Emerging Market Stocks Outperform US In 2024: A Year Of Contrasting Fortunes

Table of Contents

Macroeconomic Factors Favoring Emerging Markets in 2024

Several macroeconomic trends significantly favored emerging markets in 2024, leading to their outperformance against their developed market counterparts.

Global Economic Slowdown and its Differential Impact

A global economic slowdown, impacting developed nations like the US more severely than anticipated, played a crucial role.

- Developed economies, already facing high inflation and interest rate hikes, experienced a sharper contraction in economic activity.

- Emerging markets, while not immune, often possess greater growth potential and more room for monetary policy adjustments.

- Examples like India and several Southeast Asian nations demonstrated remarkable resilience, showcasing strong domestic demand and continued growth amidst global headwinds. This resilience highlights the diversification benefits of including emerging market economies in an investment portfolio.

Keywords: Global recession, economic resilience, growth potential, emerging market economies.

Commodity Prices and their Influence on Emerging Market Performance

The fluctuating prices of key commodities significantly influenced emerging market performance.

- Many emerging markets are significant exporters of raw materials, including oil, metals, and agricultural products.

- Rising commodity prices, particularly in the first half of 2024, boosted the revenues and profitability of companies in these sectors, positively impacting stock market performance. This is especially true for commodity-exporting nations in Africa and Latin America.

- However, it's important to note that price volatility can also pose a risk, making careful analysis of commodity price trends crucial for investors in emerging market stocks.

Keywords: Commodity prices, raw materials, oil prices, metal prices, commodity-exporting nations.

Diversification and Reduced Correlation with US Markets

Investing in emerging markets offers a powerful diversification strategy.

- Emerging market stocks often exhibit lower correlation with US stocks, meaning their price movements are less synchronized.

- This reduced correlation helps mitigate portfolio risk, as losses in one market are less likely to be mirrored in the other.

- By diversifying into emerging markets, investors can potentially reduce overall portfolio volatility and improve risk-adjusted returns. This is a key benefit for sophisticated investors seeking to optimize their investment strategy.

Keywords: Portfolio diversification, risk mitigation, correlation, market volatility, investment strategy.

Sector-Specific Performance Drivers in Emerging Markets

The outperformance of emerging market stocks wasn't uniform across all sectors. Specific industries experienced particularly strong growth.

Technology and Innovation in Emerging Markets

The technology sector in several emerging markets experienced explosive growth.

- India and China, for instance, witnessed significant advancements in FinTech, e-commerce, and other technology-driven sectors.

- This rapid technological development fueled strong stock market performance for companies operating in these spaces.

- The digital transformation occurring in many emerging markets presents compelling opportunities for investors in emerging market tech stocks.

Keywords: Tech stocks, FinTech, digital transformation, emerging market technology.

Infrastructure Development and its Stock Market Implications

Massive infrastructure investments in many emerging markets provided a significant boost.

- Governments across various regions are investing heavily in transportation, energy, and communication infrastructure.

- This infrastructure development creates numerous opportunities for investors in construction, materials, and related sectors.

- The long-term growth potential associated with infrastructure projects makes them an attractive investment avenue in emerging markets.

Keywords: Infrastructure development, construction, infrastructure investments, emerging market infrastructure.

Consumer Spending and the Rise of the Middle Class

The expanding middle class in many emerging markets is fueling significant consumer spending.

- Increased disposable income translates into higher demand for consumer goods and services.

- This rise in consumer spending drives growth in retail, FMCG (fast-moving consumer goods), and other consumer-oriented sectors.

- Investors can capitalize on this trend by focusing on companies catering to the growing needs of the emerging market consumer.

Keywords: Consumer spending, middle class growth, consumer goods, retail, emerging market consumers.

Risks and Challenges in Emerging Market Investing

While the potential rewards are significant, investing in emerging markets also involves considerable risks.

Geopolitical Risks and Political Instability

Geopolitical risks and political instability can significantly impact investments.

- Political unrest, conflicts, and changes in government policies can create uncertainty and volatility in emerging markets.

- Careful due diligence and risk assessment are crucial before investing in regions with potential political instability.

- Staying informed about geopolitical developments is paramount for managing risk in this sector.

Keywords: Geopolitical risk, political instability, emerging market risks, investment risks.

Currency Fluctuations and Exchange Rate Risks

Currency fluctuations can significantly impact returns on emerging market investments.

- Changes in exchange rates can affect the value of investments when converting them back to the investor's home currency.

- Hedging strategies can mitigate some of this currency risk, though they come with their own costs and complexities.

- Understanding the currency dynamics of specific emerging markets is essential for making informed investment decisions.

Keywords: Currency risk, exchange rate fluctuations, hedging strategies, emerging market currencies.

Regulatory Uncertainty and Governance Issues

Regulatory uncertainty and corporate governance issues can pose significant challenges.

- Some emerging markets may lack robust regulatory frameworks or strong corporate governance practices.

- This lack of transparency and accountability can increase investment risks.

- Investors should thoroughly investigate the regulatory environment and corporate governance standards before committing capital.

Keywords: Regulatory uncertainty, corporate governance, emerging market regulation, investment governance.

Conclusion: Emerging Market Stocks: A Promising Investment Opportunity for 2024 and Beyond

In 2024, emerging market stocks significantly outperformed their US counterparts, driven by various macroeconomic factors and sector-specific growth. While opportunities abound, investors must also acknowledge the inherent risks associated with these markets. Key advantages include diversification benefits, high growth potential in various sectors, and the rise of the middle class. However, geopolitical risks, currency fluctuations, and regulatory uncertainties require careful consideration. Explore the potential of emerging market stocks to diversify your portfolio and capitalize on the growth opportunities in these dynamic economies. Learn more about investing in emerging market equities and consider adding them to your investment strategy for long-term growth.

Featured Posts

-

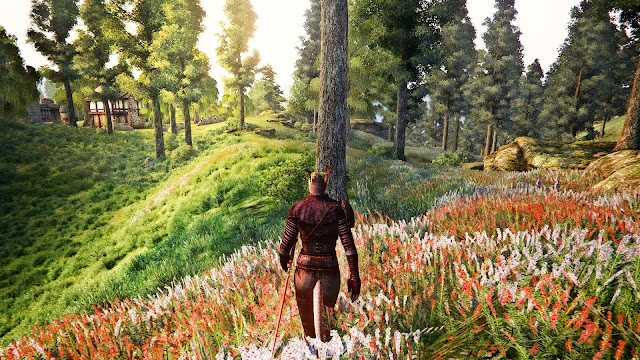

Oblivion Remastered Now Available From Bethesda

Apr 24, 2025

Oblivion Remastered Now Available From Bethesda

Apr 24, 2025 -

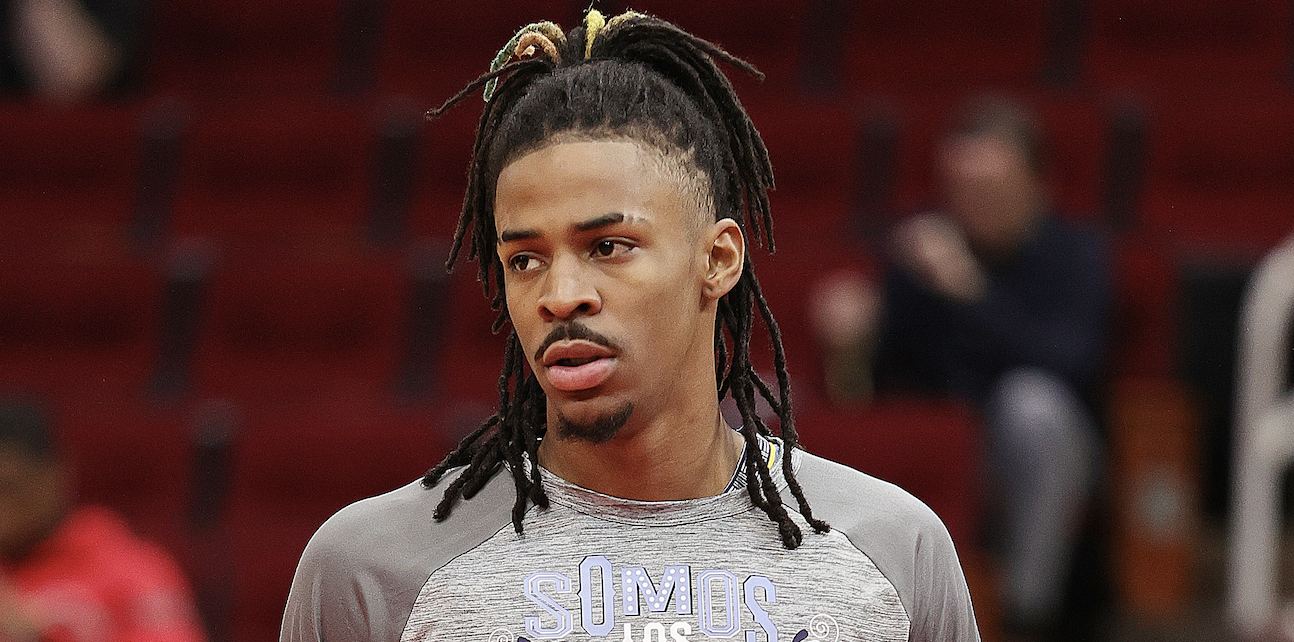

Ja Morant Under Nba Investigation A Report On The Latest Developments

Apr 24, 2025

Ja Morant Under Nba Investigation A Report On The Latest Developments

Apr 24, 2025 -

Execs Targeted Millions Stolen Via Office 365 Breaches Feds Say

Apr 24, 2025

Execs Targeted Millions Stolen Via Office 365 Breaches Feds Say

Apr 24, 2025 -

Landlord Price Gouging In La Following Devastating Fires A Celebritys Perspective

Apr 24, 2025

Landlord Price Gouging In La Following Devastating Fires A Celebritys Perspective

Apr 24, 2025 -

Subsystem Malfunction Forces Blue Origin To Cancel Rocket Launch

Apr 24, 2025

Subsystem Malfunction Forces Blue Origin To Cancel Rocket Launch

Apr 24, 2025