Elon Musk's Net Worth Falls Below $300 Billion

Table of Contents

Tesla Stock Performance and its Impact on Elon Musk's Wealth

Tesla, the electric vehicle giant founded and led by Elon Musk, is the cornerstone of his immense wealth. The recent performance of Tesla stock price has had a direct and significant impact on his net worth. A decline in Tesla's stock price directly translates to a decrease in Musk's personal wealth, as he holds a substantial number of Tesla shares.

- Recent Stock Performance: Tesla's stock has experienced considerable volatility in recent months, influenced by factors such as increased competition in the EV market, shifting consumer sentiment, and broader economic concerns. Charts showcasing this volatility would clearly illustrate the correlation between Tesla's market cap and Elon Musk's net worth.

- Factors Affecting Tesla's Stock Price:

- Competition: The rise of other electric vehicle manufacturers is putting pressure on Tesla's market share.

- Market Sentiment: Investor confidence in Tesla, and the broader tech sector, has been affected by economic uncertainty.

- Economic Conditions: Global economic downturns and inflationary pressures impact consumer spending and investment in the automotive sector.

- Elon Musk's Tesla Shares: The sheer number of Tesla shares owned by Elon Musk amplifies the impact of even small percentage changes in the Tesla stock price on his overall billionaire net worth.

The Influence of SpaceX Valuation on Elon Musk's Overall Net Worth

SpaceX, Musk's aerospace manufacturer, plays a crucial, albeit less transparent, role in his overall net worth. Unlike Tesla, SpaceX is a privately held company, making its valuation less readily available and subject to more speculation.

- SpaceX's Valuation Challenges: Accurately determining SpaceX's SpaceX valuation is difficult due to its private nature. While various estimates exist, they are often based on funding rounds and comparisons to publicly traded companies in the aerospace sector.

- SpaceX's Growth and Potential: SpaceX's ambitious projects, such as Starlink and its growing role in NASA missions, contribute significantly to its potential valuation. Future successes or setbacks in these ventures directly affect Musk's billionaire net worth.

- Impact on Elon Musk's Net Worth: Although less immediately obvious than Tesla's impact, SpaceX's valuation significantly contributes to Musk's overall financial picture. Positive developments, such as successful launches and new contracts, increase his net worth, while setbacks may reduce it.

Other Investments and Their Contribution (or Lack Thereof)

Beyond Tesla and SpaceX, Elon Musk has other investments, though their overall contribution to his billionaire net worth compared to his major holdings remains relatively smaller. However, the performance of this diversified portfolio still influences his overall financial status.

- Identifying Other Investments: While complete details of Musk's personal investments are not publicly available, some investments, such as his holdings in other companies or real estate assets, likely play a minor role in his total asset value.

- Impact of Other Investments: The performance of these other assets contributes, to a lesser extent, to fluctuations in Musk’s overall net worth. Analyzing these assets’ performance requires deeper research beyond publicly accessible information.

The Broader Economic Context and Market Volatility

The recent drop in Elon Musk's net worth isn't solely attributable to Tesla and SpaceX; it's also interwoven with broader market volatility and economic factors.

- Economic Downturn Fears: Concerns about a potential recession or economic slowdown significantly impact investor sentiment and asset valuations.

- Inflation's Impact: High inflation erodes the purchasing power of assets, affecting the overall value of investments including those held by high-net-worth individuals.

- Interest Rate Hikes: Increased interest rates can also dampen investment activity and reduce valuations in certain market sectors.

Conclusion: Understanding the Fluctuations of Elon Musk's Net Worth – What's Next?

The decrease in Elon Musk's net worth below $300 billion is a result of a confluence of factors. The performance of Tesla stock price and the less transparent but still significant SpaceX valuation are key drivers, influenced by both company-specific developments and broader economic conditions. Understanding the interplay between these factors is crucial to comprehending the dynamic nature of extreme wealth and its susceptibility to market fluctuations. While predicting the future is impossible, the volatility surrounding Elon Musk's net worth highlights the risks and rewards inherent in heavily market-dependent fortunes. Stay informed about the ever-changing landscape of Elon Musk's net worth by following [your website/publication name] for regular updates and analysis on billionaire net worth changes and Tesla stock price trends.

Featured Posts

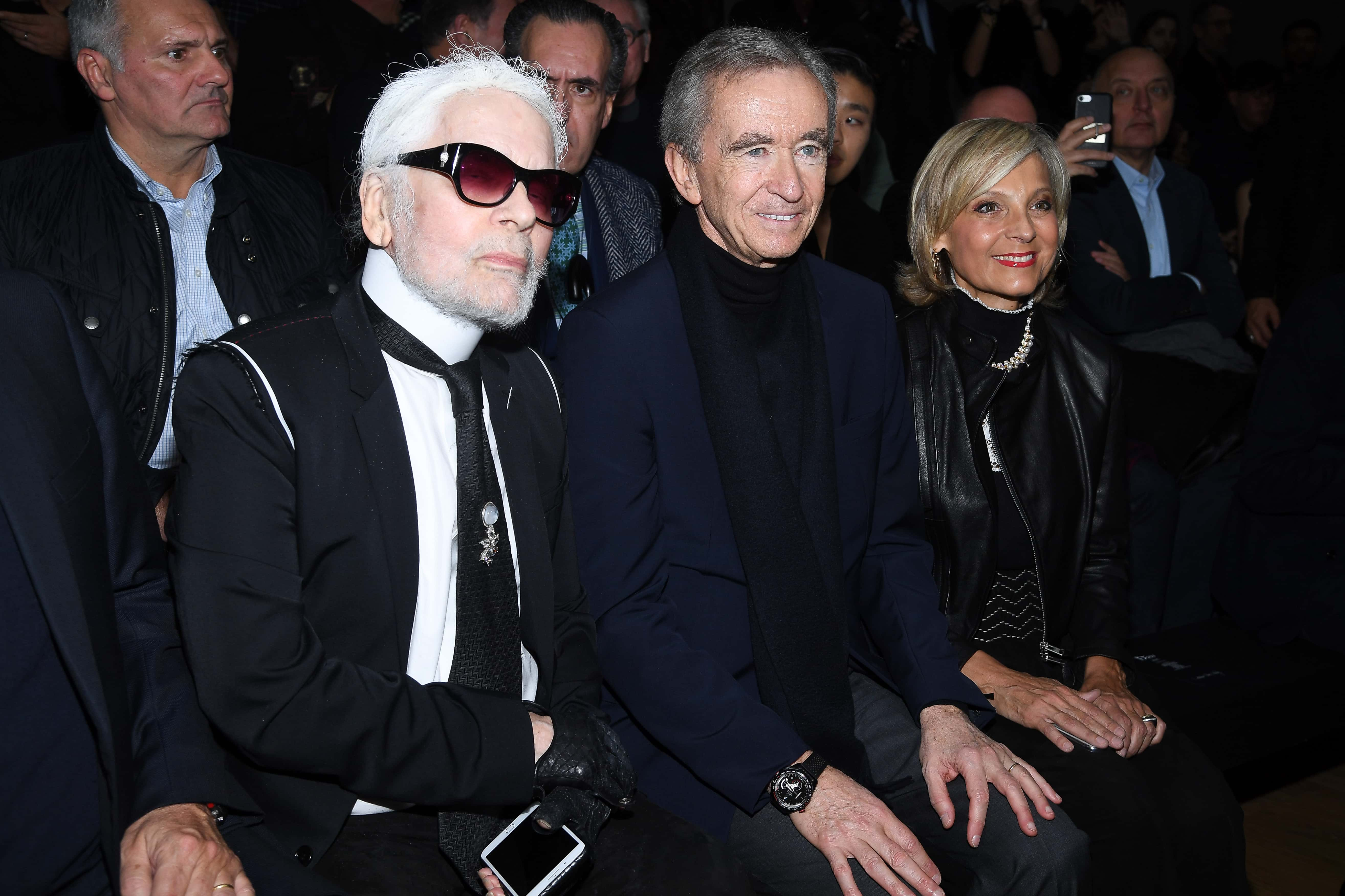

-

Death Of Diver During Recovery Of Sunken Tech Tycoon Superyacht

May 10, 2025

Death Of Diver During Recovery Of Sunken Tech Tycoon Superyacht

May 10, 2025 -

Indian Stock Market Live Sensex Nifty Performance And Top Movers

May 10, 2025

Indian Stock Market Live Sensex Nifty Performance And Top Movers

May 10, 2025 -

Melanie Griffith And Dakota Johnson At Materialist Premiere

May 10, 2025

Melanie Griffith And Dakota Johnson At Materialist Premiere

May 10, 2025 -

Franko Polskoe Oboronnoe Partnerstvo Ukreplenie Bezopasnosti V Evrope

May 10, 2025

Franko Polskoe Oboronnoe Partnerstvo Ukreplenie Bezopasnosti V Evrope

May 10, 2025 -

The Billionaire Without Berkshire Shares Canadas Potential For Leadership In Investing

May 10, 2025

The Billionaire Without Berkshire Shares Canadas Potential For Leadership In Investing

May 10, 2025