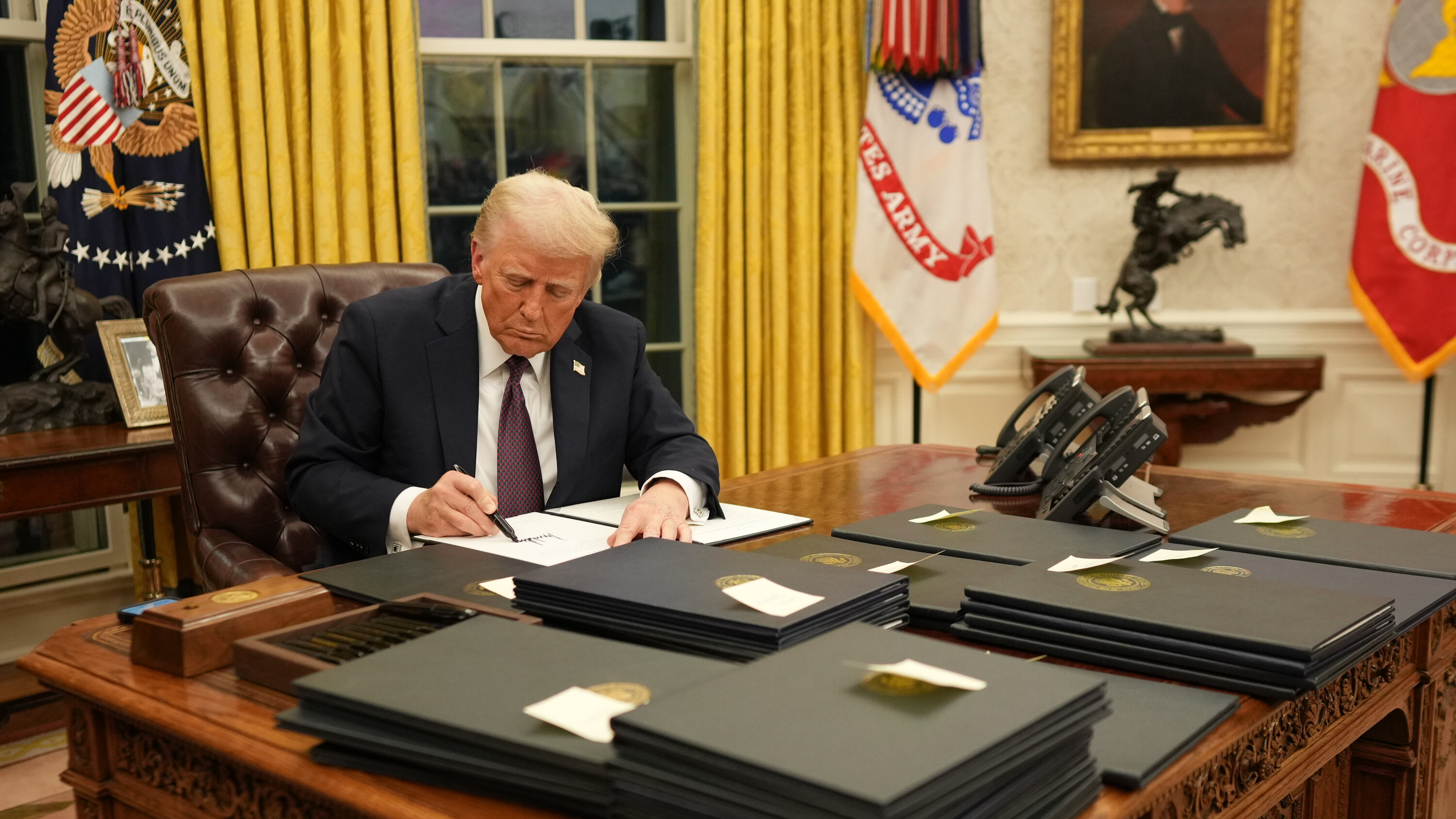

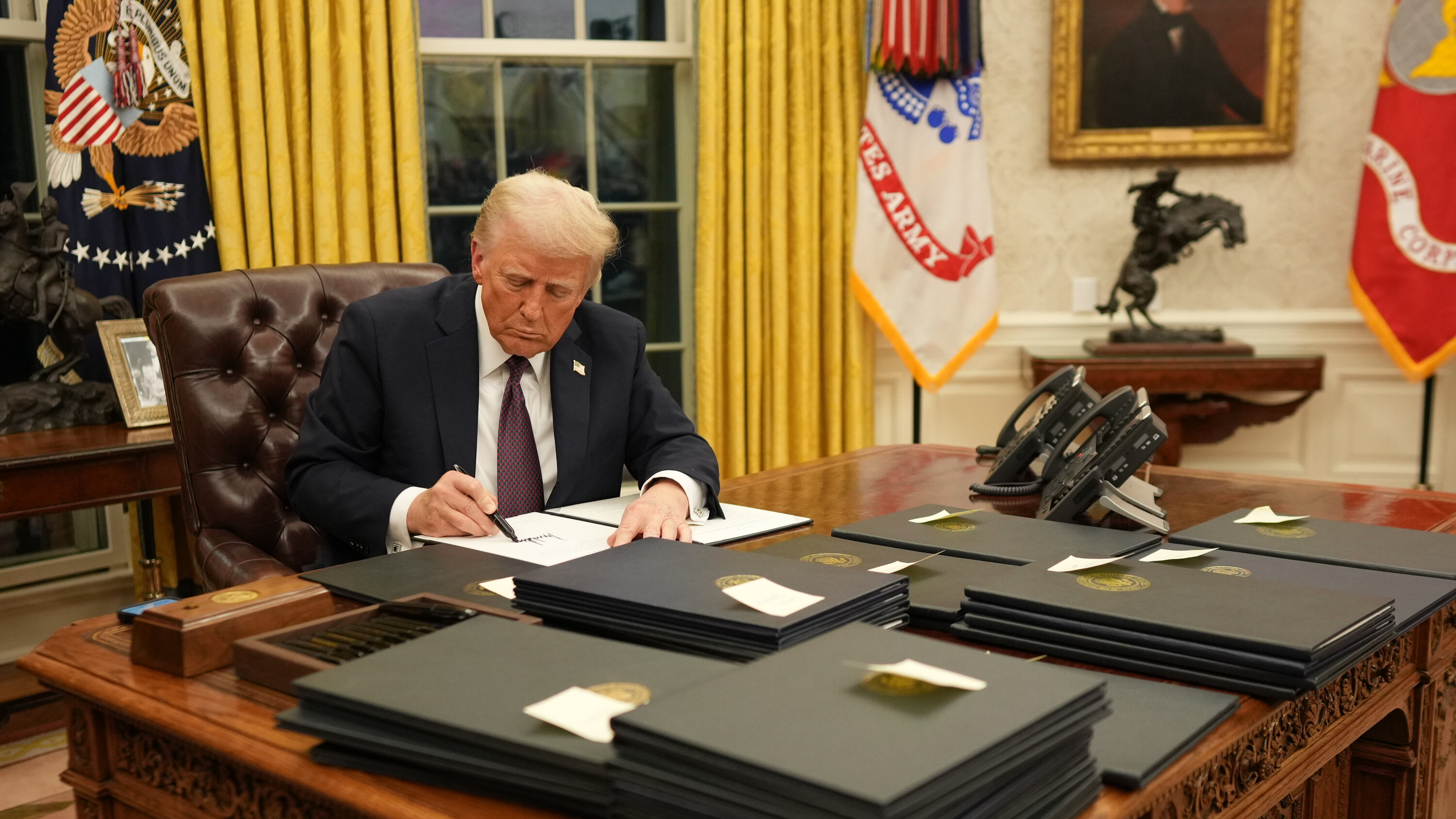

Euronext Amsterdam Market Reaction: 8% Stock Increase After Trump's Tariff Announcement

Table of Contents

Understanding the Initial Market Shock

Trump's tariff announcement triggered a wave of global market uncertainty. Major indices worldwide experienced a significant dip, reflecting a decline in investor confidence across various sectors. The initial reaction on Euronext Amsterdam mirrored this global trend, with a noticeable, albeit brief, downturn before the remarkable 8% surge.

- Global market uncertainty and volatility: The announcement created widespread fear among investors, leading to significant volatility and sell-offs in many markets.

- Decline in investor confidence: Uncertainty about the long-term economic consequences of the tariffs eroded investor confidence, causing many to divest from riskier assets.

- Immediate impact on major indices worldwide: The Dow Jones, Nasdaq, and other major global indices all experienced substantial losses following the news.

Analyzing the 8% Stock Increase on Euronext Amsterdam

The 8% stock increase on Euronext Amsterdam after the initial dip presents a fascinating case study in counter-cyclical market behavior. While the global market reacted negatively, specific sectors on the Amsterdam exchange experienced significant gains. Several factors likely contributed to this unexpected positive reaction:

- Potential sector-specific benefits from the tariffs: Certain sectors might have benefited from reduced competition due to the tariffs, leading to increased profitability for Amsterdam-listed companies in those sectors.

- Safe-haven effect: With global markets in turmoil, some investors may have sought refuge in perceived stable markets like Euronext Amsterdam, driving up demand for its stocks.

- Short-covering: Traders who had bet against the market (short positions) may have covered their positions, leading to a surge in buying pressure.

- Unexpected positive economic indicators specific to the Netherlands or Amsterdam-listed companies: Positive news unrelated to the tariffs, but released around the same time, could have contributed to the increase.

The Role of Specific Companies and Sectors

While aggregate data shows an 8% increase, the impact wasn't uniform across all sectors. Identifying specific companies and sectors that experienced the most significant gains is crucial for understanding the intricacies of this market reaction. For example, companies in certain sectors, perhaps those less directly exposed to the newly imposed tariffs or those benefiting from a weakened Euro, may have seen disproportionately large increases.

- Company-specific news or announcements coinciding with the tariff announcement: Positive news released by individual companies around the same time could have amplified the overall positive market sentiment.

- Industry-specific analysis of the impact of the tariffs: A detailed sector-by-sector analysis is needed to understand which industries were most and least impacted by the tariffs.

- Comparative analysis of similar companies on other exchanges: Comparing the performance of Amsterdam-listed companies with similar companies on other exchanges can shed light on the unique factors affecting Euronext Amsterdam.

Long-Term Implications for Euronext Amsterdam

The 8% surge on Euronext Amsterdam raises questions about the sustainability of this positive market reaction. While it demonstrated resilience in the face of global uncertainty, the long-term implications remain unclear.

- Continued investor confidence in Euronext Amsterdam: The event could bolster investor confidence in the long-term stability and resilience of the Euronext Amsterdam exchange.

- Potential for further growth or correction in the coming weeks and months: The market may continue its upward trajectory or experience a correction, depending on several factors including further economic developments and investor sentiment.

- Comparison with historical market trends and reactions: Analyzing past market reactions to similar events can help predict future trends and assess the potential for long-term growth.

Conclusion

The surprising 8% stock increase on Euronext Amsterdam following Trump's tariff announcement highlights the complexity of global markets and the importance of sector-specific analysis. While the initial global reaction was overwhelmingly negative, specific sectors and companies on Euronext Amsterdam benefited unexpectedly, showcasing the nuanced and often unpredictable nature of market dynamics. Understanding the interplay of global events and their localized impacts is crucial for effective investment strategies. Stay informed on the evolving situation by regularly checking for updates on the Euronext Amsterdam market and analyzing the impact of global events on specific sectors. Understanding the nuances of the Euronext Amsterdam market reaction to major events like this tariff announcement is crucial for successful investment strategies. Learn more about navigating the complexities of the Euronext Amsterdam market and its responses to global economic news.

Featured Posts

-

Nemecke Firmy A Hromadne Prepustanie Analyza Situacie Na H Nonline Sk

May 24, 2025

Nemecke Firmy A Hromadne Prepustanie Analyza Situacie Na H Nonline Sk

May 24, 2025 -

Natures Embrace A Seattle Woman Finds Solace During The Pandemic

May 24, 2025

Natures Embrace A Seattle Woman Finds Solace During The Pandemic

May 24, 2025 -

Ferrari Hot Wheels The Mamma Mia Factor In New Releases

May 24, 2025

Ferrari Hot Wheels The Mamma Mia Factor In New Releases

May 24, 2025 -

Jonathan Groffs Just In Time A Night Of Broadway Stars

May 24, 2025

Jonathan Groffs Just In Time A Night Of Broadway Stars

May 24, 2025 -

Ferraris New Bengaluru Service Centre What To Expect

May 24, 2025

Ferraris New Bengaluru Service Centre What To Expect

May 24, 2025