Entertainment Stock Dip: Is Now The Time To Buy?

Table of Contents

Analyzing the Current Entertainment Stock Market Dip

The recent dip in entertainment stocks is a complex issue influenced by several interacting economic factors and industry-specific trends. Understanding these factors is crucial before considering any investment.

-

Economic Headwinds: Inflation and rising interest rates are impacting consumer spending, leading to reduced disposable income. This directly affects the entertainment industry, where discretionary spending on movies, gaming, and streaming services is often the first to be cut.

-

Sub-Sector Performance: The entertainment sector isn't monolithic. Streaming services are facing increased competition and subscriber churn, while the gaming industry shows mixed results depending on individual titles and platform performance. The film industry, particularly box office revenue, is still recovering from pandemic-related disruptions. For example, some major streaming companies have seen significant stock price drops, while others in the gaming sector have demonstrated relative resilience.

-

Specific Stock Examples: Several prominent entertainment stocks, including those in major streaming platforms and gaming companies, have experienced double-digit percentage drops in recent months. It's vital to research the specific financial performance and future outlook of each company before investing.

-

Short-Term Risks: The market remains volatile. There's a risk that the dip could continue, leading to further losses in the short term. Geopolitical instability and unforeseen economic events could also negatively impact the sector.

Identifying Undervalued Entertainment Stocks

Identifying undervalued entertainment stocks requires careful analysis using both fundamental and technical approaches. This is where due diligence and a robust investment strategy are paramount.

-

Valuation Methods: Fundamental analysis focuses on a company's intrinsic value by examining financial statements, while technical analysis uses charts and patterns to predict price movements. For long-term investment in entertainment stocks, fundamental analysis is generally preferred.

-

Key Metrics: Several key metrics help determine undervaluation, including the price-to-earnings ratio (P/E ratio), the price-to-sales ratio (P/S ratio), and the PEG ratio (Price/Earnings to Growth ratio). A lower ratio compared to industry averages or historical data could suggest undervaluation.

-

Research Resources: Reputable financial news websites, investment platforms, and brokerage research reports provide valuable information on entertainment stock valuations. However, remember that these are tools, not guarantees.

-

Long-Term Perspective: Chasing short-term gains in a volatile market is risky. A long-term investment strategy, focused on the fundamental value and growth potential of the company, is recommended. Avoid impulsive decisions based solely on short-term price fluctuations.

The Long-Term Potential of the Entertainment Industry

Despite recent market volatility, the entertainment industry boasts substantial long-term growth potential driven by several key factors.

-

Industry Growth Projections: Market research consistently points to continued growth in the entertainment industry, driven by increasing global consumption and technological advancements. While specific numbers vary depending on the source and the segment, the overall trend is positive.

-

Emerging Trends: The metaverse, esports, and the continued expansion of streaming services are just some of the emerging trends that could significantly boost industry growth and create exciting new investment opportunities within entertainment stocks.

-

Technological Advancements: Technological innovation continues to reshape entertainment consumption. Higher-quality streaming, immersive gaming experiences, and advancements in virtual and augmented reality will drive demand for entertainment content and services.

-

Industry Resilience: The entertainment industry has demonstrated remarkable resilience throughout various economic downturns. People's innate need for entertainment and escapism often makes it relatively resistant to severe economic shocks.

Mitigating Risks in Entertainment Stock Investment

Investing in entertainment stocks, like any investment, carries risk. A well-defined risk management strategy is crucial to protect your investment.

-

Diversification: Diversifying your investment portfolio across different entertainment sub-sectors and other asset classes is vital to reduce the impact of any single stock's underperformance. Don’t put all your eggs in one basket.

-

Risk Management Strategies: Dollar-cost averaging (investing a fixed amount at regular intervals) and setting stop-loss orders (automatically selling a stock if it falls below a certain price) can help mitigate risk in a volatile market.

-

Professional Advice: Consulting with a qualified financial advisor before making significant investment decisions is highly recommended, especially for those new to stock market investing. A financial professional can provide personalized advice based on your risk tolerance and financial goals.

Conclusion

The recent entertainment stock dip presents a potential buying opportunity for long-term investors who are comfortable with moderate risk. While short-term volatility persists, a thorough analysis of individual company fundamentals, coupled with a diversified investment strategy and proper risk management, can significantly improve your chances of success. Understanding the long-term growth potential of the entertainment industry is key to making informed decisions. Don't miss this chance to potentially capitalize on the current entertainment stock dip. Start your research today and explore the exciting investment opportunities available in this dynamic sector. Learn more about how to effectively buy entertainment stocks and build a strong, diversified investment portfolio.

Featured Posts

-

Analyzing Putins War Focused Economic Strategy In Russia

May 29, 2025

Analyzing Putins War Focused Economic Strategy In Russia

May 29, 2025 -

Unlocking Shiny Pokemon In Pokemon Tcg Pocket

May 29, 2025

Unlocking Shiny Pokemon In Pokemon Tcg Pocket

May 29, 2025 -

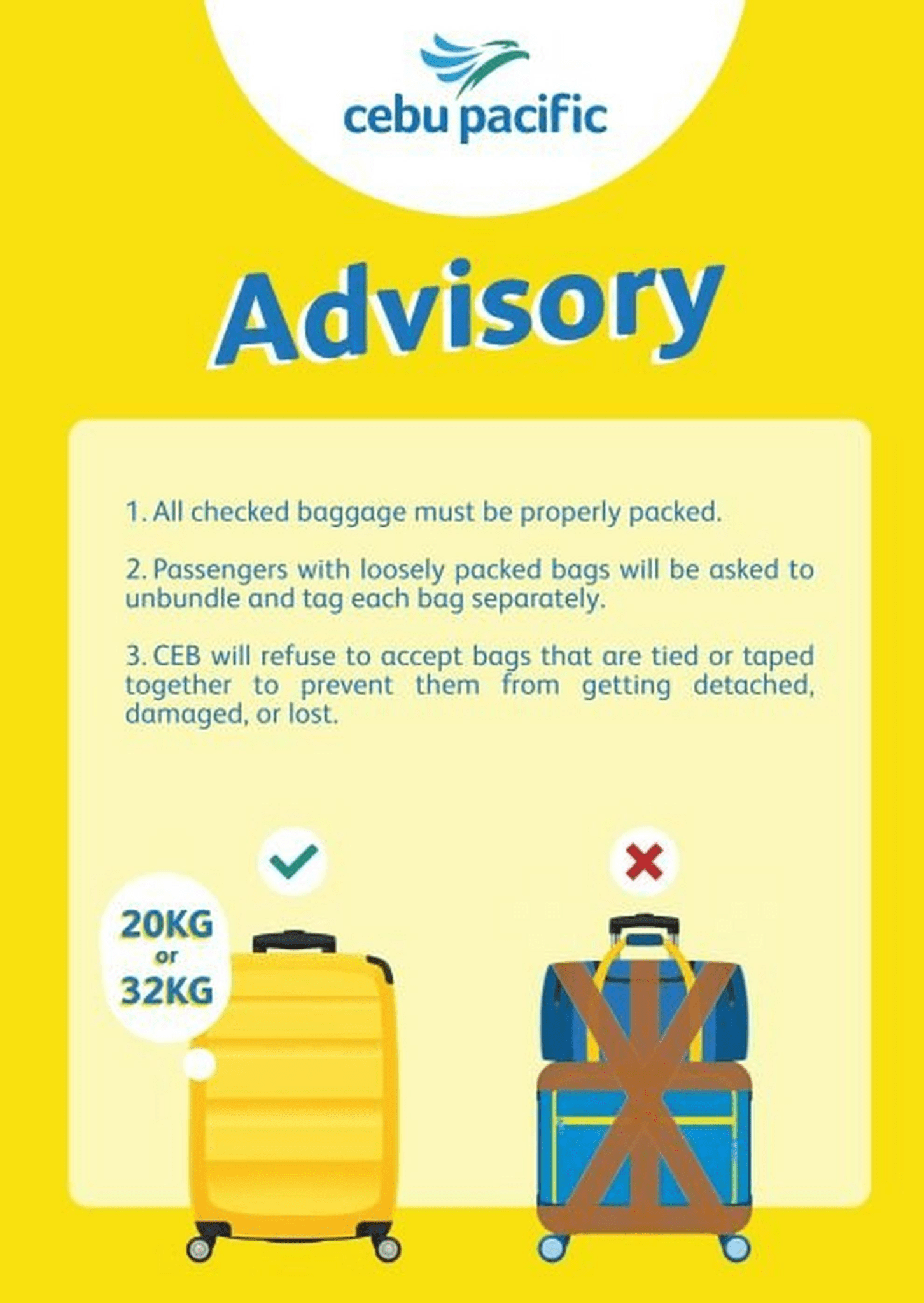

Southwests Baggage Fee Change A Threat To Punctuality

May 29, 2025

Southwests Baggage Fee Change A Threat To Punctuality

May 29, 2025 -

Alastqlal Irth Alajyal Wmswwlyt Alhadr

May 29, 2025

Alastqlal Irth Alajyal Wmswwlyt Alhadr

May 29, 2025 -

Meyer Turku Names New Ceo Cargotec Executive Replaces Tim Meyer

May 29, 2025

Meyer Turku Names New Ceo Cargotec Executive Replaces Tim Meyer

May 29, 2025