchandise, fueling speculation about a broader adoption of the cryptocurrency by the company. This further amplified Dogecoin's price.

-

Potential future integration of Dogecoin into SpaceX projects: While currently unsubstantiated, the possibility of Dogecoin integration into SpaceX projects could significantly boost the coin's value and legitimacy.

-

Examination of Musk's broader vision for cryptocurrency adoption: Musk is a vocal proponent of cryptocurrency adoption, and his actions with Dogecoin might reflect a broader vision for the future of finance and technology. This vision, however, needs further clarification.

The Ethical Considerations

Elon Musk's influence on Dogecoin raises significant ethical concerns. His actions highlight the potential for market manipulation and the vulnerability of retail investors to social media manipulation.

-

Market manipulation: The sheer impact of Musk's tweets raises concerns about his responsibility in influencing market behavior, potentially harming or benefiting investors based on his pronouncements.

-

Investor protection: Regulatory bodies need to bolster investor protection mechanisms to safeguard against the volatile nature of meme coins and the influence of social media personalities.

-

Regulatory oversight: Increased regulatory oversight is crucial to address the potential for market manipulation and ensure transparency within the cryptocurrency market. This includes stricter regulations regarding public statements made by influential figures in relation to crypto assets.

-

Financial responsibility: Investors need to take responsibility for their investment decisions, understanding the inherent risks associated with volatile assets like Dogecoin and avoiding investments based solely on social media hype.

Conclusion

Elon Musk's influence on Dogecoin is undeniable, driving significant price volatility and highlighting the risks and rewards of investing in cryptocurrencies, particularly meme coins. The correlation between his tweets and Dogecoin's price movements is clear, prompting discussions on market manipulation and the need for increased regulatory oversight. While the potential for substantial gains exists, the volatile nature of Dogecoin underscores the importance of thorough research and a cautious approach to investment. Remember, investing in Dogecoin, or any cryptocurrency heavily influenced by social media personalities, carries significant risk.

Call to Action: Before investing in Dogecoin or any cryptocurrency, conduct thorough research, understand the inherent risks involved, and consult with a qualified financial advisor. Don't let social media hype alone dictate your investment decisions. Further explore the complexities of Elon Musk’s influence on the cryptocurrency market and the constantly evolving landscape of Dogecoin to make informed investment choices.

Featured Posts

-

Pogacars Solo Triumph A Detailed Look At His Tour Of Flanders Win

May 26, 2025

Pogacars Solo Triumph A Detailed Look At His Tour Of Flanders Win

May 26, 2025 -

Effective Flood Alert Systems Protecting Your Home And Family

May 26, 2025

Effective Flood Alert Systems Protecting Your Home And Family

May 26, 2025 -

Bank Of Canada Rate Cut Outlook Shifts Following Retail Sales Increase

May 26, 2025

Bank Of Canada Rate Cut Outlook Shifts Following Retail Sales Increase

May 26, 2025 -

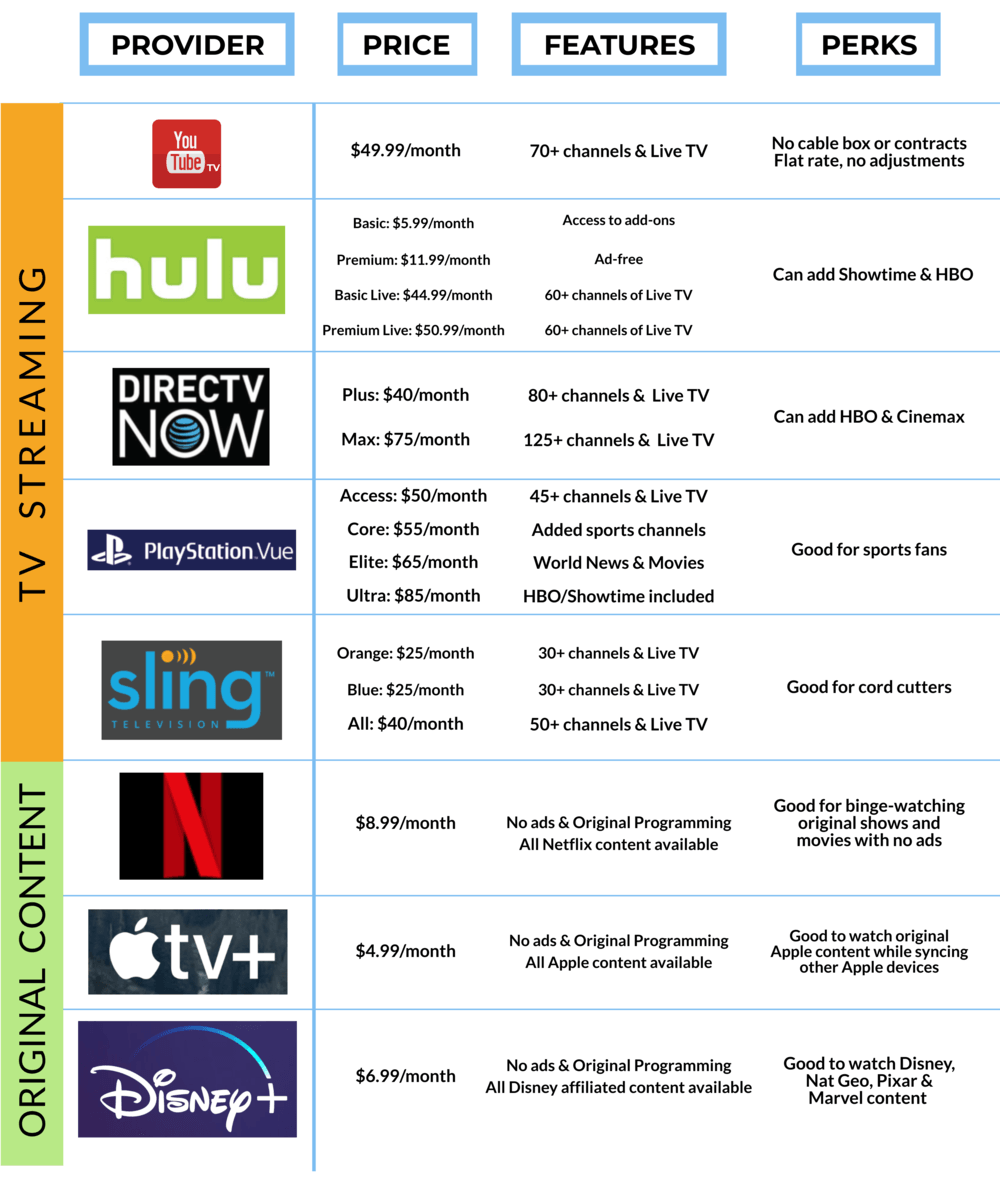

Monday Night Viewing 10 Top Tv And Streaming Options

May 26, 2025

Monday Night Viewing 10 Top Tv And Streaming Options

May 26, 2025 -

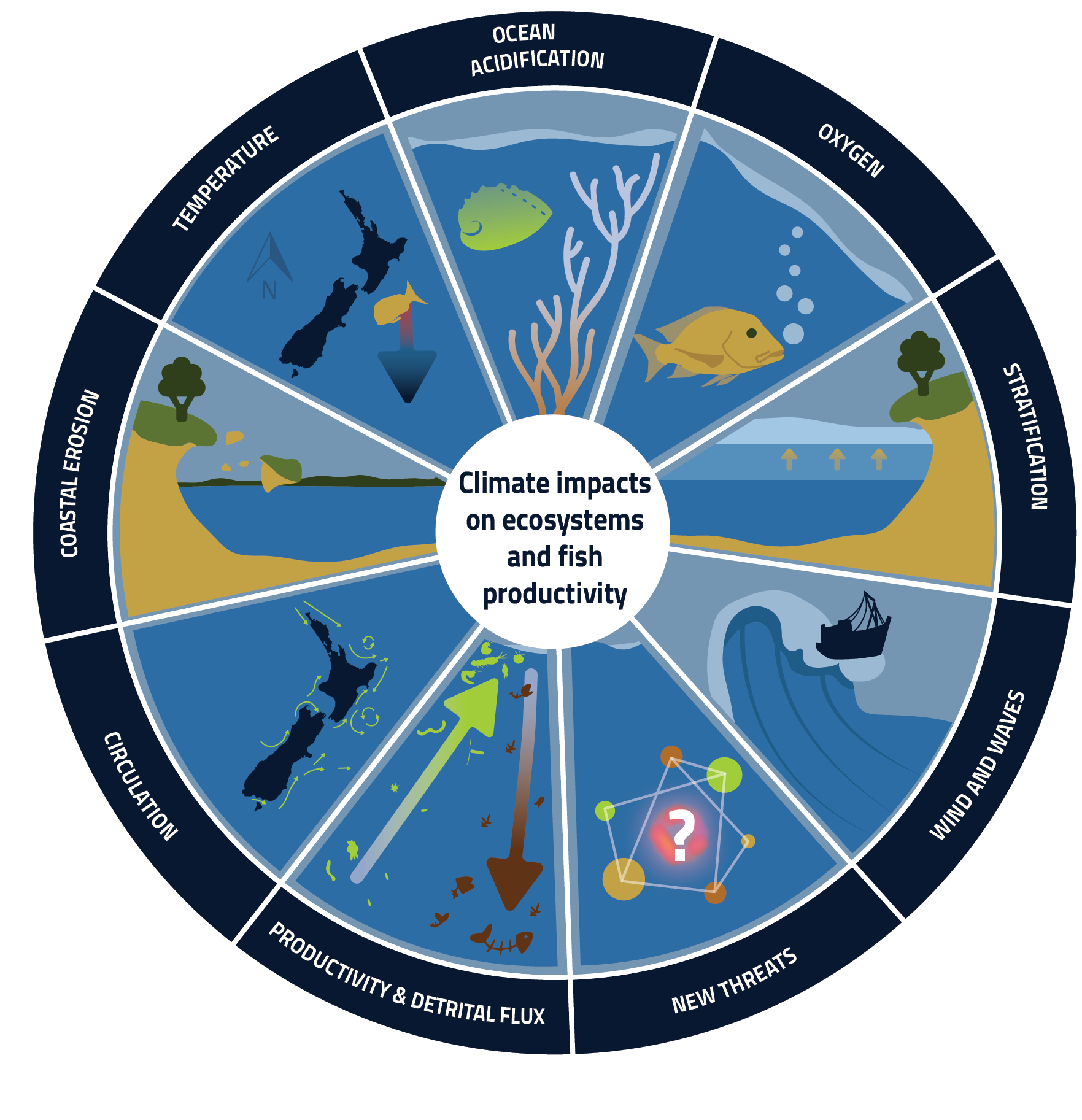

A Fungi That Could Eat You From The Inside Out The Threat Of Climate Change

May 26, 2025

A Fungi That Could Eat You From The Inside Out The Threat Of Climate Change

May 26, 2025