Euronext Amsterdam Sees 8% Stock Market Increase After Trump's Tariff Announcement

Table of Contents

Trump's Tariff Announcement and its Immediate Impact on Euronext Amsterdam

Former President Trump's announcement involved [insert specifics of the tariff announcement, e.g., new tariffs on specific imported goods or a change in existing trade agreements]. The immediate market reaction was a swift and significant upward trend on the Euronext Amsterdam. This surge demonstrated a complex interplay of factors, with some anticipating potential benefits for Dutch businesses.

- The AEX index, a key indicator of Euronext Amsterdam's performance, saw an 8% jump within the first hour of the announcement.

- Other indices on the Euronext Amsterdam also experienced substantial gains, with [mention other indices and their percentage increases].

- Trading volume increased dramatically, indicating a high level of investor activity. [Include specific data on the increase in trading volume – e.g., "Trading volume increased by X% compared to the previous day's average."]

- The investor response was primarily characterized by buying pressure, suggesting a positive outlook despite the initial uncertainty surrounding the tariff announcement.

Sector-Specific Analysis: Winners and Losers After the Tariff Announcement

The impact of the tariff announcement wasn't uniform across all sectors within the Euronext Amsterdam market. Some sectors thrived while others experienced a more muted response or even a decline.

- Winners: The technology sector saw a 10% increase, likely due to reduced competition from previously heavily tariffed imports. The energy sector also experienced significant gains, possibly due to [explain the reason, e.g., increased global demand].

- Losers: The agricultural sector showed a slight dip, potentially reflecting concerns about increased export difficulties or decreased competitiveness. [Mention other sectors and their performance with explanations].

- This varied performance underlines the importance of considering sector-specific factors when analyzing the impact of global trade policies on stock market performance.

The Broader Global Context: International Market Reactions and Euronext Amsterdam's Response

While Euronext Amsterdam reacted positively, other major stock markets showed varied responses to the same news.

- Dow Jones: Experienced a 2% increase, suggesting a generally positive sentiment in the global markets.

- FTSE 100: Remained relatively stable, indicating a more cautious reaction in the UK market.

- Euronext Amsterdam's strong performance compared to other markets can be attributed to several factors. [Explain the reasons. E.g., The strong performance may be due to the diversification of the Dutch economy, making it less vulnerable to specific tariff impacts; or, it might be due to the Dutch government's proactive measures to mitigate the negative effects of the tariffs.]

This comparison highlights the unique position of Euronext Amsterdam within the global financial landscape.

Long-Term Implications and Predictions for Euronext Amsterdam

The sustainability of the 8% increase remains a key question. While the initial reaction was positive, the long-term effects of the tariff announcement will depend on various factors.

- Continued Growth: Experts predict continued growth in the technology and energy sectors, driven by [explain the reasons].

- Potential Risks: Potential downsides include [mention potential risks, e.g., a broader global economic slowdown, changes in consumer spending, or further unforeseen trade actions].

- Long-Term Outlook: The long-term outlook for Euronext Amsterdam is cautiously optimistic, based on the resilience of the Dutch economy and its capacity to adapt to changing global trade dynamics.

Conclusion

The significant increase in the Euronext Amsterdam stock market following the Trump tariff announcement underscores the importance of staying informed about global events impacting investment decisions. The 8% surge, the sector-specific winners and losers, the comparison to global market reactions, and the outlook for long-term sustainability all paint a complex picture. The Euronext Amsterdam market demonstrated resilience and adaptability. Monitor the Euronext Amsterdam market closely and consider adjusting your investment strategy accordingly to capitalize on future opportunities in the dynamic world of Euronext Amsterdam stock trading. Stay informed about upcoming news affecting the Euronext Amsterdam stock market.

Featured Posts

-

The Phone Rings Silent Her Continued Wait

May 25, 2025

The Phone Rings Silent Her Continued Wait

May 25, 2025 -

Mercedes Driver George Russell Settles 1 5m Debt Contract Renewal On The Horizon

May 25, 2025

Mercedes Driver George Russell Settles 1 5m Debt Contract Renewal On The Horizon

May 25, 2025 -

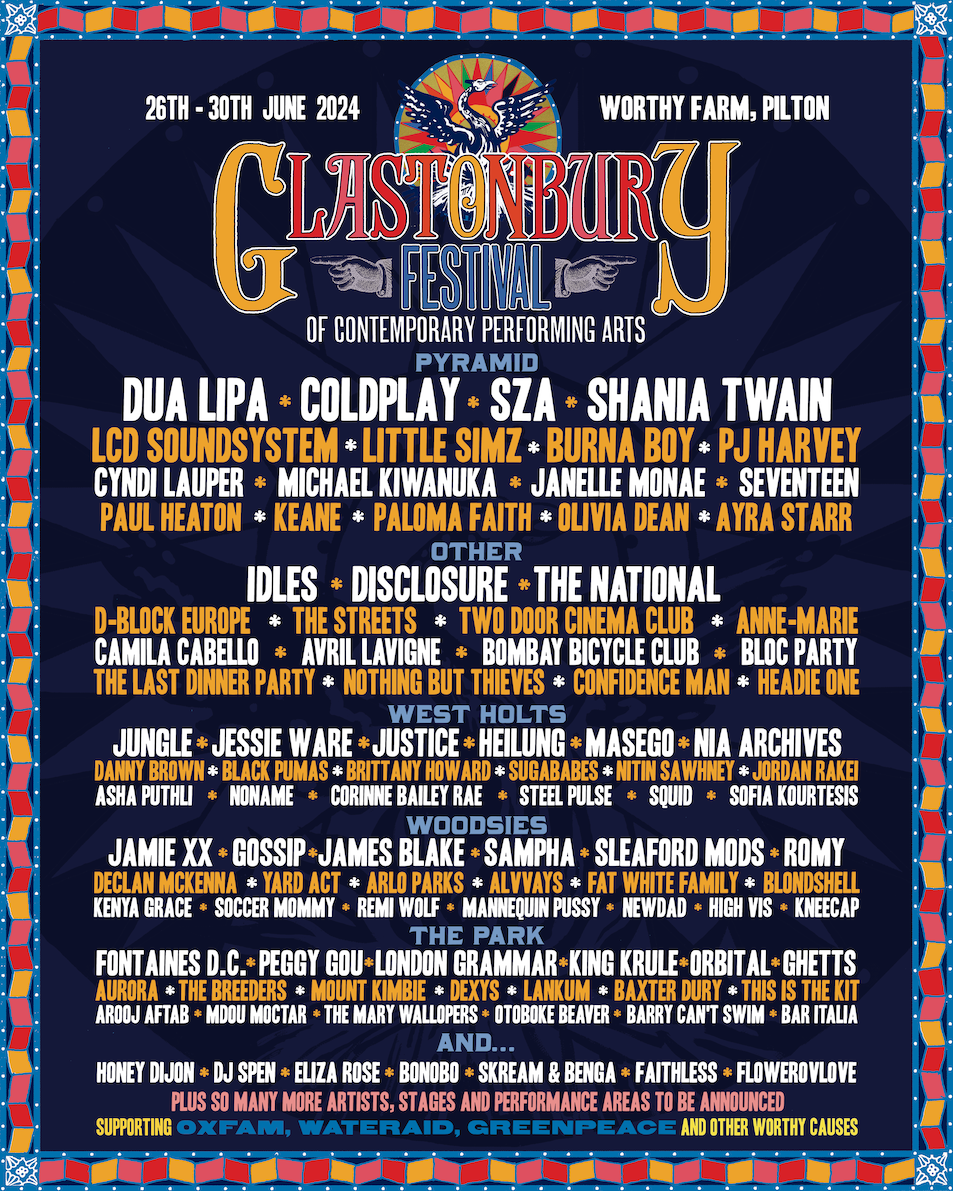

Confirmed Glastonbury 2025 Performers Lineup Details And Ticket Purchase

May 25, 2025

Confirmed Glastonbury 2025 Performers Lineup Details And Ticket Purchase

May 25, 2025 -

Naomi Campbells Potential Met Gala Absence Details Of The Anna Wintour Conflict

May 25, 2025

Naomi Campbells Potential Met Gala Absence Details Of The Anna Wintour Conflict

May 25, 2025 -

Prezzi Abbigliamento Usa Come I Dazi Influenzano Il Costo Della Moda

May 25, 2025

Prezzi Abbigliamento Usa Come I Dazi Influenzano Il Costo Della Moda

May 25, 2025