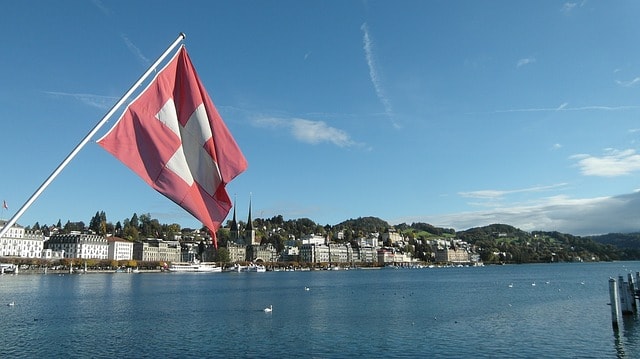

Euro And European Futures Surge: Swissquote Bank Analysis

Table of Contents

Underlying Economic Factors Driving the Euro's Rise

The recent strengthening of the Euro is underpinned by a confluence of positive economic indicators pointing towards a robust Eurozone economy. Improved economic growth, coupled with a decrease in inflation, has boosted investor confidence and fueled demand for the Euro. These positive trends are reflected in several key data points:

- Stronger-than-expected Eurozone PMI (Purchasing Managers' Index): The PMI consistently exceeding forecasts suggests a healthy expansion in manufacturing and services across the Eurozone, indicating robust economic activity.

- Decreased unemployment rates in key European economies: Lower unemployment figures signify increased consumer spending and a strengthening labor market, contributing to overall economic growth and stability.

- Positive revisions to GDP forecasts: Upward revisions to GDP growth projections further solidify the positive outlook for the Eurozone economy, attracting foreign investment and strengthening the Euro.

- Increased consumer and business confidence: Surveys showing improved sentiment among consumers and businesses suggest a positive outlook, supporting investment and economic expansion.

These encouraging signs contribute to a positive European economic outlook, making the Euro a more attractive currency for investors, thus driving its rise. Strong GDP growth, coupled with a controlled inflation rate, paints a picture of sustained economic strength within the Eurozone.

Impact of Geopolitical Events on European Futures

Geopolitical developments also play a significant role in influencing European futures. Recent positive shifts in the global political landscape have contributed to increased investor confidence and reduced uncertainty, positively impacting European markets. Key examples include:

- Resolution of trade disputes: The easing of trade tensions with key trading partners has reduced uncertainty and boosted investor confidence, leading to increased investment in European markets.

- Stabilization in a volatile region: Improved stability in previously volatile regions has lessened geopolitical risk, creating a more favorable investment environment for European assets.

- Positive diplomatic developments: Constructive diplomatic efforts have fostered a more stable international environment, reducing uncertainty and encouraging investment flows into the Eurozone.

Reduced geopolitical risk allows investors to focus on the fundamental economic strengths of the Eurozone, thereby further supporting the surge in Euro and European futures. The improved global political climate contributes significantly to the positive sentiment surrounding European assets.

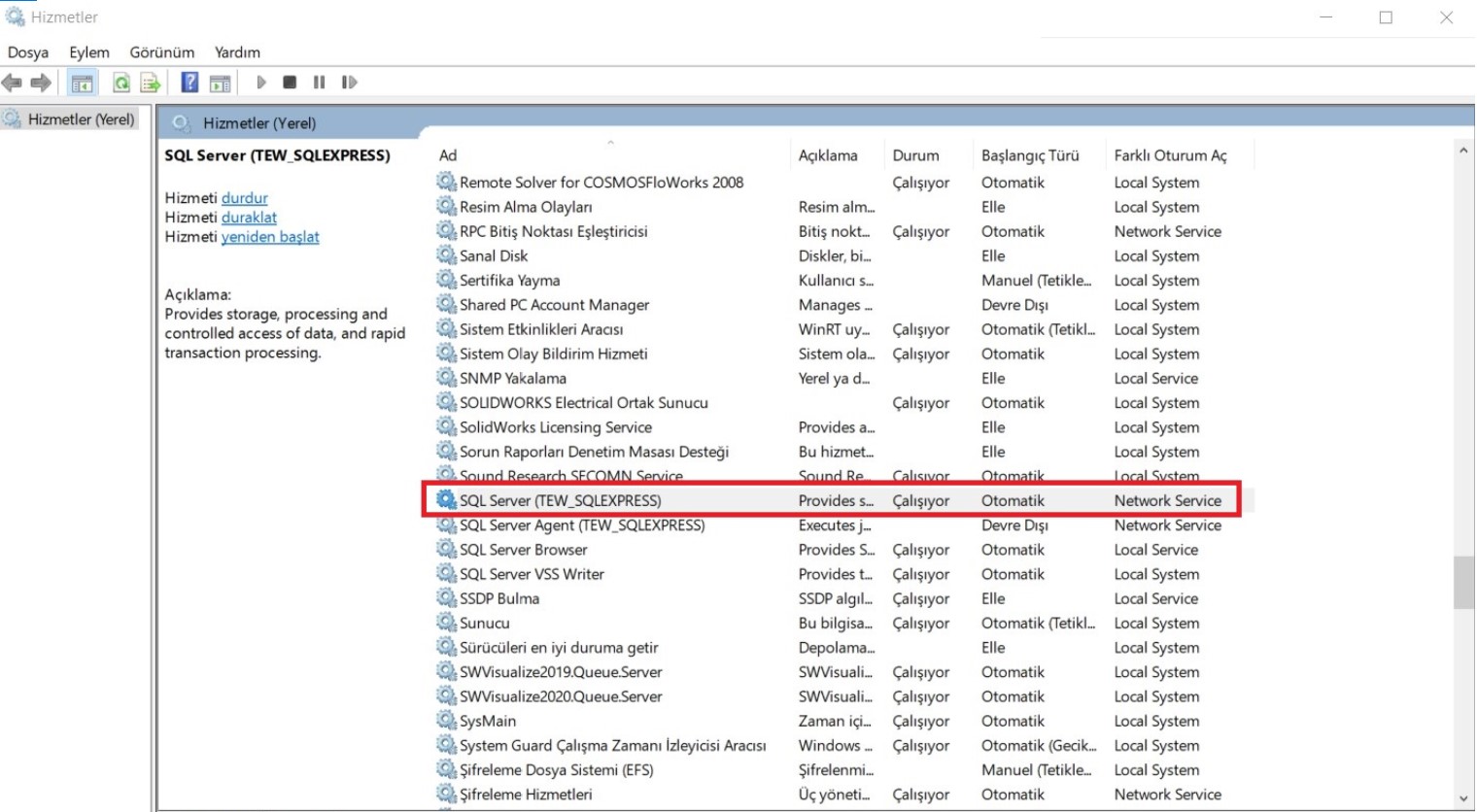

Swissquote Bank's Market Analysis and Predictions

Swissquote Bank's analysis highlights the interplay between robust economic fundamentals and a more stable geopolitical landscape as the primary drivers of the recent surge in Euro and European futures. Their market analysis points to continued positive momentum, though they caution against complacency. Swissquote Bank's forecasts suggest a continuation of the current upward trend, albeit with potential periods of consolidation. [Include chart or graph here if available from Swissquote Bank illustrating their predictions]. Their analysis emphasizes the importance of careful risk management and diversified investment strategies within this dynamic environment. The bank's expertise in forex trading and financial markets provides investors with valuable insights into navigating this evolving landscape.

Investment Strategies in Light of the Surge

Based on Swissquote Bank's analysis, several investment strategies may be considered, though all carry inherent risk. It's crucial to conduct thorough due diligence and understand your personal risk tolerance before making any investment decisions. Potential investment strategies include:

- Investing in Euro-denominated assets: This strategy benefits from the strengthening Euro, offering potential capital appreciation.

- Trading European stock indices: Exposure to leading European stock indices offers diversification and the potential for growth based on the overall economic strength of the region.

- Utilizing futures contracts for hedging or speculation: Futures contracts can be used to hedge against potential losses or to speculate on future price movements.

Careful portfolio diversification and robust risk management are essential elements of any successful investment strategy in this context. Remember that past performance is not indicative of future results, and all investments carry risk.

Conclusion: Navigating the Surge in Euro and European Futures with Swissquote Bank

The surge in Euro and European futures is driven by a combination of strong economic indicators within the Eurozone and a more stable geopolitical environment. Swissquote Bank's insightful market analysis provides crucial context for understanding this trend and developing informed investment strategies. Staying informed about market developments is critical for successful navigation of this dynamic market. To gain a deeper understanding of the opportunities and potential risks, consult Swissquote Bank's comprehensive analysis and expert insights on Euro and European futures. Stay ahead of the curve with Swissquote Bank’s expert analysis of Euro and European futures. Visit our website today to learn more.

Featured Posts

-

Carsamba Ledra Pal Da Dijital Veri Tabani Ile Isguecue Piyasasi Analizi

May 19, 2025

Carsamba Ledra Pal Da Dijital Veri Tabani Ile Isguecue Piyasasi Analizi

May 19, 2025 -

How The Stealthy Wealthy Accumulate Wealth Practical Strategies For Quiet Financial Growth

May 19, 2025

How The Stealthy Wealthy Accumulate Wealth Practical Strategies For Quiet Financial Growth

May 19, 2025 -

The Threat Of Over Regulation Londons Festivals Under Scrutiny

May 19, 2025

The Threat Of Over Regulation Londons Festivals Under Scrutiny

May 19, 2025 -

Justyna Steczkowska Taniec W Reczniku Nowy Hit Eurowizji

May 19, 2025

Justyna Steczkowska Taniec W Reczniku Nowy Hit Eurowizji

May 19, 2025 -

Analyzing The Wnba And Accusations Of White Guilt A Critical Look

May 19, 2025

Analyzing The Wnba And Accusations Of White Guilt A Critical Look

May 19, 2025