Energy Giant SSE Cuts Spending By £3 Billion Amidst Economic Slowdown

Table of Contents

Reasons Behind SSE's £3 Billion Spending Cut

The £3 billion spending cut reflects a confluence of factors impacting SSE's investment strategy. These factors are deeply intertwined with the broader economic climate and the evolving energy market.

Impact of the Economic Slowdown

The global economic downturn is significantly impacting investment decisions across all sectors, and the energy sector is no exception. The current economic climate is characterized by several key factors that make large-scale energy investments riskier:

- Increased borrowing costs impacting project viability: Rising interest rates make securing financing for large-scale energy projects more expensive, potentially rendering some projects unprofitable. This directly affects the return on investment (ROI) calculations for SSE's projects.

- Reduced consumer spending impacting energy demand forecasts: A weakening economy leads to decreased consumer spending, impacting energy demand forecasts and making it more challenging to justify substantial investments in new capacity.

- Uncertainty in the global energy market influencing investment decisions: Geopolitical instability and fluctuating energy prices add another layer of uncertainty, making long-term investment planning more complex and risky.

- Pressure from shareholders to maintain profitability and reduce risk: Shareholders are increasingly demanding that companies prioritize profitability and reduce risk in the face of economic uncertainty, prompting SSE to reassess its investment portfolio.

Review of Existing Projects and Investment Portfolio

SSE's decision wasn't arbitrary. It's likely the result of a thorough review of its existing projects and investment portfolio, focusing on optimizing resources and prioritizing profitability:

- Prioritization of renewable energy projects with strong long-term prospects: SSE is likely focusing on renewable energy projects like wind and solar power, which have strong long-term growth potential and align with the global shift towards cleaner energy.

- Delay or cancellation of less profitable fossil fuel projects: With the increasing focus on decarbonization and the potential for stranded assets, less profitable fossil fuel projects are likely being delayed or cancelled.

- Focus on operational efficiency and cost reduction across existing infrastructure: Improving the efficiency of existing assets is crucial for maximizing returns and minimizing waste.

- Stricter scrutiny of future capital expenditure proposals: Future investment proposals will be subject to much stricter evaluation, ensuring only the most financially viable and strategically important projects are approved.

Consequences of the Spending Cuts for SSE and the Wider Energy Sector

SSE's spending cut will have implications both for the company itself and for the broader UK energy market.

Impact on SSE's Growth Strategy

The significant reduction in spending could temporarily slow SSE's growth, particularly in the renewable energy sector. This could have several consequences:

- Potential delays in achieving renewable energy targets: The reduced investment could push back SSE's timetable for achieving its renewable energy targets and its overall transition to a low-carbon business model.

- Impact on job creation in the renewable energy sector: Delays in renewable energy projects could impact employment opportunities in this rapidly growing sector.

- Reduced investment in research and development of new energy technologies: Less funding for R&D could hamper innovation and slow the development of new, sustainable energy technologies.

Implications for the Broader Energy Market

SSE's decision could signal a wider trend of reduced investment in the UK energy sector, raising significant concerns:

- Potential impact on energy supply and prices: Reduced investment could strain energy supply, potentially leading to higher energy prices for consumers.

- Reduced competition in the energy market: Less investment could lead to decreased competition, potentially affecting consumer choice and innovation.

- Concerns regarding the UK's ability to meet its climate change targets: A slowdown in investment in renewable energy could jeopardize the UK's ability to meet its ambitious climate change targets.

SSE's Future Strategy and Outlook

Despite the substantial spending cuts, SSE is likely to maintain its long-term strategic goals, focusing on both efficiency and sustainability.

Focus on Operational Efficiency

Improving operational efficiency and cost reduction will be critical to offsetting the impact of reduced investment:

- Implementing cost-cutting measures across all departments: SSE will likely implement measures to streamline operations and reduce costs across its entire business.

- Optimizing existing infrastructure to improve performance and reduce waste: Optimizing existing infrastructure is key to maximizing efficiency and minimizing energy waste.

- Investing in digital technologies to enhance operational efficiency: Digital technologies can play a significant role in optimizing operations, reducing costs, and improving decision-making.

Long-Term Vision and Sustainability Goals

SSE's commitment to its long-term sustainability goals remains firm:

- Reaffirming commitment to net-zero targets: The company is likely to reaffirm its commitment to achieving net-zero emissions targets.

- Continued investment in renewable energy projects where financially viable: SSE will continue to invest in renewable energy projects, prioritizing those with strong financial viability.

- Focus on developing innovative sustainable energy solutions: Investment in R&D for innovative sustainable energy solutions will remain a priority, albeit possibly at a reduced level.

Conclusion

SSE's £3 billion spending cut is a significant response to the challenging economic climate and uncertainties in the energy market. While this may temporarily impact growth, the focus on operational efficiency and continued commitment to renewable energy demonstrates a strategic recalibration rather than a retreat from long-term goals. The impact on the wider energy sector warrants close monitoring. Stay informed about further developments regarding SSE's financial performance and the broader implications of reduced energy spending in the UK. Understanding these shifts is crucial for navigating the evolving energy market and the transition to a low-carbon future.

Featured Posts

-

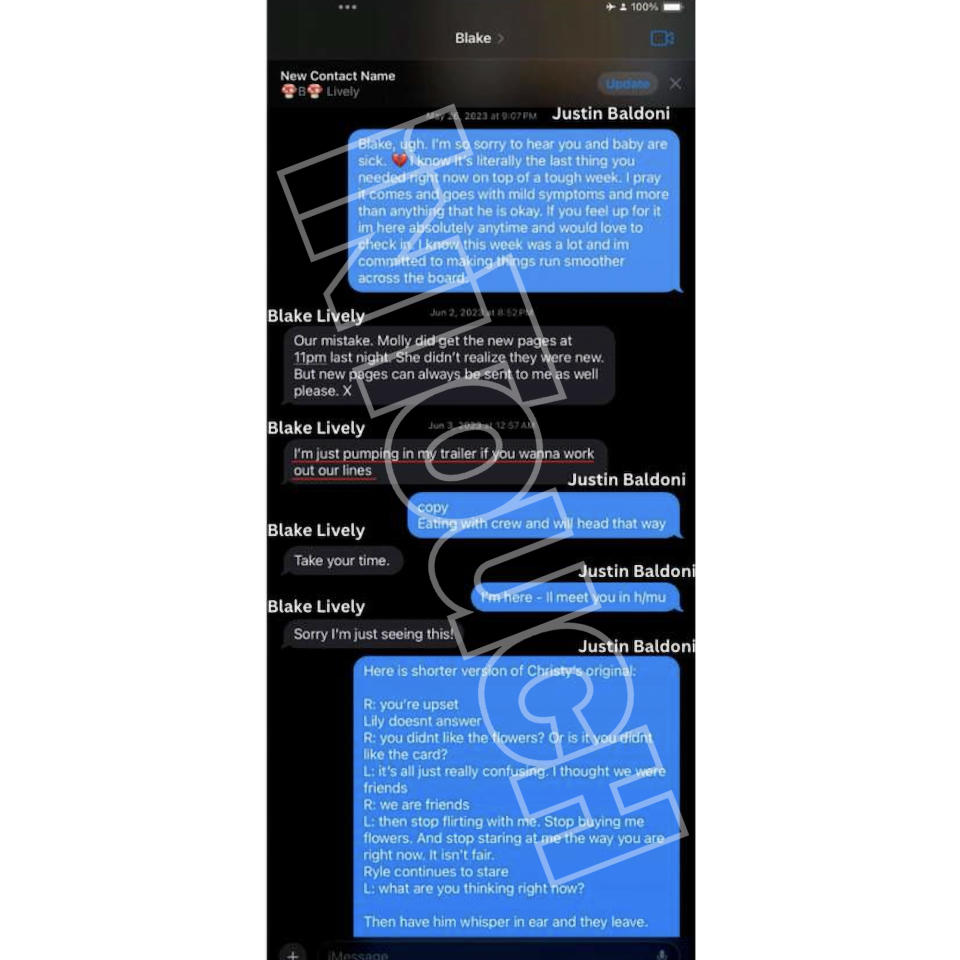

Blake Livelys Alleged Actions A Comprehensive Look At Recent Reports

May 22, 2025

Blake Livelys Alleged Actions A Comprehensive Look At Recent Reports

May 22, 2025 -

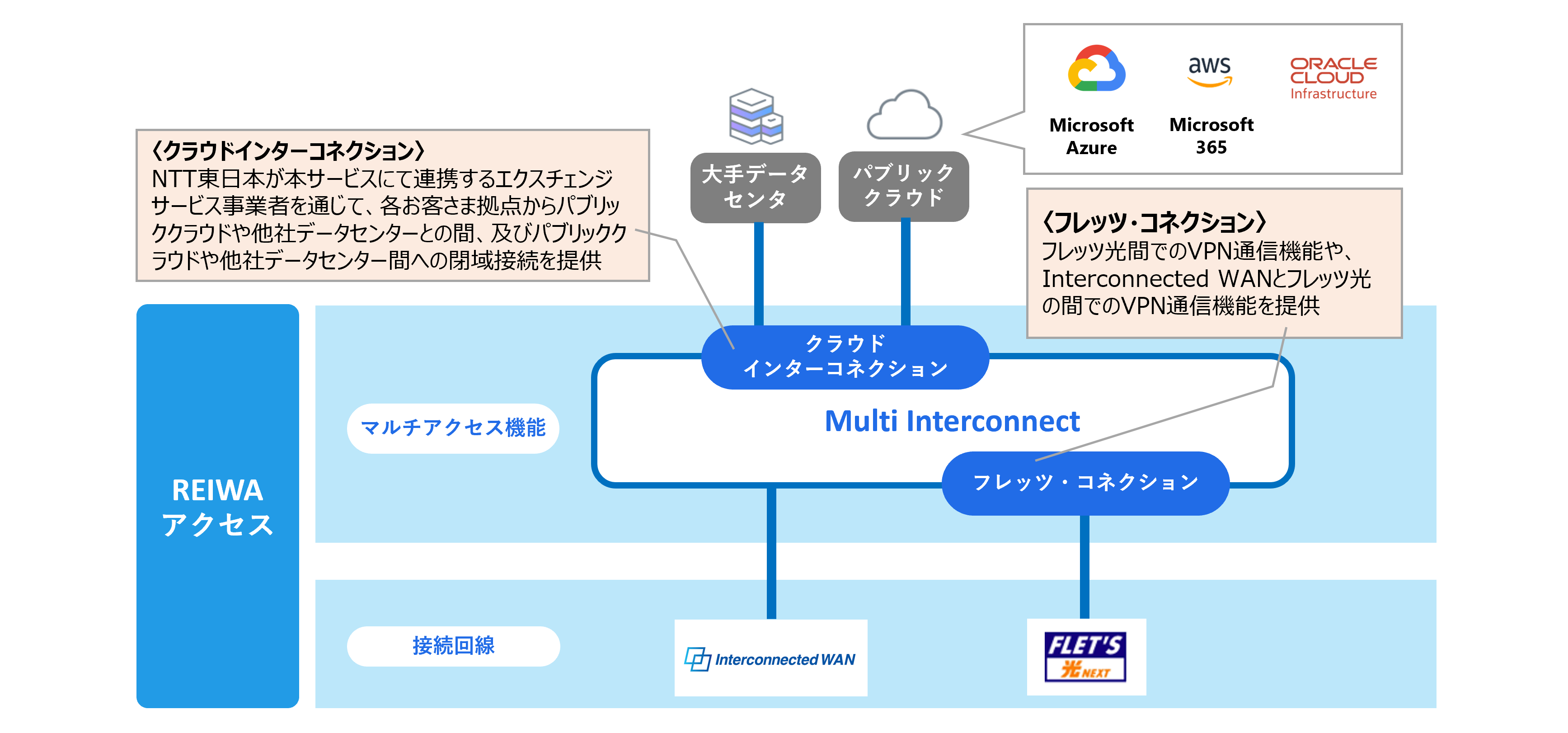

Ntt Multi Interconnect At Be X Ascii Jp

May 22, 2025

Ntt Multi Interconnect At Be X Ascii Jp

May 22, 2025 -

Susquehanna Valley Storm Damage Insurance Claims And Financial Assistance

May 22, 2025

Susquehanna Valley Storm Damage Insurance Claims And Financial Assistance

May 22, 2025 -

Significant Fire At Pre Owned Vehicle Dealership Emergency Response Underway

May 22, 2025

Significant Fire At Pre Owned Vehicle Dealership Emergency Response Underway

May 22, 2025 -

Peregovori Schodo Vstupu Ukrayini Do Nato Zayava Yevrokomisara

May 22, 2025

Peregovori Schodo Vstupu Ukrayini Do Nato Zayava Yevrokomisara

May 22, 2025