Escape To The Country: Financing Your Rural Property

Table of Contents

Understanding the Unique Challenges of Rural Property Financing

Securing a loan for a rural property differs significantly from urban financing. Understanding these unique challenges is the first step towards successful escape to the country financing.

Higher Loan-to-Value Ratios (LTVs) and Appraisal Challenges

Rural properties often present unique appraisal hurdles. Limited comparable sales data and lower market liquidity compared to urban areas can result in lower appraisals. This often translates to higher loan-to-value ratios (LTVs) and, consequently, a need for larger down payments or smaller loan amounts.

- Research lenders specializing in rural properties: Many lenders have experience with the nuances of rural property valuation.

- Obtain a professional appraisal from a rural property expert: An appraisal from an appraiser familiar with rural markets will provide a more accurate valuation and strengthen your loan application.

- Consider a larger down payment: A larger down payment can compensate for potential appraisal challenges and improve your chances of loan approval. This is a key aspect of successful escape to the country financing.

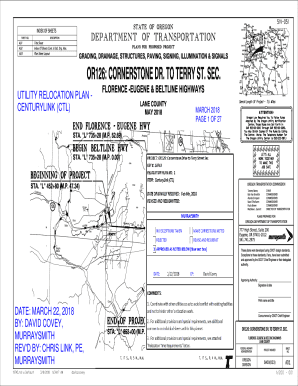

Location and Accessibility Considerations

The location of your rural property significantly impacts its value and financing options. Properties in remote areas with limited access to utilities and amenities may be harder to finance. Lenders assess the risk associated with such locations.

- Assess the property's accessibility and proximity to amenities: Carefully consider factors such as road conditions, distance to schools, hospitals, and other services.

- Be prepared to explain the property's location and its potential value to lenders: Highlight the property’s unique features and potential for appreciation.

- Explore government-backed loan programs: Programs like USDA loans may be more lenient on location requirements than conventional lenders.

Exploring Different Financing Options for Rural Properties

Several financing options cater to the specific needs of rural property buyers. Understanding these options is vital for effective escape to the country financing.

Traditional Mortgages

Conventional mortgages can finance rural properties, but they often require excellent credit scores and substantial down payments, sometimes exceeding 20%. Securing a competitive interest rate is crucial.

- Compare interest rates and loan terms from multiple lenders: Shop around to find the best deal.

- Improve your credit score before applying for a mortgage: A higher credit score significantly improves your chances of approval and secures better interest rates.

- Save diligently for a substantial down payment: The larger your down payment, the better your chances of securing a loan.

USDA Rural Development Loans

The United States Department of Agriculture (USDA) offers rural development loans designed to make homeownership in rural areas more accessible. These loans offer significant advantages for escape to the country financing.

- Check your eligibility on the USDA Rural Development website: Eligibility criteria include income limits and property location within designated rural areas. There are two main types: 502 Guaranteed and Direct loans, each with its requirements.

- Understand the income limits and property location requirements: Ensure your income and the property location meet the program's criteria.

- Be prepared for potential longer processing times: USDA loan processing times can be longer than conventional mortgages.

Farm Credit Loans

For agricultural properties and land, Farm Credit institutions offer specialized financing options tailored to the needs of farmers and ranchers. These loans often have longer terms and focus on the agricultural aspect of the land.

- Research local Farm Credit associations: They are cooperative lending institutions serving agricultural communities.

- Understand the requirements for agricultural loans: These loans may require detailed financial information about your farming operation.

- Consider long-term financing options suitable for agricultural operations: These loans often offer longer repayment periods to align with the long-term nature of agricultural investments.

Tips for a Successful Rural Property Financing Application

A strong financial profile and working with the right lender are key factors for successful escape to the country financing.

Strengthening Your Financial Profile

A strong financial foundation significantly increases your chances of loan approval.

- Pay down high-interest debt: Reduce your debt-to-income ratio to improve your creditworthiness.

- Maintain consistent employment: Demonstrate stable income to reassure lenders of your ability to repay the loan.

- Save diligently for a down payment and closing costs: Having sufficient savings shows financial responsibility.

Working with a Rural Property Specialist

Partnering with experienced professionals is crucial.

- Find a lender familiar with USDA and other rural loan programs: Their expertise simplifies the application process.

- Seek out a lender who understands the nuances of rural property valuations: This ensures a fair and accurate appraisal.

- Be prepared to answer detailed questions about your plans for the property: Lenders want to understand your intentions and the property's long-term value.

Conclusion

Securing financing for your escape to the country requires careful planning and preparation. By understanding the unique challenges and exploring various financing options like traditional mortgages, USDA loans, and Farm Credit loans, you can significantly increase your chances of success. Remember to strengthen your financial profile and work with a knowledgeable lender experienced in rural property financing. Start planning your escape to the country today – find the right financing and make your rural dreams a reality! Don't hesitate to explore all your escape to the country financing options today.

Featured Posts

-

Prominent Maryland Attorney And Advocate George L Russell Jr Dies

May 25, 2025

Prominent Maryland Attorney And Advocate George L Russell Jr Dies

May 25, 2025 -

Titan Sub Implosion Footage Reveals The Devastating Sound

May 25, 2025

Titan Sub Implosion Footage Reveals The Devastating Sound

May 25, 2025 -

Your Escape To The Country A Step By Step Relocation Plan

May 25, 2025

Your Escape To The Country A Step By Step Relocation Plan

May 25, 2025 -

Tim Rices Return New Lyrics For Land Of Sometimes In The Lion King Universe

May 25, 2025

Tim Rices Return New Lyrics For Land Of Sometimes In The Lion King Universe

May 25, 2025 -

The China Us Trade Truce Exporters Scramble To Capitalize

May 25, 2025

The China Us Trade Truce Exporters Scramble To Capitalize

May 25, 2025