Escape To The Country: Financing Your Rural Dream

Table of Contents

Understanding Rural Property Values and Appraisal

Rural property valuation presents complexities not typically found in urban areas. Unlike city properties, where comparable sales data is abundant, rural property appraisals require a nuanced understanding of factors that significantly impact value. These include:

- Land Size: The acreage plays a crucial role, significantly impacting the overall value. Larger plots of land command higher prices.

- Condition of Property: The age, structural integrity, and overall condition of any existing buildings are key factors. Renovation needs can heavily influence appraisal value.

- Location: Proximity to towns, schools, and essential amenities will affect value. Remote properties, while offering greater privacy, may have lower values.

- Access to Amenities: The availability of utilities like electricity, water, internet, and reliable roads is crucial and impacts the appraisal.

- Potential for Development: The zoning regulations and the potential for future development (e.g., building additional structures or subdividing the land) influence the property's worth.

Bullet Points:

- Importance of a qualified rural appraiser: Finding an appraiser experienced in rural properties is essential for an accurate valuation.

- Potential challenges in obtaining accurate valuations: The scarcity of comparable sales in rural areas can make obtaining a precise valuation challenging.

- Impact of market fluctuations in rural areas: Rural property markets can be more susceptible to fluctuations than urban markets, impacting appraisal values.

Navigating Rural Mortgage Options

Securing a country home loan requires careful consideration of the various mortgage options available. Understanding the nuances of each will help you make an informed decision. Common options include:

- Conventional Loans: These are offered by private lenders and are suitable for rural properties, but often require a higher down payment and a strong credit score.

- USDA Rural Development Loans: These government-backed loans are specifically designed for rural properties and often offer favorable terms, including low down payments and competitive interest rates. Eligibility is based on income and location, with specific requirements for the property.

- FHA Loans: The Federal Housing Administration insures these loans, making them accessible to borrowers with lower credit scores. While they can be used for rural properties, the appraisal process may be more stringent.

Bullet points:

- USDA Rural Development Loans: These are particularly advantageous for low-to-moderate-income borrowers looking to purchase rural properties. Check the USDA website for eligibility requirements and program details.

- Conventional loans and their suitability for rural properties: While suitable, they often demand higher down payments and stricter credit qualifications.

- FHA loans and their potential role in rural home financing: FHA loans offer a pathway for borrowers with less-than-perfect credit to purchase a rural home.

- Potential for higher down payments in rural areas: Lenders may require higher down payments for rural properties due to perceived higher risk.

Securing Pre-Approval and Working with Lenders

Before you start searching for your dream country home, securing pre-approval for a rural mortgage is crucial. This establishes your borrowing capacity and strengthens your position when making an offer on a property. It’s essential to find lenders familiar with the intricacies of rural property financing. These often include:

- Local Banks and Credit Unions: They often possess detailed local market knowledge and are more likely to understand the unique aspects of rural property financing.

- Specialized Lenders: Some lenders focus on agricultural or rural loans and possess expertise in this niche market.

Bullet Points:

- Gathering necessary documentation for pre-approval: This typically includes proof of income, credit reports, and employment history.

- Importance of strong communication with lenders: Open communication with your lender is critical throughout the process.

- Negotiating favorable terms for your rural mortgage: Don't hesitate to negotiate interest rates, loan terms, and closing costs.

Additional Costs and Considerations for Rural Properties

Beyond the mortgage itself, several other costs must be considered when financing a rural property:

- Property Taxes: These can vary significantly depending on the location and the assessed value of the property.

- Insurance: Insurance premiums for rural properties may be higher due to factors like increased distance from emergency services and higher risk of damage from natural disasters.

- Well and Septic Maintenance: If your property relies on a well and septic system, be prepared for regular maintenance and potential repair costs.

Bullet Points:

- Higher insurance premiums due to increased risk factors: Factor in potentially higher insurance costs compared to urban areas.

- Potential costs associated with well and septic systems: Budget for regular maintenance and potential repairs of these essential systems.

- Utility infrastructure considerations (electricity, internet access): Rural properties may have limited or unreliable access to utilities. Investigate the costs and availability of these services beforehand.

- Unexpected repair costs for older rural properties: Older rural properties often require more maintenance and repairs.

Realizing Your Country Dream Through Smart Financing

Financing a rural property requires careful planning and a thorough understanding of the unique aspects of rural property valuation and mortgage options. By understanding rural property values, exploring different mortgage options, securing pre-approval, and accounting for additional costs, you can significantly increase your chances of securing your rural dream. Remember, working with lenders specializing in rural properties is key to a smooth and successful financing process. Start planning your escape to the country today by researching lenders, exploring your financing options, and taking the first steps towards securing your rural mortgage and financing your country home. Don't delay in securing your rural dream; start your research now!

Featured Posts

-

Flying Around Memorial Day 2025 When To Book For Best Prices

May 24, 2025

Flying Around Memorial Day 2025 When To Book For Best Prices

May 24, 2025 -

Joe Jonas Responds To Couple Arguing About Him The Full Story

May 24, 2025

Joe Jonas Responds To Couple Arguing About Him The Full Story

May 24, 2025 -

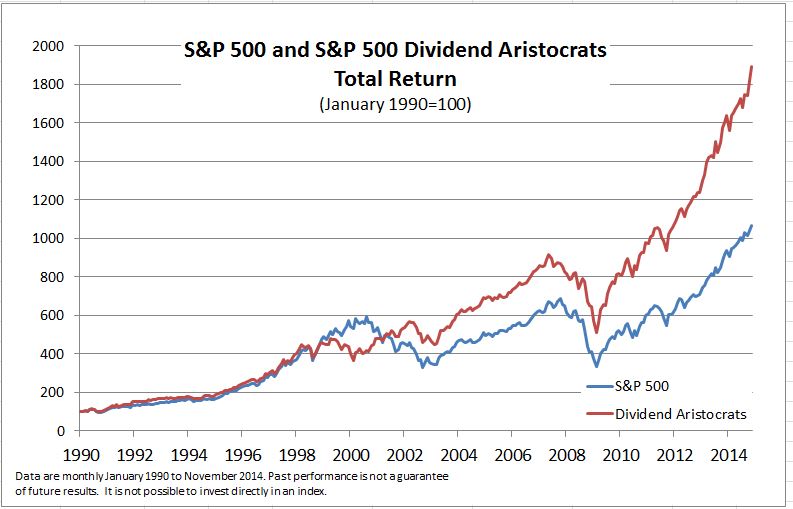

Amundi Dow Jones Industrial Average Ucits Etf Tracking The Nav And Its Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Tracking The Nav And Its Implications

May 24, 2025 -

Skolko Let Geroyam V Filme O Bednom Gusare Zamolvite Slovo Razbor Po Personazham

May 24, 2025

Skolko Let Geroyam V Filme O Bednom Gusare Zamolvite Slovo Razbor Po Personazham

May 24, 2025 -

Apresentacao Oficial Ferrari 296 Speciale E Seu Motor Hibrido De 880 Cv

May 24, 2025

Apresentacao Oficial Ferrari 296 Speciale E Seu Motor Hibrido De 880 Cv

May 24, 2025