ETF Sales Pressure: Taiwan's Regulatory Scrutiny Of Financial Firms

Table of Contents

Intensified Regulatory Oversight and its Impact on ETF Sales

Recent amendments to Taiwan's financial regulations have dramatically increased the burden of compliance for firms selling ETFs. This intensified regulatory oversight is directly impacting sales strategies and profitability. The increased focus on investor protection is leading to several key changes:

-

Stricter Client Suitability Assessments: Financial institutions are now required to conduct far more rigorous client suitability assessments and risk profiling before recommending any ETF investment. This involves a deeper understanding of the client's investment goals, risk tolerance, and financial knowledge. Failure to adequately assess client suitability can lead to significant penalties.

-

Enhanced Due Diligence: The due diligence process for selecting and recommending ETFs has become significantly more demanding. Firms must thoroughly research and evaluate the underlying assets, the fund manager's track record, and the potential risks associated with each ETF. This meticulous approach increases operational costs and requires specialized expertise.

-

Scrutiny of Marketing Materials and Sales Practices: Regulatory bodies are scrutinizing marketing materials and sales practices with a keen eye for misleading or exaggerated claims. Clear and accurate communication regarding ETF risks is paramount. Any instances of misrepresentation can result in severe consequences.

-

Increased Compliance Costs: Implementing robust compliance programs and conducting thorough due diligence comes at a considerable cost. Financial firms are facing higher expenses related to legal counsel, compliance software, and staff training.

-

Potential Sales Restrictions: The regulatory changes might lead to limitations on the types of ETFs that can be actively promoted, particularly those perceived as higher risk. This restricts product choices and may impact sales targets.

The Role of Market Volatility and Investor Sentiment

Market volatility plays a significant role in influencing ETF sales pressure. Fluctuations in both the global and Taiwanese markets directly impact investor confidence and their appetite for riskier investment products.

-

Investor Confidence and ETF Performance: Negative ETF performance, particularly during periods of market downturn, erodes investor confidence and leads to reduced demand. This is further amplified by broader economic uncertainty.

-

Geopolitical Events and Economic Uncertainty: Geopolitical events and economic uncertainties significantly impact investor sentiment. Times of heightened uncertainty often see investors shift towards more conservative investment strategies, impacting the demand for ETFs.

-

Shifting Investor Preferences: Investor preferences are constantly evolving. The increased scrutiny on risk management is forcing investors to become more discerning, seeking greater transparency and detailed information before committing funds.

-

Adapting Sales Strategies: Financial firms need to adapt their sales strategies to address these evolving investor concerns. This includes providing transparent and comprehensive information about ETF risks and potential returns, and offering a wider array of investment options to suit diverse risk profiles.

Specific Examples of Regulatory Actions and their Consequences

Several recent cases illustrate the consequences of non-compliance in Taiwan's ETF market. For instance, [Insert Example 1: Name of a financial institution fined for non-compliance and the penalty amount]. This case highlights the importance of robust risk management and proper client suitability assessment. Another example, [Insert Example 2: Another case of regulatory action and its consequences], underscores the need for accurate marketing and transparent disclosures. These enforcement actions serve as a cautionary tale for other financial institutions operating in Taiwan. The fines imposed significantly impact profitability and can damage the firm's reputation. Conversely, compliant institutions benefit from a stronger reputation and enhanced client trust.

Strategies for Financial Firms to Navigate the Changing Regulatory Landscape

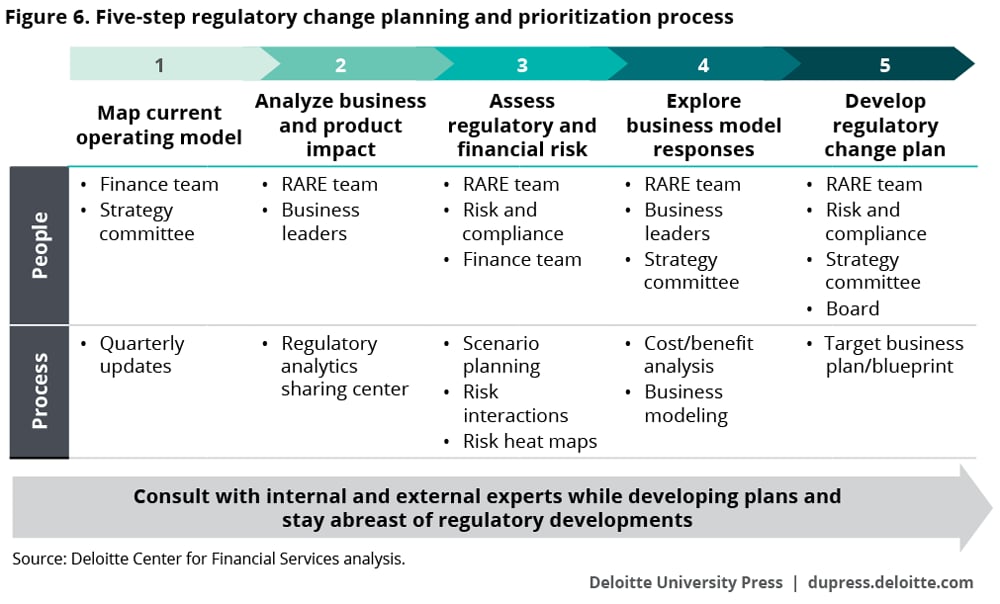

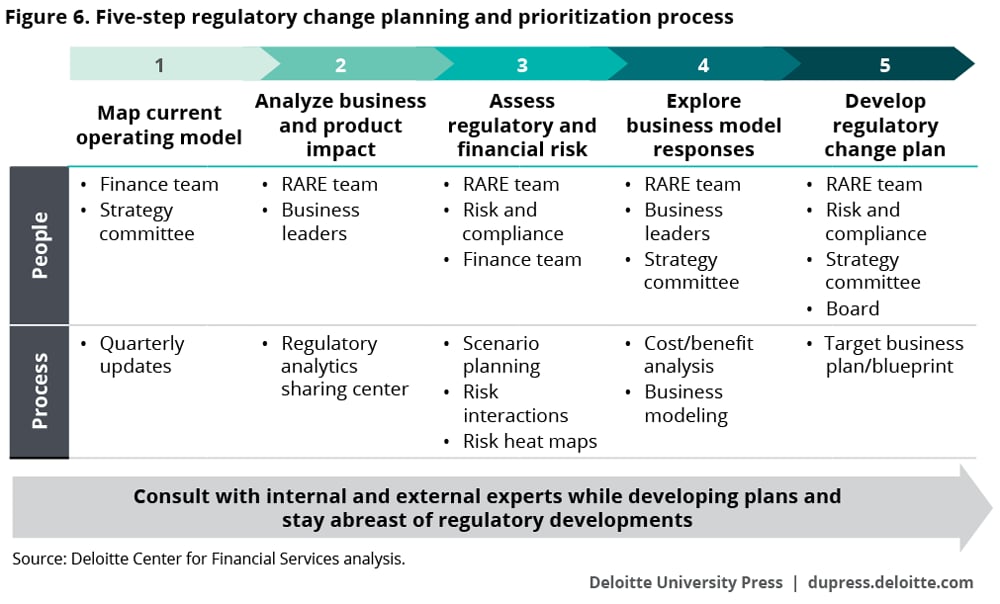

Navigating the increased regulatory scrutiny requires a proactive and multi-faceted approach. Financial firms must implement comprehensive strategies to ensure compliance and maintain sustainable growth in the ETF market.

-

Investing in Compliance Technology: Adopting advanced compliance technology can streamline processes, automate tasks, and reduce errors. This ensures that the firm's operations are compliant with the latest regulations.

-

Robust Sales Staff Training: Providing comprehensive training for sales staff on regulatory requirements, client suitability assessments, and ethical sales practices is crucial. Continuous education and updates are necessary to keep pace with evolving regulations.

-

Transparent Marketing Materials: Developing clear, concise, and transparent marketing materials for ETFs is critical to managing investor expectations and avoiding misrepresentations.

-

Proactive Engagement with Regulators: Maintaining open communication and proactive engagement with regulators allows firms to understand evolving expectations and proactively address potential compliance gaps.

-

Diversifying Product Offerings: Offering a diverse range of investment products can help mitigate risks and cater to the changing needs and preferences of investors.

Conclusion

The increased regulatory scrutiny in Taiwan is significantly impacting ETF sales, forcing financial firms to adapt their strategies and prioritize compliance. Market volatility and investor sentiment further compound the challenges. Understanding the evolving regulatory landscape is crucial for all financial firms operating in Taiwan. Staying informed about changes in regulations and implementing effective compliance strategies, including advanced technology and robust training programs, are essential for mitigating risks and ensuring sustainable growth in the ETF market. Proactive adaptation to this ETF sales pressure is vital for long-term success.

Featured Posts

-

Mls Injury News Martinez And White Sidelined For Saturdays Match

May 15, 2025

Mls Injury News Martinez And White Sidelined For Saturdays Match

May 15, 2025 -

The Unexpected Truth Behind Trumps Egg Price Comments

May 15, 2025

The Unexpected Truth Behind Trumps Egg Price Comments

May 15, 2025 -

Ataka Rf Na Ukrainu 200 Raket I Dronov Posledstviya I Analiz

May 15, 2025

Ataka Rf Na Ukrainu 200 Raket I Dronov Posledstviya I Analiz

May 15, 2025 -

Kanadensiska Stjaernor Uteblir Vm Hockeyn 2024 Tre Kronors Chanser Oekar

May 15, 2025

Kanadensiska Stjaernor Uteblir Vm Hockeyn 2024 Tre Kronors Chanser Oekar

May 15, 2025 -

Padres Vs Pirates Prediction Picks And Odds For Todays Mlb Game

May 15, 2025

Padres Vs Pirates Prediction Picks And Odds For Todays Mlb Game

May 15, 2025