Eramet To Benefit From China's Curbs On Lithium Technology Exports

Table of Contents

China's Curbs on Lithium Technology Exports: A Strategic Move

China's recent restrictions on the export of certain lithium technologies represent a significant strategic shift. These measures are primarily driven by a desire to secure its own domestic supply chain for lithium-ion batteries, a critical component of its ambitious plans for electric vehicle manufacturing and renewable energy infrastructure. Furthermore, the restrictions aim to accelerate China's technological advancement in the lithium sector, fostering innovation and reducing reliance on foreign expertise.

The restrictions affect various lithium technologies, including specific battery components and advanced processing technologies crucial for high-performance batteries. This targeted approach aims to solidify China's position as a global leader in battery production and technology. The consequences are far-reaching:

- Increased domestic production of lithium-ion batteries in China: This strengthens China's domestic industry and reduces its dependence on foreign suppliers.

- Reduced reliance on foreign suppliers: China aims to become self-sufficient in lithium-related technologies, limiting its vulnerability to global supply chain disruptions.

- Potential for higher prices of lithium-related materials globally: Reduced supply from China will likely lead to increased prices for lithium globally, benefiting producers outside of China.

- Shift in global lithium supply chain dynamics: The restrictions are forcing a re-evaluation of global supply chains, opening opportunities for alternative suppliers.

Eramet's Strategic Positioning and Competitive Advantages

Eramet, a leading global player in the mining and metallurgical industries, is well-positioned to capitalize on these changes. The company possesses significant lithium assets and expertise, making it a key beneficiary of the evolving market dynamics.

Eramet's strategic advantages include:

- Existing lithium projects and production capabilities: Eramet operates several lithium projects, including its significant stake in the WMC (Western Mining Corporation) in Australia, a vital source of spodumene, a key lithium ore. This established presence provides a strong foundation for increased production.

- Geographical diversification: Eramet's lithium projects are geographically diversified, reducing its reliance on any single region and mitigating risks associated with geopolitical instability.

- Technological expertise and innovation: Eramet is investing heavily in R&D to optimize lithium extraction and processing, ensuring it remains at the forefront of technological innovation. This focus on sustainable and responsible mining practices further enhances its competitive position.

Specific examples of Eramet's strategic assets include:

- Its lithium projects in Australia and other regions less affected by Chinese restrictions.

- Strong partnerships and collaborations with leading battery manufacturers.

- Ongoing R&D efforts in improving lithium extraction and processing through technologies like direct lithium extraction (DLE).

- A commitment to environmentally responsible and sustainable mining practices.

Increased Demand and Market Share for Eramet

The increased global demand for lithium, partly fueled by China's export restrictions, will directly translate into increased demand for Eramet's products. This shift in the global supply chain presents a unique opportunity for Eramet to expand its market share significantly.

The potential benefits for Eramet include:

- Forecasted growth in global lithium demand: The global market for lithium is expected to grow exponentially in the coming years, driven by the electric vehicle revolution.

- Expected increase in Eramet's production capacity: Eramet is likely to expand its production capacity to meet the growing demand, resulting in significant revenue growth.

- Potential for new contracts and supply agreements: The shift in the global supply chain will open up new opportunities for Eramet to secure lucrative contracts with battery manufacturers.

- Improved profitability for Eramet: The increased demand and favorable market conditions will lead to higher profit margins for Eramet.

Potential Challenges and Mitigation Strategies for Eramet

Despite the promising outlook, Eramet faces potential challenges. Increased competition from other lithium producers and fluctuating lithium prices are key concerns. However, Eramet is actively implementing mitigation strategies to address these challenges effectively:

- Strategies to manage price volatility: Eramet is likely to employ hedging strategies and long-term contracts to mitigate the impact of price fluctuations.

- Plans to expand production capacity strategically: Eramet will carefully plan its capacity expansion to balance supply with demand and avoid overproduction.

- Investment in research and development: Ongoing investments in R&D will ensure Eramet maintains a technological edge in lithium extraction and processing.

- Risk management strategies to mitigate geopolitical uncertainties: Eramet's geographical diversification strategy helps mitigate risks associated with geopolitical instability.

Conclusion: Eramet's Promising Future in a Shifting Lithium Landscape

China's restrictions on lithium technology exports have created a favorable environment for Eramet's growth. The company's strategic positioning, technological expertise, and geographical diversification provide a significant competitive advantage in this rapidly evolving market. Eramet is well-equipped to capitalize on the changing dynamics in the global lithium supply chain, translating into increased production, market share, and profitability. To learn more about Eramet's lithium investments and its role in the future of lithium technology, explore Eramet's website and follow their initiatives closely. Understand the implications of Eramet and China's lithium export curbs for the future of this critical industry.

Featured Posts

-

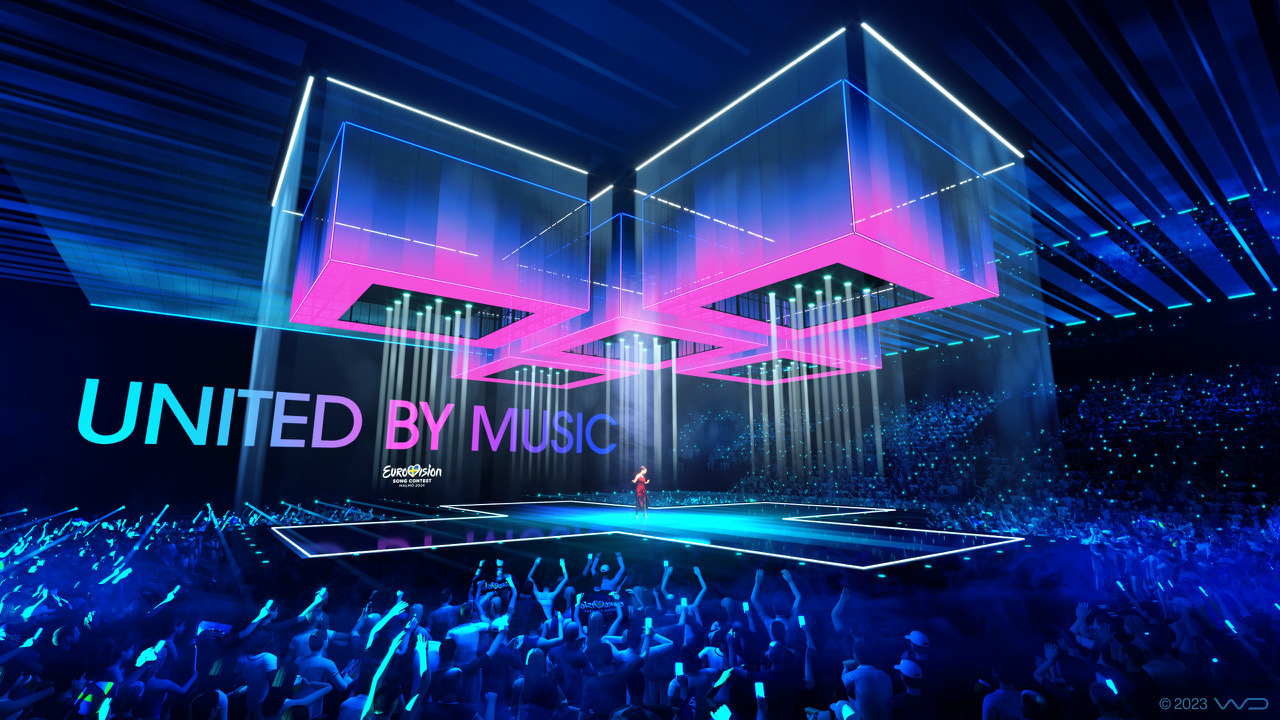

2025 Eurovision Significant Opposition To Israels Presence

May 14, 2025

2025 Eurovision Significant Opposition To Israels Presence

May 14, 2025 -

Fraenkische Schweiz Kirschbluete In Pretzfeld Und Umgebung

May 14, 2025

Fraenkische Schweiz Kirschbluete In Pretzfeld Und Umgebung

May 14, 2025 -

Kanye West And Bianca Censori Repairing Their Relationship

May 14, 2025

Kanye West And Bianca Censori Repairing Their Relationship

May 14, 2025 -

Kenin Injury Paolinis Dubai Victory Cut Short

May 14, 2025

Kenin Injury Paolinis Dubai Victory Cut Short

May 14, 2025 -

Eurovision 2025 All Important Dates Final And Semi Finals

May 14, 2025

Eurovision 2025 All Important Dates Final And Semi Finals

May 14, 2025