Ethereum Nears $2,700: Wyckoff Accumulation Analysis

Table of Contents

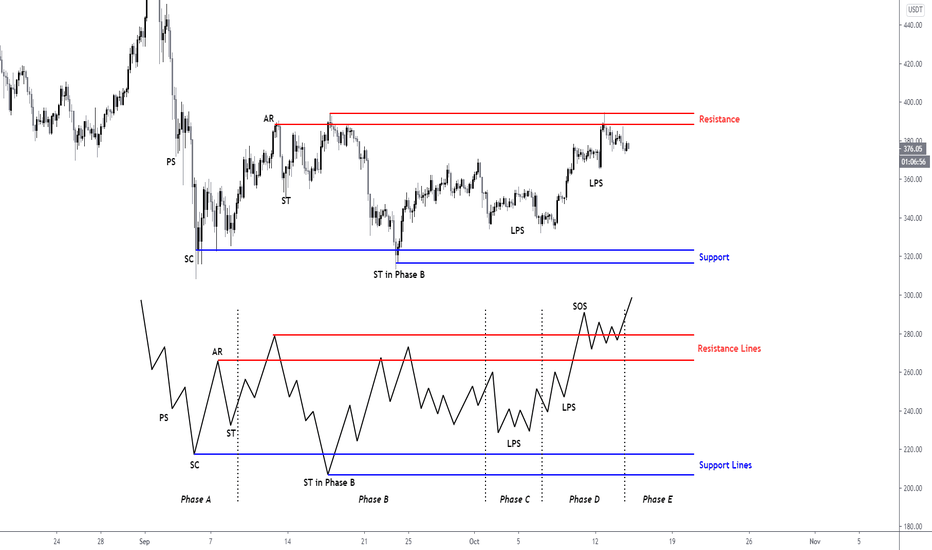

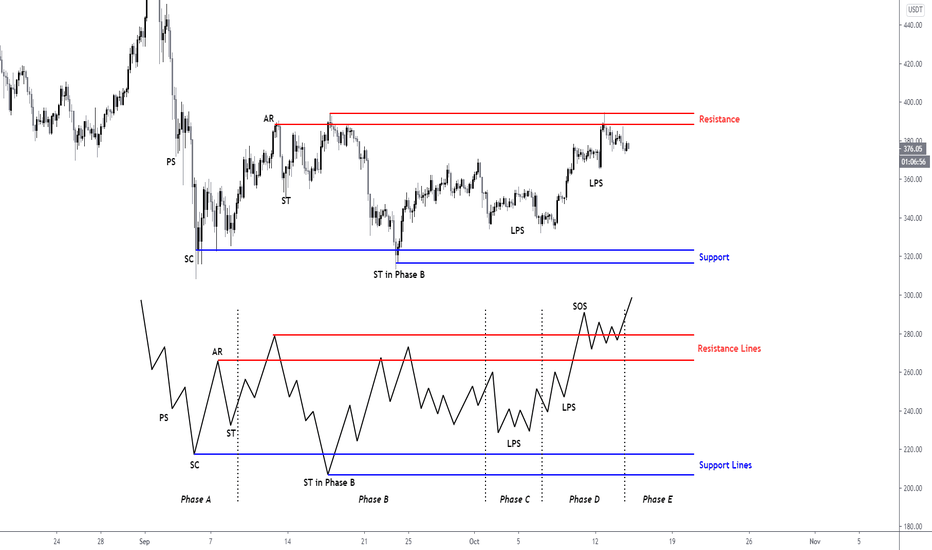

This article delves into a technical analysis of Ethereum's current market behavior using the Wyckoff method, a powerful tool for identifying potential accumulation phases before significant price increases. We will examine key phases, supporting technical indicators, on-chain metrics, and potential risks to determine if Ethereum is indeed poised for a bullish breakout.

Understanding Wyckoff Accumulation in the Context of Ethereum

The Wyckoff Accumulation method identifies periods where large investors (smart money) are secretly accumulating a significant amount of an asset before a price surge. It's characterized by a series of phases, each with distinct price and volume characteristics. Understanding these phases is crucial for identifying potential accumulation in Ethereum.

Let's examine the key phases within the context of Ethereum's recent price action (Note: Illustrative charts would be inserted here showing these phases in relation to Ethereum's price history).

- Spring: A brief upward price move designed to shake out weak holders. In Ethereum's case, we observed a small rally followed by a slight pullback, potentially acting as a spring.

- Markup: A period of higher volume and price increases, often characterized by strong buying pressure. Ethereum showed signs of this phase during a recent period of upward momentum.

- Sign of Weakness (SoW): A period of lower volume and slight price declines, allowing smart money to accumulate further. This phase often involves a test of a key support level. A recent pullback in Ethereum’s price could potentially represent this phase.

- Secondary Test: A retest of the SoW low, confirming support and attracting more buyers. This phase, if successfully completed, strongly suggests accumulation. A second test of a recent support level would validate this phase within Ethereum's analysis.

Volume analysis is critical in each phase. High volume during markups confirms strong buying pressure, while declining volume during the SoW and secondary test suggests smart money accumulation.

Technical Indicators Supporting Wyckoff Accumulation in Ethereum

Several technical indicators support the Wyckoff accumulation hypothesis for Ethereum. (Note: Charts illustrating these indicators alongside Ethereum's price would be included here).

- RSI (Relative Strength Index): A reading below 30 often suggests oversold conditions, and in Ethereum's case, we have seen periods where the RSI dipped below this level, suggesting potential accumulation.

- MACD (Moving Average Convergence Divergence): Bullish divergences in the MACD, where the price makes lower lows but the MACD forms higher lows, are often a sign of accumulating buying pressure. We've observed this pattern in Ethereum's recent chart.

- OBV (On-Balance Volume): The OBV shows a rising trend despite periods of price consolidation, indicating underlying accumulation. In Ethereum, the OBV has exhibited a generally upward trend despite recent price fluctuations.

Potential divergences or confirmations from these indicators offer further insights into the strength of the accumulation pattern. Any conflicting signals should be carefully considered to assess the overall market sentiment and potential risks.

On-Chain Metrics Suggesting Potential Accumulation

On-chain data provides another layer of confirmation for the Wyckoff accumulation hypothesis. (Note: Charts visualizing the on-chain data would be inserted here.)

- Exchange Balances: Decreasing exchange balances suggest investors are moving their Ethereum off exchanges, indicating a belief in a price increase. We've seen a trend of decreasing Ethereum held on exchanges recently.

- Active Addresses: A rise in active addresses implies increased participation and network activity, potentially indicating increased demand. Ethereum has shown a recent uptick in active addresses.

- Transaction Volume: While the price may fluctuate, a sustained transaction volume can indicate persistent demand and buying pressure. This has been consistently observed for Ethereum.

Risk Assessment and Potential Scenarios for Ethereum

While the Wyckoff Accumulation pattern is promising, it’s crucial to acknowledge potential risks.

- Invalidation: A significant breakdown below key support levels would invalidate the accumulation pattern, suggesting a more bearish outlook.

- Price Targets: If the accumulation pattern holds, potential price targets could range from $3000 to $4000 depending on the strength of the subsequent breakout.

- Risk Management: Always implement proper risk management techniques, such as stop-loss orders, to mitigate potential losses.

Various scenarios are possible: a bullish breakout above $2700 leading to substantial gains, a continued sideways trend, or a bearish breakdown below key support levels.

Conclusion: Ethereum's Potential and the Future of Wyckoff Accumulation Analysis

Our Wyckoff Accumulation analysis suggests that Ethereum's price movement around the $2700 mark may indicate a potential bullish trend reversal. The convergence of technical indicators, on-chain data, and the characteristics of a Wyckoff Accumulation pattern paints a compelling picture. However, risks remain, and careful monitoring is essential. The success of this analysis hinges on whether Ethereum can decisively break above the $2700 resistance level.

Stay informed about Ethereum's price movements and continue your own Wyckoff Accumulation analysis to make informed decisions. Further research into Ethereum price analysis, the Wyckoff method for Ethereum, and Ethereum market predictions will enhance your understanding and trading strategies.

Featured Posts

-

Oklahoma City Thunder Vs Portland Trail Blazers How To Watch On March 7th

May 08, 2025

Oklahoma City Thunder Vs Portland Trail Blazers How To Watch On March 7th

May 08, 2025 -

Is War Imminent Examining The Kashmir Factor In India Pakistan Relations

May 08, 2025

Is War Imminent Examining The Kashmir Factor In India Pakistan Relations

May 08, 2025 -

Thunder Players Criticize National Media

May 08, 2025

Thunder Players Criticize National Media

May 08, 2025 -

Kripto Varliklarda Miras Sifre Bilinmezse Miras Kaybi Riski

May 08, 2025

Kripto Varliklarda Miras Sifre Bilinmezse Miras Kaybi Riski

May 08, 2025 -

Gha Condemns Proposed Jhl Privatization A Critical Analysis

May 08, 2025

Gha Condemns Proposed Jhl Privatization A Critical Analysis

May 08, 2025