EUR/USD: Lagarde's Renewed Focus On Strengthening The Euro's International Standing

Table of Contents

Lagarde's Initiatives to Enhance the Euro's International Standing

Lagarde's strategy to enhance the euro's global presence involves a multi-pronged approach focusing on several key areas. Her actions aim not only to increase the euro's usage in international transactions but also to solidify the Eurozone's economic strength and resilience.

Promoting the Euro as a Global Reserve Currency

- Increased advocacy for euro usage in international trade and finance: Lagarde has actively promoted the euro as a viable alternative to the US dollar in international transactions, advocating for its increased use in reserves and cross-border payments.

- Collaboration with international organizations: The ECB is working with international financial institutions to facilitate the euro's adoption in global markets. This includes streamlining cross-border payment systems and promoting the euro's role in international trade agreements.

- Deepening of financial markets: The ECB is working to foster deeper and more liquid euro-denominated financial markets to attract international investors and enhance the euro's attractiveness as a reserve currency.

The US dollar currently dominates the global reserve currency landscape, holding a significant market share. However, increasing geopolitical uncertainties and the desire for diversification are creating opportunities for other currencies, including the euro. A higher international usage of the euro would reduce reliance on the dollar, benefiting European businesses by decreasing their exposure to dollar-related volatility and potentially lowering transaction costs. While achieving parity with the dollar remains a long-term goal, increasing the euro's usage in international reserves even modestly could significantly boost its standing.

Strengthening the Eurozone Economy

A robust Eurozone economy is fundamentally linked to the euro's strength. Lagarde's efforts to improve the economic performance of the Eurozone are directly tied to her currency ambitions.

- Inflation control through monetary policy: The ECB has implemented a series of monetary policies aimed at controlling inflation while supporting sustainable economic growth. This includes adjusting interest rates and managing liquidity in the financial system.

- Structural reforms: The ECB is encouraging member states to undertake structural reforms to enhance the competitiveness and productivity of the Eurozone economy.

- Investment in sustainable growth: The ECB is promoting investment in sustainable and green technologies to support long-term economic growth and improve the Eurozone's resilience to global shocks.

Strong GDP growth, stable inflation rates, and a healthy fiscal environment all positively influence investor confidence, thereby increasing the demand for the euro and supporting a stronger EUR/USD exchange rate. The ECB's commitment to fostering these factors is vital for achieving Lagarde's objectives.

Addressing Geopolitical Risks and Uncertainties

Geopolitical events and global uncertainties can significantly impact currency markets. The ECB plays a critical role in managing and mitigating these risks.

- Maintaining financial stability: The ECB actively works to maintain financial stability within the Eurozone, particularly during times of crisis. This includes acting as a lender of last resort to banks and taking measures to support the financial system during times of stress.

- Strategic communication: Clear and transparent communication by the ECB regarding its policies and responses to global events helps maintain investor confidence and minimize market volatility.

- Diversification of energy sources: The Eurozone's dependence on Russian energy has been a source of vulnerability. Reducing this dependence is crucial for the region's economic and political stability, which in turn affects the euro's strength.

The war in Ukraine, energy crises, and global trade tensions create uncertainty that can negatively impact the euro. However, the ECB's proactive approach to managing these risks, promoting economic resilience, and maintaining clear communication aims to mitigate the negative impact on the EUR/USD exchange rate.

Impact on the EUR/USD Exchange Rate

Lagarde's initiatives have both short-term and long-term implications for the EUR/USD exchange rate.

Short-Term Volatility and Long-Term Trends

- Market reaction to ECB policies: The market's reaction to Lagarde's statements and policy decisions will cause short-term volatility in the EUR/USD exchange rate. Announcements about interest rate changes or other monetary policy adjustments can lead to immediate fluctuations.

- Investor sentiment: Overall investor confidence in the Eurozone economy and the euro's future prospects will also play a significant role. Positive sentiment will typically lead to increased demand for the euro and strengthen the EUR/USD exchange rate, while negative sentiment can have the opposite effect.

- Geopolitical developments: Unexpected geopolitical events can significantly impact the EUR/USD exchange rate in the short term, regardless of the ECB’s long-term strategy.

The long-term trend will depend largely on the success of Lagarde's initiatives in strengthening the Eurozone economy and increasing the euro's global usage. Successful implementation of these policies should, over time, lead to a stronger euro against the dollar.

Implications for Investors and Businesses

Fluctuations in the EUR/USD exchange rate have a significant impact on investors and businesses.

- Currency trading: Currency traders closely monitor the EUR/USD exchange rate to profit from short-term fluctuations.

- Portfolio diversification: Investors use the EUR/USD exchange rate to diversify their investment portfolios and manage currency risk.

- Import/export costs: Businesses engaged in international trade are directly impacted by changes in the EUR/USD exchange rate, influencing their import and export costs. A stronger euro makes imports cheaper for European businesses but exports more expensive for international buyers.

- Hedging strategies: Businesses can use various hedging strategies, such as forward contracts or options, to mitigate currency risk and protect themselves against adverse exchange rate movements.

For example, a German exporter selling goods to the US will see lower revenues in euros if the EUR/USD exchange rate weakens. Conversely, a US company importing goods from Europe will pay more dollars if the euro strengthens.

Conclusion

Christine Lagarde's concerted effort to enhance the euro's global standing is a significant development that will significantly impact the EUR/USD exchange rate. Her strategic initiatives, aimed at fostering economic strength within the Eurozone and promoting the euro as a prominent reserve currency, possess the potential to lead to long-term appreciation of the euro against the dollar. Although short-term volatility is expected, successful execution of these policies could have a positive impact on businesses, investors, and the overall stability of the global financial system. To make informed decisions about currency trading and international investments, staying updated on the latest developments in ECB monetary policy and the EUR/USD exchange rate is crucial. Understanding the influence of Lagarde's actions on the EUR/USD is vital for navigating the complexities of the foreign exchange market.

Featured Posts

-

Informasi Jadwal Kapal Km Lambelu Nunukan Makassar Hingga Juni 2025

May 28, 2025

Informasi Jadwal Kapal Km Lambelu Nunukan Makassar Hingga Juni 2025

May 28, 2025 -

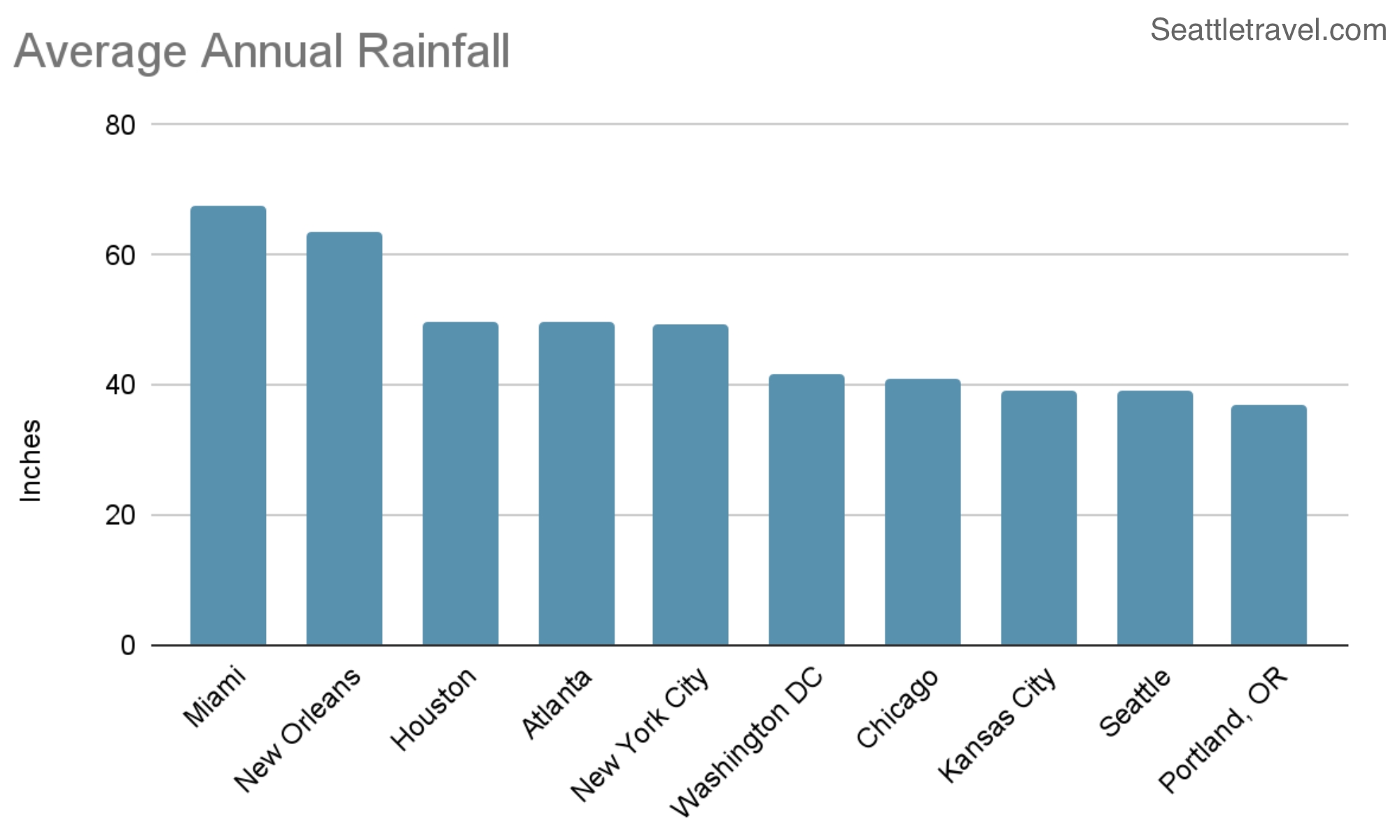

Continuous Rain Expected In Seattle This Weekend

May 28, 2025

Continuous Rain Expected In Seattle This Weekend

May 28, 2025 -

Good Morning America Hailee Steinfelds Polished Suit Look

May 28, 2025

Good Morning America Hailee Steinfelds Polished Suit Look

May 28, 2025 -

Luis Diaz Arsenals Unexpected Transfer Target

May 28, 2025

Luis Diaz Arsenals Unexpected Transfer Target

May 28, 2025 -

Hailee Steinfelds Angel Margarita A Premium Beers Group Collaboration

May 28, 2025

Hailee Steinfelds Angel Margarita A Premium Beers Group Collaboration

May 28, 2025